June 12th, 2025 | 07:05 CEST

Unbelievable but true! Bonus shares from BYD, VW restructuring, Antimony Resources and thyssenkrupp in focus

With each passing day of escalating geopolitical conflicts, one thing becomes clear: secure supply chains for industry and manufacturing are a thing of the past. The German and European industrial landscape, in particular, is feeling the effects of increasing sanctions, which are narrowing supply chains and, in some cases, drying them up completely. Capital markets are sensitive to such scarcity scenarios, with long-term interest rates rising and risk indicators skyrocketing. How are industrial companies responding to this environment, and is there any hope for a revival of global trade? These are all legitimate questions when following political developments on both sides of the Atlantic. What trends should investors keep an eye on?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

BYD CO. LTD H YC 1 | CNE100000296 , VOLKSWAGEN AG VZO O.N. | DE0007664039 , THYSSENKRUPP AG O.N. | DE0007500001 , ANTIMONY RESOURCES CORP | CA0369271014

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Antimony Resources – A strategic metal moves into the geopolitical spotlight

Given China's announced export restrictions on certain metals, Western industrial companies are seeking secure supply chains. They do not want to be subjected to international tariff wrangling, which will ultimately lead to further price increases in the raw materials sector and unstable procurement markets. In the case of antimony (chemical symbol: Sb), this affects a strategically important metal with a wide range of industrial applications. It is mainly used as antimony trioxide (Sb₂O₃) in alloys but also serves as a flame retardant in the form of an additive in plastics, textiles, cable insulation, electronics, vehicle interiors, and building materials. It is also widely used as a catalyst in PET production. China, Russia, and Tajikistan control 90% of global supply. In September 2024, China restricted global and US antimony exports, and since March 2025, the EU has also been affected. Including processing, China controls about 80% of the global supply, and there is currently no mineable source of antimony in the US.

In the context of rising military spending, a special application is coming to the fore: antimony is used in the manufacture of flame-retardant fabrics, which are critical for the safety of military personnel. It is also a key component in communications equipment, night vision goggles, ammunition, and laser targeting devices. Its ability to improve the durability and performance of these critical tools makes it indispensable for modern defense strategies. In the Canadian province of New Brunswick, a significant discovery was made some time ago in the Bald Hill concession area. Explorer Antimony Resources recently secured a 100% option from Globex Mining and is looking to further expand its antimony portfolio. The Bald Hill deposit is known for its high-grade antimony mineralization, with grades of 3% to 4% already identified. Previous owners have drilled 25 holes since 2008. In drill hole DDH08-03, 11.7% was measured over 4.51 meters, with 20.9% Sb in a 2.29-meter section. An additional 2,500 meters of drilling will now be carried out to rapidly advance the project. To finance the project, the Company raised CAD 318,000 in a private placement at the beginning of June. At the same time, an additional 650 hectares of land were acquired. The Company has issued just under 43 million shares, resulting in a low market capitalization of CAD 4 million. For investors in critical metals, this is a value-adding addition with great potential.

thyssenkrupp – Group restructuring continues

A major consumer of antimony is the German industrial holding company thyssenkrupp. The Company's executive board has long recognized the need to secure supply channels. However, the general problems facing industry are compounded by home-grown issues and a historically accumulated debt to pensioners. thyssenkrupp began restructuring three years ago, but after a rapid rise in its share price to over EUR 10, it has again disappointed with poor quarterly figures. Following a change in the executive board in 2024, the goal was announced to make all business areas independent and ready for the capital market. The plan is to transform the Company into a strategic management company with a majority shareholding. Initial steps, such as the joint venture with Steel Europe and the partial spin-off of Marine Systems (TKMS), have already been initiated. Materials Services and Automotive Technology are also set to follow, with the Decarbon Technologies segment planned to become independent at a later date. Due to the current high sensitivity of the TKMS division, the IG Metall union is even calling for nationalization to secure the division and its jobs. Order intake has recently increased by a full 50% due to the rearmament efforts of NATO countries in particular. At its current level of around EUR 8.40, the stock is trading at a 2025 P/E ratio of 16. On the LSEG platform, there are only 4 "Buy" recommendations out of 12 analyses, with an average price target of EUR 8.27. One can only hope that TKMS's planned IPO will enable the Company to turn things around.

