April 29th, 2024 | 06:30 CEST

Turnaround within reach; invest in hydrogen 3.0 now? Nel ASA, Plug Power, dynaCERT and Daimler Truck

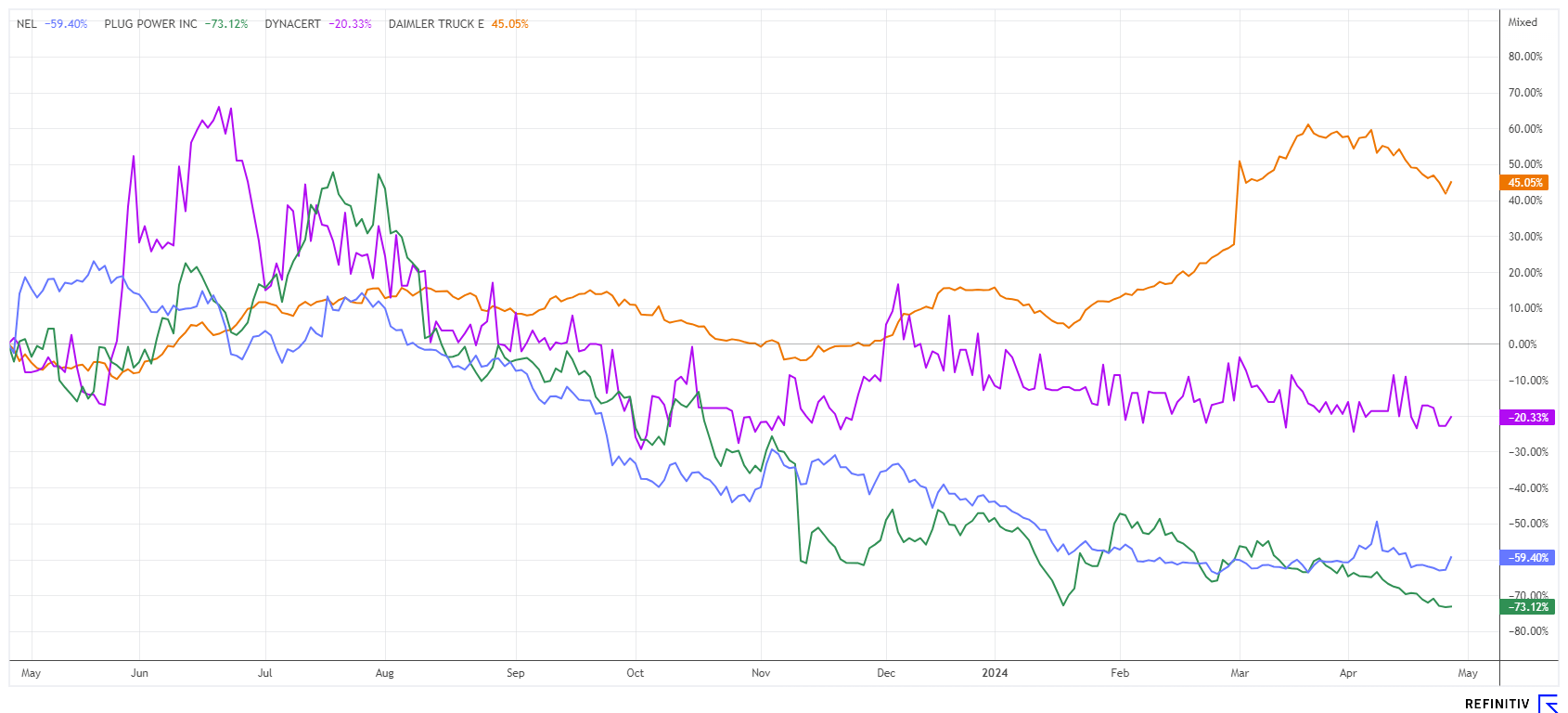

No sector has been hit as hard in recent months as the hydrogen sector. Even after 70 to 90% losses in individual well-known public stocks, the starting signal for a recovery rally does not yet seem to be in sight. However, there are now an increasing number of listed business models that use hydrogen as a clean, climate-friendly fuel. Spurred on by public subsidies, attempts are now being made to combine alternative energy generation and clean combustion processes. Whether in steel production, industrial manufacturing, or transportation, the application areas are diverse. Are interested investors now facing a technical rebound in the hydrogen sector?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

NEL ASA NK-_20 | NO0010081235 , PLUG POWER INC. DL-_01 | US72919P2020 , DYNACERT INC. | CA26780A1084 , Daimler Truck Holding AG | DE000DTR0013

Table of contents:

"[...] The VERRA certification adds credibility to dynaCERT's emission reduction technologies by demonstrating compliance with internationally recognized standards for carbon emissions reductions and sustainable development. [...]" Jim Payne, CEO, dynaCERT Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Daimler Truck - Hydrogen truck manages 1000 km

Daimler Truck has successfully demonstrated that hydrogen fuel cell technology can be an important solution for the decarbonization of flexible and demanding long-distance road transport. A prototype of the Mercedes-Benz GenH2 Truck approved for public road traffic covered a distance of 1,047 km on one tank of liquid hydrogen as part of the Daimler Truck "HydrogenRecordRun." This is not only in test mode but also in different driving and charging situations. However, development at Daimler Benz is also moving towards electromobility in the alternative drive sector, particularly for buses.

