ESG

Commented by Fabian Lorenz on January 20th, 2026 | 07:15 CET

The dirty GOLD RISK! RZOLV Technologies with a billion-dollar opportunity and takeover fantasy!

With a price of around USD 4,600 per troy ounce, there is a gold rush atmosphere. But there is a risk that mine operators and authorities alike fear: cyanide. This highly toxic chemical is becoming key, especially for low-grade deposits that are now profitable again. It was also responsible for one of Europe's biggest environmental disasters. This is precisely where RZOLV Technologies comes into play. The Canadian company is working on a water-based, biodegradable leaching formulation that is intended to replace cyanide in existing plants – without expensive conversions and at low cost. The potential is enormous. If the upcoming industrial test is successful, the stock could move up to a new league and make RZOLV a hot takeover candidate.

ReadCommented by Armin Schulz on January 12th, 2026 | 07:10 CET

The license to mine: With RZOLV Technologies, Barrick Mining and Agnico Eagle could gain new scope - without cyanide

Gold mining has long relied on a single, highly toxic molecule: cyanide. Today, tightening regulations, rising ESG scrutiny, and increasingly complex ore bodies are challenging this long-standing industry standard. A paradigm shift is emerging in which access to clean extraction technology, rather than mere ownership of the metal, is becoming the decisive strategic lever. This change is casting innovative providers such as RZOLV Technologies and established mining giants such as Barrick Mining and Agnico Eagle in a new strategic light.

ReadCommented by Nico Popp on January 8th, 2026 | 07:10 CET

Gold rush without toxins: Why Newmont and Equinox are under pressure, and RZOLV Technologies could become the key stock of the new super cycle

Gold is back on the big stage. Driven by geopolitical hot spots, structural weakness in the US dollar, and the insatiable appetite of central banks, the precious metal is racing from one all-time high to the next. But while prices are rising, the situation for mine operators is deteriorating: dependence on highly toxic cyanide is becoming more and more of a problem. Environmental regulations are becoming stricter, approval procedures are dragging on for decades, and social resistance is blocking billion-dollar projects. The technology company RZOLV Technologies is positioning itself in this area of tension between record prices and ecological dead ends. While industry giants such as Newmont and Equinox Gold are looking for ways to secure their production in a sustainable manner, RZOLV is providing the long-awaited technological answer: gold extraction that does not require any toxic chemicals and thus has the potential to reshuffle the cards in global mining.

ReadCommented by André Will-Laudien on December 16th, 2025 | 07:20 CET

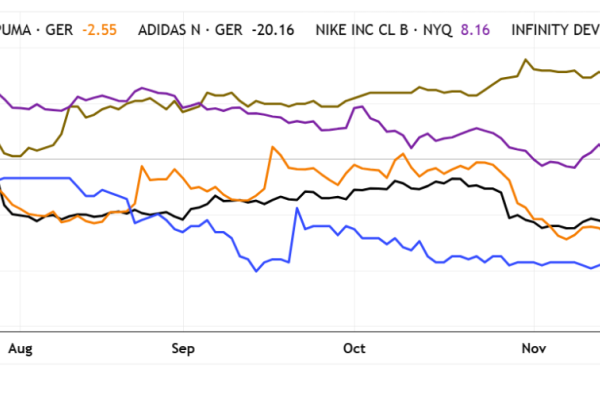

Impact investing, with super dividends into 2026 – Nike, RE Royalties, Adidas, Puma, and Infinity Development

Impact investing has become increasingly important in recent times as investors increasingly recognize that capital flows generate not only returns but also social and environmental impacts. In light of climate change, resource scarcity, and social imbalances, many market participants are no longer satisfied with using financial metrics alone as a benchmark. Regulatory authorities are promoting this development through stricter ESG requirements and greater transparency requirements for companies and financial products. At the same time, younger generations are demanding that their assets be consistent with their values and have a measurable positive impact. If you are looking for something, you will find suitable investments!

ReadCommented by André Will-Laudien on November 5th, 2025 | 07:15 CET

Money or gold – Where can investors expect another 150% return? ESG-compliant with RE Royalties, Deutsche Bank, PayPal, or Fiserv?

Gold continues to fascinate as a scarce and value-preserving asset. However, its extraction often comes with significant environmental and social challenges, making the label "sustainable" difficult to apply. Money, on the other hand, especially in the form of cash or digital currency, is intangible and based on trust; in modern times, its sustainability is defined by its use in ESG-compliant investments. And these are diverse! With its "Green Deal," the EU is driving a comprehensive transformation and directing capital toward sustainable technologies and projects through support programs and ESG regulations. This is particularly relevant for institutional investors, who are increasingly required to consider climate risks and social responsibility. Much of this capital flows into green infrastructure and technological innovation. Private investors, meanwhile, have green investments on their radar, though the primary focus here remains on returns. Let's dive into the world of financiers.

ReadCommented by Nico Popp on September 1st, 2025 | 07:05 CEST

The key to higher returns: How ESG is making Newmont, Intel, and Almonty more successful

Just a few years ago, ESG was a buzzword that companies in industry and mining could use to present themselves in a favorable light. Today, standards for sustainable business practices are clearly defined and bring tangible benefits to all who adhere to them. For example, cooperation with local residents and adherence to high environmental standards at mining companies such as Newmont and Almonty ensure better financing conditions and motivated, skilled workers. Potential customers such as Intel also pay close attention to the conditions under which raw materials are extracted. In this article, we explain how ESG and returns go hand in hand.

ReadCommented by Nico Popp on May 31st, 2022 | 11:53 CEST

Funds will not resist here: BASF, Saturn Oil + Gas, Nordex

Sustainable investing is the trend. According to the German Federal Investment and Asset Management Association, EUR 580 billion is invested in sustainable funds in Germany alone. And the trend is rising. Younger people in particular attach great importance to sustainability. Since sustainable investing is not detrimental to returns but, on the contrary, can even be beneficial, interest is also growing among older investors. We take a closer look at three stocks!

ReadCommented by Nico Popp on May 2nd, 2022 | 11:32 CEST

Do not ignore ESG risks: Deutsche Bank, Ximen Mining, BYD

ESG is more than electric company cars, a paperless office and avoiding unnecessary air travel. Those who take the third pillar of the ESG approach seriously must also pay attention to good corporate governance. In the criteria of the index and data providers, good "governance" is about, among other things, management structures and sophisticated control instances at the corporate level. We explain why the "G" in ESG can bring tangible benefits to investors and how investors can invest in companies with good ESG criteria.

ReadCommented by Armin Schulz on May 25th, 2021 | 08:16 CEST

Deutsche Bank, Mineworx Technologies, Deutsche Telekom - ESG stocks have enormous potential

ESG stands for Environmental, Social and Governance. The Environmental area covers environmental pollution or hazards, such as CO2 emissions and energy efficiency issues. In the Social space, health care, occupational safety and social commitment are assessed. Under leadership, one looks at sustainability, corporate values and their control processes. The trend towards ESG shares has increased significantly in recent years. Especially for the younger generation, sustainability is fundamental. We take a look at three companies that are addressing sustainability.

ReadCommented by Carsten Mainitz on March 15th, 2021 | 09:03 CET

Bayer, dynaCERT, JinkoSolar - green performance stars!

Sustainable investing has developed from a "nice to have" to a "must-have." Many empirical studies have also shown that investors who invest "green" do not have to forego returns. On the contrary, there are indications that a skillful weighting of ESG factors - these stand for Environment, Social, Governance - can improve the risk-return ratio. We show you three ESG stocks with which you will outperform in the truest sense of the word!

Read