November 25th, 2022 | 10:29 CET

TubeSolar, Nordex, Siemens Energy - Energy drivers for the portfolio

German Engineering is a seal of quality, also abroad. What sometimes takes a little longer in development pays off in the long run. Solar system manufacturer TubeSolar from Augsburg can be pleased about a TÜV certification for its patented products. In Germany, the share of photovoltaics in the power grid rose by 11.2%, and worldwide the CAGR of PV installations increased by 32%. JinkoSolar, a leading Chinese manufacturer of solar modules, has also played a significant role in this growth. However, China shares entail risks. Siemens Energy is not without risk at the moment either. The management heads are changing in the internal takeover game of the Spanish wind energy company Gamesa.

time to read: 5 minutes

|

Author:

Juliane Zielonka

ISIN:

TubeSolar AG | DE000A2PXQD4 , SIEMENS ENERGY AG NA O.N. | DE000ENER6Y0 , NORDEX SE O.N. | DE000A0D6554

Table of contents:

Author

Juliane Zielonka

Born in Bielefeld, she studied German, English and psychology. The emergence of the Internet in the early '90s led her from university to training in graphic design and marketing communications. After years of agency work in corporate branding, she switched to publishing and learned her editorial craft at Hubert Burda Media.

Tag cloud

Shares cloud

TubeSolar AG - Solar plant modules are now TÜV certified

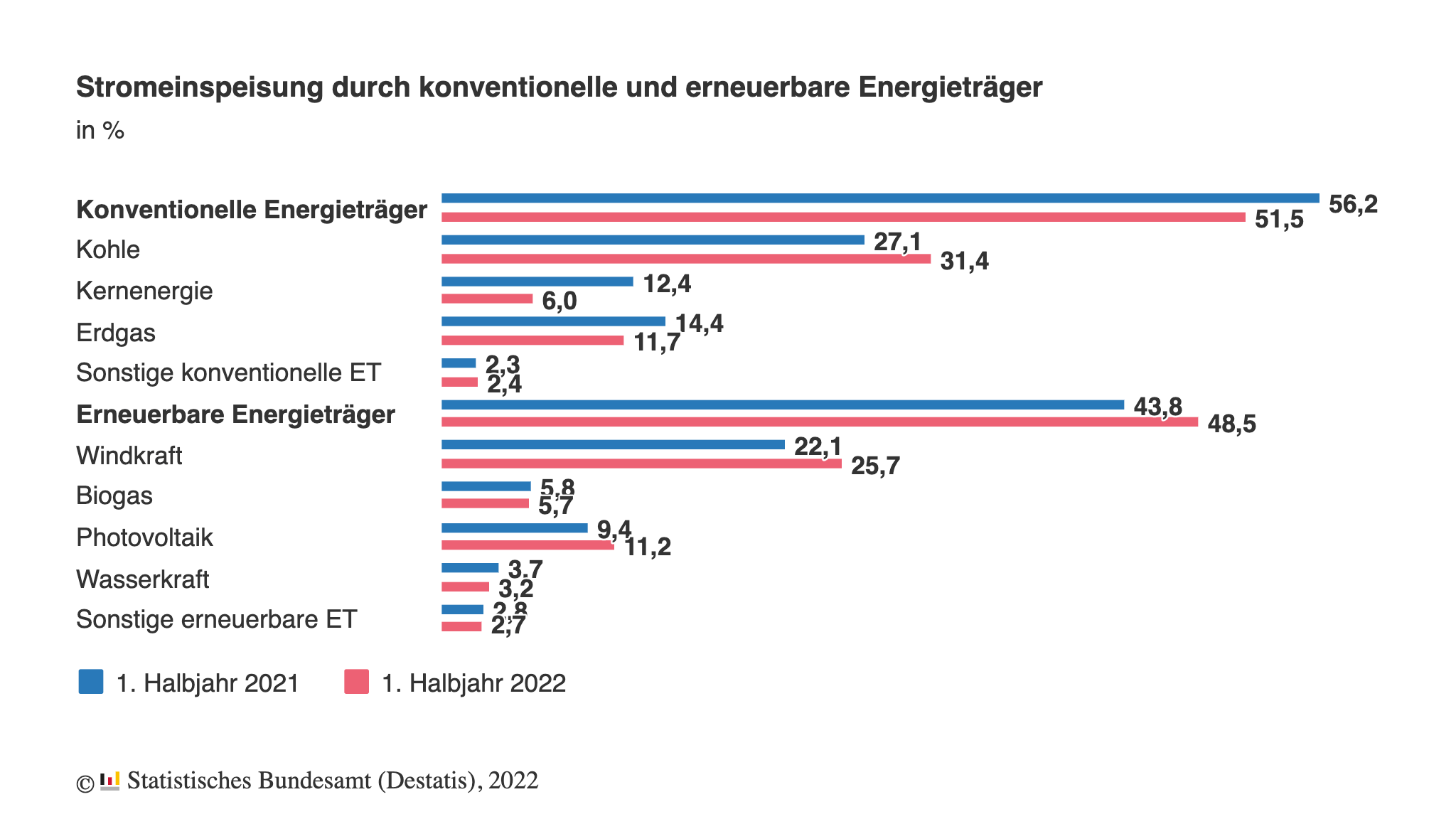

The market for photovoltaic systems is on the upswing. Due to the sunny summer months in Germany, electricity feed-in from photovoltaics increased by 20.1% to a share of 11.2% (for comparison: in the 1st half of 2021: 9.4%). Globally, according to Fraunhofer Research, the compound annual growth rate (CAGR) of cumulative PV installations increased by 32% between 2010 and 2021.

