January 6th, 2026 | 07:35 CET

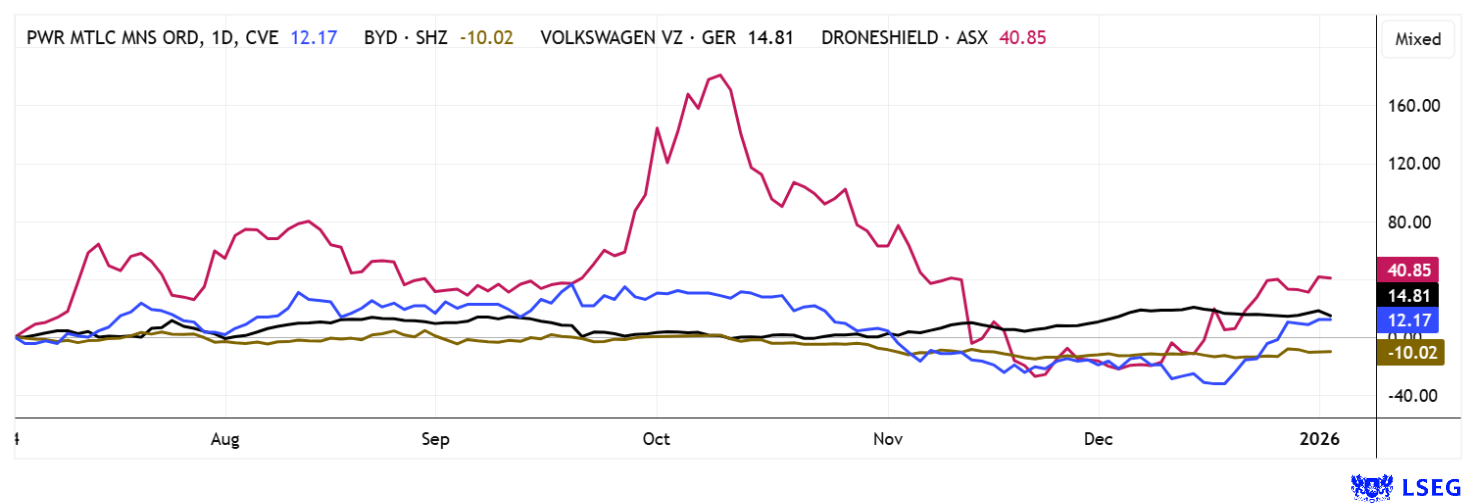

Up and down: Doublers and halvers among themselves! BYD, VW, DroneShield, and Power Metallic

And once again, it is full steam ahead. While last year saw a sunny scenario in terms of returns for AI, defense, and silver stocks, these sectors are performing even better in the new year. Rumors of a physical silver shortage have now been confirmed by futures exchange warehouses. This could mean that the "one-way movement" in strategic metals will continue. Rumor has it that the shortages may even be spreading to a range of industrial metals. As the world's largest producer of these raw materials, China is tightening export controls and redirecting resources toward its domestic industry. Much of this is still unconfirmed, but the recent price explosion to over USD 12,000 for copper speaks volumes. Investors would be well advised to diversify their allocations to be ready for the most important developments!

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

BYD CO. LTD H YC 1 | CNE100000296 , VOLKSWAGEN AG VZO O.N. | DE0007664039 , DRONESHIELD LTD | AU000000DRO2 , POWER METALLIC MINES INC. | CA73929R1055

Table of contents:

"[...] Nickel, therefore, benefits twice: firstly from its growing importance within batteries and secondly from the generally growing demand for such storage. [...]" Terry Lynch, CEO, Power Nickel

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

DroneShield – Back up 100% after an 80% loss

The Australian drone defense specialist is no longer out of the spotlight. Heavy selling by insiders and employees had pushed the share price from EUR 3.78 to below EUR 0.80 between September and the end of November – a loss of 80% from its peak. Investors hoping for a booming defense sector were alienated by employees and company founders, who used the achievement of certain revenue targets to take private profits while NATO discussed the needs of the drone sector. In hindsight, one could of course say: what a buying opportunity! But we would like to point out that in September, it was also announced that many shares would be up for sale again once further revenue hurdles were reached. This means that the scenario could even repeat itself. So anyone who got in at around EUR 1 or lower should perhaps be happy about the doubling of the share price and get ahead of the next wave of selling. We consider the announcement of an AUD 8 million military contract with an estimated 2025 annual volume of AUD 250 million to be window dressing at the end of the year. Raise your stops to EUR 1.88.

