September 27th, 2023 | 08:05 CEST

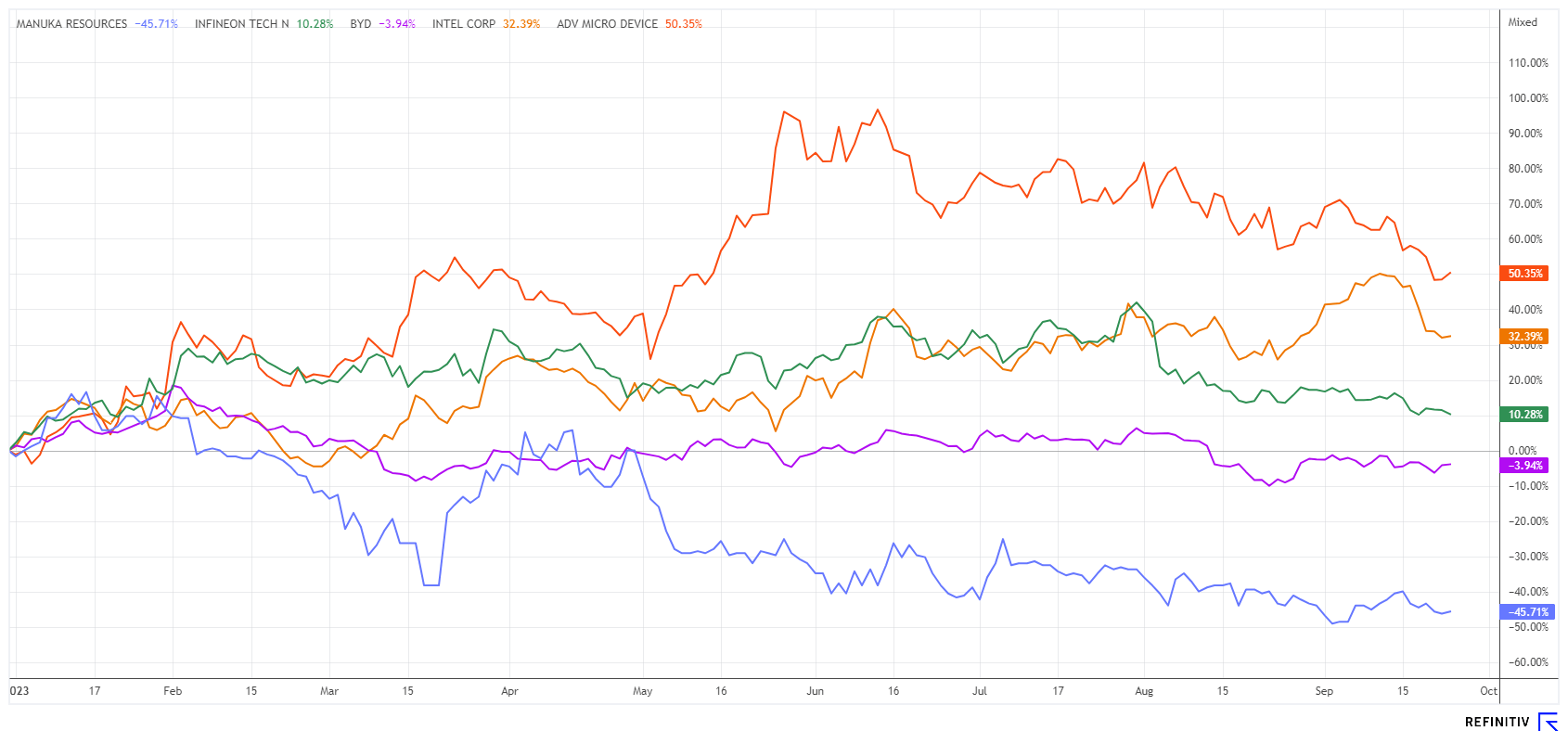

The high-tech gold rush on the Nasdaq is waning: BYD, Manuka Resources, and Infineon remain on the buy list

For those investing in green or high-tech sectors, keeping an eye on the supply chains of raw materials is crucial. After all, in times of geopolitical upheaval, nothing seems more important to the industry than securing its foreign sources of critical resources. The EU and the US have already responded by adding several metals to the list of strategic elements. For the capital markets, too, the fight against global warming has become an issue that cannot be ignored. We focus on successful protagonists that can enhance any portfolio.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

BYD CO. LTD H YC 1 | CNE100000296 , Manuka Resources Limited | AU0000090292 , INFINEON TECH.AG NA O.N. | DE0006231004

Table of contents:

"[...] Internally we expect the resource to significantly grow the deeper we mine. [...]" Dennis Karp, Executive Chairman, Manuka Resources

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BYD - Now also in Mexico

The IAA Mobility trade show in Munich had already given a foretaste of where the journey in mobility is headed. BYD's exhibition space with 5 new models met with the highest interest. It is essential to note that the Chinese automaker can offer its products, on average, 20% cheaper than German manufacturers in nearly all model categories. In this context, the EU Commission will scrutinize the subsidy policy of the Beijing government.

