February 20th, 2023 | 13:49 CET

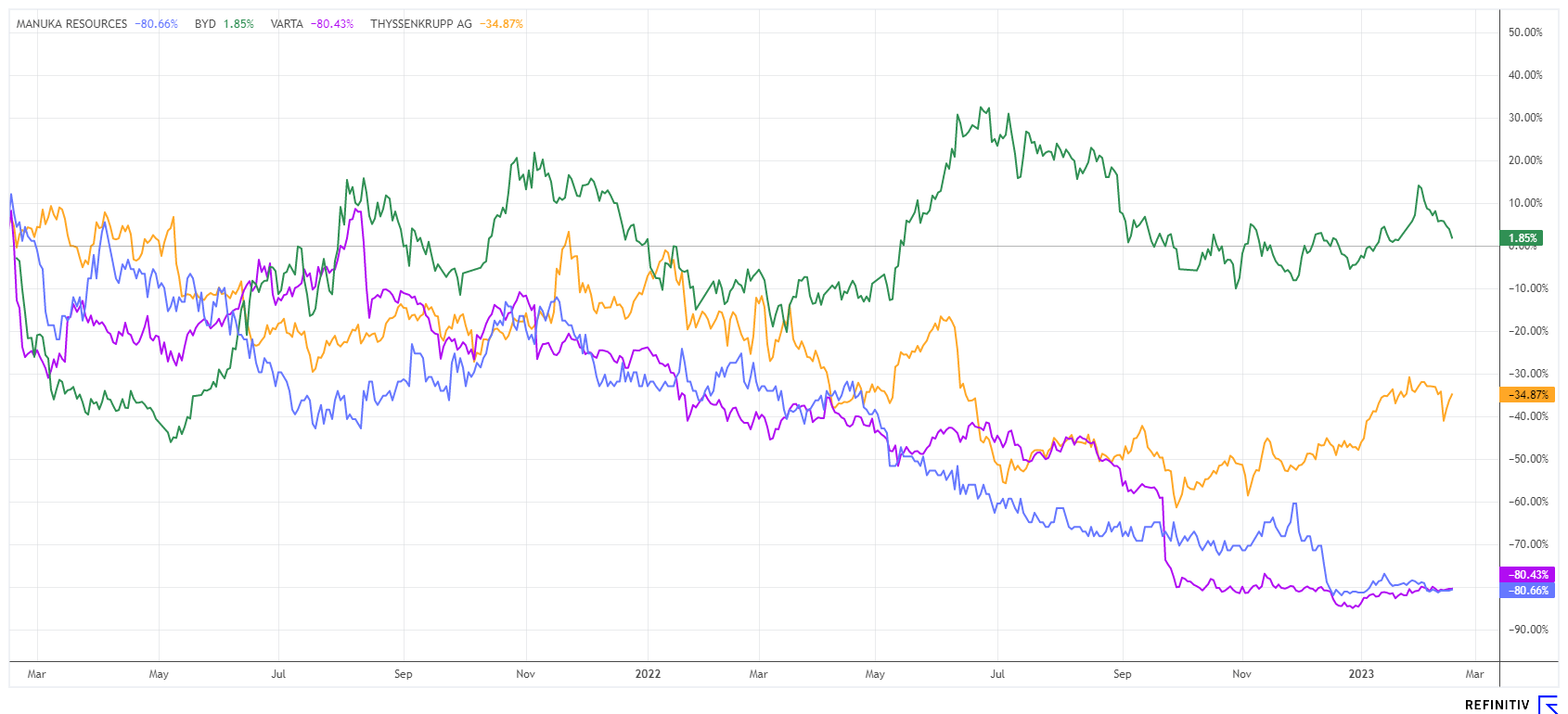

The Greentech rally continues: Shares of ThyssenKrupp, Manuka Resources, BYD and Varta in focus

The pessimists among economists were proven wrong at the beginning of the year. No, the German GDP did not fall in 2022, but rose by a full 1.9%. Who would have thought that with the supply chain problems, growth would be possible at all? Due to the war in Ukraine, rising energy prices and record inflation, economic regeneration in 2022 turned out surprisingly better than expected. This is due to various special effects, such as restructuring our energy supply, which positively affected the German economy. So far, there has also been no gas emergency, which would have weighed heavily on industry. We look at opportunities in the emerging Greentech industry.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

THYSSENKRUPP AG O.N. | DE0007500001 , Manuka Resources Limited | AU0000090292 , BYD CO. LTD H YC 1 | CNE100000296 , VARTA AG O.N. | DE000A0TGJ55

Table of contents:

"[...] We knew the world was rapidly electrifying and urbanising and needing significant amounts of copper to do so. [...]" Nick Mather, CEO, SolGold PLC

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

ThyssenKrupp - Worse figures, but low valuation

ThyssenKrupp shares headed south with the figures for the first quarter of 2023. At EUR 9.0 billion, sales of the MDAX member were exactly level with the prior year. Except for steel trading, all divisions achieved growth. Trading in steel products halved in mid-2022 due to lower steel prices, giving the Group a -10% drop in sales in the division and a slump in EBIT from EUR 219 million to EUR 20 million. With figures from other areas maintained, net profit reached EUR 98 million or EUR 0.12 per share.

