May 3rd, 2023 | 07:15 CEST

The copper war! Nordex, Orestone Mining, Nel ASA, ThyssenKrupp - Shortage of copper weighs on Greentech expansion

The World Copper Conference 2023 took place in Chile in mid-April. According to the experts, the global energy turnaround requires huge investments in new industrial metal mines, especially copper. The red metal has become very rare, and the large deposits are working at their capacity limits. One figure made the conference participants turn pale. According to estimates by the International Copper Association (ICA), at least USD 105 billion must be invested to provide enough mining capacity for the upcoming demand. Converted into quantities, this means 6.5 million tonnes more than the production from 2022. Anyone hearing these figures doubts the successful solution to climate change. Some stocks are to be considered in this context.

time to read: 3 minutes

|

Author:

André Will-Laudien

ISIN:

ORESTONE MINING CORP. | CA6861543032 , NEL ASA NK-_20 | NO0010081235 , THYSSENKRUPP AG O.N. | DE0007500001 , NORDEX SE O.N. | DE000A0D6554

Table of contents:

"[...] If we pursue our goals conscientiously, the market will adjust its valuation accordingly, I am sure. Often, all it takes is a trigger. [...]" Ryan McDermott, CEO, Phoenix Copper

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Orestone Mining - Copper and gold in the ground

The largest copper reserves in the world are in Chile. Here, the Company Codelco mines about 1.8 million tonnes of the coveted red metal annually. It is followed by BHP with 1.7 million tonnes, Freeport-McMoran with 1.5 million tonnes and Glencore with 1.3 million tonnes. If you add up the current production of the industry giants, the additional demand of 6.5 million tonnes identified by ICA is roughly the same.

If one searches for possible copper projects, one also comes across the Canadian explorer Orestone Mining (ORS). ORS owns a 105 sq km copper-gold project called Captain in northern British Columbia. The project is located in a perfect jurisdiction and includes a number of suitable porphyry targets that have already been explored by geophysical surveys and drilling. Nearby, the well-known companies IamGold and Centerra are mining. If Orestone is successful, the property's true value will quickly become clearer, and an acquisition deal could be on the cards.

Orestone is currently combining the available geological data with new airborne magnetic surveys. This will be followed by further deep drilling to 1,000 metres to further define the metal body. The share is still in hibernation and trades between CAD 0.03 and CAD 0.04. As a result, the entire project is only valued at just under CAD 2 million. If high grades are discovered, it will likely increase by several 100%.

Nordex - After the rise, now the fall?

Most Greentech solutions aim to replace fossil fuels with renewable alternatives. What is needed, however, are metals. Wind and solar plants, in particular, have a tremendous amount of cabling and must be built solidly because of their wind and weather resistance. The Hamburg-based company Nordex specializes in large wind turbines and energy parks. The price increases of the last two years have had a full impact, and the Corona pandemic prevented the Company from consistently delivering on time. It was only at the end of 2022 that the situation eased, and the Company's share price could double again from its low. However, since reaching the EUR 15 mark, the share has been consolidating again. One reason could be the flattening of incoming orders, as these lagged in the first quarter compared to the previous year. Between January and March, the Company received orders for 177 wind turbines with a total capacity of about 1 gigawatt (GW), about 200 MW less than in 2022. In fact, this should not be a disaster, but after a 100% increase in the share price, investors also take profits. From a chart perspective, the share becomes interesting again for a new entry in the region of EUR 9-10.

Hydrogen 3.0 - Is the third wave of increase about to start?

