May 9th, 2023 | 09:10 CEST

Turnaround stocks with a 300% chance do not come along every day - BASF, Defiance Silver and TUI

Whenever the stock market reaches new highs, investors look for lagging stocks. This is not so easy because a weak price performance has its reasons. But often, things are simply overlooked. We present three stocks with a good story to tell but have been left behind. BASF, Defiance Silver and TUI were conspicuously undercut. And amid all the turbulence in the financial system, silver is stealthily making its way upwards and easily overcoming the USD 25 mark. Watch out at the edge of the platform!

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

BASF SE NA O.N. | DE000BASF111 , DEFIANCE SILVER CORP. | CA2447672080 , TUI AG NA O.N. | DE000TUAG505

Table of contents:

"[...] Internally we expect the resource to significantly grow the deeper we mine. [...]" Dennis Karp, Executive Chairman, Manuka Resources

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Silver - A versatile metal

Geopolitical upheavals and doubts about the state of the financial system, along with galloping inflation, are a good breeding ground for precious metal investments. Gold, for example, climbed to a new all-time high of over USD 2,080 last week, but its little brother, silver, has not yet managed to move into the limelight on a sustained basis. Wrongly, because whether 5G technology, flexible displays or RFID chips, new areas of application in the high-tech sector will significantly increase the industrial demand for the precious multi-talent silver in the coming years. It is well known that silver is the metal with the best electrical conductivity and the highest light reflection on Earth. Its very low electrical resistance led to its use in semiconductors and batteries as early as 20 years ago. Silver offers a lower transmission loss and higher efficiency than copper. For the current year, the analysis house Metals Focus expects industrial demand to rise to over 1 billion ounces of silver. That puts the record high of 1.07 billion ounces from 2013 within reach again.

Defiance Silver - Prospective silver project with upside

Canadian junior Defiance Silver (DEF) is developing several silver projects in Mexico, primarily in the Fresnillo Belt. Here, more than 6.2 billion ounces of silver have historically been mined to date, representing about 10% of global silver production. The focus of the Canadians is the flagship project, San Acacio, which is located in the middle of the Zacatecas Silver District. The San Acacio mine of the same name is located directly on the border of the Defiance claims, not far from the Veta Grande vein structure, whose discovery dates back to 1546. More than 200 million ounces of silver have been mined here, and part of the property has never been explored using modern methods.

