February 17th, 2026 | 07:00 CET

Tungsten price explodes to USD 1,737: Why Almonty is now becoming the West's money printing machine – bottleneck for Sandvik and Rheinmetall

A scenario is currently unfolding on the commodity markets that even experienced traders and analysts describe as "extraordinary," if not a "tectonic shift." While investors often look to gold or copper, an exponential price development is taking place in a strategic niche that is turning the calculations of the entire Western industry upside down and creating new hierarchies. The tungsten market, the metal that forms the backbone of the modern defense and high-tech industry due to its extreme hardness and heat resistance, has spiraled out of control. Almonty is the only Western producer to create significant new capacity in 2026.

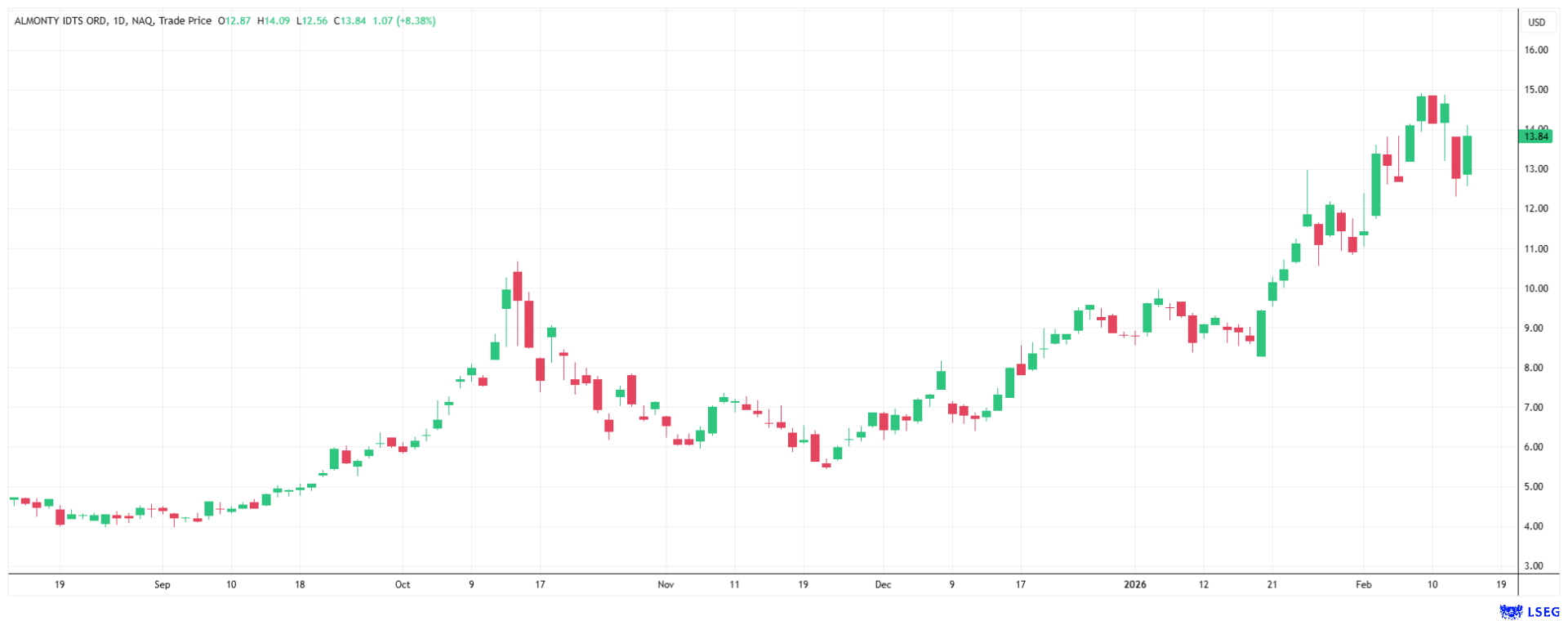

The price of ammonium paratungstate (APT), the global benchmark product for tungsten trading, is skyrocketing. Within a single week, the price in Rotterdam shot up by more than 26% to reach an average price of USD 1,737 per mtu (metric ton unit). To really understand the drama of this development, one needs to look at the timeline. **At the beginning of 2025, the price was still hovering around USD 340. By the end of 2025, it had more than doubled to USD 862, which was already considered sensational. But what we are now experiencing in the first quarter of 2026 is no longer a normal market fluctuation. It is a wave of panic buying that has caused the price to increase fivefold in just over a year. In this extremely dynamic environment, there are many losers on the buyer side – but on the producer side, there is one clear winner that is positioned like no other: Almonty Industries.