Despite a high level of innovation and good sales figures, CEO Martin Daum is not entirely satisfied with the first quarter, as fewer vehicles were sold in all major markets. From January to March, the DAX-listed company's sales fell by 13% to just under 109,000 units compared to the same period last year. Still, experts see this as an expected normalization of the global truck markets. While Europe and North America performed satisfactorily, the environment in Asia was weak. A full 29% fewer commercial vehicles were sold there. In contrast, the bus business recorded a small increase of 1%.

Daimler Truck shares reached their high of EUR 47.85 in March and are currently around 15% lower. Analysts on the Refinitiv Eikon platform expect a slight decline in sales of 2% to around EUR 54.5 billion for the current year. However, this is expected to rise again to EUR 62.7 billion by 2026. The current P/E ratio of around 9.1 would fall to around 7.5 in 2 years. It is not expensive for a global technology market leader who also offers a dividend of just under 5%.

dynaCERT - Into a new era

The Canadian company dynaCERT is a technology supplier for the transport industry in all segments. With the sophisticated hydrogen add-on HydraGEN™ (HG1), diesel combustion processes can be optimized to such an extent that, depending on the type of use, fuel savings of between 8% and 20% can be achieved. In addition, the soot and nitrogen content is reduced, making the exhaust gases cleaner. The technology is particularly well-suited for public transport companies, freight forwarders, and the mining industry to meet environmental regulations and reduce the carbon footprint of entire fleets.

The Company is collaborating with the organization VERRA to enable the issuance of CO2 credits for the use of the technology in the future. Once VERRA certifies dynaCERT solutions, there will be tradable pollution rights in addition to the economic incentive provided by fuel savings. This benefits both the Company's and others' environmental records. Solutions of this kind directly contribute to the active climate policies of Western governments. Investors have become somewhat impatient due to the long wait for certification. A large number of shares are currently changing hands, indicating increased attention on the share. Since certification by VERRA could be announced any day now, long-term investors, in particular, should take advantage of the opportunity to get in.

Nel ASA and Plug Power - Consolidated?

Nel ASA and Plug Power are currently experiencing interesting daily movements. There are often 10% swings upwards, but they are quickly neutralized. Technical observers are offered recovery attempts by traders who want to set the "hydrogen" momentum in motion again. The headwind for this action often comes in the form of operating figures, which have not been particularly inspiring for months.

What is missing across the board are public contracts such as this one from Nel ASA. In the US, for example, the Norwegians are cooperating very prominently with hydrogen project developer Hy Stor Energy on the Mississippi Clean Hydrogen Hub (MCHH) project. As part of the cooperation, a volume of more than 1 GW in the form of alkaline electrolysers has been reserved at Nel. Subject to the final investment decision, production at the plant on Herøya in Norway is scheduled to take place between 2025 and 2027. So far, however, it is only a letter of intent, which Nel will not consider as an order intake or order backlog until a firm order has been received.

Opinions are divided when it comes to Plug Power, with the share price already falling to USD 2.14 this year when management announced a USD 1 billion financing via the stock exchange. The shares were not offered to existing shareholders but were placed on the market by investment banks "at the best price". Although the capital increase has now been completed, the share price is barely budging at USD 2.42. Nevertheless, the hydrogen company, which has run into financial difficulties, has some promising news to report. Plug Power has succeeded in signing further contracts for the delivery of so-called Basic Engineering and Design Packages (BEDP) for projects in Europe and the US with a total capacity of up to 350 MW of PEM electrolysers. Since the introduction of the BEDP offer just two years ago, Plug Power's electrolysis business has experienced continuous growth, but investors are not yet able to benefit from this.

Plug Power provides technical buy signals above the USD 2.75 mark, while Nel ASA should first cross the EUR 0.52 line. Although this is only 15 to 20% away in both cases, investors are still too scared to call for a turnaround after a price loss of over 85% in the last two years.

While Daimler Truck's truck and bus business continues to boom, the hydrogen sector is currently just managing to keep its feet on the ground. The major producers of electrolysers, such as Nel ASA and Plug Power, are still waiting for public orders, while dynaCERT, on the other hand, continues to land international orders. Nevertheless, the markets are waiting impatiently for the expected VERRA certification for the issue of emission rights. If it comes soon, the valuation is likely to rise faster.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.