July 7th, 2025 | 07:00 CEST

The gold hammer! Goldman Sachs predicts USD 4,500 – Barrick, Desert Gold, Rheinmetall, and thyssenkrupp

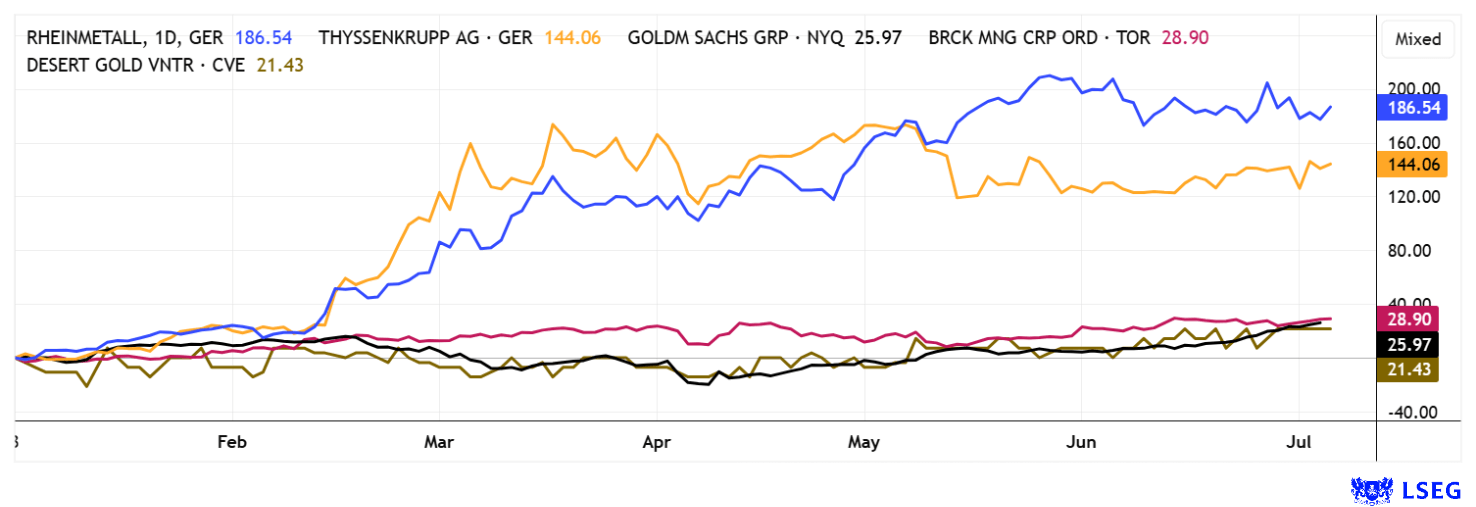

The highest current estimate by investment banks for the price of gold is USD 4,500 per ounce by the end of 2025. This is the extreme scenario from Goldman Sachs, which could materialize in the event of a severe recession or major geopolitical escalation. In addition to the ever-present war scenarios, the economic outlook in the US also remains a source of uncertainty. The prospect of persistently high interest rates is fueling inflation concerns, with many wealthy investors pulling out of the dollar and increasingly turning to gold. This is also because US fiscal policy is perceived as increasingly chaotic. Additional tariffs are pushing the budget deficit even higher, creating an environment in which tangible assets are becoming more attractive. The increased demand for gold from institutional investors, funds, and central banks sends a clear message: the precious metals sector is on the verge of a new upswing.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

GOLDMAN SACHS GRP INC. | US38141G1040 , BARRICK MINING CORPORATION | CA06849F1080 , DESERT GOLD VENTURES | CA25039N4084 , RHEINMETALL AG | DE0007030009 , THYSSENKRUPP AG O.N. | DE0007500001

Table of contents:

"[...] We will trigger indirect creation of 1,665 new jobs nationwide, while directly employing 300 staff - 270 operational and 30 administrative. [...]" Dennis Karp, Executive Chairman, Manuka Resources Limited

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Barrick Mining – Moderate performance so far

The latest attacks by Israel and the US on Iranian nuclear facilities have brought the situation in the Middle East to a new level of escalation. From a Western perspective, it is understandable that a nuclear-armed Iran is considered a threat. However, this situation carries the risk of further military expansion and acts as an accelerant on the commodity markets. The price of oil has already reacted sharply upward and almost as sharply downward. While many investors continue to prefer equities, others are seeking refuge in the precious metals sector. Gold is considered a reliable store of value in times of crisis. Since the beginning of the year, its price has risen by around 30% and is repeatedly approaching the USD 3,500 mark.

