February 9th, 2026 | 07:00 CET

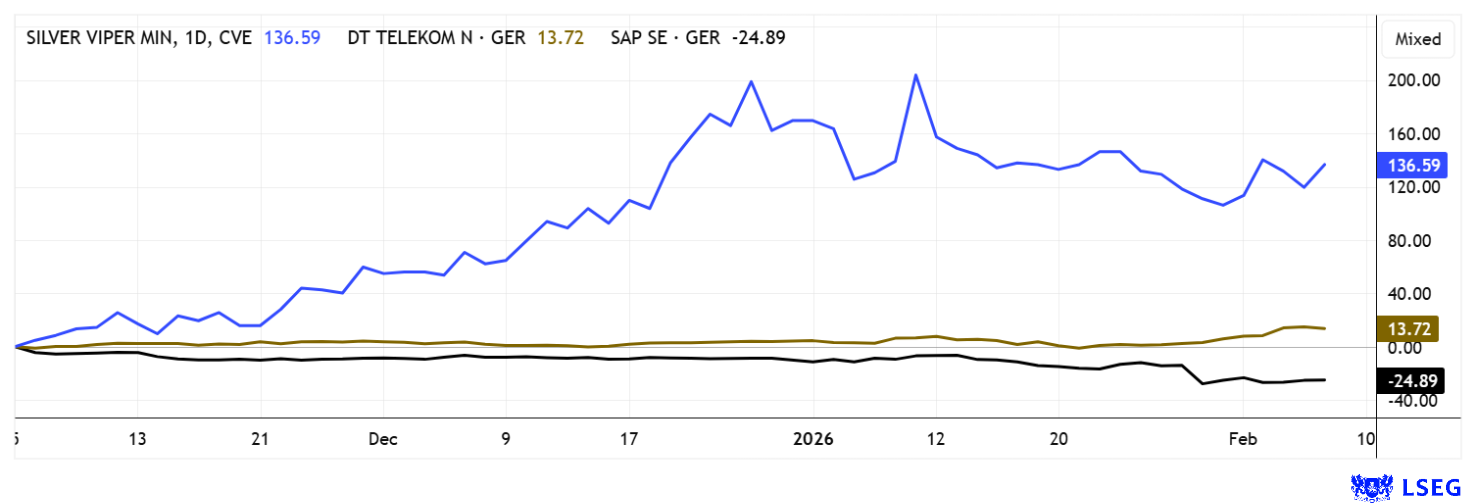

Turnaround after the sharp correction? Silver price target USD 100 with Silver Viper, SAP, and Deutsche Telekom

Fallen hard and then left on the ground for a while - that describes the silver price, which surged like a rocket from USD 50 to USD 122 over the past three months, only to collapse to USD 72 in a single day. That represents a 40% drop, with more than 500 million ounces in derivative-equivalent volume traded. For context: annual global silver production has been around 800 million ounces for several years, and no meaningful short-term increases are expected. Now, however, the March delivery period is drawing closer, when approximately 1.5 billion ounces of physical silver will have to be delivered. The key question is: who actually has these quantities? The warehouses of the futures exchanges have been severely depleted in recent months by the exercises of ETFs, processors, and investors, and new goods on the world markets are being meticulously absorbed by high-tech producers. It will be fascinating to see how, and with which measures, exchanges attempt to navigate their delivery obligations. Against this backdrop, we take a look at the up-and-coming silver company Silver Viper and two representatives of the German DAX high-tech group, SAP and Deutsche Telekom. In a highly volatile market environment, they offer a welcome opportunity for portfolio diversification.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

SILVER VIPER MINER. CORP. | CA8283344098 , SAP SE O.N. | DE0007164600 , DEUTSCHE TELEKOM ADR 1 | US2515661054 , DT.TELEKOM AG NA | DE0005557508

Table of contents:

"[...] Internally we expect the resource to significantly grow the deeper we mine. [...]" Dennis Karp, Executive Chairman, Manuka Resources

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Silver Viper – Dream destinations in Mexico

This silver sell-off was intense! However, Canadian explorer Silver Viper Minerals flexed its muscles. The company has positioned itself remarkably robustly, both operationally and strategically, in a highly volatile silver market, outperforming the underlying commodity price with significantly above-average share performance. While the silver price has recently experienced extreme swings, the company has been able to justify its valuation primarily through company-specific progress and consistent project development.

The Canadians are focusing on several gold and silver projects in Mexico, all of which are located in established precious metal regions with good infrastructure. The core La Virginia project forms the foundation of the growth story, as extensive historical and current drilling data have already created a robust resource base. The ongoing and planned exploration programs now aim to significantly expand the known mineralization both laterally and at depth and further increase the economic value of the project. A key milestone was the successful raising of approximately CAD 17 million in capital, which not only secures financing for the next phase of development but also underscores the confidence of institutional investors. These funds enable Silver Viper to advance several projects in parallel, thereby diversifying exploration risk.

