December 16th, 2025 | 07:20 CET

Impact investing, with super dividends into 2026 – Nike, RE Royalties, Adidas, Puma, and Infinity Development

Impact investing has become increasingly important in recent times as investors increasingly recognize that capital flows generate not only returns but also social and environmental impacts. In light of climate change, resource scarcity, and social imbalances, many market participants are no longer satisfied with using financial metrics alone as a benchmark. Regulatory authorities are promoting this development through stricter ESG requirements and greater transparency requirements for companies and financial products. At the same time, younger generations are demanding that their assets be consistent with their values and have a measurable positive impact. If you are looking for something, you will find suitable investments!

time to read: 6 minutes

|

Author:

André Will-Laudien

ISIN:

NIKE INC. B | US6541061031 , RE ROYALTIES LTD | CA75527Q1081 , ADIDAS AG NA O.N. | DE000A1EWWW0 , PUMA SE | DE0006969603 , INFINITY DEVELOP. HD-_01 | KYG4772A1085

Table of contents:

"[...] If we pursue our goals conscientiously, the market will adjust its valuation accordingly, I am sure. Often, all it takes is a trigger. [...]" Ryan McDermott, CEO, Phoenix Copper

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

RE Royalties – Green Bonds, ESG Focus, and Measurable Climate Impact

Companies that meet impact criteria often benefit from better access to capital, a higher reputation, and longer-term investor loyalty. Studies also show that sustainable business models reduce risk and are more resilient to economic and geopolitical shocks. Impact investing thus combines economic rationality with social responsibility and is becoming a central component of modern capital markets.

This is precisely where RE Royalties' financing programs come in. The Company operates in a market environment characterized by rapidly growing sustainable financing, where renewable energy is increasingly becoming the core of institutional capital allocation. Against this backdrop, the Canadian company positions itself as a specialized financier that consistently applies a royalty and licensing model familiar from the commodities industry to solar, wind, water, and storage projects. Instead of bearing the operational risks of plant operation, RE Royalties provides non-dilutive capital and secures long-term, contractually fixed revenue shares. This model forms the basis for stable, recurring cash flows and a growing portfolio of over 100 investments.

RE Royalties is currently underlining its expansion ambitions with letters of intent worth around CAD 50 million for new projects in the US, Canada, and the Maldives. The pipeline includes high-quality projects in the areas of solar, wind, energy storage, and decentralized energy generation, which are intended to further diversify the earnings base. At the same time, the extension and upgrade of an existing CAD 3 million loan to Powerbank, including higher interest rates and a royalty component, demonstrates the negotiating power and partnership strength of the model. The almost complete repayment of the outstanding Series 1 green bonds, which were issued five years ago, is also strategically significant. The underlying green bond framework received the highest "dark green" rating from S&P Global Ratings, meeting the highest ESG standards.

On the environmental side, the financed projects make a measurable contribution to reducing greenhouse gas emissions and promoting the energy transition. At the governance level, the appointment of Alexa Blain to the Board of Directors strengthens expertise in the sectors of impact investing, climate finance, and institutional capital allocation. RE Royalties is gaining additional visibility through its listing on the Frankfurt Stock Exchange, which facilitates access to European ESG-oriented investors. Europe is considered a key market for sustainable investments due to regulatory clarity and high demand. Despite growing investment activity, the distribution policy remains a central element of the investment story. It will be converted to an annual payment. With a market valuation of just under CAD 10 million, RE Royalties is a super bargain!

CEO Bernard Tan explains how he is turning the tables in the world of finance in an interview with Lyndsay Malchuk.

https://www.youtube.com/watch?v=sKWA0kb1A_s

How Adidas, Nike, and Puma are sharpening their sustainability strategies

Adidas, Nike, and Puma are pursuing different, sometimes ambitious ESG strategies to embed environmental and social responsibility in the global sporting goods market. Adidas has firmly embedded sustainability in its corporate strategy and recently received a strong ESG rating from S&P Global, which particularly recognizes environmental, social, and corporate governance. Adidas has also defined concrete goals for reducing CO₂ emissions, using sustainable materials, and promoting the circular economy, including a new shoe collection made from 100% recycled plastic. Management aims to classify 90% of its products as sustainable and make the entire supply chain climate neutral, while promoting a product-related circular approach through programs such as "Made to Be Remade" and partnerships with initiatives such as "Parley for the Oceans."

Nike, in turn, has established a "zero CO₂ and zero waste approach" with its "Move to Zero" initiative, which aims to completely eliminate emissions and waste. This includes the use of sustainable materials, recycling programs for end-of-life products, and a focus on durable designs to further embed circular economy principles. Nike also emphasizes the importance of ethical sourcing and fair working conditions along its supply chains in terms of social standards.

Puma has formulated ambitious goals for emissions reduction, circular economy, and human rights in its "Vision 2030," which are recognized as 1.5-degree compatible by the Science Based Targets Initiative (SBTi). Under its "Forever Better" program, Puma is investing in sustainable raw materials, bio-based materials, and circular product solutions to reduce waste and lessen its environmental impact.

