October 18th, 2023 | 06:50 CEST

Turnaround for Plug Power stock? Barrick Gold and Manuka Resources are also on the rise

Is this the turnaround for Plug Power? After all, the stock has gained about 20% in the past few days. Looking at the longer-term price chart of the hydrogen pioneer, this is only a small success, but at least it is a start. Barrick Gold's stock has also seen an upswing in recent days, and the outlook for the fourth quarter could give the gold company a further boost. The CEO of Australian resource company Manuka Resources has expressed optimism that the stock will soon reach higher prices. "For a company that is already producing gold and has two projects fully funded, we are extremely cheap at a valuation of AUD 25 million. So we should have seen the bottom," commented Dennis Karp at the recent IIF virtual investor conference. Where does this optimism come from?

time to read: 4 minutes

|

Author:

Fabian Lorenz

ISIN:

PLUG POWER INC. DL-_01 | US72919P2020 , BARRICK GOLD CORP. | CA0679011084 , Manuka Resources Limited | AU0000090292

Table of contents:

"[...] Our projects are at the initial, high reward exploration stage. [...]" Humphrey Hale, CEO, Managing Geologist, Carnavale Resources Ltd.

Author

Fabian Lorenz

For more than twenty years, the Cologne native has been intensively involved with the stock market, both professionally and privately. He is particularly passionate about national and international small and micro caps.

