November 3rd, 2025 | 07:10 CET

Trade war over? Not at all! Here is what's happening now with Graphano Energy, Porsche, and Volkswagen

The US and China have agreed to a kind of truce in their trade conflict. China's export restrictions on metals, which were only announced in October, have been lifted. In return, China will purchase agricultural products from the US, and the agreement will be renegotiated in a year's time. What US President Donald Trump is selling as a major victory is, at best, a temporary ceasefire. The past few weeks have shown that the preliminary agreement will change little for Western industrial companies: they have gained time and must make good use of it.

time to read: 3 minutes

|

Author:

Nico Popp

ISIN:

Graphano Energy Ltd. | CA38867G2053 , PORSCHE AUTOM.HLDG VZO | DE000PAH0038 , VOLKSWAGEN AG VZO O.N. | DE0007664039

Table of contents:

"[...] We know exactly what we are doing and are implementing what we consider to be a proven technology in an industrially applicable and scalable way. [...]" Uwe Ahrens, Director, Altech Advanced Materials AG

Author

Nico Popp

At home in Southern Germany, the passionate stock exchange expert has been accompanying the capital markets for about twenty years. With a soft spot for smaller companies, he is constantly on the lookout for exciting investment stories.

Tag cloud

Shares cloud

Porsche and VW in the valley of tears

The mood is currently gloomy at sports car manufacturer Porsche: the Baden-Württemberg-based company, accustomed to success, has to cut costs. Where once huge margins amazed the competition, today there is gloom. The 2024 annual report still showed a double-digit operating margin of 15%. This year, however, there was a drastic slump. For the first nine months of 2025, Porsche reported revenue of EUR 26.86 billion, 6% less than in the same period last year. The remaining operating profit of only EUR 40 million corresponds to an operating return on revenue of 0.2% – too little for Porsche. As a result, the group is postponing a planned electric SUV indefinitely and remaining loyal to the combustion engine for longer. In recent years, Porsche has increasingly electrified its fleet. However, the Taycan electric sports car and the Macan electric SUV in particular fell short of expectations. Although the vehicles received praise, the key data is not entirely convincing when compared to the latest Chinese innovations in battery technology.

Since Porsche vehicles have been considered innovative and technically sophisticated down to the last detail for decades, spoiled customers today are disappointed when range or charging speed fail to impress. The situation is similar for the parent company Volkswagen. Compared to competitors from South Korea or China, VW models are no longer seen as technologically leading. Especially when it comes to value for money, rivals such as KIA or BYD often deliver more. The key question now: how can Porsche catch up with its Asian competitors?

Battery innovations need their own supply chains – Graphano Energy is ready

For years, batteries for electric vehicles were considered a commodity. Executives emphasized that energy storage devices could be sourced globally. But the reality is somewhat different. Specialized manufacturers such as CATL are far ahead of the competition in terms of technology. Since the battery is crucial for both range and performance, German premium brands in particular, which want to be synonymous with driving pleasure, should be at the forefront of battery technology. In-house developments are necessary**, and even after the temporary truce in the trade dispute, independent supply chains remain essential.

The Canadian graphite company Graphano Energy offers precisely that. Its core focus is on developing promising properties with high graphite content in southern Quebec, including Lac Aux Bouleaux (LAB), Black Pearl, Lac Saguay, and Standard. LAB lies directly adjacent to Northern Graphite's only producing graphite mine in North America. Graphano already has an agreement in place to use this processing facility if production begins, saving both time and costs.

Graphano Energy gains time and benefits from the political tailwind

The newly established Major Projects Office in Canada, which aims to accelerate the approval process for projects involving critical metals, also promises more efficient processes. Graphano CEO Luisa Moreno praises the initiative and emphasizes that it comes at just the right time for her company to advance Graphano's projects. Although the recent easing of trade restrictions should mean that more graphite from China will come onto the world market than before, the agreement between China and the US is initially limited to one year. Car manufacturers and the battery industry know that this agreement could end at any time. Long-time observers of Chinese politics assume that China will focus on selling processed products rather than raw materials in the long term. However, the innovations in battery technology that are so important for car manufacturers like Porsche, and which could set the Company apart from its competitors, can only be achieved through in-house developments. Furthermore, batteries imported directly from China offer no cost advantage. Chinese competitors such as BYD, which manufacture their own batteries, are likely to continue enjoying significant cost advantages without their own Western supply chains for battery metals. A comeback for the German automotive industry would therefore be rather unrealistic.

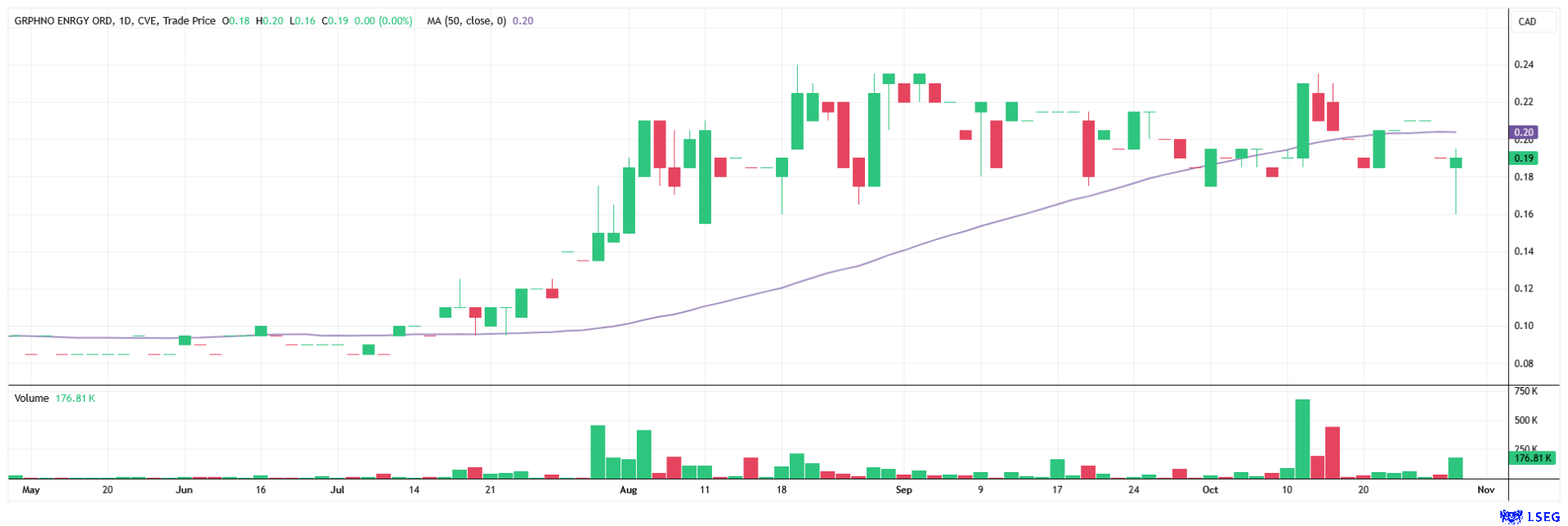

The pause in the trade conflict gives all parties involved some time. Car manufacturers like Porsche and Volkswagen should use this time to drive their own innovations in battery technology, possibly with partners, and to establish their own supply chains for battery metals. Graphite in particular can make a difference as an anode material and gives battery manufacturers flexibility in product design. Graphano Energy is perfectly positioned to go into production in the coming years. Resource estimates and individual drilling results are convincing, and the Company also has political tailwind in Canada. The stock remains an exciting option for profiting from investments in Western supply chains for battery metals.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.