April 16th, 2024 | 07:05 CEST

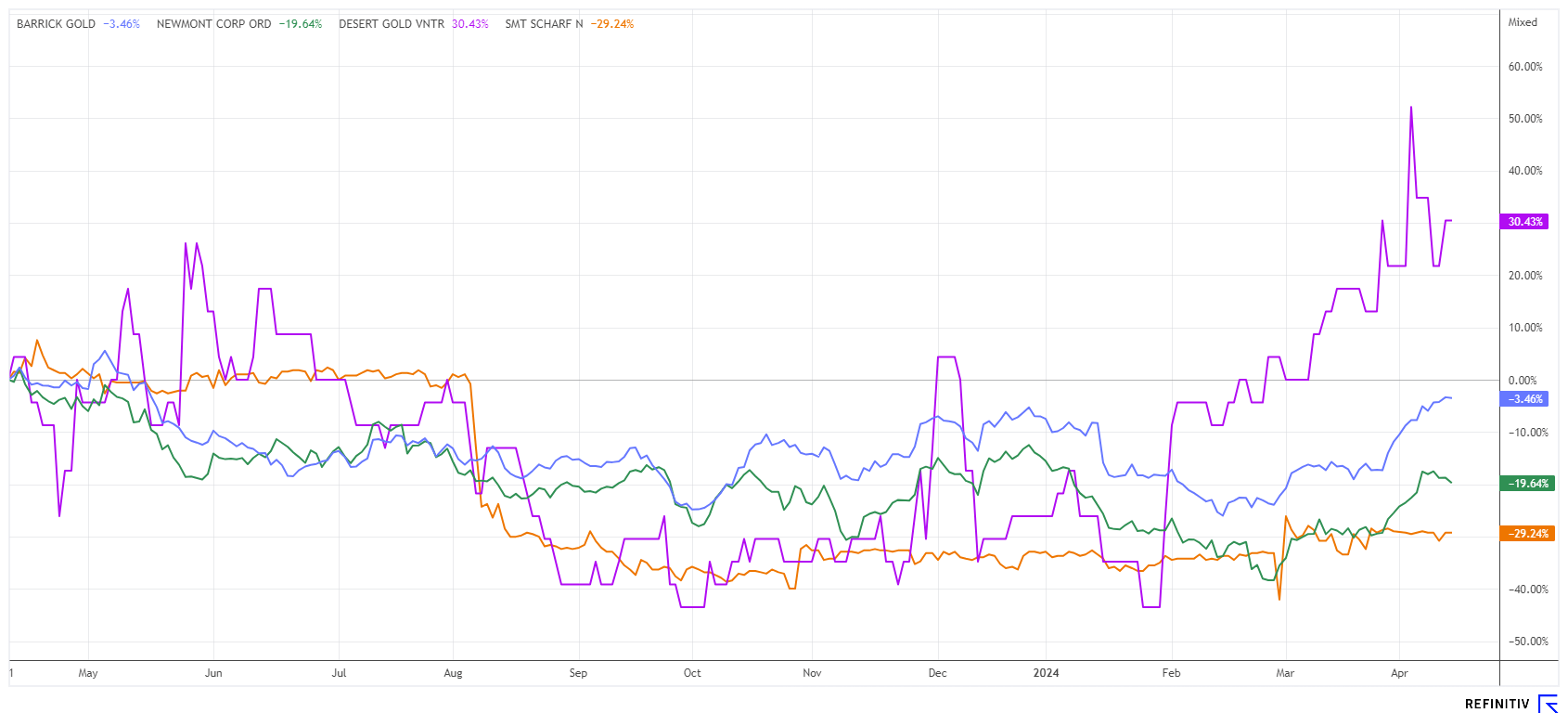

The cannons are thundering, and gold and silver remain in demand! Barrick, Newmont, Desert Gold and SMT Scharf in focus

The overnight attack by Iran on Israel underscores the current geopolitical uncertainty. Regardless of whether there is further escalation in the Middle East, the world has already changed dramatically since February 2022. This includes shifts in investor behavior. Until the first quarter of 2024, shares in the artificial intelligence and high-tech sectors were bullish; now, defense stocks and precious metals are on the agenda. After decades of disarmament, NATO, in particular, is now facing a decade of rearmament, and private investors are expressing their restraint in consumption by increasing their focus on private security. This is reflected in the increased purchases of gold and silver. For years, precious metals have been stable guarantors of the daily dwindling purchasing power. We believe that the new valuation cycle in the commodities sector is only just beginning, which is why we are examining favorable entry opportunities.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

NEWMONT CORP. DL 1_60 | US6516391066 , BARRICK GOLD CORP. | CA0679011084 , DESERT GOLD VENTURES | CA25039N4084 , SMT SCHARF AG | DE0005751986

Table of contents:

"[...] We quickly learned that the tailings are high-grade, often as high as 20 grams of gold per tonne; because they are produced by artisanal miners, local miners who use outdated technology for gold production. [...]" Ryan Jackson, CEO, Newlox Gold Ventures Corp.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Gold and silver - The awakening of precious metals

