April 5th, 2023 | 20:24 CEST

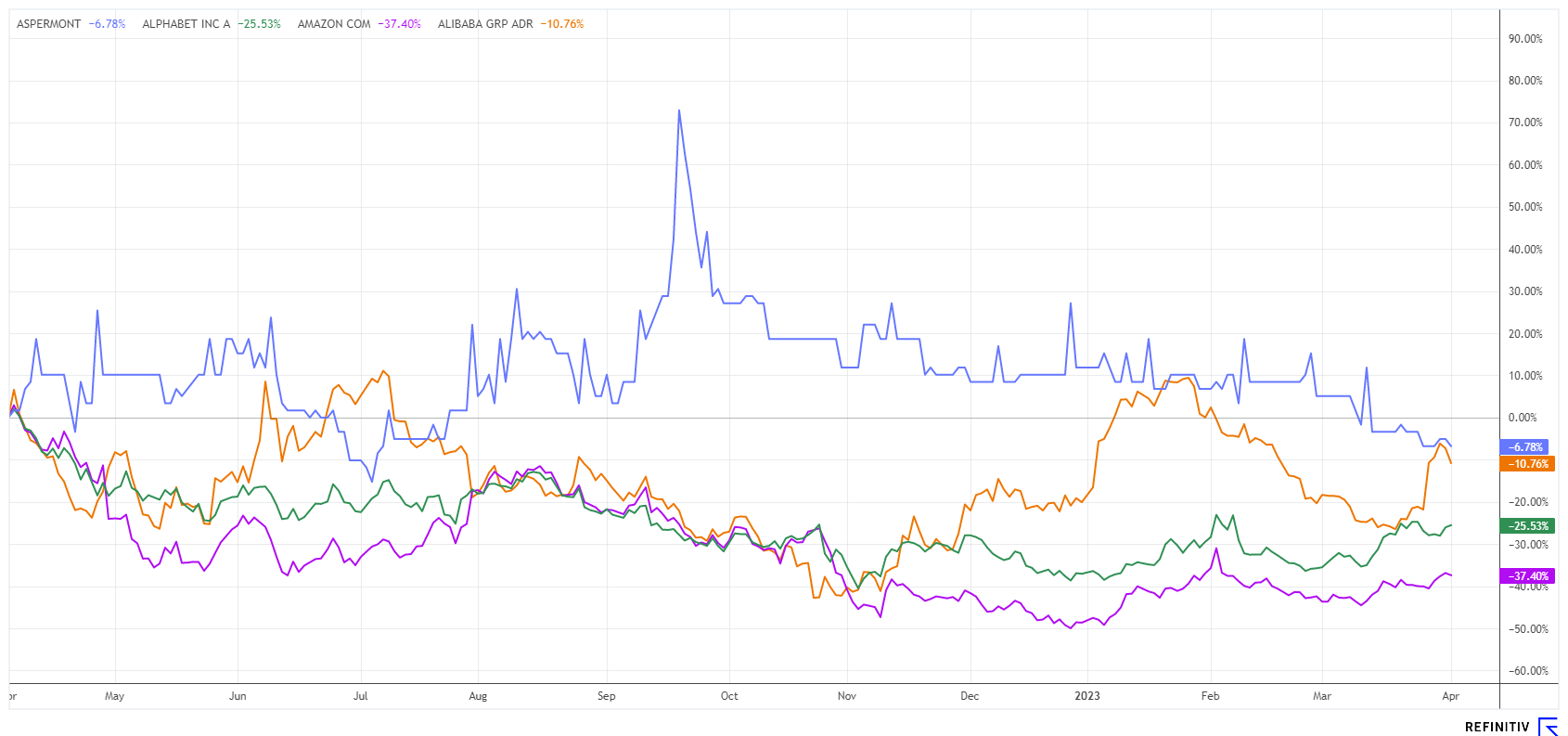

Triple AAA is in demand in the crisis - Amazon, Aspermont and Alibaba keep their promises!

The DAX rises and rises and rises. At 15,742 points, a new high for the year was reached again yesterday, and the all-time high at around 16,290 points now also appears within reach. The strong rise in interest rates of recent months has slowed down somewhat, as inflation rates are no longer in double digits. However, it is questionable whether the next bull market on the NASDAQ is imminent since the FED recently indicated that it was not yet thinking about interest rate cuts. The so-called "dot plots" of the central bank members, however, speak a different language. We look at some classic growth stocks that are now returning to focus.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

AMAZON.COM INC. DL-_01 | US0231351067 , ASPERMONT LTD | AU000000ASP3 , ALIBABA GR.HLDG SP.ADR 8 | US01609W1027

Table of contents:

"[...] We have built one of the largest land packages of any non-producer in the belt at over 440 sq.km and have made more than 25 gold discoveries on the property to date with 5 of these discoveries totaling about 1.1 million ounces of gold resources. [...]" Jared Scharf, CEO, Desert Gold Ventures Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Amazon - The first quarter profit maker

The Jeff Bezos share is back. It took a long time to consolidate, but now another milestone in value generation has been set with a 23% gain in the quarter. Investors welcome the return of tech stocks to the investment universe, having watched their favourites sell off in recent months under pressure from rising interest rates. That seems to be over now, and the new tech rally can start dynamically into the new quarter with the NDX above 13,000.