Power Metallic Mines – At the forefront of the international race

The AI boom is putting pressure on energy infrastructure. Globally, new AI clusters and cloud centers are emerging on a weekly basis. Initiators are desperately searching for regions with abundant renewable electricity, but without storage and transmission networks, much of this green energy would remain unusable for 24/7 operation. Studies on long-term decarbonization assume that grids with high proportions of wind, hydro, and solar power will require storage capacity in the order of several terawatt hours to close supply gaps over hours and days while also supplying data centers and electric mobility. The Long Duration Energy Storage Council, for example, estimates that global investments of up to USD 3 trillion will be necessary by 2040 to install 1.5 to 2.5 TW of long-term storage. Anyone thinking in these categories needs access to electrical metals.

It is obvious that Power Metallic should be watched more closely in this environment. The Québec-based exploration company has clearly positioned itself in an increasingly tense raw materials environment. CEO Terry Lynch is steering the expansion specifically toward those metals of the future that are essential for electric mobility, hydrogen technologies, and high-tech components. A decisive step toward growth was the acquisition of over 300 additional claims around the Nisk project, which significantly expanded the exploration area. This is in a region that is politically stable, mining-friendly, and known for its solid infrastructure.

The macroeconomic situation is a decisive factor in competition. According to current market analyses by the International Energy Agency (IEA), there is a threat of a structural nickel deficit of up to 15% from 2027 onwards, while global copper reserves have fallen to their lowest level in 15 years. Both are indispensable raw materials that Power Metallic is specifically targeting. The signs point to a storm in 2026. Power Metallic is expanding its exploration pipeline with projects such as Nisk East and Hydro Lands, which are considered geologically promising extensions of the existing system. The Lion-Tiger-Deep target remains particularly exciting, with strong geophysical signals indicating previously unexplored sulfide zones. Thanks to a solid financial base, Power Metallic can now use state-of-the-art technology to accelerate its projects.

At the end of the year, there was a jump in valuation in response to suspected short attacks in December. Those who were unable to cover their positions quickly enough are now facing a 60% higher market capitalization of CAD 300 million. The stock is still about 50% below its 12-month high of approximately CAD 2.00. Those who have not yet invested should not hesitate.

CEO Terry Lynch provided an overview of the current status of exploration work in Québec at the most recent International Investment Forum (www.ii-forum.com) on December 3.

BYD versus VW – 2026 will be the year of reckoning

International car manufacturers are just as dependent on supply chains and international relations. The focus is repeatedly on the Chinese high-tech company BYD. Known to many investors only as an e-mobility supplier, the Company has been producing chips and batteries in-house for several years now. This makes the Company resilient to numerous upheavals, such as those faced by the Wolfsburg-based VW Group. Although VW's share price rose by 15% in 2025, the starting level was at a 15-year low of around EUR 83. The situation was quite different for BYD. With prices around EUR 17.50, the dynamic company reached its preliminary high in May 2025, followed by strong profit-taking. BYD is set to open its plant in Hungary this year, while VW is launching its battery offensive in Spain. From an investor's perspective, BYD is now valued at EUR 100 billion, twice as much as VW. However, the comparable P/E ratios for 2026 are 11 and 5, respectively. From a strategic perspective, BYD will exert considerable pressure by doubling its dealer network, but the German automaker from Wolfsburg has streamlined its operations and positioned itself for an open battle against China. It remains to be seen who will win the race for returns in 12 months. Diversifying investors are considering both approaches!

There have been many examples of spectacular stock market movements recently. Due to the heavy use of machines and AI analysis systems, humans are no longer at an advantage, as their actions can be anticipated. Good diversification has therefore become the cornerstone of protecting one's portfolio.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.