January 4th, 2024 | 07:15 CET

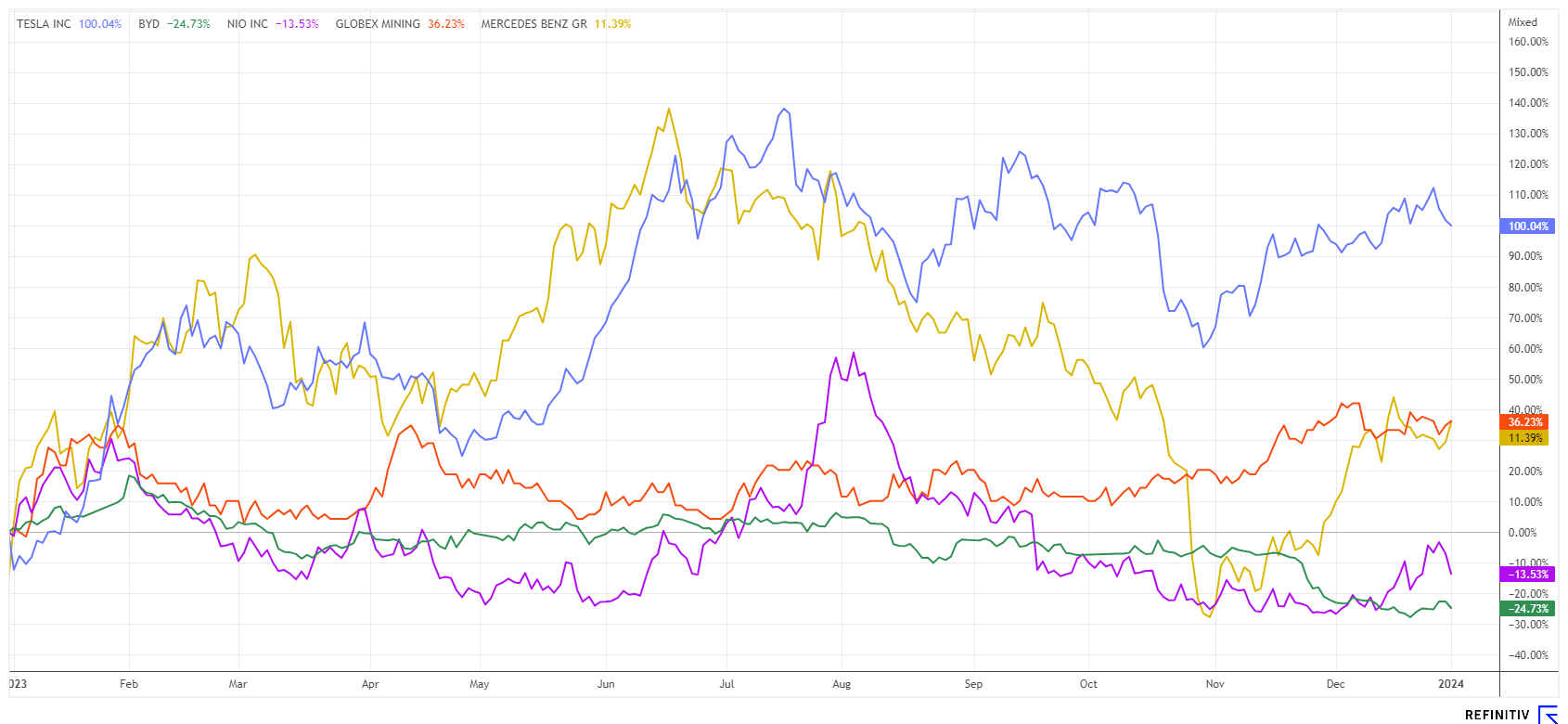

This is where the music plays: Top values wanted for 2024! Mercedes, Globex Mining, BYD, and NIO to the inspection!

It was a challenging year for the otherwise popular automotive stocks. Berlin and Brussels no longer want combustion engines, but consumers do. Then, to top it off, the environmental bonus was also cut at Christmas. The traffic light coalition believes that e-mobility should now sell itself. Far from it, say the experts: combustion engines still account for 97% of road vehicles. Those in office are governing for minorities, as there has long been a lack of scientific facts and a lack of tact. But well, customers are voting with their feet, turning new vehicles into shelf warmers and buying their beloved diesel SUVs through the used car market. This market could even flourish over the next few years and demand scarcity premiums. Where are the opportunities for investors?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

MERCEDES-BENZ GROUP AG | DE0007100000 , GLOBEX MINING ENTPRS INC. | CA3799005093 , BYD CO. LTD H YC 1 | CNE100000296 , NIO INC.A S.ADR DL-_00025 | US62914V1061

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Mercedes-Benz Group - The full environmental bonus as a discount

Those who bet on Mercedes-Benz last year were at least holding on to a stock in the DAX 40 index. Although the cross-section measured by the index achieved a plus of 19%, this super performance was attributable to the five heavyweights Siemens, SAP, Allianz, Telekom and Airbus. Overall, there were 26 losers and only 14 winners in the index.