AMZN shares are likely to be rewarded for recent restructuring measures aimed at making the group leaner, more efficient and more innovative. These include, for example, the expansion of the logistics division for services such as same-day delivery and new product initiatives. To best implement the adhoc shopping experience, Amazon has opened nearly 50 ultra-fast delivery locations since 2019, mainly near major metropolitan areas. This number is expected to grow to at least 150 in the coming years. Therefore, the e-commerce giant wants to invest massively in logistics structures and thus expand the moat to the competition even further.

Besides fast deliveries, Amazon is also planning ultra-fast internet. Under the name Kuiper, the Company has already been working on building its own satellite internet since 2019. To this end, Amazon has booked a large part of the world's space capacities until 2027 and wants to launch half of the required 3200 satellites into orbit by then. All segments of the population that have only had an inadequate network up to now or would like a new provider can be considered customers. The first test customers will be supplied with internet from space as early as 2024. The Company is also consistent in its fight against product piracy and online fraud: last year, 6 million articles and 800,000 suspicious accounts were removed from the product range. The stock is recovering but is still about 60% away from the 2022 high.

Aspermont Ltd. - Live conferences again at last

Australian media specialist and XaaS provider Aspermont Ltd is transferring its strength from the old economy to the online world. This successful transformation of the last few years could have come out of a textbook. In just a few years, the Australians evolved from a venerable publishing house to a modern XaaS provider with a vast database of over 8 million high-level contacts from business and finance. Its distinctive business approach provides digital services and B2B media in the mining, energy and agriculture sectors, helping participants in the network both view important information and formulate funding requirements simultaneously.

After a long COVID absence from the live event business, the Company has returned with its first face-to-face events. At the end of March, more than 40 mining companies met with over 400 investors under the label "Mining Journal Select" in London. The response was tremendous. Mining clients of Aspermont could present their business models in a luxurious atmosphere and make further contacts in the financial world. Under the new energy and climate change determinants, sensitive supply relationships are especially important for critical metals. Mining companies worldwide have recognized the advantage of securing key building blocks in supply chains through strong contractual relationships. Aspermont is an enabler of such relationships and offers all the necessary information on trends, prices and market developments as an added bonus.

Currently, the liquid stock is trading at a low AUD 0.018, with a market capitalization of just under AUD 44 million. For the research house GBC this is only the beginning. They vote with a price target of AUD 0.11 and a "Buy" rating valid for the next 12 to 24 months. Business is good, and the share deserves significant appreciation.

Alibaba - Break-up fantasy drives the share price

The hedge funds' premonitions have hit the mark this time as Alibaba came out with its restructuring plans last week. Jack Ma, the Company's founder and major shareholder, wants it to split into six operating subsidiaries, which would then be successively floated on the stock market. This is similar to what happened with Google when the old Group share was converted into Alphabet Holding, and in future, all businesses will be united under the holding umbrella.

For Alibaba, the charm lies in the huge uplift in value that such a move should set in motion. Alibaba Group CEO Daniel Zhang remains in his post, hoping for leaner structures and faster decision-making processes in the individual sectors. In addition, creativity and impact should increase quickly, as lengthy coordination processes could be eliminated in the future. Alibaba was founded in 1999 by Jack Ma and subsequently rose to become one of Asia's largest internet corporations. Its offerings include e-commerce systems such as Alibaba.com, Taobao.com, Tmall.com and Aliexpress.com, as well as the financial services provider Ant with its Alipay platform. In addition, the group owns the map service amap.com and several cloud service providers. The group grows more than 10% annually in sales but has regulatory problems in its home country due to a growing lack of transparency.

Alibaba shares are up 8% at EUR 89.50 for the current year, with a low of EUR 59 from 2022. The stock is currently trading at a very interesting level with a 2023 P/E ratio of 14. The break-up rumours should be good for a higher valuation in the long term. However, this also requires that the reputation of Chinese stocks on the NASDAQ returns. Geopolitically, a complete rehabilitation is not to be expected at present.

Stock markets got off to a strong start in the first quarter of the year. While China's Alibaba and Amazon are surprising with structural changes, Aspermont can now fully live out its digitized business model. Overall, the following applies: In a balanced portfolio, the risks are significantly lowered.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.