August 21st, 2023 | 07:00 CEST

The correction wave is rolling: Adyen, Almonty Industries, Nel ASA - is a 100% turnaround quickly possible?

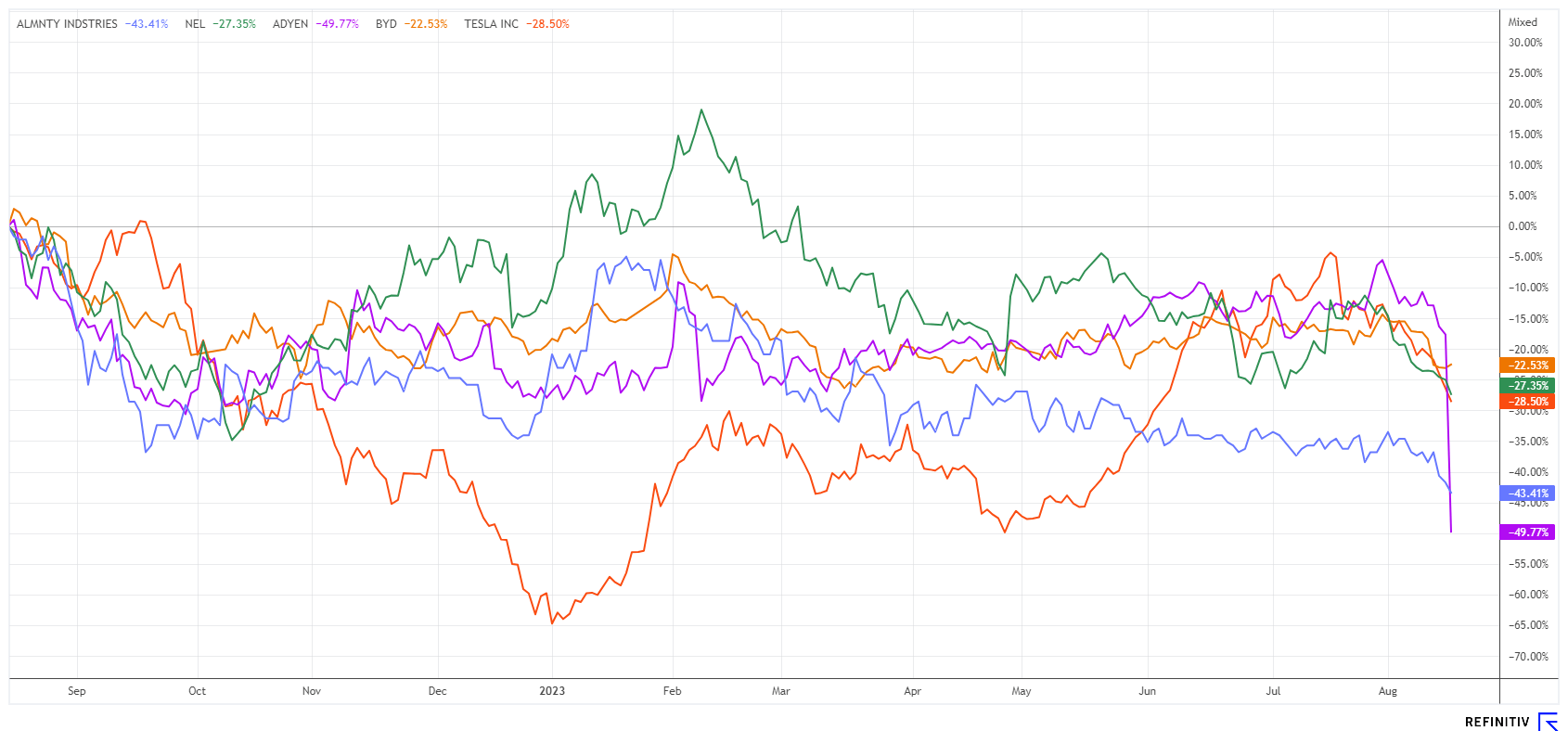

Looking back, 2023 has been an exceptionally good stock market year. However, there has been no noticeable momentum for a few weeks now; instead, major players are trying to maintain the high level. However, the profit warnings are piling up, which we should have received for months, given the economic weakness. But the executives are taking time to lower their forecasts, hoping things improve. The fact that stocks still trended upward for months despite huge interest rate increases is due to the reawakened NASDAQ bull market with the trending topics of Artificial Intelligence and Greentech. But just hoping for falling interest rates is not enough. Now sentiment has also turned, and prices are falling. Time for us to take a look at some of the "Fallen Angels". Who will manage the turnaround?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

ADYEN N.V. EO-_01 | NL0012969182 , ALMONTY INDUSTRIES INC. | CA0203981034 , NEL ASA NK-_20 | NO0010081235

Table of contents:

"[...] While tungsten has always played an important role in the chip industry, it is now being added to batteries for e-cars. [...]" Lewis Black, CEO, Almonty Industries

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Adyen BV - Corrected expectations and a sellout

Who would have thought? Mobile payments and payment processing on the web should provide a secure business model in a time of advancing digitalization. But trees do not always grow to the sky in an economic downturn, not even for the successful Adyen. Last Thursday, the Company presented figures for the past half-year, which were far below analyst expectations. The share plunged by almost 50%.

