February 27th, 2024 | 07:00 CET

Timing is half the battle! Watch out for defense stocks: Renk, Rheinmetall, Hensoldt, and dynaCERT in focus!

Despite a red-green government, defense stocks are in demand again in Germany. After years of pacifism, Berlin's traffic light government is now firing up arms investments everywhere with conviction. The aim is to make the war in Ukraine a success for Europe by supplying weapons - an interesting experiment and an entirely new direction in the German political spectrum. The underfunding of the German Bundeswehr has been rightly recognized, and now an additional EUR 100 billion is to be allocated under the Basic Law. The stock market picks up on this trend and values the sought-after armaments higher and higher, and international exports are now more legitimized than ever. That is how quickly times change. This brings fantasy to the share price and a windfall for resourceful investors. Where do further opportunities lie?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

RENK AG O.N. | DE000RENK730 , RHEINMETALL AG | DE0007030009 , HENSOLDT AG INH O.N. | DE000HAG0005 , DYNACERT INC. | CA26780A1084

Table of contents:

"[...] We are committed to stay as the number one Canadian and global leader in the Hydrogen-On-Demand diesel technology [...]" Jim Payne, CEO, dynaCERT Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Renk Group - Successful IPO at the right time

The hype surrounding the shares of Renk Group AG from Augsburg is not surprising. Once again, the British investment company Triton demonstrated a keen sense by acquiring the Company from MAN in 2020 for nearly EUR 700 million, and it is now valued at EUR 2.8 billion. A smooth quadrupling for the resourceful financial investors, who had likely believed in a renaissance of armaments, in the first year of Corona. With the conflict between Russia and Ukraine now two years old, the perfect time had come to re-place the stake with a doubled purchase price. As part of the public offering, 33.3% of the outstanding capital was offered at EUR 15. The shares rose rapidly from the very first day, as other institutional investors also took up blocks of shares and the free float was thus kept relatively low. Subsequent demand catapulted the share price by almost 100% in just three weeks.

The mechanical engineering company Renk is now a significant player in the global market for mission-critical drive solutions and transmission systems, with a long track record of success. The construction of special gearboxes for tanks, frigates, icebreakers and industry in particular will likely provide a further boost in the coming years. The Company also intensified its digital expertise by acquiring a stake in augmented reality specialist Modest Tree. On top of this came the acquisition of several divisions of the US-based defense contractor L3Harris Technologies. This significantly strengthened the Company's position in the global market for military vehicles. Nevertheless, with sales of just under EUR 850 million in 2022, the Augsburg-based company aims to generate around EUR 1 billion in 2023. Analysts estimate that Renk can grow by around 20 to 25% per year with its unique solutions. Whether this can be achieved in Germany remains to be seen. At EUR 27.80 and a market capitalization of EUR 2.8 billion, we believe the share price has run somewhat hot in the short term. The share should come back again towards EUR 20-24.

