May 5th, 2023 | 09:50 CEST

The future calls for battery metals! BYD, Grid Metals, VW - The international pecking order in e-mobility is reshuffling!

Since Western governments have finally started to get serious about climate protection, the media have focused on the areas of energy, mobility and health. It is clear to all participants that the changes in the world climate will lead to undesirable developments. Glaciers are melting, the earth's temperature is rising, and the oceans are already too warm for many species. Huge investments are being made in renewable power generation and modern mobility solutions, and it requires access to metals. Some companies are making a name for themselves, and shareholders can profit from this.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

BYD CO. LTD H YC 1 | CNE100000296 , GRID METALS CORP. | CA39814L1076 , VOLKSWAGEN AG VZO O.N. | DE0007664039

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BYD - It is getting exciting now

The South Korean market research company SNE Research has published important statistics on the development of the global battery market. According to these statistics, the Chinese conglomerate BYD maintained its strong position behind the industry leader CATL with an astonishing 35% global market share. The Korean runner-up, LG Energy Solutions, follows close behind with 14.5%.

Competition in the energy storage market is fierce because, with the accelerated legislation in Western economies, Asian manufacturers want to maintain their supremacy over Tesla & Co. Another big player is Japan's Panasonic, which has been rooted in Europe for decades and covers 9% of the market. Worldwide demand reached a full 133 GWh, or 38.6% more than the 95.9 GWh in the previous year. While CATL's battery is expected to maintain its number one position, as it is in high demand, especially in the Tesla Model 3, Model Y, SAIC Mulan, GAC Aion Y and the Chinese commercial vehicle market. Nevertheless, BYD grew at an all-time high of 21.5 GWh and up 115.5%. According to SNE Research, BYD is gaining popularity, especially in the Chinese domestic market, thanks to its price competitiveness through its vertically integrated supply chain, including self-supply. BYD shares have recently been able to stabilise somewhat at EUR 27.6. However, the 52-week high at EUR 41.8 is still 50% away. Exciting!

Grid Metals - On the pulse of the times

Metals are indispensable, especially for Greentech solutions such as wind and solar power plants. E-mobility also requires three times the amount of copper and needs graphite, nickel, cobalt and above all, lithium. So far, only some of the big producers have been able to cushion the industry's massive rush for raw materials accordingly. As a result, the price of individual metals has risen, in some cases, dramatically.

The Canadian company Grid Metals (GRDM) has recognised the increasing demand for lithium and is concentrating on the exploration of nickel, copper, PDM and lithium with its projects Donner Lake, Mayville and Makwa northeast of Winnipeg (Manitoba). The most extensive work is currently taking place in Donner Lake. There is also already a producing mine in the neighbourhood called Tanco. The Makwa-Mayville multi-metal project has already reached the PEA stage. Grid Metals also has other properties in Ontario.

The Company has now brought Brandon Smith (CFA, MFE) on board as Chief Development Officer. A capital markets expert with over a decade of experience, Smith most recently served as a senior equity analyst for battery metals developers at one of Canada's leading investment banks. From now on, the projects should move forward at a faster pace. The GRDM share price recently reacted positively to the progress, rising from CAD 0.13 to CAD 0.18. With a valuation of just under CAD 30 million, this is by no means the end of the road.

VW - Strong market share losses in China

The former DAX heavyweight Volkswagen made up only limited ground in the first quarter. The difficult purchasing of materials and the growing competition in the Middle Kingdom are causing problems. If one excludes the valuation of hedging transactions in materials purchasing, operating profit in the first quarter grew by 35% on an adjusted basis to about EUR 7.1 billion; otherwise, it fell by 31% to EUR 5.7 billion. This sends net profit down EUR 2 billion to EUR 4.7 billion.

There is still a shortage of car electronics in the industry. Supply chains are working better again, but there are still annoying shortages of certain materials. Quarterly sales rose by almost 22% to EUR 76 billion. However, this includes a price dynamic and not, as one might think, an explosion in the number of models delivered. Sales recovered in Europe and North America, while the VW Group had considerable problems in China.