The Company also revised its full-year guidance, with the Duisburg-based company now expecting a decline in operating profit from EUR 2.1 billion to an amount in the mid to high triple-digit millions and at least break-even for the year. We consider the share price reaction of minus 10% to the published figures excessive because the IPO plans for the hydrogen subsidiary Nucera are on track. As of December, ThyssenKrupp still has cash and cash equivalents of EUR 11.50 per share.

Nucera is currently inundated with orders. Sales could go through the roof and quickly become a pearl on the parent company's balance sheet. Experts estimate the total value of the H2 subsidiary at EUR 4 billion, which would be a share value of EUR 2.6 billion for the 66% stake. The total market capitalization of the parent company is currently only EUR 4.3 billion for estimated sales of around EUR 36 billion in 2023, and the book value is calculated from the 2021 balance sheet at an astonishing EUR 17. Undervalued!

Manuka Resources - Concretizes its growth strategy

Commodity companies can make an important contribution to environmental and climate protection through environmentally friendly extraction processes. Despite all the public criticism of mining, metals are needed in the Greentech industry to get the energy turnaround off the ground. Australia's Manuka Resources Limited, based in the Cobar Basin, New South Wales, not only has two highly prospective projects in gold and silver with historic production, but also positioned itself in the area of critical metals such as vanadium, iron and titanium with the acquisition of the South Taranaki Bight project (STB).

Manuka Resources CEO Dennis Karp on Feb 15, 2023 at the 6th IIF

A strategic exploration review of the Cobar Basin properties in 2023 has highlighted the significant potential in silver, gold and high-grade base metals. Evaluation of all available geophysical data and reports, some dating back more than 30 years, has now been completed and is yielding positive results. Additional resources of 22 to 35 million ounces grading 40-50 grams per tonne (g/t) silver are now suspected, primarily from the existing pits at Wonawinta. At the same time, 249,000 to 527,000 ounces at 2.5-3.8 g/t gold grades can be identified that can be recovered by depth expansion. In addition, zones of polymetallic mineralization, including high-grade copper of up to 3%, were discovered. "The results of the strategic exploration review indicate significant resource potential at our Cobar properties, particularly concerning silver and gold in the vicinity of the mine, but also high-grade copper as well as zinc and lead," stated Chairman Dennis Karp.

The next drilling in 2023 will bring these discoveries to light and provide the key to delineating the resource. The Wonawinta deposit has a JORC resource of 51 million ounces of silver and 207,000 tonnes of lead. The new exploration budget is estimated at more than AUD 8 million over two years, allowing for approximately 24,000 meters of drilling. The Company is currently valued at only AUD 43.8 million and has total debt of AUD 15.3 million. Limit collecting!

Varta - New CFO gives hope

Varta gave its investors a horror year in 2022 with three profit warnings and minus 80% in the share price. The reason was the massive increase in material costs to around EUR 400 million per year. With planned sales of around EUR 870 million in 2023, the Company will likely remain in the red unless veritable solutions are found to contain costs.

However, the group is preparing to get its operational woes under control in 2023. In addition to hiring ex-Lenzing manager Thomas Obendrauf as the new chief financial officer from May 2023, CEO Markus Hackstein has also brought in the restructuring experts from Boston Consulting. The board spokesman hopes this will lead to progress in increasing efficiency and making the necessary cost reductions, as well as in realigning the business units.

Well-known analyst firms such as DZ Bank and Goldman Sachs have lowered their ratings for Varta to Hold and Neutral, respectively, and adjusted their 12-month price targets to EUR 25 and EUR 30, respectively. Warburg votes with "Sell" and a price target of EUR 17.50. Meanwhile, the average price target is EUR 27.30 and thus even below the current quotation of EUR 28.40. The first preliminary figures will come to light in the next few days, but final figures for 2022 will not be available until April 26. Wait and see!

BYD - Overtakes competitor Tesla in China

BYD recently announced that it expects an adjusted annual profit of just over EUR 2.2 billion for 2022. That would be about 1,200% higher than in 2021. 99-year-old US investor and friend of Warren Buffett, Charles Munger, keeps falling in love with the BYD share: "The Chinese electric carmaker is a remarkable company that is way ahead of US carmaker Tesla, at least in China," he said on the sidelines of an investor conference.

Berkshire Hathaway's original USD 500 million investment in 2008 peaked at USD 8 billion, as BYD's stock value has risen more than 600% in the past decade alone. Berkshire had even slightly reduced its BYD stake last year after the value became too expensive in the short term. Asked whether he would prefer Tesla or BYD as an investment, Munger said, "Tesla lowered its prices in China twice last year; BYD raised its prices. We are direct competitors. BYD is so far ahead of Tesla in China, it is almost ridiculous." At EUR 27.35, BYD is down about 35% from its 2022 high of EUR 41.8. However, the estimated 2023 P/E ratio is still 23.5.

The Greentech trend remains strong as many governments worldwide continue to expand their investments in environmentally friendly technologies. This gives the technology leaders a good order book and increases the need for low-cost raw materials. ThyssenKrupp and BYD are convincing as broad-based industrial stocks. Manuka Resources could score as one of the future suppliers.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.