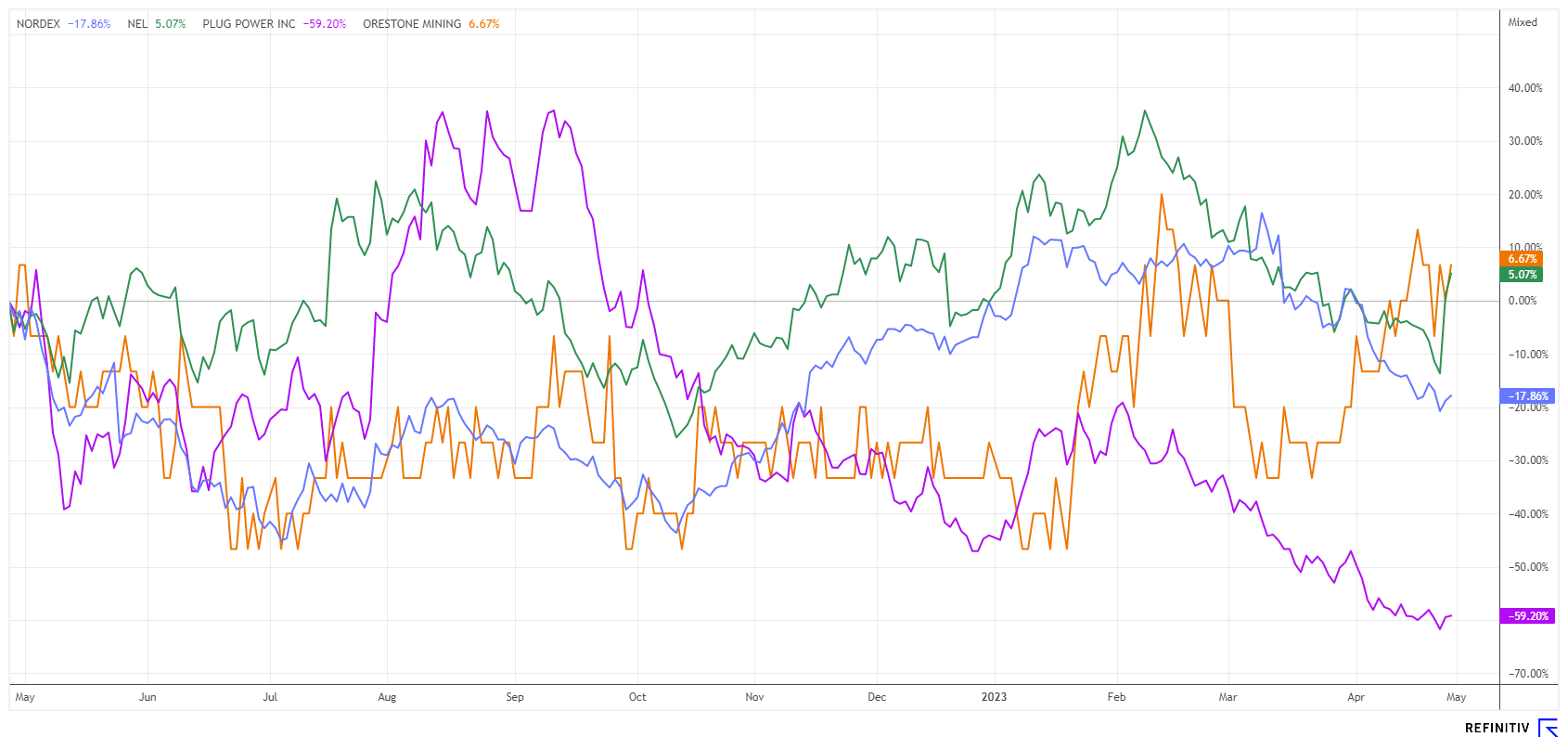

If one is already thinking about alternative energy generation, the road to hydrogen is close. The two industry favourites, Nel ASA and Plug Power have lost a lot of ground in recent weeks, and investors are wondering where the next support could be.

Nel ASA's figures were worse than expected, but the group shines with a large order and cash balance of NOK 4.2 billion. In the first quarter, turnover increased by 68% to NOK 359 million, but unfortunately, net profit ended up on the sidelines at NOK 192 million due to high investments and depreciation. However, it certainly helps that new orders are still going strong with +161% to NOK 555 million. Competitor Plug Power is not getting on its feet at all at the moment because, in addition to disappointing figures for 2022, there is also a class action lawsuit against CEO Andy Marsh, as thousands of investors were misled by far too optimistic statements in recent years, causing the share price to fall by over 80%.

Light at the end of the tunnel could come for industry with the announced IPO of ThyssenKrupp's H2 subsidiary. The spin-off is already making decent sales and profits and could bring it to a valuation of EUR 3 to 4 billion in the event of an IPO. MDAX-listed ThyssenKrupp still owns 66% of the subsidiary and is itself valued at only EUR 4 billion. But when the hydrogen sector turns on, the stock market will likely be essential for Nucera's plans.

The EU, the US and China provide the Greentech market with a lot of money and a flood of laws, putting pressure on private and public budgets alike. Nordex, Nel ASA and Plug Power are in demand but currently on a downward trend. Orestone Mining, on the other hand, could begin to take off unnoticed if exploration finds significant gold or copper ore.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.