August 3rd, 2023 | 16:00 CEST

Uranium soon to be sanctioned? GoviEx Uranium, Plug Power, Nel ASA, AMS Osram - Can hydrogen solve the energy issue?

Somehow, energy policy has become very complicated. The EU sanctions coal, oil, gas and gold from Russia, but uranium remains untouched. Why? There is one who vehemently opposes this behind the scenes in Brussels: France! The German Minister of Economics, Robert Habeck, does not want to accept this. Of course, Germany no longer needs uranium for its decommissioned nuclear power plants, and the defense industry has its own sources of supply, which are not known to the public for security reasons. There is also the military coup in Niger, one of the world's major uranium-producing countries. What do investors have to pay attention to now?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

GOVIEX URANIUM INC A | CA3837981057 , PLUG POWER INC. DL-_01 | US72919P2020 , AMS OSRAM AG | AT0000A18XM4 , NEL ASA NK-_20 | NO0010081235

Table of contents:

"[...] Why should a modular electrolyzer cost more than a motorcycle? [...]" Sebastian-Justus Schmidt, CEO and Founder, Enapter AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

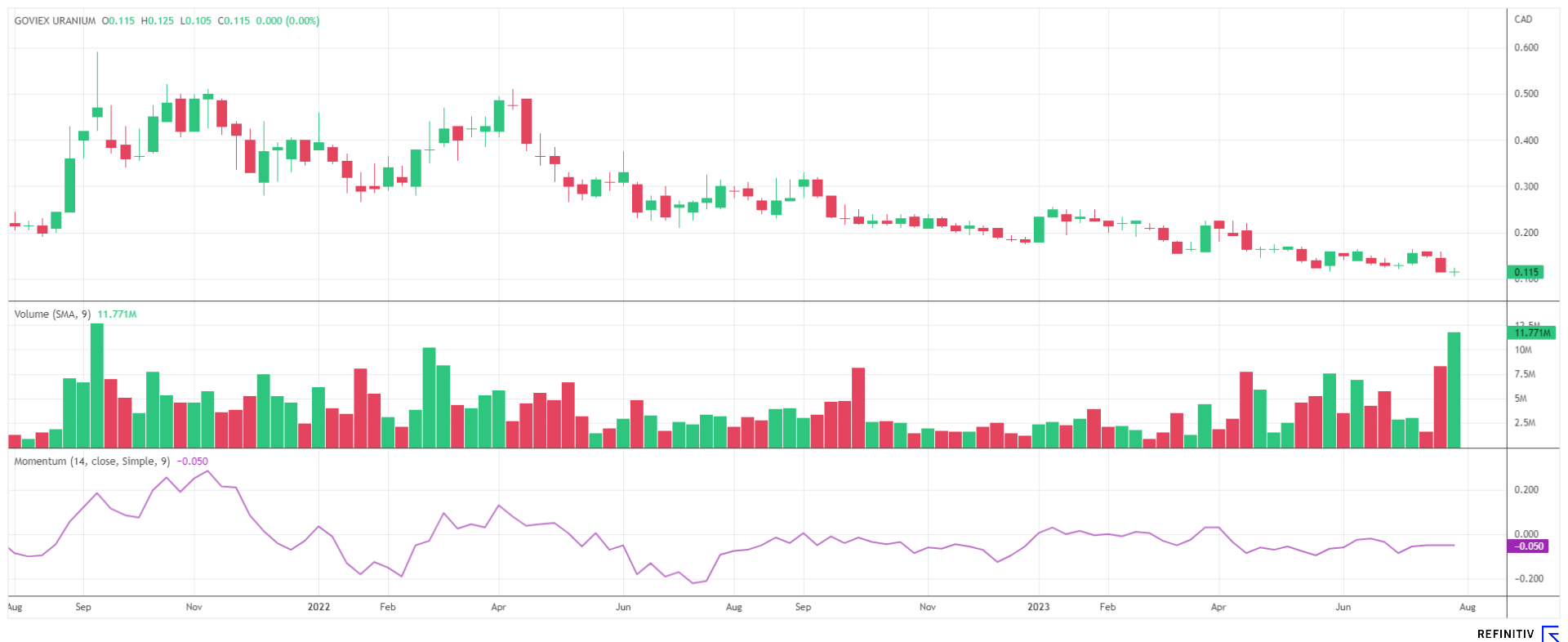

GoviEx Uranium - Strategic metals from Africa

Despite the coup in Niger, the management of Canadian explorer GoviEx Uranium currently remains calm. Immediately after the military takeover, the Economic Community of West African States (ECOWAS) met for meetings in Nigeria and decided on initial sanctions until President Bazoum's reign is restored. The coup leaders' assets are frozen, and capital transfers are not possible for the time being. However, General Tchiani's followers care little because they agree with the neighboring states of Burkina Faso and Mali on how to proceed. They intend to stand firm against the surrounding countries and may even consider calling for Wagner mercenaries for assistance. Demonstrators in the capital Niamey celebrated the fall of the president and showed their support for Russia.

