November 5th, 2025 | 07:15 CET

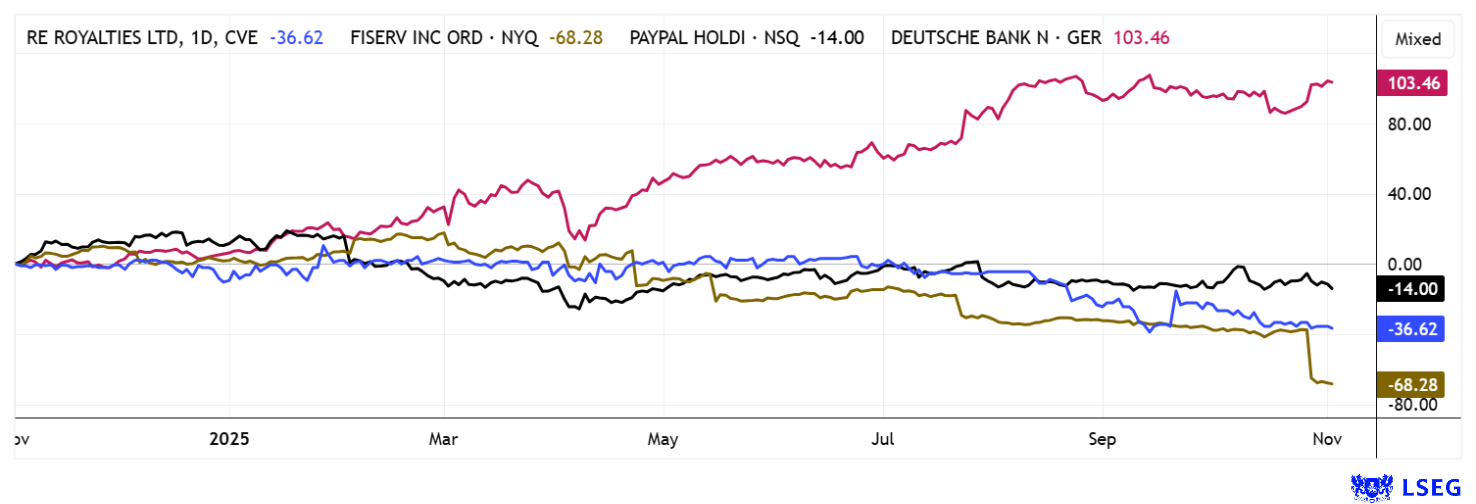

Money or gold – Where can investors expect another 150% return? ESG-compliant with RE Royalties, Deutsche Bank, PayPal, or Fiserv?

Gold continues to fascinate as a scarce and value-preserving asset. However, its extraction often comes with significant environmental and social challenges, making the label "sustainable" difficult to apply. Money, on the other hand, especially in the form of cash or digital currency, is intangible and based on trust; in modern times, its sustainability is defined by its use in ESG-compliant investments. And these are diverse! With its "Green Deal," the EU is driving a comprehensive transformation and directing capital toward sustainable technologies and projects through support programs and ESG regulations. This is particularly relevant for institutional investors, who are increasingly required to consider climate risks and social responsibility. Much of this capital flows into green infrastructure and technological innovation. Private investors, meanwhile, have green investments on their radar, though the primary focus here remains on returns. Let's dive into the world of financiers.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

RE ROYALTIES LTD | CA75527Q1081 , DEUTSCHE BANK AG NA O.N. | DE0005140008 , PAYPAL HDGS INC.DL-_0001 | US70450Y1038 , FISERV INC. DL-_01 | US3377381088

Table of contents:

"[...] Our SMSZ project is the largest contiguous land package of any exploration company in the region at 400km2 and overlays a 38km portion of the prolific Senegal Mali Shear Zone. [...]" Jared Scharf, CEO, Desert Gold Ventures Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

RE Royalties – Green finance on the rise

The market for sustainable financing has experienced a dynamic growth phase in recent years. In 2024 alone, green bonds worth around USD 500 billion were issued worldwide, which was a historic high. Experts expect the total volume to grow to over USD 5 trillion by 2030 (CAGR +12%). Europe remains the largest and most strictly regulated market, supported by the now-established EU taxonomy, which defines clear transparency and documentation standards.