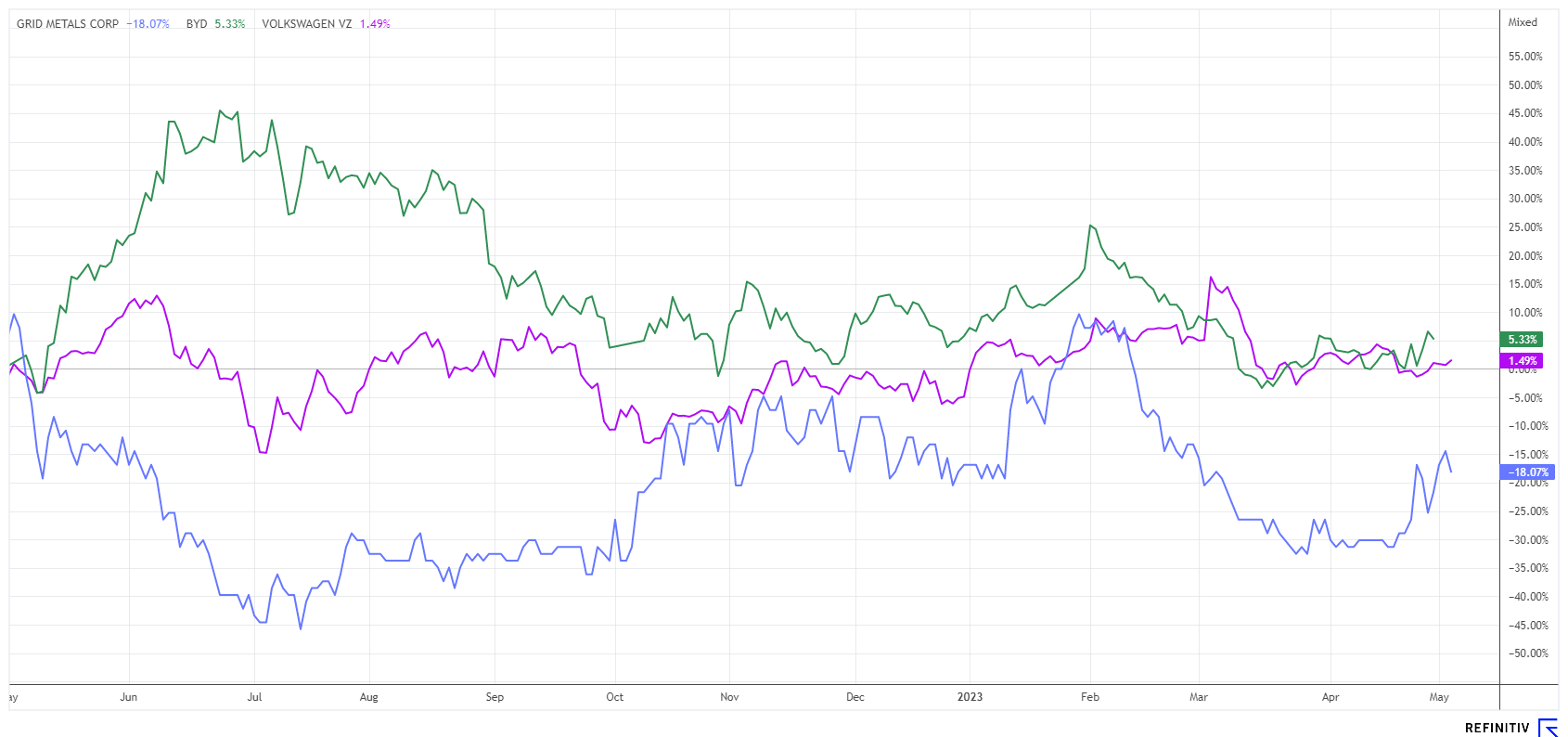

CFO Arno Antlitz nevertheless sees a "promising start to the 2023 financial year" and a "solid performance". In the all-important sales country of China, sales fell by 14.5% from January to March and by a somewhat greater amount for e-cars. For the first time, the core brand VW had to relinquish the market leadership it had held for decades to local rival BYD. While the global e-car business grew by 42% to 141,000, the relative share of 7% in the mix is still manageable. Operational problems remain with software. Compared to the good DAX performance, the VW share has lost around 18% in the last 12 months. According to experts at Refinitiv Eikon, the stock is trading at a 2024 P/E ratio of under 4. From a technical chart perspective, it should not drop below 113 EUR; otherwise, it could turn frosty despite rising spring temperatures.

The international automobile market is currently undergoing a reorganisation. The markets in Europe, the USA and China remain strong. However, local manufacturers are showing more dynamism than their competitors. BYD and VW are currently not particularly popular with shareholders, while Grid Metals could shine quite quickly with exploration successes.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.