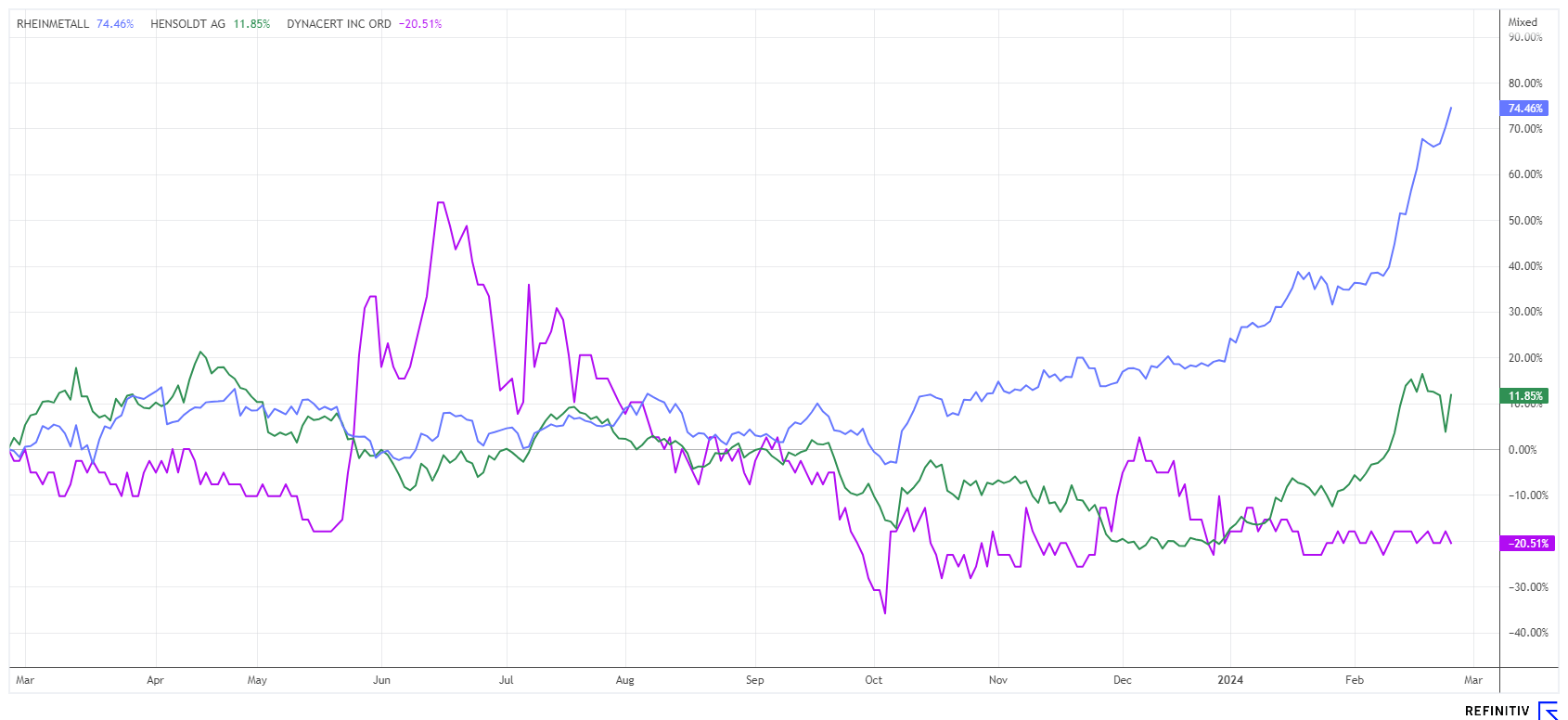

Rheinmetall and Hensoldt - What do the analysts say?

Given the advanced share prices of Rheinmetall and Hensoldt, it is interesting to look at the opinions of analysts. Rheinmetall's average expected price target of EUR 409.50 has already been significantly exceeded at EUR 421. On March 14, the Düsseldorf-based company plans to report on the year 2023. Sales of EUR 6.41 billion were generated in 2022. This is expected to rise to at least EUR 7.3 billion in 2023 and reach EUR 9.6 billion in the current year. This strong guidance is currently giving the share price wings. In just over two weeks, investors will know whether the management can meet or even exceed expectations. The current rise at least shows great optimism.

The 12-month consensus for Munich-based defense specialist Hensoldt has also been exceeded. Here, expectations were EUR 31.1. Like Rheinmetall, sales are expected to grow by at least 20% per annum, which certainly justifies the current P/E ratio of 19. In the price/sales valuation, Hensoldt still has room for improvement with a factor of 1.5. However, the Company still has just under EUR 400 million in debt capital, which is included in the valuation and thus somewhat slows down further price increases. However, the experts at Warburg Research expect much greater investment in European deterrence and have raised their medium-term forecasts significantly. If the NATO countries do not invest more significantly in armaments, they risk being denied US support by Trump. **So set sail and keep the pace: Warburg says the new target price is EUR 39.50. With new major projects and an order book of over EUR 2 billion, the price dip of EUR 23.50 in December is long gone.

dynaCERT - With full coffers and bulging order books

The Canadian specialist for hydrogen applications for large diesel combustion engines is more focused on peace and climate protection. Whether buses, trucks, mining vehicles or power generators, the diverse applications of the HydraGEN™ technology allow the combustion process to be optimized by double-digit percentage points with the addition of H2. Over CAD 50 million has been invested in the technology in recent years, and international sales are now gaining momentum and leading the Toronto-based company into the harvest phase.

Certification by the world-renowned VERRA Institute is currently underway, which will allow the generation of CO2 certificates upon completion. Customers will then be able to integrate these certificates into their fleet accounting as a tax and cost reduction approach. However, the business model must still be pre-financed due to the lack of certification, so the need for working capital is still relatively high. However, based on the current technical status, the dynaCERT technology has clear blockbuster potential, as it fits perfectly into the climate strategy of public institutions and sustainable companies. The recently completed capital increase at CAD 0.15 raised a total of CAD 5.4 million, enabling the Toronto office to continue working on the delivery of the systems ordered and to step up international sales. Of course, early certification by VERRA is important. Compared to the investments already made, the share is currently very favorable.

In addition to Artificial Intelligence, the defense sector is emerging as a top-performing segment in 2024. dynaCERT, on the other hand, can boast a peace technology. The spark could soon ignite quickly and deliver similar leaps in returns.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.