February 29th, 2024 | 08:30 CET

Uranium with exploding demand! Kraken Energy ideally positioned, hydrogen with Nel ASA and Plug Power in rebound?

Some politicians are feverishly dreaming of making energy generation climate-neutral! Those who take a closer look at the matter realize that the speed of adaptation to more sustainable electricity production must be supported by sizeable public investment budgets. In Germany and the EU, so-called eco-taxes are levied on private transport, which are used to finance alternative energy generation. That is the green theory, as expensive environmental projects should benefit the general public. Because the EU recently gave nuclear energy the "green light" in its taxonomy, this form of energy is now coming back into focus. The protagonists of this view are the nuclear power supporters France, Spain, Poland and the Czech Republic, with Germany notably staying out of this topic. Worldwide, over 50 reactors are expected to come online in the next few years, and what is needed for that is uranium. Which shares should be in focus now?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

KRAKEN ENERGY CORP | CA50075X1024 , NEL ASA NK-_20 | NO0010081235 , PLUG POWER INC. DL-_01 | US72919P2020

Table of contents:

"[...] Why should a modular electrolyzer cost more than a motorcycle? [...]" Sebastian-Justus Schmidt, CEO and Founder, Enapter AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Uranium - Futures prices paint a picture of scarcity

Global uranium production is already below the needs of energy companies today, and according to the World Nuclear Association, it will reach a critical phase as early as 2025. There are not enough new mining sites that could even come close to meeting the growing demand. At the moment, electricity producers can only keep their heads above water thanks to recycling and sales activities for strategic stocks. Looking ahead to 2030, there will be a shortfall of around 25% of uranium demand.

After peaking at around USD 105, the uranium future saw its first consolidation in February 2024. It currently stands at USD 95.60, but the two largest producers, Kazatomprom and Cameco, recently reported that their estimated production is already sold out until 2025. At the same time, however, new power plants are still being connected to the grid, and decommissioned reactors are being revived. Reluctant suppliers, in particular, have failed to commit to long-term supply contracts in good time. There is now a need for more fuel supplies for the coming years. The current rally is, therefore, likely to continue.

Kraken Energy - Safe uranium from Nevada and Utah

The US and its Western allies have long recognized the urgency of the uranium supply crisis. Now, time is of the essence. The Canadian industry giant Cameco can sit back and relax because all it has to do is manage and deliver its abundant resources efficiently. In the global ranking, however, it is not Canada but Kazakhstan, with a capacity of around 24,000 tons, that tops the list of producers. However, there is a dangerous proximity to Russia here. Canada follows hot on its heels with a good 7,000 tons, ahead of Namibia and Australia. In recent years, the US has been preparing to develop its own production. Suitable deposits are located, for example, in Nevada and Utah.

The Canadian explorer Kraken Energy has acquired the mining rights to four high-grade uranium deposits - three in Nevada and one in Utah. A Phase I drilling program has now started on the Harts Point project in Utah. The concession area is being explored for the first time and investigated from two drilling platform locations over a strike length of 5 km to a depth of 1,000 m. The uranium-bearing bedrock of the Chinle Formation has already shown increased radioactivity in three historical oil wells. The 2,622-hectare Harts Point concession area is located in the centre of the Colorado Plateau, which has produced over 590 million pounds of U3O8 at a grade of 0.2 to 0.4% since the 1950s. Kraken has a 75% option on the property. It sounds very promising.

CEO Matthew Schwab recently stated: "With its proximity to significant historical uranium production and existing infrastructure for future processing capacity, the property is perfectly situated to capitalize on the project's exceptional potential and discover a trend of high-grade uranium deposits in a mining-friendly area." Things are now getting exciting for Kraken Energy's 54.3 million shares. **They are currently trading in the CAD 0.11 to 0.13 corridor. This means that the market capitalization is only CAD 6.5 million. Given the high project quality, this is a very manageable valuation. Collect!

