November 20th, 2025 | 07:15 CET

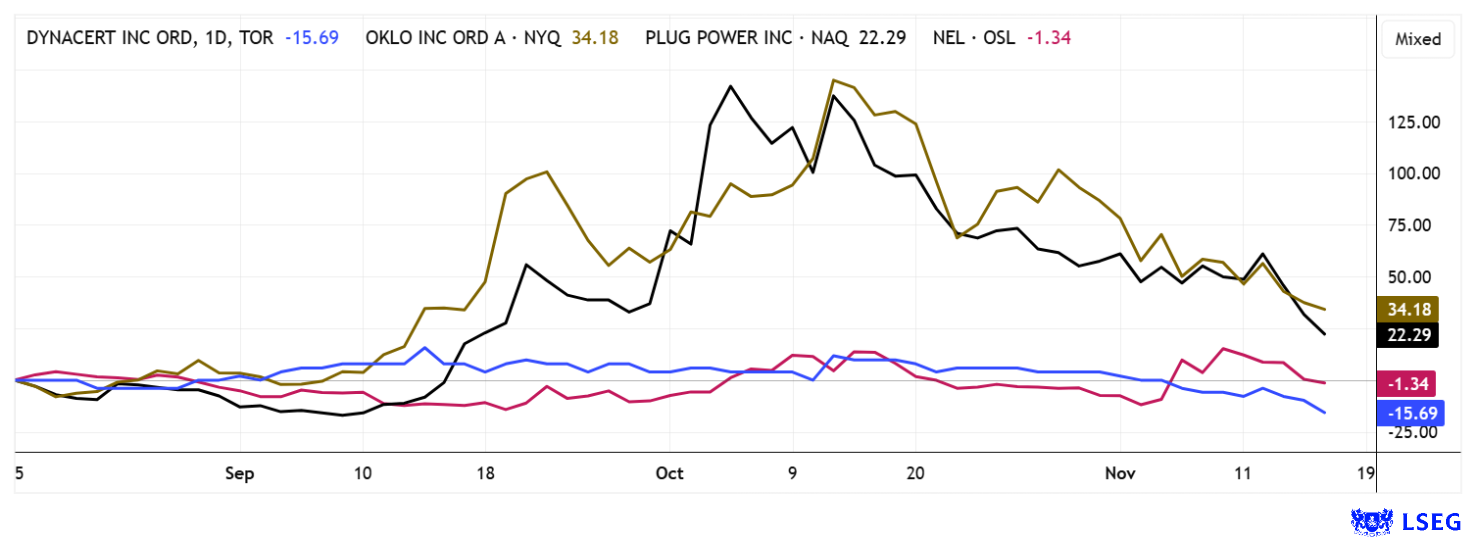

The stock market shows gravity! Black Friday prices for Plug Power, dynaCERT, Oklo, and Nel ASA

The stock market is prone to slight corrections. Is this the beginning or just a test of gravity? No one knows for sure, because machines rule the market. They generate automatic buy and sell orders based on trends, order frequency, and daily volume. Currently, it appears that the lower sales by small investors are actually generating further downward momentum. At the same time, the big players have not even considered their positions yet. For the hydrogen sector, the sobering results of COP30 in Brazil are decisive. Here, somewhat risky financing models are being discussed, and without the US, it hardly makes sense to join forces.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

PLUG POWER INC. DL-_01 | US72919P2020 , DYNACERT INC. | CA26780A1084 , OKLO INC | US02156V1098 , NEL ASA NK-_20 | NO0010081235

Table of contents:

"[...] We are committed to stay as the number one Canadian and global leader in the Hydrogen-On-Demand diesel technology [...]" Jim Payne, CEO, dynaCERT Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

dynaCERT – The future of low-emission transport is now

We have reported several times recently on the Canadian technology company dynaCERT. With the international rollout to Texas and Mexico, tangible progress is now visible. It is all about the patented HydraGEN™ technology, with which dynaCERT is setting new standards in low-emission mobility. The technology generates hydrogen and oxygen directly at the engine through electrolysis of water, which reduces diesel consumption by up to 8% and significantly reduces CO₂ and NOx emissions. HydraGEN™ improves diesel fuel combustion by adding gases and ensures more efficient, cleaner combustion with fewer pollutants. The system is already in use in North America, Europe, and other regions, including by freight forwarders, in the mining industry, and in port operations. Recently, the French port of Rochefort demonstrated that even retrofitting port cranes can lead to significant emissions and fuel savings.

dynaCERT's technology meets strict environmental requirements and has been certified for emissions reductions by the international certification body Verra. The market breakthrough is currently evident in new large orders, for example, in Mexico, one of the world's largest truck markets. There, dynaCERT is cooperating with the Texas-based distributor Hydrofuel Technologies, which has ordered 100 units of HydraGEN™ technology for delivery within a year. One thing is clear: Mexico is the gateway to Latin America. However, dynaCERT also reports projects in Australia and Canada, such as Caterpillar haul trucks and H2 generators for extreme environments.