Economically, it can be assumed that Western raw materials companies and investors will continue as before for the time being because the West African states depend on the export of raw materials for their economic strength. Niger is a mining-friendly country and, despite changing regimes, has conducted uninterrupted uranium mining activities over the past 50 years. It is the sixth-largest producer of uranium. In the north, GoviEx is developing the prospective Madaouela project near the mining sites of French state-owned Orano. The concession area near Arlit is 1,200 km or 18.5 hours by car from the troubled capital Niamey. This means that GoviEx is in a position to meet all its obligations to employees and suppliers and expects this situation to be maintained.

GoviEx Uranium's properties are well spread across the continent in Niger, Mali and Zambia. The Central Madaouela Project is a very important project for both GoviEx and Niger as it supports the country's socio-economic growth. The broad-based portfolio lends certainty, as significant opportunities currently exist in the uranium project in Zambia, for which a mining license has been granted. The multi-metal Falea project in Mali also remains highly interesting for future supply to Western industries. Because of the news situation, the GXU share initially went on a dive, with prices around CAD 0.12. The three flagship projects are now valued at only CAD 84 million. Those who are courageous seldom buy at a low price.

ams OSRAM - The group is being repositioned

Aldo Kamper, the new Head of ams OSRAM, wants to thoroughly shake up the German-Austrian chip and sensor group. In the future, the focus will be on returns generated from the automotive, industrial and medical technology sectors. ams OSRAM has become big thanks to lavish orders from California's Silicon Valley. Over the years, the mobile communications and data group Apple has accounted for almost a quarter of the Company's sales, but in the future, it will only play a subordinate role.

The Company now intends to divest unprofitable businesses with sales of EUR 300 to 400 million, including low-value lenses for smartphones. Instead, ams OSRAM intends to concentrate on special semiconductors in the future, and the Group also wants to retain its automotive and special lighting business. The realignment is associated with a non-cash goodwill impairment of EUR 1.3 billion, resulting in a net loss of approximately EUR 1.5 billion in the second quarter. Over 70% of this is due to adjustments to the opto-semiconductor business of Munich-based lighting group OSRAM, which AMS swallowed just two years ago after a tough takeover battle for more than EUR 4 billion. Today, the entire group with 21,000 employees is worth only EUR 2 billion. Parallels to Bayer-Monsanto are permitted.

The new CEO, Kamper, is no stranger to the industry. He had until recently led the ailing automotive supplier Leoni and wants to develop the operating margin at AMS to 15% by 2026. "Our long-term growth opportunities are good and remain intact," he said with conviction in a conference call. Investors were enthusiastic, pushing the share price up by a full 15% last week. Analysts on the Refinitiv Eikon platform expect sales to decline to around EUR 4 billion by 2026 due to the restructuring, but profitability is expected to increase by a good 50% in the process. The stock is an attractive turnaround opportunity between EUR 7.50 and EUR 8.00.

Plug Power and Nel ASA - The favor of the hour

Whoever thinks of hydrogen automatically has the US fuel cell specialist Plug Power on their radar. This is good because the Company is currently benefiting enormously from international declarations by politicians that the topic of hydrogen is now on the top list in the field of alternative energies. Not least, with the successful IPO of ThyssenKrupp subsidiary Nucera, the sector has regained high visibility.

After an 85% sell-off in Plug Power shares since January 2021, there were only minor attempts to buck the downward industry trend until May 2023. Price-to-sales ratios of over a factor of 20 had sent the H2 sector into a two-year consolidation, which is now taking a turn again with a strong accumulation of public procurement. Both Nel ASA and Plug Power now have bulging order books, which will drive sales up by more than 200% over the next 3 years. That said, current valuations still do not appear cheap, yet Nel ASA and Plug Power can grow into future valuations with current P/S ratios of 10 and 5, respectively. If the companies significantly increase the beat rate through investment capital, nothing will stand in the way of a long-term higher valuation.

From a chart perspective, Nel ASA should no longer slip below the EUR 1.05 mark, which has already been confirmed 4 times. Plug Power is in a better position. After exceeding the EUR 10 mark, one can speak of a lower reversal. However, a retest of this breakout level is possible. Therefore, it is advisable to consider buying both stocks only during corrections.

The energy issue remains a major puzzle within the EU. Thus, the handling of fossil raw materials is not very understandable, but the non-sanctioning of uranium on the part of the large alliance partner France is understandable. After all, 56 nuclear power plants operate west of the Rhine, and Germany is one of the largest customers of this precious energy. For investors, there are good opportunities in uranium and hydrogen. The restructuring of ams OSRAM could take a little longer but has upside potential.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.