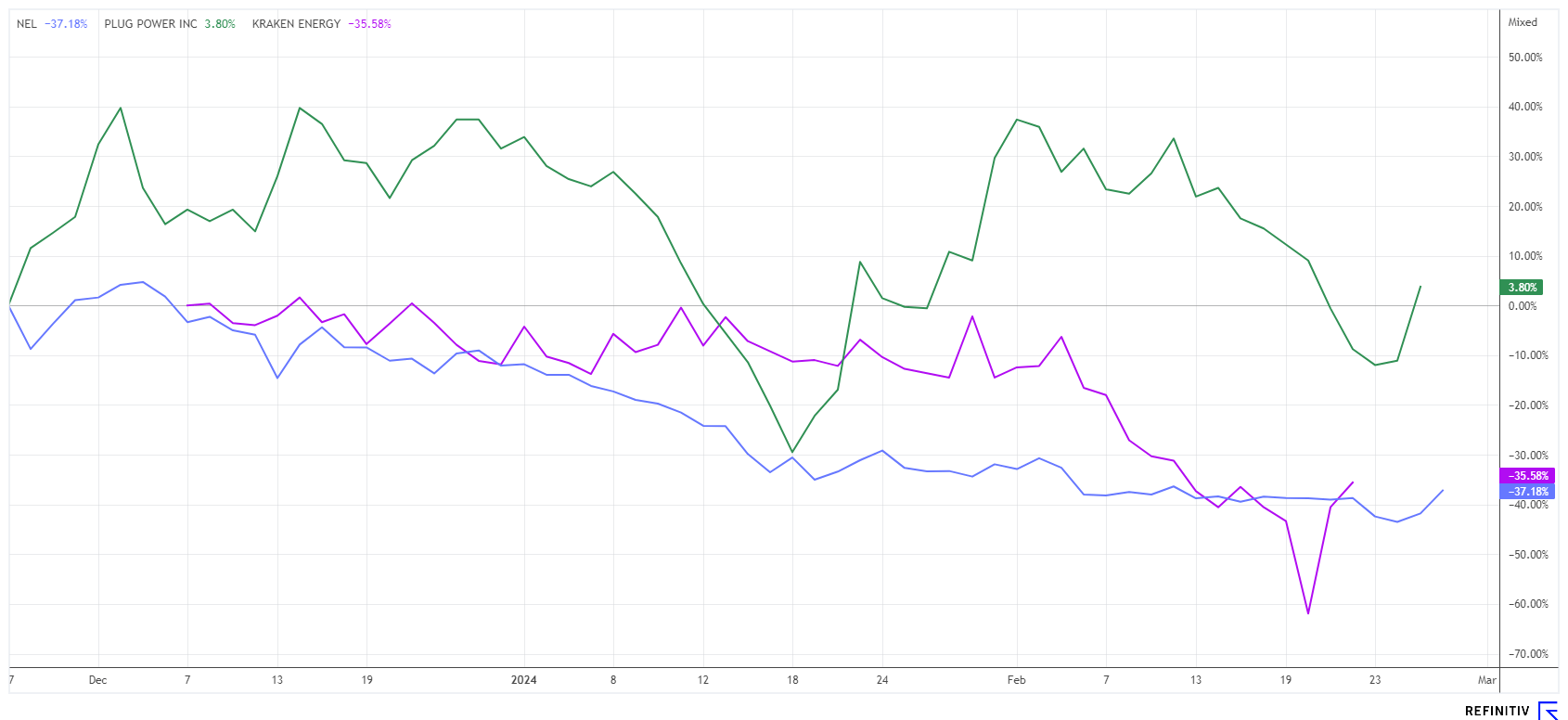

Nel ASA and Plug Power - The chance of a rebound is growing

There is further bad news from the hydrogen sector. The well-known protagonists Nel ASA and Plug Power are still in free fall after the challenging year 2023. At EUR 2.01, the Americans reached a new 5-year low in mid-January, while Nel ASA did not fare much better at EUR 0.369. However, the shares seem to have stabilized in the last three days. The upcoming reporting season, which Nel ASA hopefully opened yesterday, is now exciting.

The electrolyser pioneer from Norway increased its revenues in Q4 by 29% to NOK 534 million, while experts' estimates were only just under NOK 442 million. However, EBITDA remained in the red at NOK 106 million, halving the losses compared to the previous year. This meant that Nel was even able to exceed expectations and calm nervous minds slightly. The cash position of NOK 3.6 billion was also convincing, extending the period until the next capital increase, which will probably have to be carried out in 2025 due to persistently negative operating margins. It is also positive that the spin-off of the loss-making Tank Infrastructure division is being driven forward. Nevertheless, order intake remains in decline, with the Norwegians having to cope with a sharp drop of 81%. After an early 10% rise, the share quickly lost ground again and landed at just under EUR 0.42 - a small gain on the previous day.

It will be interesting to see what happens with US competitor Plug Power, with Q4 figures scheduled for Friday, March 1. By midweek, there was already a measurable 20% jump in the share price - expecting good news may still be premature. However, a technical recovery is in the air after a price loss of over 90% since 2021. However, the share price will only rise if Plug Power's turnover reaches the billion mark and can report a loss of less than USD 0.37 per share. What the dazzling CEO Andy Marsh has to report at the end of the week is certainly one of the most eagerly anticipated financial events at the upcoming month's change.

The energy market remains intriguing. The uncertainty surrounding fossil fuels and the growing pressure from the climate transition is leading to a stronger focus on CO2-reducing alternatives such as nuclear energy or hydrogen. The uranium market has already picked up on the positive trends and has been bullish since the end of 2023. The hydrogen sector, on the other hand, is still in the doldrums. For those looking to make an opportunity-oriented investment, investing in multiple uranium projects and mixing in some hydrogen stocks may be wise.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.