December 29th, 2025 | 06:55 CET

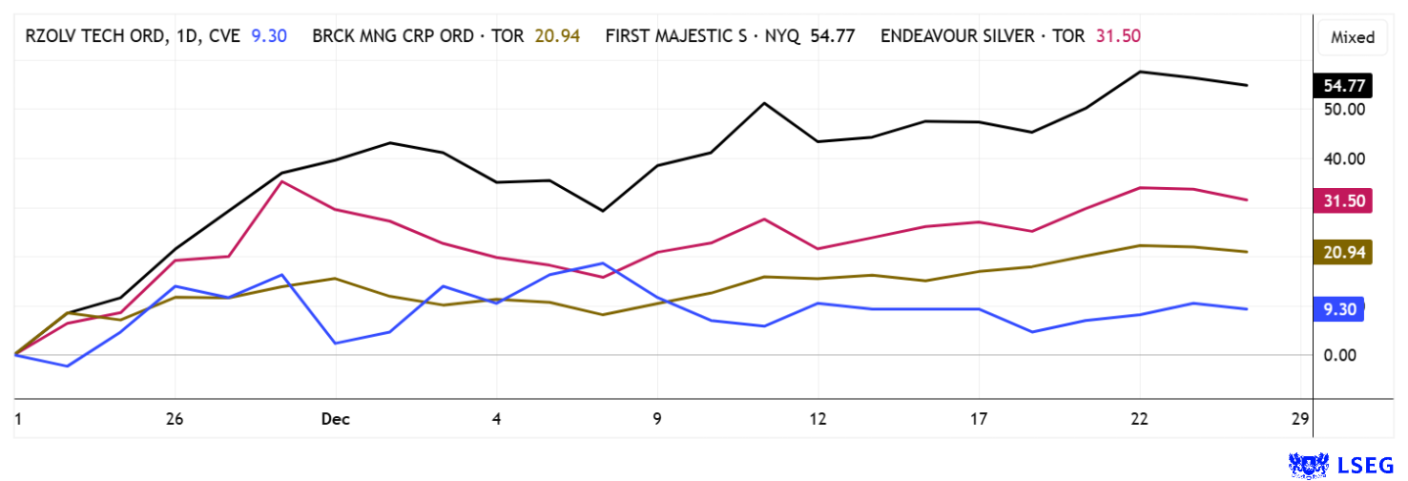

The gold and silver frenzy continues! Barrick, RZOLV Technologies, First Majestic, and Endeavour Silver

Who would have thought? While much of the Christian world is celebrating a quiet Christmas, the precious metals market is booming. Gold has surged to USD 4,530, and silver, completely wild, has even broken through the USD 75 mark. Both metals are setting new all-time highs and displaying chart patterns not seen in years. Market participants are surprised by this sudden "knot bursting". Yet the reason seems obvious to many: for years, gold and silver prices were kept low in order to conceal the astronomical expansion of money supply and to cover up the underlying inflation. With returns now ranging from 70 to 140%, price increases are becoming evident that can only be explained by a long-overdue revaluation and an acute shortage of physical supply. Now it remains to be seen who can stay afloat in the flood. For mining companies and service providers, the time has come to close long-standing valuation gaps. We take a closer look.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

BARRICK MINING CORPORATION | CA06849F1080 , RZOLV TECHNOLOGIES INC | CA76091C1032 , FIRST MAJESTIC SILVER | CA32076V1031 , ENDEAVOUR SILVER CORP. | CA29258Y1034

Table of contents:

"[...] Our SMSZ project is the largest contiguous land package of any exploration company in the region at 400km2 and overlays a 38km portion of the prolific Senegal Mali Shear Zone. [...]" Jared Scharf, CEO, Desert Gold Ventures Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Barrick Mining – Repositioning through geopolitical flexibility

Barrick Mining is one of the world's largest gold and copper producers, but in 2025, there were still a number of problems to be solved. With record prices continuing, 2026 is now a year full of strategic decisions for the group. The protracted conflict in Mali appears to be settled, as Barrick regained control of the important Loulo-Gounkoto mining complex after almost a year of production stoppage. In return, the Company accepted a compensation payment in the hundreds of millions, while Mali returned previously confiscated gold reserves to Barrick. This removes a significant geopolitical uncertainty factor, especially since the complex has produced around 700,000 ounces of gold annually in recent years. With gold prices currently at record levels, this means that billions in revenue potential have been released. Strategic options are now being reorganized.