time to read: 3 minutes

|

Author:

Nico Popp

ISIN:

ALMONTY INDUSTRIES INC. | CA0203987072 , SANDVIK AB | SE0000667891 , RHEINMETALL AG | DE0007030009

Table of contents:

"[...] While tungsten has always played an important role in the chip industry, it is now being added to batteries for e-cars. [...]" Lewis Black, CEO, Almonty Industries

Author

Nico Popp

At home in Southern Germany, the passionate stock exchange expert has been accompanying the capital markets for about twenty years. With a soft spot for smaller companies, he is constantly on the lookout for exciting investment stories.

Tag cloud

Shares cloud

The nightmare of Rheinmetall and Sandvik: When reality dictates the price

For the industrial heavyweights of the West, this price development is a shock that cuts deep into their balance sheets. Companies such as Rheinmetall, the German defense giant, and Sandvik, the Swedish global market leader for cutting tools, find themselves in a strategic dilemma. Tungsten is not "nice to have" for their products, but simply indispensable.

With a melting point of 3,422 degrees Celsius, the highest of any metal, and a density almost equal to that of gold, there is no substitute for tungsten in critical applications. Rheinmetall needs the metal for its kinetic energy armor-piercing ammunition. Sandvik needs it to harden drills, milling cutters, and tools that are harder than the steel they are designed to work on. When China, which historically controlled over 80% of the market, turns off the export tap, these Western corporations have no choice. They must accept the market price to keep their production running and avoid contractual penalties. With strategic stocks in the West having been neglected for decades, these industrial giants are now fighting for every available ton on the spot market. Stocks are empty, and demand from the defense industry is at a record high given the geopolitical situation in the world. The result is the current price jump to USD 1,737 - a price that was considered science fiction 18 months ago.

Almonty Industries: Perfect timing for the "super cycle"

Almonty Industries is stepping into this vacuum of fear and scarcity. The company is in the midst of ramping up production at its world-class Sangdong mine in South Korea. The mine is considered the largest new opening since the 1970s and outperforms the Chinese in terms of production costs – all in a secure jurisdiction and fully ESG-compliant. The ramp-up of the Gentung Browns Lake project in the US state of Montana is also planned for 2026. Almonty has been mining in Portugal for years. The timing could not be more perfect. Almonty will bring its new capacity to market in 2026 – exactly when market panic is at its peak and prices are skyrocketing. Management has developed and financed the mine over many years and pushed ahead against all odds. Now the company is reaping the rewards of an unprecedented geopolitical shortage.

The mathematics of margin explosion

But why is this price increase so explosive for Almonty shares? The answer lies in operational leverage. In mining, the costs of extracting a ton of rock are largely fixed. Wages, energy, diesel, and maintenance do not fluctuate to the same extent as the price of the raw material. A hypothetical calculation illustrates the dynamics: Assuming that the production costs of a mine comparable to Sangdong would be USD 250 to 300 per mtu, the project would be profitable at a selling price of USD 340. At a tungsten price of USD 862 (market price of tungsten at the end of 2025), it was already highly attractive. But at a price of USD 1,737, as we are currently seeing, the margin explodes. Revenue per ton increases fivefold, but profit per ton increases tenfold or more. What was originally planned as a solid, cash flow-positive mine is transforming at this price level into a cash flow machine that generates massive surpluses every month. The mine operator can use these free funds to pay off debt in record time, pay dividends, or finance further projects without diluting shareholders. Regardless of this hypothetical example, more and more analysts are recognizing this potential at Almonty – and have raised their price targets in recent days.

Unrivaled in the West: The strategic moat

However, the strongest argument in favor of Almonty shares is their unique geopolitical position. There is no other producer in the Western sphere of influence that can supply tungsten in this quantity, quality, and reliability. The Sangdong mine is one of the largest tungsten deposits in the world outside China and has extremely high-grade ores, which further benefits the cost structure.

Almonty is thus no longer just a simple mining company; it is in fact the guarantor of security of supply for NATO countries and the high-tech industries of South Korea and the US. In a world that is breaking down into geopolitical blocs, security of supply is becoming the hardest currency. While Rheinmetall and Sandvik groan under high costs and desperately search for non-Chinese materials, Almonty dictates the terms. For shareholders, this is a unique opportunity that rarely comes along. The market has not yet priced in what the squeeze on the tungsten market really means for Almonty.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.