April 15th, 2024 | 06:30 CEST

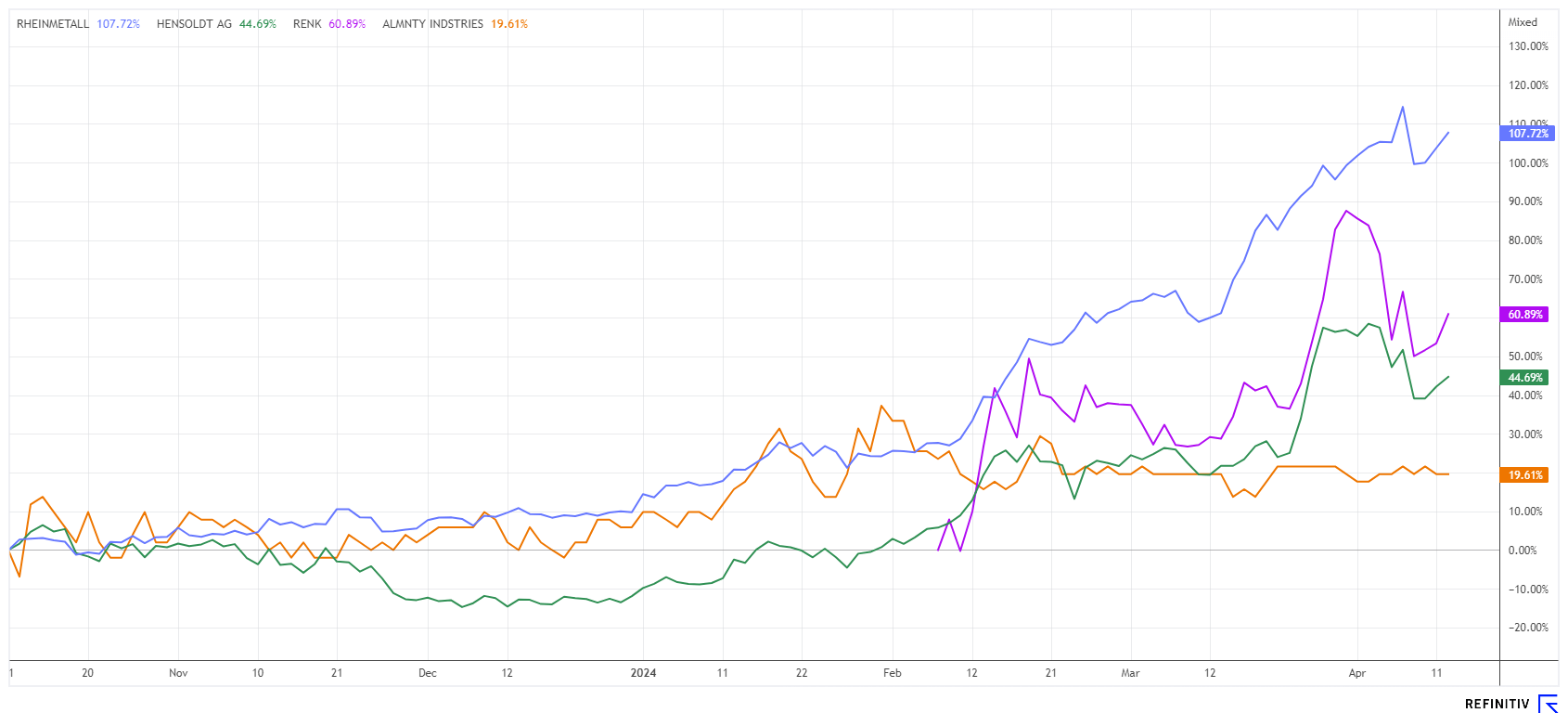

Threat to Europe, Demand for Defense Persists! Rheinmetall, Almonty Industries, Renk and Hensoldt

Europe is gearing up, as since February 24, 2022, peace has become a thing of the past. Europe lived in harmony for a whole 77 years, with the exception of the warlike dissolution of Yugoslavia as a regional conflict. Today's world resembles the situation in the 1970s and 1980s, as the Iron Curtain is re-establishing itself as a political border. The old world order that has prevailed since the end of the Cold War has been shattered by Russia's invasion of Ukraine. Consequently, NATO has regained a new role; after years of disarmament, it has now become a sought-after defense alliance. The accession of Finland and Sweden now strengthens the alliance towards the east. What now looms large is rapid rearmament! Where can investors still participate?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

RHEINMETALL AG | DE0007030009 , ALMONTY INDUSTRIES INC. | CA0203981034 , RENK AG O.N. | DE000RENK730 , HENSOLDT AG INH O.N. | DE000HAG0005

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Rheinmetall - High volatility, but always in demand

What a crash last week. While Rheinmetall reached a new all-time high at the beginning of the week on the back of its usual strength, this was immediately followed by a major correction. On April 9, the share price temporarily soared to EUR 570.60, but just two hours later, the share price was at EUR 493 - a 14% drop in a flash crash movement, with over 1.9 million shares changing hands. Typically, the stock only trades around 300,000 to 500,000 shares on Xetra; on this day, 5% of the capital was available on the market. Coincidence or warning sign?