BYD and VW – After the panic comes the upside

There is currently a lot of volatility in the pricing for the Chinese e-mobility leader "Build your Dreams (BYD)." In May, there was a drastic price reduction for all new e-models, which is intended to boost sales in the newly entered EU market. Customer interest is enormous, yet new registrations of BYD models are still in the low thousands. Nevertheless, large container ships carrying up to 3,000 vehicles are sailing from China to Antwerp every week. More than 5.5 million units are to be delivered worldwide this year. BYD has a major advantage in the price war thanks to its vertically integrated supply chain, as it manufactures its own semiconductors and batteries. The Chinese sanctions on raw materials are also playing into the Company's hands. By favoring domestic manufacturers, it does not have to worry about supply chain problems. BYD will open its own production facility in Hungary in the EU in 2026, which will also eliminate import duties. For those wondering about the price rise from around EUR 16 to almost EUR 50: BYD has issued bonus shares in several rounds!

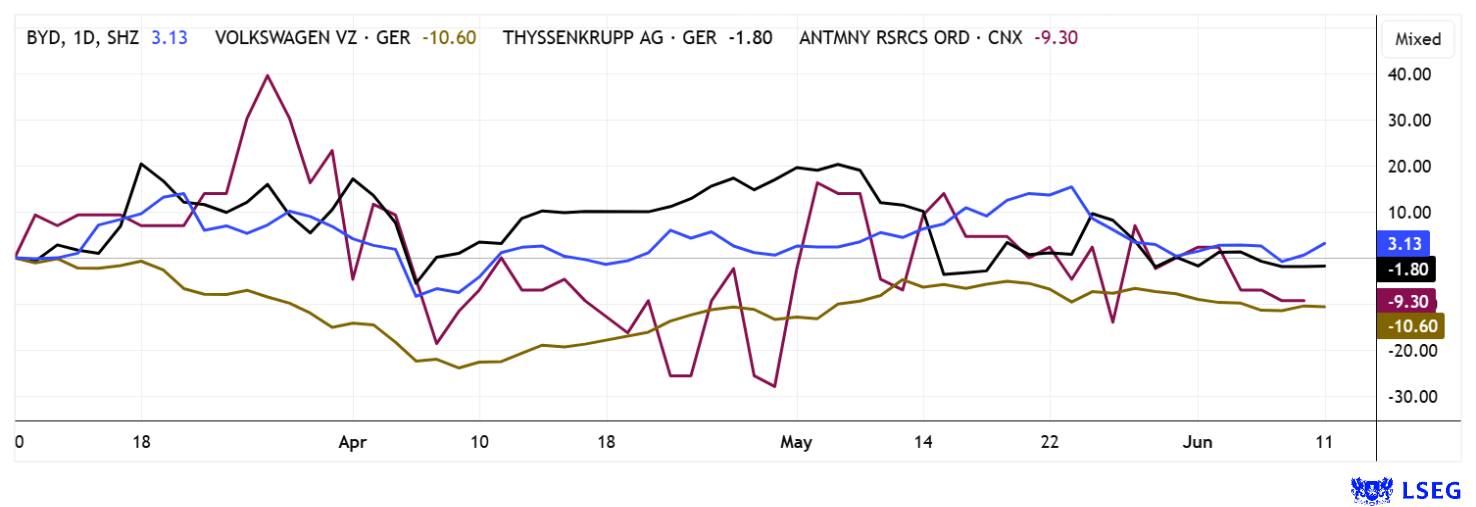

For Volkswagen, the German market leader in e-mobility, the Chinese company's strong momentum could be another blow. After years of IT problems with its ID models, business has at least stabilized since mid-2024. VW announced deep cuts in personnel and production capacity back in December. According to the announcement, the Wolfsburg, Zwickau, Osnabrück, and Dresden sites will be affected by the reduction in annual production capacity. The main share of the cuts will be made at the main plant in Wolfsburg, with no fewer than 500,000 units to be saved, as production of the traditional VW Golf model will be relocated to Mexico at the end of 2026. One can only hope that the measures will be effective, as VW is one of the worst performers in the DAX 40 index with a 12-month performance of minus 16%. Its Chinese competitor has seen its share price rise by over 90% in the same period. The only consolation is that VW is trading at a 2025 P/E ratio of 3.7 and is paying a dividend of almost 7%. BYD is valued at twice as much as its Wolfsburg counterpart in terms of market capitalization. Perhaps the gap will close again at some point once Wolfsburg has repositioned itself.

2025 could turn out to be a top year for strategic metals. The underlying supply chain issues are leading to a permanent increase in the price of raw materials, which is putting pressure on the margins of manufacturing companies. In Germany, thyssenkrupp and VW are among the hardest hit, while BYD benefits from China's domestic supply chain and is fully vertically integrated. Antimony Resources offers an opportunity for strong gains, as there is currently virtually no domestic production of the critical raw material antimony in North America.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.