BYD is in the process of building up its international presence in addition to its strong home market. In Europe, it has already set up shop in Germany, Norway, the Netherlands and Spain. Now, the next expansion step is to Mexico, where BYD wants to produce abroad for the first time. The Texan electric pioneer Tesla already announced the construction of a new Gigafactory in Santa Catarina in the state of Nuevo León in the north of the country at the beginning of 2023. BYD will now follow suit.

Mexico is already an important location for the US auto industry due to its duty-free access to the US market. Mexican politicians are very interested in a plant for e-cars because it creates jobs in a structurally weak region. In addition to Mexico, the Chinese automotive group also plans to expand in Thailand and Brazil - good news for the BYD share. After an extensive correction at the beginning of 2023, the value is again striving towards the EUR 30 mark in September. With a growth rate of almost 15% per annum, a current 2024 P/E ratio of 18.5 is not too expensive.

Manuka Resources - Well positioned for the climate turnaround

The efforts of politicians to act responsibly for future generations are fueling the imagination in the field of renewable energies and future mobility. Particularly for Europe, a location poor in raw materials, important metals must travel long distances to be processed by the local industry in a way that adds value. The situation is different for the continent of Australia. Here, almost every raw material is available in sufficient quantities, and due to its geographical location, it is the leading supplier to Asia's most important industrial zones.

Manuka Resources Limited, based in the Cobar Basin, New South Wales, not only owns two highly prospective projects in gold and silver with historic production but is also positioning itself in the critical metals sector with the acquisition of the South Taranaki Bight project (STB) completed in 2022. Of interest is the vast deposit of vanadium, which is increasingly coming into focus as a new metal for battery production.

Manuka had recently reported that gold production had resumed at the former Mt Boppy gold mine. Since August, new sampling has also led to a significant increase in the resource. According to the latest estimate, the mineral resource is now over 160,000 ounces and can be mined at grades of about 2 grams per ton of rock. It is likely that further ore deposits can be found through deeper exploration of the property.

Importantly for Manuka, ongoing gold sales now provide the opportunity to develop both the Wonawinta Silver and Base Metals Project and the new STB Offshore Vanadium Project. Next year, work is also expected to expand to the McKinnons Mine and Pipeline Ridge properties. With the STB project, Manuka has a pearl in its portfolio that can multiply the company's valuation in the future. MKR shares are currently trading at a low of AUD 0.046 in Australia. The market capitalization of EUR 16.4 million is much too low for the total valuation of the individual projects. Speculative investors are, therefore, betting on a revaluation or a takeover by an international commodity group.

Manuka CEO Dennis Karp will provide a live update on the current projects at the 8th International Investment Forum on October 10, 2023, at 10:30 AM. Click here to register.

Infineon - A Great European Responsibility

Among chip stocks, Munich-based Infineon is always on the map when it comes to energy efficiency and smart automotive solutions. As recently published, Infineon has now been entrusted at the EU level with the management and coordination of the extensive European research project EECONE (European ECOsystem for greeN Electronics). The initiative aims to increase sustainability in technical products by researching technologies across the value chain, from design and manufacturing to usage and recycling. EECONE is one of the key digital technologies research projects that the EU supports as a joint venture and is currently funding with EUR 35 million.

EECONE is based on the 6R concept (Rethink, Refuse, Reduce, Reuse, Repair, Recycle); the electronics installed in the form of semiconductors and printed circuit boards are to use less material and operate reliably for longer. In addition, Artificial Intelligence (AI) is to be used to extend the service life of electronics. Of course, this does not automatically make Infineon a sought-after AI stock. Recently, however, there were upgrades from some brokers, especially in the area of silicon carbide semiconductors, which is expected to continue to do well, as Berenberg confirms with the vote "Buy" and price target EUR 44. Earnings per share are expected to rise from EUR 1.91 to EUR 2.61 in the current fiscal year, an increase of 37%. The 27 experts on the Refinitiv Eikon platform see an average 12-month price target of EUR 47.15. There is currently no negative vote.

Greentech stocks performed very well in 2022 and are consolidating somewhat in the current year. Currently, this presents an opportunity to acquire standard stocks like BYD and Infineon at attractive prices. The entire exploration sector also suffers from the globally low valuations. Manuka Resources is an interesting representative from Australia pursuing several promising projects.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.