All of Europe is gearing up for the energy transition. In France, for example, it will soon be mandatory to upgrade car parking lots with solar. Under Article 11 of the "Law to Accelerate Renewable Energies," half of the space is to be equipped with structures supporting photovoltaic modules. The regulation is scheduled to take effect in July 2023. France currently generates only 25% of its electricity from renewable sources - significantly less than most European countries. Emmanuel Macron, the French president, plans to increase solar energy in France tenfold to over 100 gigawatts.

The German company TubeSolar AG specializes in designing dual-purpose solar systems. Instead of using all of a surface area just for PV systems, TubeSolar's engineering team thought ahead from the start. Their patented photovoltaic tube construction allows the use of conventional areas such as car parking spaces and additionally the installation of solar systems.

The Company is a spin-off from Osram. Currently, TubeSolar is focusing on the dual use of agricultural land. Recently, they received certification from TÜV Rheinland, which underscores the quality of the products and their universal application. This investment is an opportunity for long-term investors.

TubeSolar plans to commission the first highly automated production line (20 MW) this year. By the end of 2025, TubeSolar aims to increase its production capacity to 250 MW. An updated DCF model, which takes into account lowered risk via a lower WACC estimate (10.9% vs 12.1%) after certification, results in a new price target of EUR 7.80 (previously: EUR 7.50) for the stock.

JinkoSolar - Growth through foreign business

In 2021, Europe accounted for nearly 22% of total cumulative PV installations. But in China alone, installations amount to 37% (compared to 33% in 2020). Investors cannot avoid top dogs like Chinese company JinkoSolar. The Company manufactures a wide range of solar and storage products for solar projects of all sizes, serving both industrial and residential customers.

But investments in Chinese companies remain fraught with risk. China's government this year has sought to limit excessive borrowing by developers. This crackdown has led to a decline in property sales and prices, bond defaults and the suspension of housing construction. Homeowners feel angered by this and are threatening to stop making their mortgage payments.

The third quarter went well for JinkoSolar. Total revenue was RMB 19.52 billion (USD 2.74 billion), up 3.6% quarter-on-quarter and 127.8% YOY. The increases from the previous quarter and the previous year were primarily due to an increase in shipments of solar modules. Net income in the third quarter was USD 77.3 million. According to the report, most business happens outside China. However, the Chinese government continues to pursue a Zero-COVID strategy. This leads to the FIFA World Cup Transmission from Qatar to pixelate the stadium audience so that Chinese citizens are not disturbed by the maskless spectators.

But Xiande Li, JinkoSolar's chairman and chief executive officer, is upbeat: "We are pleased to report better-than-expected results this quarter, despite further increases in commodity prices, power rationing at our manufacturing facilities, and an earthquake in Sichuan Province, where one of our manufacturing facilities is located. Total solar shipments in the third quarter were 10.9 GW, doubling year-on-year. Total revenues were $2.74 billion, up 127.8% year-over-year."

Siemens Energy - Bruch follows Lopez in Gamesa takeover poker game

Siemens Energy operates globally along nearly the entire energy value chain. Its products include gas turbines, steam turbines, generators, transformers and compressors. The 67% stake in Siemens Gamesa Renewable Energy makes Siemens Energy the global market leader in renewable energy.

Wind turbine maker Siemens Gamesa yesterday named Siemens Energy CEO Christian Bruch as its new chairman amid a controversial takeover bid by its main shareholder. Bruch will succeed Miguel Ángel López, who has decided to leave the Company to seek new challenges. He joined Siemens Gamesa in December 2017 as chief financial officer and was appointed non-executive chairman in 2018. Siemens Gamesa said the CEO change is the "logical next step" in the potential merger and integration within Siemens Energy, which unions oppose because of planned job cuts.

Born in 1970 in Düsseldorf, Bruch holds a doctorate in engineering from the Swiss Federal Institute of Technology in Zurich (ETH), Switzerland. He studied mechanical engineering at Leibniz Universität Hannover, Germany, and at the University of Strathclyde, Glasgow, UK.

His long career spans mechanical engineering and the energy industry. Before becoming CEO of Siemens Energy AG in 2020, he held senior positions at companies such as Linde AG and RWE AG.

Earlier, Siemens Gamesa announced that its board had issued a positive opinion on Siemens Energy's offer of EUR 18.05 (USD 18.65) per share in cash for the remaining one-third it does not yet hold in the Spanish company. Four independent board members voted unanimously to recommend the acquisition, and the remaining board members adhered to their decision, the statement added.

Last week, Siemens Energy formally launched its EUR 4.05 billion offer following approval by Spain's stock market regulator CNMV. The unions oppose the takeover and are trying to prevent the planned reduction of 2,900 jobs as part of the Company's "Mistral" strategy program.

Concentrated engineering power from Augsburg can boost the portfolio, for example, with TubeSolar. TubeSolar expects negative EBIT and operating cash flow in the lower double-digit million euro range for 2022 without taking into account its own contributions and investment grants. However, the prospects look much better. JinkoSolar is driving growth, mainly through its US business, as Zero-COVID policies still prevail in its own country. Siemens Energy, on the other hand, is battling unions concerned about preserving some 3,000 jobs that are on the line as part of the Mistral strategy for greater profitability.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.