The combination of low production costs and rich raw material deposits is making Africa increasingly attractive to commodity investors. However, not every region offers stable conditions. In Mali, for example, companies such as Barrick Mining and B2Gold invested large sums early on and were soon confronted with profound political upheaval. Nevertheless, Mali remains one of the continent's top five gold producers and thus an important location for the international mining industry. Barrick Mining, which operates the huge Loulo-Gounkoto mine, is familiar with the challenging conditions. To continue operating reliably, Barrick relies on bilateral agreements with the government. In the first quarter of 2025, Mali's gold production was approximately 161,000 ounces. This was slightly down, but within the expected range. Total costs per ounce (AISC) were favorable at USD 1,296, allowing for decent profit margins despite higher taxes. CEO Mark Bristow regularly highlights the stability of operations and emphasizes the economic significance of the industry for Mali. Barrick Mining's stock has performed relatively poorly so far, although cash flow is steadily increasing. The share price has fluctuated between USD 15.00 and USD 21.70 this year and is currently returning to the upper end of this range. It has significant ground to make up in this environment.

Desert Gold – Growth in West Africa becomes a game changer

Explorer Desert Gold, also based in Mali, recently pulled off a stroke of genius. While an economic assessment (PEA) is already planned for the SMSZ property, the geological team took a look around the neighboring Ivory Coast. After more than four months of intensive field work covering approximately 1,000 km, a dream target area for a deal emerged. With the signing of an option to acquire 90% of the Tiegba Gold Project, the Company, which has a market capitalization of only CAD 19 million, is taking the next clear step in its expansion. Tiegba is located in the resource-rich Birimian Belt, one of the most important gold regions in West Africa. While Ghana is already heavily developed, Côte d'Ivoire is still considered underexplored and therefore offers enormous discovery potential. In addition, the country boasts political stability, a reform-minded government, favorable tax conditions, and an investor-friendly attitude. Production costs are very low, approval processes are efficient, and the country's gold production has quadrupled since 2010.

International players such as Barrick Mining, Endeavour Mining, and Perseus have long been active in the region, and Desert Gold is now joining them with a strategically exciting project. This makes the Canadian company a regionally diversified player in West Africa, giving the story significantly more traction. Investors are currently also awaiting the PEA from Mali. A flurry of news could hit this completely dried-up stock at any moment. In other words, this is a situation that requires the utmost attention. Desert Gold shares have already delivered double-digit gains this year, and now it looks like the CAD 0.085 mark is about to break. We are excited to see what happens next!

Stockhouse recently interviewed CEO Jared Scharf about the details: https://stockhouse.com/video/thewatchlist/J8L9uSG6. The article contains a wealth of information.

Rheinmetall and thyssenkrupp – Armaments and defense, a generational theme

It is the same game every day. In the morning, investors pluck up their courage and push defense stocks to ever new highs. By midday, some speculators come in hoping for a dip. As a result, the highly sought-after Rheinmetall share fluctuates within a wide range between EUR 1,600 and EUR 1,950. CEO Armin Papperger recently secured a US contract for the supply of F-35 fighter jet parts. He immediately raised his revenue forecast to EUR 50 billion by 2030, up from just EUR 9.75 billion in 2024. No problem, says the CEO, because every day another NATO country places an order with the Düsseldorf-based company. Analysts on the LSEG platform expect an average 12-month price target of EUR 1,943. The investor favorite was exactly one euro below that on May 28, 2025. Do not forget: a surprise stock split announcement could easily trigger another 25% upside! However, the terrain is slowly becoming exhausted.

There is a lot of discussion about thyssenkrupp AG. Now, the federal government no longer plans to invest in thyssenkrupp Marine Systems (TKMS). Instead, it is looking for a suitable partner from the German economy or a European minority investor. Among those in the running are Thales from France and Fincantieri from Italy, which have already signaled their interest. thyssenkrupp would remain in charge with a simple majority. A financial investor with around a quarter of the shares and German roots is also considered a viable option. A similar approach is now emerging for the steel business: the previously discussed sale to a Czech investor is becoming increasingly unlikely. Instead, a minority stake of around 20% seems more likely. However, a key point of discussion remains the billions in state support for climate-friendly steel production. Specifically, this involves subsidies of around EUR 2 billion. Although such considerations repeatedly boost the share price, it simply refuses to break through the EUR 10 mark. Analysts on the LSEG platform also see the ceiling at EUR 8.85. Therefore, caution is advised!

Against a backdrop of ongoing geopolitical uncertainty, defense stocks are currently dominating the headlines. In the shadow of these trends, Desert Gold is shaping up for a potentially blockbuster year: The Canadian junior explorer is on the verge of a possible takeover or strategic partnership with a highly favorable valuation of around CAD 19 million, which is equivalent to only about USD 12 per ounce of gold in the ground. Very exciting!

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.