Canadian financier RE Royalties Ltd. has established itself as a specialized financing partner for renewable energy. The Company implements an innovative licensing and royalty model that originated in the commodities industry and has now been transferred to the clean energy sector as a pioneering solution. Rather than building facilities itself, RE Royalties provides capital for solar, wind, and hydro projects as well as energy storage solutions. In return, the Company receives interest payments and long-term, contractually secured shares in future revenues. This model creates recurring cash flows without diluting the project operators.

Shareholders also benefit from four annual dividend payments, typically CAD 0.01 per quarter. Since 2020, the total annual dividend has been CAD 0.04 per share, which at the current share price of around CAD 0.28 equates to a yield of roughly 14.3%. Even for the renewable energy sector, this is remarkably high. The attractiveness of the business model stems from diversified income streams from over 100 participating projects and long-term power purchase agreements spanning 20 to 40 years. Geographically, the portfolio has so far focused primarily on North America, supplemented by growing activities in Europe, Asia, and Africa. To date, over 130 projects with a total investment volume of more than CAD 80 million have been supported. RE Royalties presents itself to its investors almost as a fixed-term deposit, but of course, it does involve equity risk. RE Royalties sees itself as a catalyst for the energy transition and emphasizes ecological and social responsibility in addition to financial performance. Investors thus benefit not only from stable returns, but also from a positive climate and sustainability impact. A well-rounded proposition with medium-term appeal!

CEO Bernard Tan explains how he is turning the tables in the world of finance in an interview with Lyndsay Malchuk. Click here for the video

Fiserv – Halving from a standing start

Fiserv is more of a service provider, as this company primarily focuses on IT infrastructure solutions for financial institutions. Essentially, Fiserv enables banks, insurance companies, and fintechs to efficiently offer digital financial services such as online banking, account management, transfers, and fraud detection without having to develop their own complex IT systems. On the merchant side, Fiserv operates the Clover platform, a targeted payment processing solution used by small businesses and large chains such as McDonald's. This combination of financial software and payment processing gives the Company a strong market position with recurring revenue and high customer loyalty.

The Fiserv share price chart shows a sharp drop of over 40% in recent days, with a total decline of over 70% in one year. This is due to a poor Q3 report with declining revenue and profit forecasts. Earnings per share are expected to fall by 17% from USD 10.23 to around USD 8.50, as the more aggressive pricing models were not particularly well received in the market. While some experts are maintaining their "Buy" recommendations, others are urging caution and have lowered their price targets. Bernstein reacted very quickly and drastically lowered its target from USD 205 to just USD 80, with a new rating of "Market Perform." Yesterday, the stock tumbled to USD 64, and although the rate of decline is slowing slightly, it does not appear to have bottomed out yet.

PayPal versus Deutsche Bank – Two sides of the same coin

US online payment giant PayPal achieved its Q3 profit targets with USD 1.30 per share, yet the share price is still sending out negative signals. As if a 19% decline over the past 12 months were not enough, the share price fell from USD 70 to USD 58 even after the announcement that it had slightly exceeded analysts' estimates of USD 1.22. This comes despite 19 out of 44 analysts on the LSEG platform maintaining an average target price of USD 83.50. So what is holding the stock back? Management was visibly pessimistic and lowered its outlook. Competition from Apple Pay and Google Pay remains intense, limiting growth opportunities and compressing margins. In addition, there were several security issues on the platform during the past quarter. Investors are remaining cautious for the time being in view of the many uncertainties.

The situation is quite different at Deutsche Bank. For a long time, it seemed that the Frankfurt-based bank had completely missed the modernization trend. However, following the full integration of Postbank and costs of more than EUR 1 billion, the German industry leader is now back on solid footing. Within three years, DBK shares have risen from around EUR 10 to EUR 31, a phenomenal return for courageous investors who bet on a positive restructuring. Now, market capitalization is back at EUR 60 billion, up from EUR 20 billion. Encouragingly, Q3 pre-tax profit is also up around 8% year-on-year to EUR 2.4 billion, driven by strong figures from investment banking and a sharp rise in assets under management to EUR 675 billion. The average price target on the LSEG platform is a meager EUR 32.90, which leaves little room for maneuver, but at least there is a healthy 4% dividend and further room for growth in the medium term!

Green finance is a desirable topic, but it is underrepresented on the capital market. RE Royalties is closing a crucial gap here by generating recurring royalty income from renewable projects while offering investors predictable distributions, a niche model with potential for significant valuation increases. At the same time, established players such as Deutsche Bank, PayPal, and Fiserv are driving forward sustainable finance and payment infrastructures, but the topic of ESG appears only marginally.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.