September 5th, 2025 | 07:05 CEST

Trump under pressure, markets wobble – Technically position now with BYD, Almonty, and Palantir for the next 100% gains!

The stock markets are in yet another bubble, but unlike the tech bubble in 2000, investors are more prepared for the impending correction. The warning signs could not be more evident: inflation, wars, numerous global conflicts, surging interest rates, massive deficits, tariffs and trade wars! Anyone who sees short-term growth under these conditions is likely mistaken. And yet, the market is still holding on to the megatrends of artificial intelligence and defense. Admittedly, 1,000% or more could be earned here, which is good for those who rode out these trends. But caution is advised: The Shiller P/E ratio for the S&P 500 rose above 40 last week – well above the historical norm of 12 to 25. So, where is the celebration continuing? We offer a few clues.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

BYD CO. LTD H YC 1 | CNE100000296 , ALMONTY INDUSTRIES INC. | CA0203987072 , PALANTIR TECHNOLOGIES INC | US69608A1088

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Palantir – The growth and valuation miracle

Good growth but high valuation - Palantir Technologies has been attracting a lot of attention for months with new projects and contracts in the UK public sector. The most recent example is a £500,000 annual contract with Coventry City Council, where Palantir's AI systems will support the processing of cases in social services, child protection, and children with special needs. The pilot phase has already shown that the software significantly reduces the workload for social workers by transcribing documentation and automatically summarizing case files. The solution is now to be extended to other administrative areas in order to noticeably improve data integration and service quality.

However, this decision is far from undisputed. Trade unions, teachers' associations, and several local politicians have criticized the use of Palantir technology on ethical grounds and are calling for the contract to be terminated immediately. Palantir's role in US deportations and security-related military projects, such as for the Israeli army, is considered particularly problematic. Fears about data protection and the automation of sensitive social decisions are also repeatedly raised. Despite the criticism, City Hall and Palantir emphasize that all data protection standards are being complied with and that the project is justified by the relief it provides to case workers and the efficiency gains it brings. Palantir's software is also used in the Ministry of Defense, as shown by multi-year contracts worth over £75 million. At the same time, the Company is involved in additional pilot projects testing the use of artificial intelligence in policing and administration. There are already several reference projects within the EU as well.

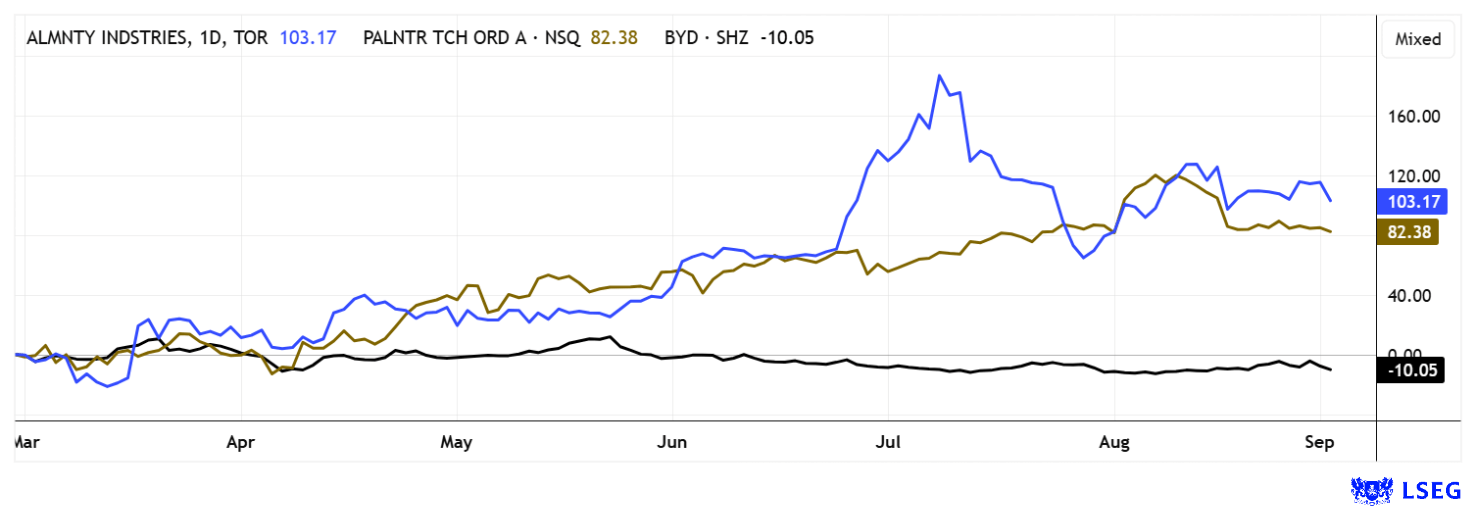

For investors, the strong order situation and Palantir's growing presence in Europe indicate a solid growth model with further acceleration. Whether this justifies the US AI company's P/E ratio of 212 and a price-to-sales ratio of 80 remains to be seen. From its peak of EUR 162 in August, September has already seen a 20% drop. It will be interesting to see how things develop!

