January 27th, 2026 | 07:30 CET

The silent power plant: How RE Royalties is driving the green boom with royalty financing – without construction noise

The energy transition is a gigantic construction project, complex and capital-intensive. While attention is focused on the big project developers and fluctuating stock prices, a quiet but powerful business model is at work in the background: royalty financing. RE Royalties has transferred this concept from the commodities sector to the world of renewables, creating its own asset class. Instead of battling wind and weather, it simply participates in the long-term revenue streams of green power plants. For investors, this could be the most elegant way to profit from the structural megatrend with comparatively low operating risk and predictable cash flows.

time to read: 4 minutes

|

Author:

Armin Schulz

ISIN:

RE ROYALTIES LTD | CA75527Q1081

Table of contents:

Author

Armin Schulz

Born in Mönchengladbach, he studied business administration in the Netherlands. In the course of his studies he came into contact with the stock exchange for the first time. He has more than 25 years of experience in stock market business.

Tag cloud

Shares cloud

From problem to pioneer status

The origins of this idea lie in a practical financing dilemma. A good decade ago, Bernard Tan, now CEO of RE Royalties, came across a promising tidal power project. The technology was there, the permits were pending, and a long-term power purchase agreement was in place. The only thing missing was the capital. The traditional options were unsatisfactory. Venture capital was too expensive, private equity too controlling, and bank loans too restrictive. There was no royalty financing for renewable energy projects, CEO Tan recalls. This gap became the founding idea.

Together with Peter Leighton, an experienced manager from the renewable energy industry, he launched RE Royalties in January 2016. Just two months later, the first royalty was acquired in British Columbia. The Company had not only found a gap in the market, it redefined it. It introduced the concept of royalty financing to the renewable energy industry. It was the first player to consistently apply a proven financial instrument to solar, wind, and hydroelectric projects. The initial public offering on the TSX Venture Exchange in November 2018 was the next logical step to raise capital for further growth and provide liquidity to shareholders.

The model: Simple, recurring, scalable

The mechanics are elegant. RE Royalties provides project developers with capital to build or expand facilities. In return, it does not receive traditional interest, but rather a percentage share of the facility's revenue, often over 20 to 40 years, known as a royalty. This is attractive to developers. It is non-dilutive capital that does not transfer voting rights and weighs less heavily on the balance sheet than pure debt. For RE Royalties, this creates a long-term, contractually secured revenue stream that is often linked to inflation-indexed electricity sales prices.

The ingenious leverage lies in recycling. The initial capital provided often flows back within a few years through scheduled repayments or even early repayments. This capital is not distributed, but immediately reinvested in the financing of new projects. Over time, an initial investment can thus grow into an entire network of steady royalty streams. COO Peter Leighton emphasizes this focus in relation to the latest announced project: "This transaction reflects RE Royalties' continued focus on partnering with renewable energy developers and acquiring royalty interests in diversified, cash flow-generating clean energy assets."

A portfolio that speaks for itself

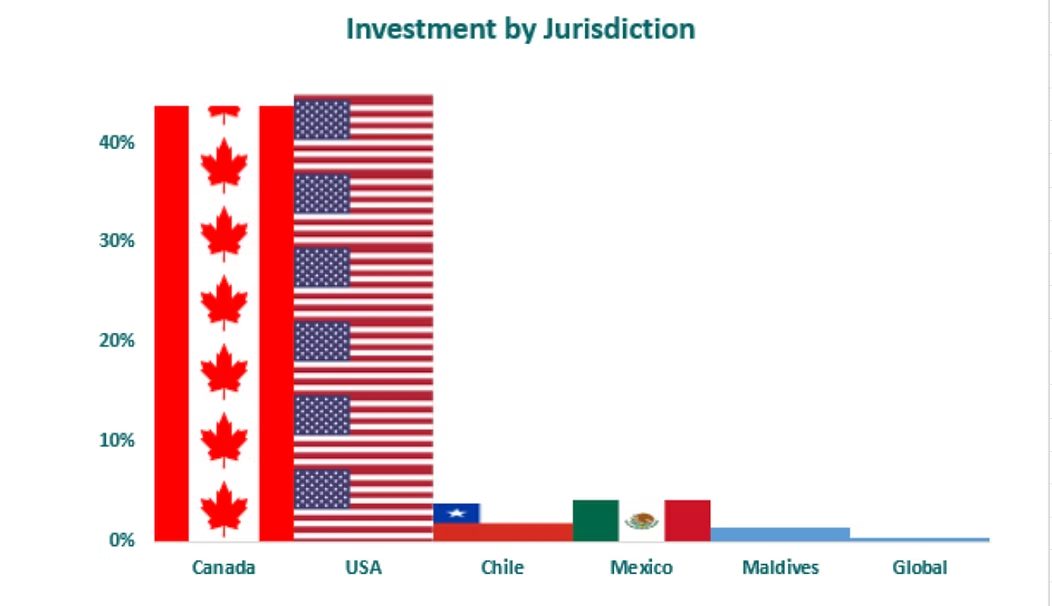

The figures testify to the successful implementation of this strategy. The current portfolio comprises over 120 royalties on solar, wind, hydro, battery storage, and biogas projects in North America, South America, and Asia. The total capacity of the underlying assets is just under 500 megawatts. That is enough to supply over 150,000 households with clean energy and avoid nearly 490,000 tons of CO2 equivalents annually. This impressive scale was achieved not through equity dilution, but through intelligent capital allocation.

Recent transactions underscore the ongoing momentum. The agreement with Solaris Energy Inc. for up to USD 9 million in royalties on two portfolios of distributed solar installations in the US is a prime example. Nick Perugini, CEO of Solaris, sums up the value of the model: "Sponsor equity is the most difficult capital to raise, and we are very excited to work with the RE Royalties team to strengthen our relationships with internal sponsor equity providers, tax credit providers, and lenders to complete the capitalization of our strong portfolios of distributed generation and solar-plus-storage projects." The Company fills this critical gap in the capital structure of developers precisely.

Strategic agility in uncertain times

The current market phase, with high interest rates and political uncertainty, plays to the strengths of the model. While pure project developers are groaning under financing costs and supply chain problems, RE Royalties is benefiting from increased demand for alternative capital. The Company reports letters of intent for approximately CAD 50 million for short-term projects in solar, wind, and storage. "These short-term opportunities reflect the strong demand for flexible, innovative capital in the renewable energy sector," analyzes Peter Leighton.

This agility is also evident in the Company's approach to shareholder returns. The recent decision to switch to annual dividend payments is strategically motivated. It gives management more flexibility to invest in highly attractive growth opportunities. Most recently, CAD 0.01 per share was distributed for the quarter. CEO Bernard Tan emphasizes the focus on long-term value: "These grants reflect the Board's commitment to aligning the interests of our team with those of our shareholders." The compensation in the form of stock options and restricted share units for management underscores this intention.

The stock is currently trading at CAD 0.32 and offers an attractive dividend yield.

RE Royalties has done more than just copy a financial product. It has established a scalable, resilient business model that sits at the heart of the energy transition: capital raising. While others bear the operational risks of construction sites and technology, the Company secures a share of the long-term, stable revenue streams of the finished infrastructure. The growing pipeline, diversified portfolio, and strategically agile management suggest that this quiet powerhouse is just getting started. For investors who want to benefit from the irreversible trend toward decarbonization without having to bear its operational pitfalls, this pioneering company offers a compelling and, to date, unique approach.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.