March 6th, 2023 | 14:07 CET

TUI, Lufthansa, Alerio Gold, Carnival - Golden summer ahead, get in now!

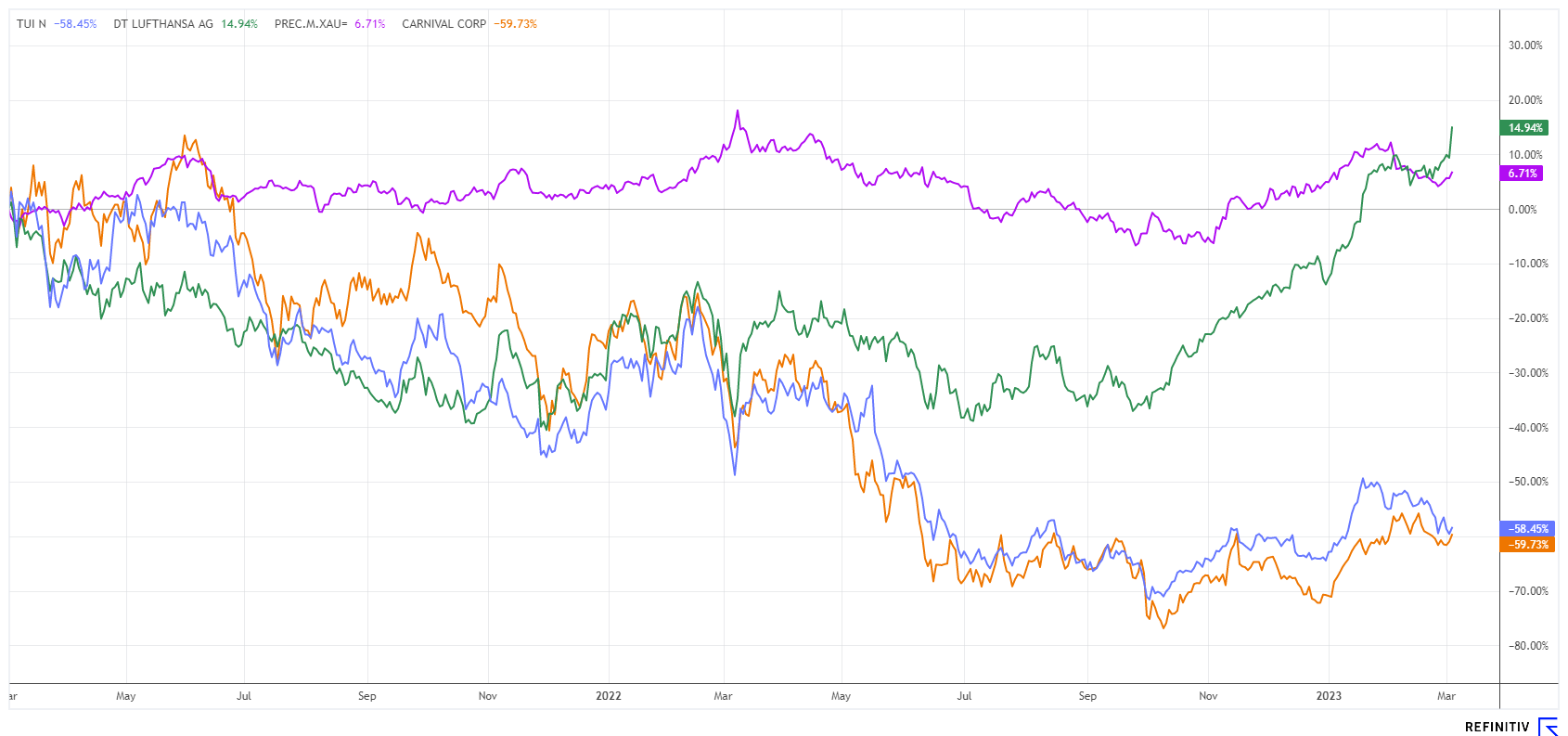

According to a survey, people in Germany are again in the mood to travel, despite numerous concerns. However, the assessment of the personal situation has clouded compared to last year because 29% of respondents fear an economic deterioration. Due to various catch-up effects, life is returning to the travel industry after two years of pandemic restrictions. Industry representatives are also consolidating. Lufthansa has already moved into the plus zone. At TUI, there was a reverse split to make future capital increases possible again. Where should you get in now?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

TUI AG NA O.N. | DE000TUAG000 , LUFTHANSA AG VNA O.N. | DE0008232125 , Alerio Gold Corp. | CA01450V1040 , CARNIVAL PLC DL 1_66 | GB0031215220

Table of contents:

"[...] Our projects are at the initial, high reward exploration stage. [...]" Humphrey Hale, CEO, Managing Geologist, Carnavale Resources Ltd.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Lufthansa, TUI and Carnival - Travel is fun again

Thanks to the recovery in ticket demand and record results in freight and maintenance, Lufthansa's EBIT reached a good EUR 1.5 billion. For 2023, CEO Carsten Spohr expects a significant increase in earnings. However, given the recent crisis management, there is not yet a dividend for shareholders because, in the second Corona year of 2021, the Company still made an operating loss of almost EUR 1.7 billion and cut many jobs. For now, the Board of Management does not provide an exact profit forecast for 2023, but experts from Refinitv Eikon expect an adjusted operating profit of EUR 1.65 billion on average. Group companies Lufthansa, Eurowings, Swiss, Austrian and Brussels carried around 102 million passengers, more than twice as many as in 2021. Currently, management is assuming an average of 85 to 90% of the pre-crisis level of 2019 for 2023. US investment bank Goldman Sachs left its rating on Lufthansa at "Neutral" with a price target of EUR 8.70 after full-year results, with the share price reaching a new 52-week high of EUR 10.51 on Friday.

Things still do not look so rosy for travel companies TUI and Carnival. The European market leader for package tours pooled its shares at a ratio of 10:1 in February to lift the share price back to a passable level at around EUR 17.70. A major capital increase is still needed to get the badly battered balance sheet back on track. Currently, bookings for the coming summer and fall are rising at double-digit rates, and industry experts assume that TUI will be able to repay the government support in full by 2025.

After raising another GBP 2.1 billion in debt, cruise expert Carnival is hopeful about the new season. Sentiment among customers is increasingly improving as Corona restraints gradually dwindle. According to surveys, America's vacationers in 2023 are happy to feel "at liberty" again, and travel bookings are picking up noticeably. The Covid-19 pandemic and flu season "struck fear into the hearts of travellers and cruise stock investors alike," commented CEO Josh Weinstein on the mood last year. Still, obstacles to rising profits exist: staffing shortages and higher food and fuel costs could make the road difficult, with ticket prices averaging 50% above 2018 levels, narrowing the potential audience for luxury long-haul travel by water. However, analysts expect Carnival to return to profitability as early as 2024.

Gold - Technical breakout above USD 1,850 imminent

Gold's performance over the past 25 years has followed the inflation trend in our economies. Before the turn of the millennium, the ounce was still below USD 200. Due to the real estate bubble after the dot-com boom and the devastating effects of the US subprime crisis, the precious metal reached its temporary peak of USD 1,950 in 2011. Subsequently, the gold price then lost value again to USD 1,120. Last week, there were some buy signals at the technical mark of USD 1,850. After an extensive consolidation in the last 3 years, a sustainable breakout could finally materialize. The general conditions for the precious metal are good: High inflation coupled with exuberant debt balances of government budgets and central banks are putting pressure on the currencies. In the last century, the world reserve currency, the US dollar, has lost 96% of its purchasing power due to inflation. On the other hand, those who have always invested their money proportionally in gold achieved an increase in value of around 8.2% per annum. That corresponds to the current inflation rate.

Alerio Gold Corp. - Gold from South America

Alerio Gold has news to share. It has received approval to trade its common shares on the OTCQB Venture Market under the ticker symbol ALEEF - effective immediately. That means that trading in Alerio is now not only possible in Canada and Frankfurt but also for US investors. This increases awareness and visibility in the global capital markets and tradable liquidity. The OTCQB is a leading market for early-stage and developing international companies.

In perspective, the Canadian gold junior could become a supplier of precious metals, with the properties located in the metal belt of the South American state of Guyana. The country is known for its significant natural resources, especially due to its proximity to the equator it is rich in water. Historically, gold accounted for 35% of the country's exports, with production exceeding 680,000 ounces in 2021. Well-known players such as Newmont, Reunion, Troy, Omai Gold and G2 Goldfields have long since explored the country.

Alerio Gold has secured the licenses for the Tassawini Gold Project. The property has a historical resource estimate of 499,000 ounces. CAD 34 million has already been invested in the study of the geology, and the current focus is on further expansion of exploration on a total of 1381 hectares of land. Currently, 73.23 million shares are issued at a price of CAD 0.06. The market capitalization is just CAD 4.4 million. If gold continues to rise, other prices should soon be on the price list.

The travel industry is recovering after the difficult pandemic period through 2022. For the balance sheets, this means a noticeable relief. Government support loans can now be repaid. Lufthansa is very far in the consolidation; this could still take some time for TUI and Carnival. Those who want to bet on gold will find a speculative addition in Alerio Gold.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.