To increase transparency, Barrick is considering spinning off its highest-quality North American gold projects into a separate publicly traded company. Among other things, the majority stake in Nevada Gold Mines, the large Dominican mine Pueblo Viejo, and the high-growth Fourmile project are to be transferred to this new entity. These assets are characterized by high production security, low costs, and first-class jurisdictions. The aim is to reduce the existing valuation gap with purely North American competitors and to create a clearly positioned investment vehicle for low-risk gold production. Barrick intends to retain a majority stake but to release capital via a separate listing. The background to this is the increasing influence of major shareholder Elliott Investment, which is pushing for a stringent capital strategy. Analysts view the move extremely positively, and the conglomerate discount should decrease. Barrick's share price has doubled since the summer. Experts are now asking themselves how to reclassify the new operating situation, including IPO speculation. The rally is likely to continue in 2026 with higher dividends and the split.

RZOLV Technologies – Cleantech innovation for sustainable metal extraction

Canadian clean tech specialist RZOLV Technologies is positioning itself as one of the most exciting innovation drivers in the field of environmentally friendly metal extraction. The Company is developing a water-based chemical that will eliminate the need for highly toxic cyanide in gold production. According to CEO Duane Nelson, mining companies worldwide spend billions annually on cyanide and its handling. These are costs that RZOLV's technology could significantly reduce in the future. Independent test results are already available, confirming recovery rates of over 90% from gold concentrates within three days. At the same time, a large-scale pilot test is underway in Arizona to demonstrate the industrial feasibility of the method and provide further reassurance to investors. What is particularly attractive is that the formulation can be used not only for gold, but also for critical metals and rare earths. In metallurgical tests, elements such as cerium, manganese, and cobalt were extracted under mild, non-toxic conditions. This also opens up a potential game-changer for battery metals and strategic raw materials. The innovative process can be integrated into existing processes, requires little energy, and is also suitable for the processing of tailings piles or low-grade deposits. RZOLV is thus opening up access to raw material sources that were previously considered uneconomical or difficult to obtain permits for.

A new management structure is paving the way for commercialization. On December 1, experienced financial manager Mark Orsmond took up the position of CFO, having already guided several companies through growth and transformation phases. Shortly thereafter, Mary Ellen Thorburn, a prominent finance and mining expert, was appointed to the board of directors. She brings international capital market experience and in-depth knowledge of project controlling for large mining companies. These personnel additions underscore that RZOLV is moving ever closer to market launch. If the pilot projects are successful, large ESG-oriented corporations in industry could become partners or customers. In addition to cost advantages, there are lower approval barriers and a clear contribution to sustainability. With a manageable market capitalization of currently CAD 28 million, a clear revaluation is on the agenda for 2026.

In a recent video with IIF host Lyndsay Malchuk, CEO Duane Nelson explains how his technological innovation puts metal extraction on an environmentally friendly footing. Click here to watch the video.

https://youtu.be/5Yd1vIA98Go?si=jfEB2GzTninK0oBu

First Majestic and Endeavour Silver – Margins reach all-time highs

Silver has long been considered a playground for speculators, but the tide has turned. The precious metal is now becoming a serious source of returns for risk-conscious investors. Producers with a solid cost structure and good growth prospects are proving particularly exciting. First Majestic Silver is exceptionally well-positioned in this regard, having significantly broadened its production profile with the acquisition of Gatos Silver. Together with the established San Dimas, Santa Elena, and La Encantada mines, this creates a powerful alliance that is expected to deliver between 14.8 and 15.8 million ounces of silver in 2025. Strong positive effects were already evident in the third quarter. Production jumped to 7.7 million ounces of silver equivalent. In order to expand production levels, more than USD 170 million is to be invested in the modernization, expansion, and exploration of the operating sites. The leverage here lies in the Los Gatos properties, as margins could skyrocket at current silver prices. Added to this is the recent announcement that First Majestic has extended its share buyback program to increase balance sheet flexibility and actively take advantage of price setbacks. Analysts on the LSEG platform are not yet able to keep up with the strong appreciation in the short term, but will have to quickly adjust their price targets in 2026.

Endeavour Silver also experienced a period of realignment in 2025, but this time with significant tailwinds. Although total costs per ounce rose by around 18% in the third quarter, the strong rise in silver prices kept profitability stable. With growing liquidity, increasing cash flows, and the Terronera project for the future, the Company is gradually expanding its production base. Together with the Guanaceví, Bolañitos, and Kolpa properties, this creates a robust foundation that could enable up to 20 million ounces of silver equivalent per year in the medium term. CIBC Capital voted "Outperform" in December and raised its 12-month price target to CAD 18, while National Bank, with the same rating, can even imagine CAD 21. There is still plenty of upside potential from the current price of CAD 13.30.

The precious metals markets are on the rise. This is revealing earnings potential that has not been seen in recent years. It is no wonder that producers who have their costs under control can now achieve dream margins, provided they have not already sold their production for years to come. High-tech mining service providers such as RZOLV Technologies have excellent opportunities for growth in this mixed situation.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.