In May 2025, Bernd Krüper, who has many years of industry experience, took over as President of dynaCERT and strengthened important partnerships, including with Cipher Neutron in the field of electrolysis technology. John Amodeo, who has extensive expertise in global corporate development, was recently appointed as the new CFO to support growth and international expansion. The Company has also raised CAD 5 million in fresh capital and is now listed on the US stock exchange. The stock is highly liquid and tradable in both Germany and Canada and is currently trading at a significant discount for no real reason. Nevertheless, GBC Research expects CAD 0.75, which means the current price of CAD 0.11 offers a multiplication over the next 12 months. Time to buy!

What do GBC analysts say about the latest developments at dynaCERT? Here is an interview by Lyndsay Malchuk with market expert Matthias Greiffenberger.

Oklo – What a price slump

SMR hopeful Oklo, from the US, has really fallen by the wayside. In wild euphoria over Trump's announcements about a revolution in nuclear energy, the share price had risen by a staggering 700% since April. After a technical peak lasting about 10 days, the reversal came. What happened? It is the abundance of projects that Oklo now plans to push forward in parallel. Investors are increasingly doubtful about the financial feasibility, because the complete implementation of just one plant requires external investors, the state, and public subsidy programs to shoulder the billion-dollar investment. The momentum is high. For example, the expansion of the collaboration with the Idaho National Laboratory is on the agenda, strengthening the R&D pipeline for important materials and fuels. The selection for three DOE reactor pilot projects signals high political confidence and accelerates the realization of the Aurora fast reactors. Finally, the planned co-location with Lightbridge for fuel production could create significant synergies. Recent progress underscores Oklo's goal of establishing a robust domestic fuel supply. At the same time, the Company is addressing regulatory hurdles through cooperation with government agencies. Investors have apparently gotten cold feet and taken their initial profits. A staggering 50% drop in price to USD 95 in just 15 trading days. Respect!

Plug Power and Nel ASA – Were these false breakout signals?

American hydrogen pioneer Plug Power is also proving to be highly volatile. In October's NASDAQ frenzy, its share price catapulted from USD 1.90 to USD 4.50 at breakneck speed. Then came Q3 figures that were only in line with expectations. CEO Andy Marsh expressed optimism for the coming years, but at the same time urged public institutions to accelerate their investments in alternative energies such as hydrogen. On the other hand, there is little news from the COP30 meeting in Brazil. Some protagonists had hoped for more positioning on this issue from the most important industrialized countries. But the absence of the US delegation alone reduces the meeting to only about 65% of global pollutant emissions. With the announcement of a USD 375 million convertible bond, PLUG management is not generating much excitement either. Due to renewed dilution, the stock fell another 14% yesterday to USD 1.86. This means that the entire increase from October has now been wiped out. It is a shame, as the technical breakout had looked promising, but now the chart resembles the Kaiser Wilhelm Memorial Church in Berlin. Wait and see!

At Nel ASA, too, the Q3 figures had only a short-term positive effect. Nel generated contract revenues of NOK 303 million, a 17% decline, but EBITA was significantly better than in the previous year at NOK -37 million compared to NOK -90 million. Furthermore, order intake is continuing to decline, causing the total order backlog to slump by 47% to NOK 984 million. The only slight consolation is the cash balance, which totaled NOK 1.8 billion on the reporting date. The share price jumped 25% to NOK 2.85 yesterday, but ended the day back at NOK 2.35. A tragedy!

Following an extensive correction in the Greentech sector, there is now room again for high-growth technology and sustainability stocks. While industry giants such as Oklo, Plug Power, and Nel ASA face a challenging scaling process, dynaCERT is increasingly coming into focus with its unique Greentech solution. The Company combines climate protection with increased efficiency in mobility and industry.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.