The Stuttgart-based company started the new year with an effective advertising strategy. Following the abolition of the environmental bonus, the Group intends to grant a 1:1 discount on its new electric cars until the end of January. Cleverly done, as the Group has long since made up for the maximum EUR 4,500 eco-bonus with a price increase. With an estimated average new electric car price of EUR 74,000, the average discount is just 6% - but even before the law changes, good negotiators could secure double-digit discounts.

Fundamentally, one should consider the share, as according to the experts on the Refinitiv Eikon platform, the P/E ratio based on the 2024 estimates is only 4.9. On top of that, there is a dividend payout of over 8%. The premium producer has rarely been so attractively priced.

Globex Mining - Major asset deal before the turn of the year

Anyone looking at fundamental valuations should also have the Canadian explorer and asset manager Globex Mining (GMX) from Quebec on their radar. The Company and its predecessor companies have more than 40 years of exploration and development behind them. CEO and founder Jack Stoch has been searching for interesting precious and industrial metal properties since the mid-seventies. Some sites are explored in-house, others are optioned to partners as a package or with individual licenses. The commodity experts have accumulated a total of 240 interesting properties.

Shortly before Christmas, there was a big bang. Globex sold a 100% interest in 8 groups of advanced gold exploration claims to its partner, O3 Mining Inc. The properties are located northwest of Lebel-Sur-Quevillon and comprise a total of 156 claims. All properties have gold occurrences that are either already outcropping or have been intersected in historic drill holes. As part of the purchase agreement, O3 Mining paid CAD 2 million to Globex at closing, consisting of CAD 150,000 in cash and 1,185,897 common shares. These are currently trading at CAD 1.60, representing an equivalent value of CAD 2 million, and will be released after holding periods of 6 and 12 months. In addition, there are royalties of between 1 and 2.5% for the 156 claims when production begins. With a market capitalization of CAD 140 million, O3 Mining is almost three times the size of Globex and owns a large number of gold deposits. Therefore, Globex's geological expertise is expected to quickly translate into tangible benefits. Currently, there are approximately 57.7 million fully diluted GMX shares. **After a low of around CAD 0.68, the share price rose to CAD 0.95 at the end of the year. In our opinion, the share should continue to provide joy in 2024, especially if the gold price gains momentum.

BYD and NIO - China sets new standards

The performance of automotive shares worldwide lags behind the generally positive stock market sentiment. This is due to the inflation-induced increase in the cost of products and the weaker purchasing power of potential buyers of expensive new vehicles. A new vehicle has become an absolute luxury item for many families.

Chinese manufacturer BYD announced at the beginning of the year that it would have produced over 3 million vehicles with alternative drive systems by 2023. Tesla reported an output of 1.84 million all-electric vehicles yesterday. Although this puts BYD ahead overall, Tesla is the global market leader on the e-stage. Although BYD passed the 3 million mark, annual sales fell slightly short of analysts' expectations of 3.05 million vehicles. In 2023, the share price only just managed to hold its own and is currently motionless on the market. After all, the P/E ratio for 2024 is calculated at over 20, and the price is three times the book value. For comparison: Volkswagen shares are trading at a price-to-book ratio of 0.3; in other words, they are roughly 10 times cheaper!

The Chinese competitor NIO can still be described as a start-up. The Chinese EV manufacturer delivered 18,012 vehicles in December, corresponding to an increase of 13.9% compared to the previous year. In the 2023 financial year, production sales reached 160,038 units, a remarkable increase of 30.7% year-on-year. The Company also presented its new flagship project, the ET9, at NIO Day 2023. The avant-garde model embodies NIO's latest advances in technological research in terms of drive, safety, and interior design. An evolutionary leap is the range of at least 700 km and a 30% battery charge in just 5 minutes.** The price could be problematic: The first units of the new model are expected to be delivered in Q1 2025 at an astonishingly high retail price of EUR 128,000.

NIO shares have lost around 13% in 2023 and are correcting by a further 10% with the latest figures. According to expert estimates on the Refinitiv Eikon platform, NIO will not be in the black until 2028. BYD and NIO are still in correction mode. There are actually no particular reasons to buy from a fundamental perspective.

The last word has not yet been spoken in the automotive business. The environmental bonus has just been scrapped in Germany, but manufacturers are prepared to grant a discount for a few weeks. This is intended to bring the last willing prospective e-vehicle buyers to the sales table. A slump in the e-mobility business is expected in the current year. However, according to statements from Berlin, the very favorable tax benefits for business use remain. In the midst of global inflation and high uncertainty, the automotive business continues to struggle. The scenario could be completely different in the precious metals sector and, thus, also for Globex Mining if gold can finally develop its radiance beyond USD 2,150.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.