Of particular strategic importance is the complete consolidation of the Coneto project, which is located in one of Mexico's most productive silver zones and already has substantial inferred gold and silver resources. The participation of renowned industry leaders such as Fresnillo and Orex Minerals lends the project additional industrial validation and brings valuable technical expertise to the table. The project portfolio is complemented by Cimarron, a gold-copper project with a proven resource that opens up additional optional value levers.

The company has also strengthened its management and governance by bringing in experienced leaders with a strong background in capital markets and commodities. This increases professionalism in financing, reporting, and strategic management and is particularly relevant in a capital-intensive exploration phase. Against this backdrop, the recent price setbacks for silver appear to be a welcome opportunity to increase exposure to Silver Viper. After highs of CAD 2.55, the stock corrected to CAD 1.65, but on Friday it had already reached CAD 2.02 again. Institutional investors such as Sprott Asset Management and US Global Investors are among the major shareholders, and the market capitalization is currently CAD 186 million – a drop in the bucket for the above-mentioned projects!

IIF presenter Lyndsay Malchuk talks to CEO Steve Cope about developments and the further exploration strategy in Mexico.

SAP – After the figures comes the next upswing?

The Walldorf-based software company SAP is certainly not a major consumer of silver, as the ERP and cloud experts supply medium-sized companies with first-class business software. However, an indirect connection is coming to the attention of investors in view of the ever-growing cloud business: large data storage facilities require enormous computing capacities in the form of large-scale systems. The construction of these gigantic data centers consumes vast quantities of metals and, since the push for AI applications, has become a bottleneck in the further development of high-tech companies. The spotlight is naturally on the important conductor metals copper and silver, but only through indirectly measurable demand. In its core business, SAP reported solid earnings and revenue figures for fiscal year 2025 at the end of January, with earnings per share and cloud revenue continuing to grow, but some key metrics falling short of analysts' expectations. As a result, SAP's share price plummeted 20% from EUR 207 to around EUR 168. There were tentative attempts at recovery last week, but analysts still consider the projected growth to be too low.

In its latest outlook, SAP confirmed its annual targets for cloud revenue and rising operating profits, but cited a certain "reduced visibility" due to geopolitical and economic uncertainties, particularly in the US. Analysts reacted differently to this cautious guidance: some continue to see strong potential, while others have lowered their price targets or adjusted their ratings. Nevertheless, 27 of 37 analysts on the LSEG platform still recommend a "Buy" with an average 12-month price target of EUR 248. Deutsche Bank has already updated its target to EUR 220 and Banco Santander to EUR 190. Based on 2027, the P/E ratio is now only 20 – cautiously accumulate in the EUR 165 to 172 range!

Deutsche Telekom – Now also active in the commercial AI business

Deutsche Telekom surprised everyone last week with a bombshell in the field of artificial intelligence. The Bonn-based company has put its first large AI factory into operation in Munich. The large-scale facility near the English Garden is part of a new innovative business model for industry, start-ups, and the government. CEO Timotheus Höttges believes that this joint project with US chip manufacturer Nvidia and Europe's largest software company SAP is putting the company on the right track to finally tap into a real growth area. For years, analysts have criticized the telecom giant's lack of aggression in the fields of the future. Over EUR 1 billion has been invested, and Finance Minister Lars Klingbeil is also enthusiastic: "This is an important milestone for the German and European AI ecosystem." The new large data center is equipped with 10,000 graphics processors from Nvidia, which are primarily intended to process AI requests from companies in the surrounding area. **Analysts were optimistic, with current ratings from ODDO, Intesa, and Berenberg certifying price targets between EUR 33 and EUR 38. The consensus on the LSEG platform is also EUR 36.88. With a dividend yield of 3.8% in 2026 and a P/E ratio of 13.7, investors in Deutsche Telekom are not far wrong at levels around EUR 30! Technically, important zones have just been recaptured.

The stock market is going through some serious ups and downs. This is not just affecting the precious metals sector; high-tech is also correcting its recent record highs, and the crypto sector is seeing sharp declines. After such a significant upward cycle over the past two years, a correction should not necessarily come as a surprise. Dynamic investors are already buying again, while others are still taking a cautious wait-and-see approach. Not everyone can simply buy into these high prices; it takes courage. The next rally is already on the horizon for Silver Viper, and SAP and Deutsche Telekom are also well on track. All three stocks are attractively priced in their sector.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.