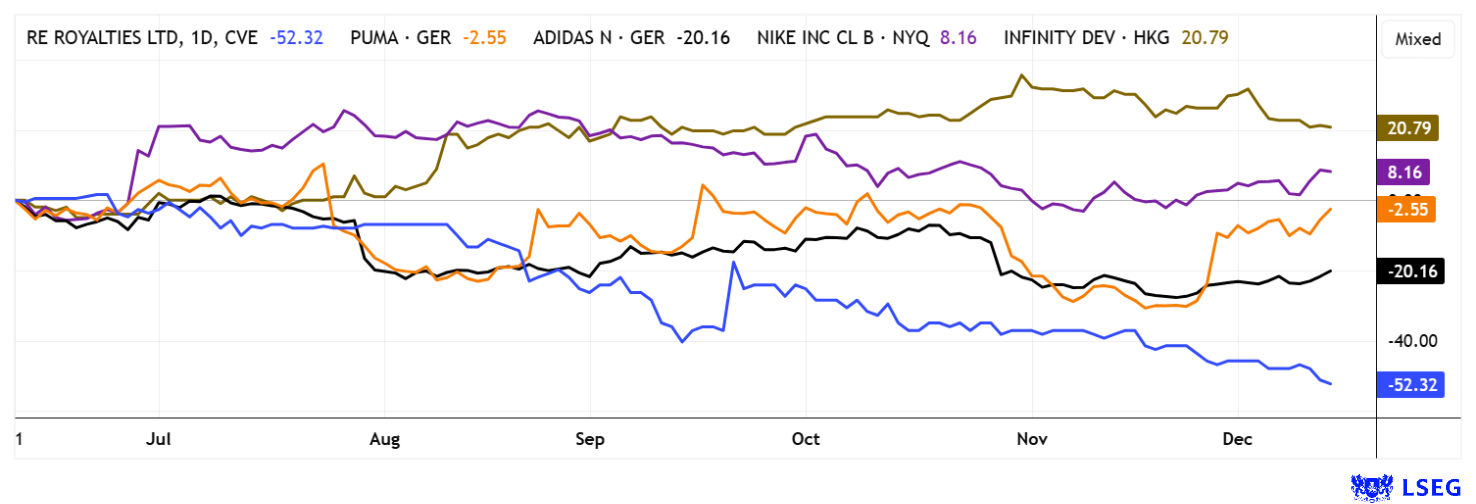

Despite different approaches, all three brands show that ESG issues are increasingly becoming an integral part of their business models in order to reduce risks and exploit opportunities in a more sustainable market environment. The recent price corrections in the sector now seem to be coming to an end. Analytically, Puma is still in the midst of restructuring, Adidas is growing again with 8-10% revenue growth and offers an 8% EBIT margin. Nike is the favorite of analysts on the LSEG platform with a total of 24 "Buy" recommendations with 23% potential over 12 months.

Infinity Development – Asia's shoe adhesive expert proves itself sustainable

Infinity Development Holdings Company Ltd. is positioning itself as an underrated leader in the Asian shoe adhesive market, offering more ESG substance than meets the eye. The Company is one of the selected suppliers to over 15 global brands such as Nike, Adidas, and Puma, whose own supply chains are subject to increasingly stringent environmental and social standards. With over 30 years of expertise and production sites in China, Vietnam, Indonesia, and Bangladesh, Infinity is deeply rooted in the Asian footwear industry, where over 90% of the world's footwear volume is manufactured. It is precisely this proximity to production centers that allows the Company to reduce emissions through short delivery routes and make processes more efficient. A key ESG lever is the technological shift towards environmentally friendly, water-based adhesives. With eight patents and collaborations with Covestro and No-Tape Japan, Infinity is actively addressing the reduction of solvents and pollutants in shoe production. In doing so, the Company not only supports regulatory requirements but also the sustainability goals of its global customers.

Its presence in several emerging markets goes hand in hand with local value creation, employment, and know-how transfer, which is becoming increasingly important in ESG ratings. The recent IPO in Singapore, which raised SGD 13.7 million for the Company and attracted institutional investors such as Rockstead, also strengthens transparency and governance structures. The fresh capital will be invested specifically in new plants in Java and Tamil Nadu, which will enable modern, more efficient production standards. The Indonesian plant in particular will increase capacity by 50%, reduce costs, and support the shift to the most dynamic shoe production country in the world. India, in turn, is benefiting from a growth rate of over 7% CAGR and offers Infinity access to an emerging, diversified production location outside China.

Financially, the Company is impressive with HKD 736 million in revenue in 2024, a net profit of HKD 100.4 million with 48% growth, and strong margins. Low debt and 12 years of uninterrupted dividend payments underscore a high level of capital discipline. Although Infinity is not a classic "green pure player," the combination of environmentally friendly product innovation, stable working structures, and improved capital market transparency delivers a credible ESG profile. With a market capitalization of around EUR 86.7 million, a revenue multiple of one, and high scalability, Infinity offers defensive quality with ESG-enabled growth potential in a systemically important segment of the global footwear industry.

Impact investing and green finance are two sides of the same coin. Today, there is a search for alternative forms of financing that also pay tribute to the next generation. RE Royalties takes these points to heart in the configuration of its business model. While the sneaker industry is suffering from margin pressure and a weak economy, things are running smoothly for Infinity, the upstream manufacturer of adhesives.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.