July 3rd, 2025 | 07:00 CEST

Unparalleled expertise in tungsten: Why Almonty Industries is in pole position

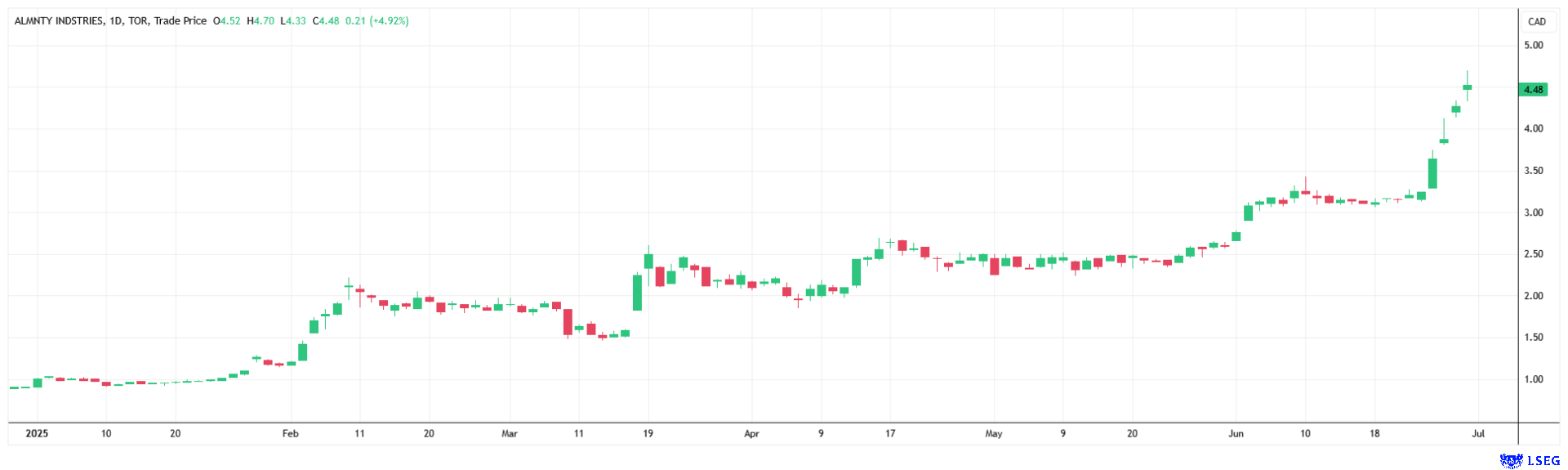

For around ten years, Almonty Industries has been synonymous with tungsten sourced from geopolitically stable regions. In just a few weeks, the massive Sangdong mine in South Korea will go into production, making the world significantly less dependent on tungsten from China. The market is rewarding this – Almonty's share price is now approximately 300% higher than it was six months ago. But outstanding mining projects, good timing, and even a bit of luck are not enough to explain Almonty's unique market position: the Company has a wealth of experience and know-how that is unmatched - and in the case of tungsten, which is considered challenging to mine and process, this will continue to make the difference for many years to come.

time to read: 3 minutes

|

Author:

Nico Popp

ISIN:

ALMONTY INDUSTRIES INC. | CA0203981034

Table of contents:

"[...] While tungsten has always played an important role in the chip industry, it is now being added to batteries for e-cars. [...]" Lewis Black, CEO, Almonty Industries

Author

Nico Popp

At home in Southern Germany, the passionate stock exchange expert has been accompanying the capital markets for about twenty years. With a soft spot for smaller companies, he is constantly on the lookout for exciting investment stories.

Tag cloud

Shares cloud

Refining tungsten is profitable – But very few can do it

At a time when industrial companies were able to order subsidized tungsten and tungsten products cheaply from China, Lewis Black put all his eggs in one basket. More than twenty years ago, he was Chairman and CEO of the tungsten company, Primary Metals. Prior to that, he served as the marketing director for SC Mining Tungsten in Thailand. In 2011, he founded Almonty Industries. Together with far-sighted anchor shareholders such as the Austrian Plansee Group and Deutsche Rohstoff AG, Black invested his own capital to make Almonty a fully integrated tungsten supplier. The German Kreditanstalt für Wiederaufbau (KfW) has been one of the partner banks for many years and finances the Sangdong mine.

After the Sangdong mine goes into production this summer, Almonty plans to complete a processing plant by 2027. The "Sangdong Downstream Extension Project" is expected to have a capacity of 4,000 tons of tungsten per year and produce ammonium paratungstate (APT) and nano-crystalline tungsten oxide. This refining of tungsten is particularly profitable and leads to significant price premiums. Industry experts emphasize that the market entry barriers for tungsten and products made from it are particularly high. The reason: expertise in tungsten is rare. When talking to Lewis Black about the situation in China, he repeatedly mentions subsidies in the Middle Kingdom. For years, state support has ensured that efficiency in the extraction and processing of tungsten has not played a major role. The result: China is no longer competitive.

Generations of experience bring cost advantages

The production costs of Chinese state-owned tungsten mines range between USD 205 and 245 per tonne. According to Lewis Black, the Sangdong mine in South Korea has the lowest production costs in the world at USD 110-120 per MTU, based on a conservative feasibility study. The reason for these cost advantages lies not only in the high grades in South Korea but also in Almonty's expertise. The Company operates the Panasqueira mine in Portugal, which has been in operation since 1896. Some of the miners there have been working for five generations and pass on their knowledge. A recent documentary by Lyndsay Malchuk from Stockhouse, who visited Panasqueira, shows what the situation is like on the ground in Portugal and what role the expertise of the Almonty Industries team plays for the company. You can find the video below this article.

The processing of tungsten presents several challenges. The material is extremely hard, cannot be machined with conventional tools for steel, and causes high wear on the tools used - which is one of the reasons why Almonty relies in part on historic machines that are no longer available for purchase today. With decades of knowledge in tungsten mining, Almonty has been operating what it claims to be the most modern tungsten laboratory in the world in Portugal for some time now. The goals: To process tungsten even more efficiently and satisfy customers such as the US defense industry and the far-sighted anchor shareholders of the Plansee Group.

Almonty Industries stands to benefit from tax incentives

The framework conditions surrounding the Sangdong mine indicate that shareholders could be among the long-term winners. The unique project, whose production capacity can be doubled with an additional investment of USD 17 million, offers high tungsten grades and significant tax advantages. The Sangdong mine is located in an area designated as a Foreign Investment Zone by the South Korean authorities. This means that no taxes are payable for the first three years after reaching profitability. In the subsequent two years, the tax rate is only half the standard South Korean corporate tax rate of 25%.

A story like something out of a movie – No chance for the competition

Looking at the development of Almonty Industries over the past few years, it reads like a movie script: A visionary CEO recognizes opportunities in the China-dominated tungsten market before anyone else, gradually builds up projects, and in the midst of a globalized world, bets everything on the giant Sangdong mine in South Korea. Then came the COVID-19 pandemic, initial doubts about globalization, the war in Ukraine, the burgeoning trade war, and escalating geopolitical tensions. Today, Almonty Industries is just a few weeks away from starting production in South Korea. Investors are increasingly recognizing that Almonty is the undisputed market and technology leader in the field of tungsten, a critical raw material used in defense and high-tech applications. The barriers to market entry for potential competitors are high. As a future partner to the US defense industry, this equity story is likely to be well received, especially in the US. Almonty Industries is planning a near-term listing on the Nasdaq.**

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.