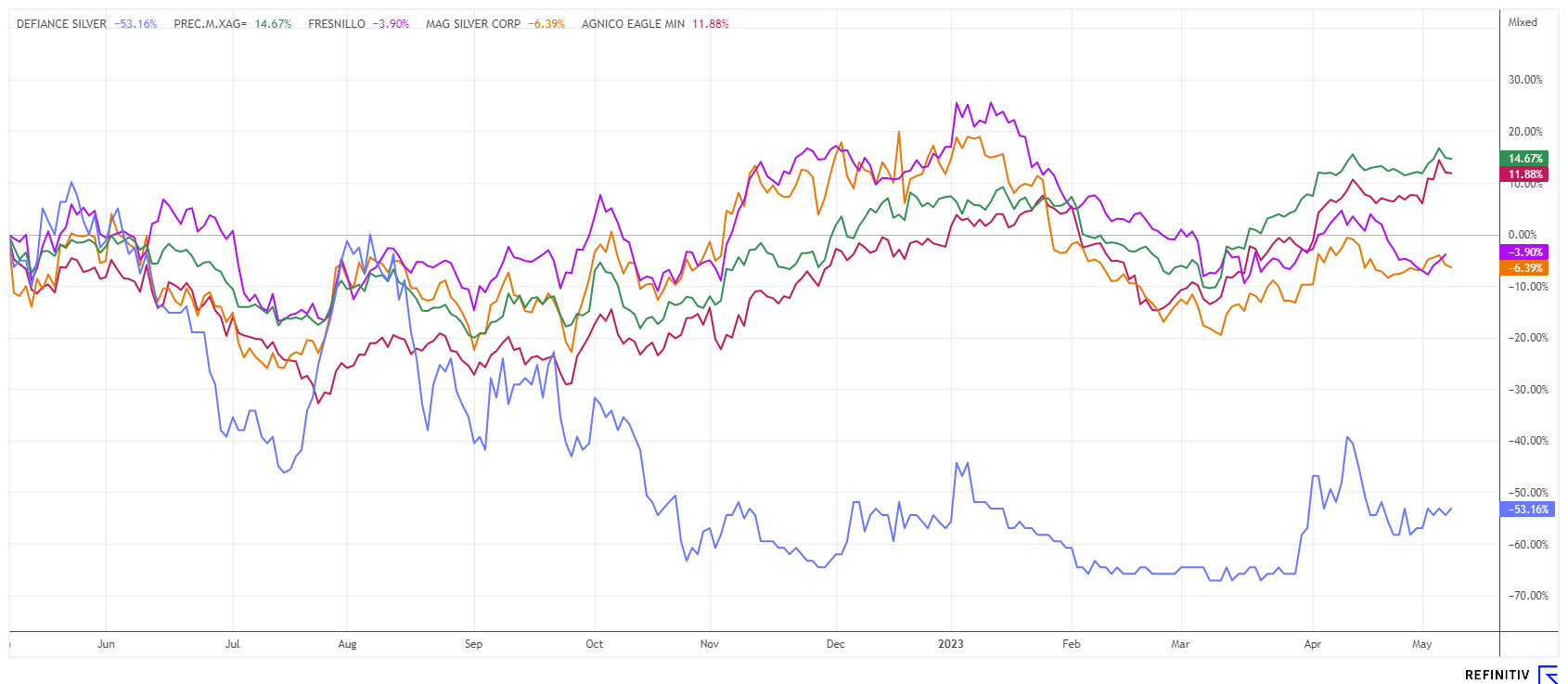

A first resource estimate of 16.9 million ounces of silver already exists for San Acacio. In addition to this property, Defiance has recently been able to significantly expand its land position in this mining district with the Lucita project as well as Panuco and Lagartos. Fresnillo, MAG Silver, Pan American and Agnico Eagle are producing in the immediate vicinity. Defiance Silver is currently pushing ahead with exploration, and further drill results can be expected in the next few weeks.

In the province of Michoacan, there is another pearl on top. Very few gold mines operate with production costs below USD 500 per ounce. Defiance Silver's Tepal gold-copper project is one of them. According to the prefeasibility study (PFS) from 2017, it can be mined here at a sustainable price of USD 400 per ounce. Admittedly, costs have risen significantly since then, but even at a 50% premium, USD 600 would be a hit at spot prices of USD 2,080. Here, a resource (M&I) of 1.8 million ounces of gold and 813 million pounds of copper. Due to the good framework data, producers also consider the advanced project a potential takeover target. Currently, the property is in a legal dispute over the concession. However, the chances are good that the lawsuit will end in Defiance Silver's favour. The Company currently has about USD 5.5 million in cash and is debt-free. At a share price of CAD 0.185, the entire company is valued at only CAD 42 million. A very promising call option on the silver price.

BASF - One of the world market leaders in battery materials

The Ludwigshafen-based company BASF is the largest chemical producer in the world. BASF is represented in 91 countries and operates 239 production sites with over 111,000 employees. An important pillar is modern materials for battery production. From 2025, the actual range of a mid-range car is expected to double from 400 to 800 km - no matter whether the air conditioning is running or the music is turned up to max volume.

Cathode materials are central to the performance, affordability and reliability of modern batteries for e-mobility. Currently, the weighted average in range is about 385 km if all weather conditions are considered. This requires modern process technology, a secure local raw material supply chain, a favourable energy mix in production and short and effective logistics along the supply chain. In 2022, BASF entered into a strategic partnership with CATL, which enables close cooperation with a leading global battery manufacturer in the field of cathode materials and battery recycling. As the global market leader, CATL supplies over 35% of all e-vehicles with its power packs.

22 out of 27 analysts on the Refinitiv Eikon platform recommend buying BASF shares with an average price target of EUR 53.78. The stock paid a 7% dividend and recovered the discount after only five trading days. At EUR 46.90, BASF is currently one of the top picks in the DAX Index, but from a chart perspective, the price must first exceed EUR 51 for the journey to continue.

TUI - This capital increase was historic

The travel giant from Hanover has just completed a mammoth capital increase. Even though sentiment has been battered lately, the share price is currently able to recover significantly from its all-time low of EUR 5.63. Thanks to the proceeds from the latest capital increase, TUI transferred EUR 750 million to WSF in a final tranche. The WSF and the state-owned development bank KfW had saved TUI from going under after the collapse due to the Corona pandemic with capital injections, bonds and credit lines totalling around EUR 4.3 billion. The Hanover-based company had already repaid part of the sum last year. A few days ago, the travel group raised around EUR 1.8 billion in fresh money from shareholders with the help of a capital increase. The management is optimistic again: "There will be no last-minute summer in 2023 like there used to be," said CEO Sebastian Ebel. He even expects prices for late bookings to become higher rather than cheaper. The major British bank HSBC has raised its rating to "buy" after the successful share placement and sees a target price of EUR 9.10, a good 40% above the current price. One can only wish TUI that the summer lives up to its promise.

The blue-chip stocks of the DAX index are jumping from one high to another, and all this against the backdrop of rising interest rates and a recessionary outlook for the economy. Nevertheless, there are opportunities for selected stocks: BASF is analytically cheap, while TUI and Defiance Silver are on the list as turnaround stocks with a good risk-reward ratio.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.