The crux is found in the operating EBITDA margin. It was a disappointing 43%, compared to 59% in the same period last year, even though sales increased by almost 22%. Profit before taxes, depreciation and amortization was 10% behind at EUR 320 million. Management justifies the poor performance with high investments for personnel expansion, but this is now to be scaled back. Investors have been accustomed to years of growth and must now adjust to significantly lower ad hoc growth rates. From its all-time high in 2021 at EUR 2,750, the share price has now lost 68%. However, the sellout could continue.

Analysts reacted quickly with new ratings. Barclays votes "Equal-Weight" and lowers the price target from EUR 1,600 to 1,150. Jefferies downgrades from "Buy" to "Hold" and sets the price target by 58% to only EUR 850. The average on the Refinitiv Eikon platform was still a high EUR 1,295 before the figures were announced. Analytically, the Adyen share is still valued twice as high as the American PayPal. Except for technical countermovements, a significantly lower revaluation is therefore likely.

Almonty Industries - All on the runway

The situation regarding strategic metals is becoming serious. The US Department of Energy's (DOE) new Critical Raw Materials list has just been released. As a result, the battery raw materials copper, nickel, lithium and cobalt are considered critical, with 69% of the very rare tungsten also being supplied from China. The report explicitly emphasizes the high importance of these raw materials and substances for electrification and climate change. Without access to these metals, society's ecological and digital transformation will encounter obstacles.

Canadian explorer and producer Almonty Industries (AII) has already fully focused on the critical tungsten market with its properties in Spain, Portugal and South Korea. With its heat resistance, the hardening metal wolfram, or "tungsten" in English, is essential for the production of high-tech applications in the fields of energy plants, IT and armaments. In addition, tungsten oxide has good properties for use in new battery technologies. Global demand will therefore increase dramatically.

The Company's mine in Sangdong is now being prepared for production. According to estimates from analyst firm Sphene Capital, it is expected to start before the end of 2023 and deliver CAD 20.6 million in EBITDA next year. By 2025, operating surpluses could even more than double to CAD 45.2 million. Almonty's stock (AII) is currently trading at just CAD 0.51 due to generally declining trends among resource companies. As a result, the market value totals a modest CAD 116 million, which is a factor of 2.4 compared to the expected EBITDA in 2025.The experts at Sphene are in a good mood and have determined a price target of CAD 1.59, a good 200% above the current level. Most interesting!

Nel ASA - The hype is over; now it gets risky

Last week, there were several downgrades for the public darling Nel ASA. Although the half-year figures were not too bad, the industry lacks momentum. Fundamentally, there is still a lack of significant public orders for the future topic of "hydrogen". Unfortunately, the new technologies still lack economic viability compared to cheap fracked gas from North America. For companies, conversion to hydrogen must offer financial incentives in addition to reliable supply. Private investors will not jump on this bandwagon with a pure subsidy policy because it is foreseeable that only placative start-up financing is possible with the strained public budgets. However, there is currently no reason for a privately driven wave of investment.

Despite only slowly rising sales and permanent losses, the price of the Nel share increased tenfold between 2018 and 2021. From the top levels above EUR 3.20, the value has now gradually declined to below EUR 1.00 most recently. From a chart perspective, the share is now stuck in a catch-up zone between EUR 0.98 and EUR 1.05. Some analyst firms recently revised their euphoric expectations very sharply. With a "Neutral" rating, JPMorgan names NOK 11.40 as a new mark and even anticipates rising operating losses. Credit Suisse sets its assessment to "Underperform" and expects a sellout to NOK 8.00 for the share. Furthermore, a large capital increase is expected in order to meet the operating milestones. After our stop at EUR 1.25, we currently see no reason for new engagements. After all, Nel is still valued at a 2023 price-to-sales ratio of 10. Tangible earnings are not expected until 2026.

The energy transition will be a difficult undertaking. Moving away from fossil fuels requires huge investments, which themselves will only come into profitability after around 10 years. It is unlikely that there will be many private investors willing to provide upfront financing, and many states will not join in either. Whether the hot tech stocks will immediately rebound after the necessary correction remains questionable. Almonty produces the important metal tungsten and should soon be in the spotlight.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.