Central banks have completed a record volume of gold purchases on the markets in 2023, with 35% of the physical gold market currently in the hands of money printers, according to statistics from the World Gold Council. By the end of the year, around 1,037 tons had been accumulated, which was the second-highest purchase since records began and only 45 tons less than in the previous strong year. With an estimated annual production of around 3,650 tons of gold, just under a third disappeared into the vaults of central banks last year. The Chinese central bank was by far the largest buyer in the first half of the year, with an increase of 103 tons, followed by Singapore with 73 tons and Poland with 48 tons. While the Polish central bank's buying motive is certainly also a response to the complex geopolitical situation in Europe, China is presumably pursuing an exit strategy from the global currency, the US dollar. In the first quarter, the gold price initially moved sideways, only reaching new all-time highs at the end of March. Gold then reached a new record high of USD 2,430 last week. Its little brother, silver, has also gained 35% since the beginning of the year to USD 28.60. The gold/silver ratio is currently 83. Historically, it has ranged between 40 and 90, which illustrates silver's strong need for appreciation.

Barrick Gold, Newmont and Desert Gold - The big players are buying now

Mining has become very expensive in well-known jurisdictions such as North and South America and Australia. Due to the strong operational inflationary spurts, some large mining companies are now focusing on relatively inexpensive Africa. That is because there are still large near-surface resources and a mining environment with manageable input sizes. The Canadian explorer Desert Gold Ventures (DAU) specializes in the Senegal-Mali Shear Zone (SMSZ). There is a mining zone here that is the size of the whole of Germany and is currently operated by companies such as Barrick, B2Gold, and Allied Gold. Production in the gold-rich area reached over 700,000 ounces in 2023. In order to keep production high, the local majors have already cast an eye on interesting neighboring projects, as buying in is much cheaper than building entirely new sites that require approval. The market is moving; in Ghana, West Africa, Asante Gold is bidding for Newmont's Akyem property, which produced 420,000 ounces of gold in 2022.

There is already said to be greater interest in the Desert Gold claims. In the first quarter, the Company completed four additional exploration core drill holes in the Mogoyarfara South and Frikjdi project sections. The Mogoyafara South deposit contains open pit constrained inferred mineral resources of 412,800 ounces of gold at a grade of 1.05 g/t Au, making it the largest known gold deposit in the SMSZ project to date. Soil sampling at the Frikidi gold target returned more than 5 grams per tonne of gold (g/t Au) in 61 cases, 5 of which contained 100 g/t Au or greater. The latest NI 43-101 technical report from 2022 indicates a total gold resource of approximately 1 million ounces with mineralization grades of 1.08 to 1.28 grams/tonne. With a current share price of CAD 0.08, the project is valued at only EUR 12 million; in a potential takeover, the entire company could be worth ten times as much.

SMT Scharf - Mining partner gains major Chinese shareholder

SMT Scharf AG, a mid-sized company, is one of the leading suppliers of rail-based transport systems. Comprehensive know-how, a global presence, high-performance products and many years of expertise as a solution provider for difficult transportation tasks are the basis of the Hamm-based group's good reputation. SMT is the global technology leader for derailment-proof monorails and floor-mounted railroads in underground mining and tunnel construction, focusing on coal mining; the name SMT stands for "Solutions for Mining and Transport". The monorails are primarily used in coal mines, gold mines and underground mining of platinum, diamonds, copper and nickel worldwide. They transport materials and personnel up to a payload of 45 tons.

SMT generated revenue of EUR 73.2 million in the 2023 financial year (2022: EUR 93.7 million). The spare parts business (+22.5%) and the service business (+20.8%) increased significantly, while the new systems business (-48.1%) recorded a noticeable decline. However, the year-on-year decline in revenue is due in particular to the reluctance of mine operators to invest in new systems and the postponement of project revenue until 2024. The operating result (EBIT) amounted to EUR 4.0 million, compared to EUR 14.3 million in the previous year. Order intake was down slightly overall at EUR 72.9 million (2022: EUR 89.7 million). CEO Reinhard Reinartz is optimistic about the current year: "We expect the mining equipment market to remain challenging in 2024. Nevertheless, we continue to see attractive growth opportunities for our company."

With the recent majority stake acquisition by Yankuang Energy Group, SMT hopes to gain good access to the Chinese market. The emergence of new high-tech mines has created a demand there for innovative and low-emission transport and logistics solutions. Based on conservative assumptions, the Executive Board expects consolidated revenue of between EUR 74 million and EUR 79 million for the 2024 financial year. The operating result is still expected to be a low EUR 1.5 million to EUR 2.5 million. The planning could be too conservative, as the global energy turnaround is making mining highly relevant again. SMT Scharf is excellently positioned with its innovative solutions. The current valuation of EUR 37.2 million accounts for just 50% of the expected revenue for 2024. Thus, the research house Montega votes conclusively with a "Buy" rating and a 12-month price target of EUR 11 - a full 60% above the current price of EUR 6.80. Highly interesting.

In times of war, inflation and excessive debt, gold and silver should regain strength. The two mining giants, Barrick Gold and Newmont Corp, are struggling with higher costs. Majors have already taken a look at Desert Gold, which has an extremely low valuation. A complete revaluation could be on the cards here in the coming months. SMT Scharf is at the lower end of the 5-year cycle and, as a technology provider, is benefiting from the global hunger for raw materials.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.