August 30th, 2023 | 07:45 CEST

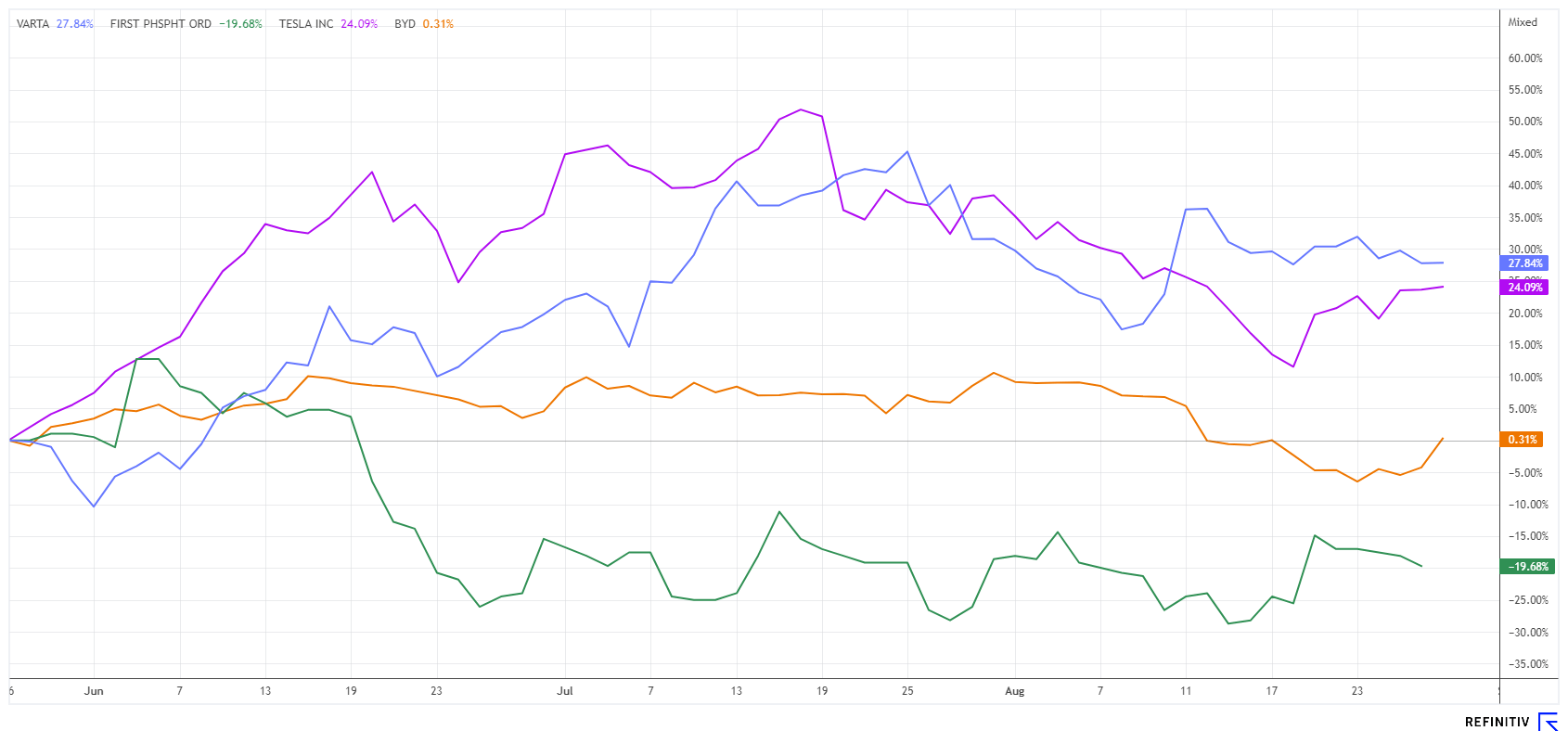

The IAA is just around the corner, and e-mobility is faltering - Where is the super battery? BYD, Tesla, Varta and First Phosphate in focus

Professor Ferdinand Dudenhöffer sees electric mobility on the decline. Despite the EU's ban on internal combustion engines from 2035, the switch to electric drive will take even longer than expected. In a recent interview, he sees the declining subsidies as of September 1 of this year as a possible showstopper. The reason: most purchases of e-vehicles are tax-motivated, and the increased interest rates have made expensive electric cars less competitive in leasing models. In addition, there are the technical limitations in safety, range and operating time compared to the mature, fuel-efficient combustion vehicles. So the challenge is to invent clean, efficient and safe battery technology. Where are the opportunities in this highly dynamic industry?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

BYD CO. LTD H YC 1 | CNE100000296 , TESLA INC. DL -_001 | US88160R1014 , VARTA AG O.N. | DE000A0TGJ55 , FIRST PHOSPHATE CORP | CA33611D1033

Table of contents:

"[...] Boron is one of the most versatile elements in the whole world! Everyone reading this text regularly uses hundreds of products that depend on boron. [...]" Tim Daniels, CEO, Erin Ventures

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Varta - Breakout attempt failed for now

The fragile growth of Varta has encountered setbacks. Shortly after the presentation of the half-year figures, the price went dynamically toward EUR 23, but by the end of August, it came back to around EUR 20. The recent figures did hint at a glimmer of hope. Revenue slipped by only 10% to EUR 339 million, and adjusted EBITDA showed a razor-thin loss of EUR 6.8 million after a profit of EUR 68.9 million in the previous year. Nevertheless, the 75% drop in sales in the LI-Coin Power segment, mainly the supply of Apple's wireless headphones, was drastic. **Here, there was a significant clouding of demand, a reduction in inventories on the part of customers, and considerable price reductions.

The area of e-mobility and the V4Drive product, which has been in development since 2021, also went quiet. As it was not possible to start test production here, the Group is now concentrating on off-grid energy storage systems in addition to consumer batteries. Despite the still challenging macroeconomic situation, the Company is optimistic for a better development in the coming months. Start-up customer projects and the seasonal increase in demand in the second half of the year should provide a surprise in the figures for the fall.

The Company is currently in the process of setting up a gigawatt factory for energy storage in Ellwangen, where the first battery modules are to be manufactured at the end of the year. JP Morgan maintains its "Neutral" rating but lowers the price target from EUR 30 to EUR 25. DZ Bank and Warburg take a more critical view and recommend selling with a 12-month price expectation of a low EUR 15. The restructuring will likely hold a few surprises in store, but from a chart perspective, the stock would first have to climb above EUR 23.70. Overall, the analysts are probably too skeptical.

First Phosphate - There are still a few surprises here

The Canadian company First Phosphate (PHOS) is also planning a long-term market entry into the "battery solutions" sector for various alternative energy applications. Large Asian battery manufacturers such as CATL, BYD and Panasonic are eyeing the latest technologies, which promise longer service life, greater safety and shorter charging cycles. The average range across the industry has recently increased from 350 to 470 km, but it is still far from the diesel range of up to 1,000 km. In addition, many flexibility restrictions must be accepted when operating an e-mobile. The disposal issue is also completely unresolved, as some manufacturers have so far refused to assume the costs for this. As a result of technological developments to date, manufacturers have agreed on a battery warranty of eight years and 160,000 km, with only a few exceptions. At least!

However, the industry is waiting for potential game-changers in the electric mobility revolution. Phosphate could also play a significant role, as it implies the elimination of critical cobalt. Both the US and Canadian governments want to become more self-sufficient from imports by developing domestic battery production. First Phosphate could play an important role as a supplier since it has access to a huge phosphate deposit in Quebec. The magmatic anorthosite phosphate rock found there is ideally suited for these purposes and can be mined for over 14 years in the Lac à l'Orignal concession area, according to the current economic assessment. With processed phosphate concentrate, magnetite and ilmenite, a net present value of CAD 795 million can thus be achieved over the mentioned time, and the mining operation would become profitable within 5 years of commencement.

The PHOS share is valued at only CAD 19.5 million at a price of CAD 0.38. In the long term, the development into a supplier of LFP cathode material could increase the value of the Company many times over. Highly interesting!

BYD and Tesla - The upcoming IAA will make a mark

In the run-up to the IAA Mobility, the European vehicle market is gearing up for a major offensive by Asian manufacturers. They shine with simpler vehicle concepts and cost advantages in production. Overall, they will be able to offer a price advantage of up to 30% for buyers from the EU despite the long import routes. **Recently, manufacturers Tesla and VW had to pass the baton in the Chinese market to BYD, even though they had already massively lowered their prices.

Technologically, the latest battery technology will also be put to the test. According to the Company, the high-performance battery technology from Chinese manufacturer Farasis Energy enables long-range and fast-charging capability. With an energy density of 330 watt hours per kilogram, a range of around 1,000 kilometers can be achieved. As a pioneer with about 150 patents, the international development team is currently working on the 5th generation of battery cells, the chemistry mix of which is still being kept secret. Farasis also offers an innovative concept for the recovery and reuse of valuable materials through its proprietary direct recycling process. Good news for industry!

That is where established manufacturers like VW, BYD and Tesla are challenged. So far, they have relied on in-house production of the electric "core cells." But that could change as young, dynamic start-ups conquer the battery market. The upcoming IAA Mobility in September will bring some momentum to the industry.

The global battery market is on the move. With Li-ion technology now coming of age, potential game-changers could be on the horizon. Clearly, the whole thing only makes sense if large-scale industrial production is possible with the new materials. Among the e-mobility stocks, BYD and Tesla remain highly valued standard stocks, and Varta and First Phosphate can be added speculatively.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.