Tag cloud

Shares cloud

Manuka Resources: Exciting mix argues for rising shares

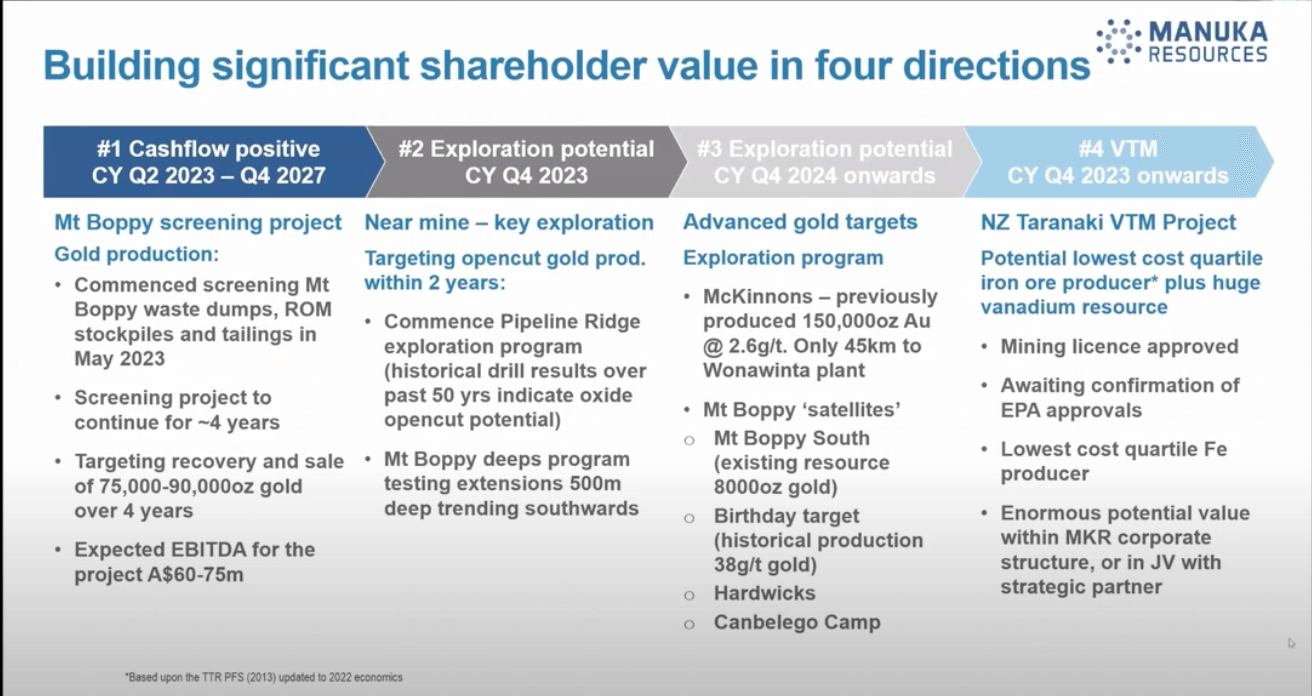

For one, Manuka has two exciting precious metals projects in Australia. The flagship is the Mt Boppy mine. The open pit mine used to be one of Australia's richest gold mines. Manuka has revitalized it and has already put it into production. The current resource estimate is 160,000 ounces of gold. Over the next 4 years, about 20,000 ounces will be mined and sold yearly. This not only provides Manuka with the financial scope to continue the exploration of Mt Boppy but also to move forward with other projects. The Wonawinta Silver project, for example, is also located in Australia. With a mineral resource estimate of 51 million ounces, it is one of Australia's largest silver deposits. Here, too, the Manuka CEO emphasized in his presentation that there was still plenty of room for expansion in the resource estimate.

The third iron in the fire is perhaps even the most exciting: the South Taranaki Bight project. It has a resource estimate totaling 3.8 billion tons of vanadium, titanium and magnetite that is "world-class." It was purchased by Manuka in November 2022 and is located offshore New Zealand. It has the lowest carbon footprint of similar projects in the world, he said. That is important because it positively impacts the carbon footprint of processors. And it is also among the world leaders in terms of costs in relation to the quality extracted. New Zealand has already invested around USD 50 million in the project.

In his presentation, Dennis Karp showed a clear roadmap to help Manuka's share price soar. For one, he said Mt Boppy is now cash flow positive and will generate positive operating earnings (EBITDA) of AUD 60 million to AUD 75 million by 2027. Then, in Q4, there should be multiple drill results from several projects at once. More projects will be reported in 2024. And then, of course, there is South Taranaki Bight. There should also be further newsflow here in the coming months. All of this is currently available for just AUD 25 million. Click here for the presentation of Dennis Karp at the recent IIF.

Barrick share jumps

In recent days, Barrick Gold's stock has jumped. After the share briefly slipped below the EUR 14 mark at the end of September, it is now back at EUR 15. This development is exemplary of the mood in the gold sector. It has improved noticeably in recent days, and the major producers usually benefit initially.

A few days ago, the gold giant reported preliminary figures for the third quarter. Accordingly, Barrick sold 1.03 million ounces of gold and 101 million pounds of copper. While more was produced in the third quarter than in the previous quarter, it was less than planned. Thus, Barrick continues to struggle with problems in the expansion of the Pueblo Viejo mine. However, Barrick now wants to get this under control and produce significantly more in the fourth quarter.

Plug Power: Is this the turnaround?

The Plug Power share has also been noticeably friendlier in recent days. The security of the hydrogen pureplay has gained around 20% in the past few days and was trading yesterday at almost USD 7.60. Previously, the share had marked a multi-year low at USD 6.32.

A few days ago, the Company joined US government officials in celebrating Plug Power's Appalachian Regional Clean Hydrogen Hub (ARCH2) selection by the Department of Energy under the Regional Clean Hydrogen Hubs program. The Regional Clean Hydrogen Hub program promotes the development of a clean hydrogen network in the United States. ARCH2 alone is expected to create more than 21,000 jobs, with over a hundred million USD in funding expected to flow for this. Plug will play an essential role in the ARCH2 Hub by acting as a project partner, supplier and provider of essential services throughout the hydrogen value chain.

Plug Power CEO Andy Marsh said, "The federal Hydrogen Hub program can accelerate the clean hydrogen economy and infrastructure development in support of our nation's clean energy future. Funding the Hydrogen Hub in conjunction with the pragmatic implementation of the Inflation Reduction Act's clean hydrogen production tax credit can solidify US climate leadership, accelerate the national clean hydrogen economy, and build on Plug's ongoing commitment to end-to-end green hydrogen solutions across the country. Plug is grateful for the Department of Energy's selection of this consortium and for the Appalachian region's efforts to develop one of the nation's leading centers for hydrogen solutions." Plug Power's involvement with ARCH2 is well known, and the recent news seems to help the struggling stock.

The stock of Plug Power continues to send signs of life. Whether it is truly a turnaround will be seen in the coming weeks. Looking at the geopolitical uncertainties in the Middle East, the turnaround in gold seems likely. This should benefit Barrick and Manuka Resources. In the case of Manuka, the mix of low market capitalization, through-financing, and the South Taranaki Bight project as a price kicker argues for an entry.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.