Almonty Industries – Preparing for the next leap

A look at a recent IPO on the Hong Kong Stock Exchange shows just how much demand there is for tungsten from Western industry. Strong international demand led to a jump in Jiaxin International Resources' valuation on the first day of trading, a clear signal of the enormous market momentum for tungsten stocks. The share price exploded by 177% at the issue price, giving the Company a market capitalization of around USD 614 million and raising HKD 1.2 billion (USD 153 million) for the Kazakh Boguty project. Analysts suspect that Almonty Industries' recent sixfold increase in its share price has led to this euphoria. Viewed soberly, however, investor enthusiasm primarily reflects access to Asian commodity projects with strong Chinese involvement, highlighting the major geopolitical dependencies.

For investors who want to hedge against these risks and focus on diversification, Almonty Industries offers a clearly superior and alternative profile. The Sangdong project in South Korea stands for Western control, supply chain security, and the establishment of strategic tungsten reserves outside China's sphere of influence. Political support, subsidies, and the involvement of experienced industrial groups such as Deutsche Rohstoff AG and Plansee guarantee a stable supply in line with Western standards. Almonty is the only promising tungsten supplier positioned on the Nasdaq and European stock exchanges, which shifts the valuation focus away from Asian supply dominance. Following recent profit-taking, the chart shows stabilization in the CAD 6 range. A total of eight LSEG analyst ratings with a price target of up to CAD 9.00 show that the party at Almonty could quickly pick up speed again. The successful IPO of Jiaxin International Resources plays into the hands of the independent Almonty, as Western industries tend to prefer the EU and South Korea as sources of critical metals over Chinese-dominated Kazakhstan. With Sangdong, Almonty provides a prime example of a geopolitically independent raw materials strategy!

Learn more about the tungsten business in the latest interview with GBC analyst Matthias Greiffenberger on Stockhouse: https://stockhouse.com/opinion/interviews/2025/07/28/building-assets-producing-critical-minerals-and-slashing-dependency-on-china

BYD – Take advantage of current sales weakness to get in

BYD is responding to the global slump in sales and backpedaling! China's leading manufacturer of electric cars is responding to the current market changes with a noticeable adjustment to its sales ambitions. Instead of selling 5.5 million vehicles in 2025 as originally planned, the Company is now aiming for only around 4.6 million vehicles, the lowest growth in five years. This new target was already communicated to suppliers and within the Company in July, but no official statement has been made as yet. BYD is losing market share, particularly in the small electric vehicles segment, while competitors such as Geely are increasing their sales, in some cases dramatically, and raising their own targets.

Production at BYD has been scaled back at several locations for the second time in a row, as high inventories and aggressive price wars are squeezing margins. The Chinese market currently appears to be well saturated, leading to a 30% drop in profits in the second quarter. The stock has lost just as much since its peak in May, despite the distribution of bonus shares. The expansion of recent years, during which BYD increased its sales tenfold and caught up with the industry leaders worldwide, now appears to be coming to an end. The focus remains on the Chinese market, where approximately 80% of sales take place. However, the weak performance of the domestic real estate sector and rapidly increasing competition are noticeably dampening demand. Management is unsettled, as only half of the original annual target has been achieved in the current calendar year to the end of August. Analytically, the valuation has now returned to a 2026 P/E ratio of 11. This presents a good entry point for long-term investors who believe in e-mobility. Technically, consolidation should stop in the range of EUR 10.50 to 11.50; otherwise, there is a risk of trouble.

The stock market is no longer a one-way street. Palantir Technologies exceeded analysts' expectations with its Q2 figures, but its share price fell 20%. Almonty Industries presented a surge from CAD 1.20 to CAD 8.40 and is currently consolidating as well. However, BYD took a real beating – poor sales figures and a sharp drop in its share price are to be reported here. All three stocks are nevertheless set for high growth in the medium term.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.