Although Goldman Sachs analyst Victor Allard raised his price target quite dramatically last week from EUR 381 to EUR 606, his unchanged "Buy" recommendation refers to the share's historically high valuation. With a current P/E ratio of 25 and a view to the coming months, the expert is somewhat skeptical and also sees growing downside potential. Meanwhile, colleagues on the Refinitiv Eikon platform are still lagging behind the current development. Here, 13 of 16 analysts recommend the share as a "Buy" with an average 12-month price target of EUR 548. This corresponds precisely to last Friday's quote. Although the environment for the share remains historically favorable, the current valuation is ahead of the expected business over the next two years. In chart terms, the share price must not fall significantly below EUR 500. Otherwise, there is a risk of a very rapid sell-off into the zone of around EUR 380 to 400. Traders are at the ready!

Almonty Industries - Mine opening is in full swing

The production of defense technology involves a whole basket of critical raw materials. Not all of them are immediately and readily available in the necessary quantities. Particularly in the case of the heat-resistant hardening metal tungsten, there is a dangerous dependency on China, where 70% of the global market is produced. Given the political chill between the US and the newly formed Asian "Eastern Bloc", the supply of this important metal is more uncertain than ever.

The Canadian company Almonty Industries owns four properties of the rare metal and is focusing on increasing global production. Western countries have high hopes for the rapid availability of additional tungsten in order to reduce their dependence on China. The revitalization of the Sangdong mine in South Korea, the largest deposit of the metal outside of China, is likely to be promising. The high-ranking visit by the US Department of Commerce to the Panasqueira mine in Spain in early 2024 is also indicative of the current tension. It is clear that the situation with critical metals is more than serious. The start of production in Sangdong is planned for the end of 2024, but with the usual delays, it could also be 2025. The main thing is that the mine gets off the ground in the long term.

The Almonty share has been in high demand this year and has already gained 50% at its peak. The share is currently trading between CAD 0.60 and CAD 0.62. At the end of March, around CAD 2.5 million was raised in several financing steps, with management taking a stake of around 35%. As an important tungsten supplier, the market capitalization of EUR 97 million is far from the strategic value. Given the current geopolitical landscape, the story should, therefore, be able to develop very favorably.

On April 17, 2024 at 17:30 CET, CEO Lewis Black will appear in front of the camera at the 11th International Investment Forum and report on the latest developments. Click here to register.

Hensoldt and Renk Group - This looks like a summit formation

As second-tier defense stocks, Hensoldt and the Renk Group are attracting attention. Both stocks have major investors on board and receive regular inflows from smaller investors who still want to jump on the bandwagon of defense stocks.

With the takeover of ESG, sensor specialist Hensoldt has moved into a new league. As a system integrator, the Munich-based company offers platform-independent, networked complete solutions. At the same time, the Company, as a technology leader, is driving forward the development of defense electronics and optronics, continuously expanding its portfolio based on innovative approaches to data fusion, artificial intelligence and cyber security. In 2023, the Company generated sales of EUR 1.85 billion. The ESG acquisition adds strong design and system integration capabilities to Hensoldt's product and solutions business. Analysts on the Refinitiv Eikon platform expect sales of EUR 2.20 billion in 2024, rising to EUR 2.55 billion in 2025. With a market capitalization of EUR 4.5 billion, the potential is currently largely exhausted. An active "Buy" recommendation with a price target of EUR 36.20 has already been exceeded by 10%. Although the ongoing purchases by defense investors are still stabilizing the share price, the potential for growth is believed to be very limited.

The situation is similar for the Augsburg-based Renk Group, which has returned to the stock market. The expert for special gearboxes has major investors such as Triton, KNDS and the US fund company Wellington Management. Around 26% of the shares are in free float, and so far, only one analyst out of five has issued a "Buy" recommendation. According to consensus estimates, sales increased by 9% to EUR 926 million in 2023 and are expected to reach EUR 1.05 billion and EUR 1.17 billion, respectively, in 2024/2025. That is quite limited growth for such a unique environment of dramatic rearmament. The share is considered fairly valued, with a market capitalization of EUR 3 billion. The high in 2024 has likely already been seen at just under EUR 38.

The defense industry is experiencing a dramatic renaissance. The availability of strategic metals remains crucial, as geopolitical uncertainties burden supply chains. This situation may well worsen in the current year. Almonty Industries has a vital role to play by creating capacity in secure jurisdictions.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.