August 28th, 2025 | 07:15 CEST

The BioNxt Solutions formula: How a simple idea can turn into a billion-dollar business – Without high risk

In the pharmaceutical industry, promising active ingredients often fail due to a simple problem, such as administration. Canadian biotech company BioNxt Solutions has taken on precisely this challenge. With a smart platform for oral dissolvable films and patches, the Vancouver-based innovator could not only make life easier for patients but also open up a lucrative growth opportunity for investors. We took a closer look at the promising technology behind it.

time to read: 4 minutes

|

Author:

Armin Schulz

ISIN:

Bionxt Solutions Inc. | CA0909741062

Table of contents:

"[...] As a company dedicated to developing treatments for rare heart diseases, we see this as an opportune moment to contribute to the fight against heart disease and make meaningful strides in improving heart health worldwide. [...]" David Elsley, CEO, Cardiol Therapeutics Inc.

Author

Armin Schulz

Born in Mönchengladbach, he studied business administration in the Netherlands. In the course of his studies he came into contact with the stock exchange for the first time. He has more than 25 years of experience in stock market business.

Tag cloud

Shares cloud

The billion-dollar problem with taking pills

What if a vital medication did not work properly simply because it was too complicated to take? Or because it broke down in the body before reaching its target? This issue not only causes billions in losses for healthcare systems but also reduces the quality of life for countless patients, especially those suffering from chronic conditions such as neurological or autoimmune diseases.

The elegant solution: Oral films instead of pills

This is precisely where BioNxt Solutions comes in. The Company, with its research and development headquarters in Germany, is developing intelligent dosage forms that are designed to make established active ingredients more efficient and patient-friendly. The focus is on oral dissolving films (ODFs), which dissolve under the tongue, and transdermal patches. The goal is as simple as it is obvious: more reliable absorption of the active ingredient, fewer side effects, and greater adherence to treatment.

Flagship MS: A prime market with a weak point

The Company's flagship project is a sublingual cladribine formulation for the treatment of multiple sclerosis (MS). Nearly 3 million people worldwide are affected by this disease. A large proportion of them suffer from swallowing difficulties, which makes taking conventional tablets a real challenge. BioNxt circumvents this issue by allowing the active ingredient to be absorbed directly through the oral mucosa.

The economic relevance of this approach becomes clear when examining the reference product. Merck's cladribine tablet, Mavenclad, achieved revenue of around EUR 1 billion in 2023. The annual cost of treatment is in the six-figure range. BioNxt does not want to reinvent the wheel; instead, it aims to improve the delivery method. "We believe there is a compelling opportunity to rethink the administration of complex molecules like semaglutide. Our oral thin film platform is designed to enhance treatment adherence and patient comfort," sums up CEO Hugh Rogers.

The pragmatic path: Less risk, shorter route to the goal

The appeal for investors lies in the pragmatic approach. Since cladribine is already approved and its efficacy is well established, BioNxt is focusing on demonstrating bioequivalence. This regulatory path is significantly leaner, less expensive, and more time-efficient than seeking approval for a new drug. The Company plans to launch a pivotal study later this year. If successful, there will be little standing in the way of approval for the novel dosage form.

But the Company's ambitions do not end with MS. A second program targets the rare disease myasthenia gravis (MG), a market estimated to be worth USD 6.7 billion by 2032. Here, too, swallowing difficulties are common. A special approval status can be applied for "rare diseases," guaranteeing exclusivity and protection from competition for several years. This would be another valuable building block for the business model.

Patents as a foundation: Building a valuable IP portfolio

The technological basis for these ambitions was laid with the acquisition of the German company Vektor Pharma TF GmbH in 2019. This brings valuable expertise in film development and production scaling. Since then, BioNxt has steadily expanded its IP position. Recent successes include approval for patent granting by the European Patent Office (EPO) and acceptance of core claims by the Eurasian Patent Organization (EAPO).

"The confirmation of the Company's most important intellectual property in Europe is an important milestone for BioNxt," commented CEO Rogers on the development. Even more significant could be a broader platform patent that protects not only the active ingredient cladribine, but the entire sublingual delivery technology for a range of diseases. This would significantly increase the value of the technology platform.

The news flow is currently intensifying. The relocation of research activities to a modern laboratory complex in Munich, the receipt of the active ingredient cladribine for the production of clinical batches, and the successful formulation of initial prototypes are all concrete operational milestones that pave the way for the upcoming pivotal study.

Tailwind from a huge overall market

The broader market environment is highly supportive. Experts estimate that the global market for drug delivery systems will surpass USD 3 trillion by 2034. A major focus is on solutions that address the needs of patients with neurological conditions, many of whom struggle with traditional medication intake. In such cases, the delivery method can determine a treatment's success or failure.

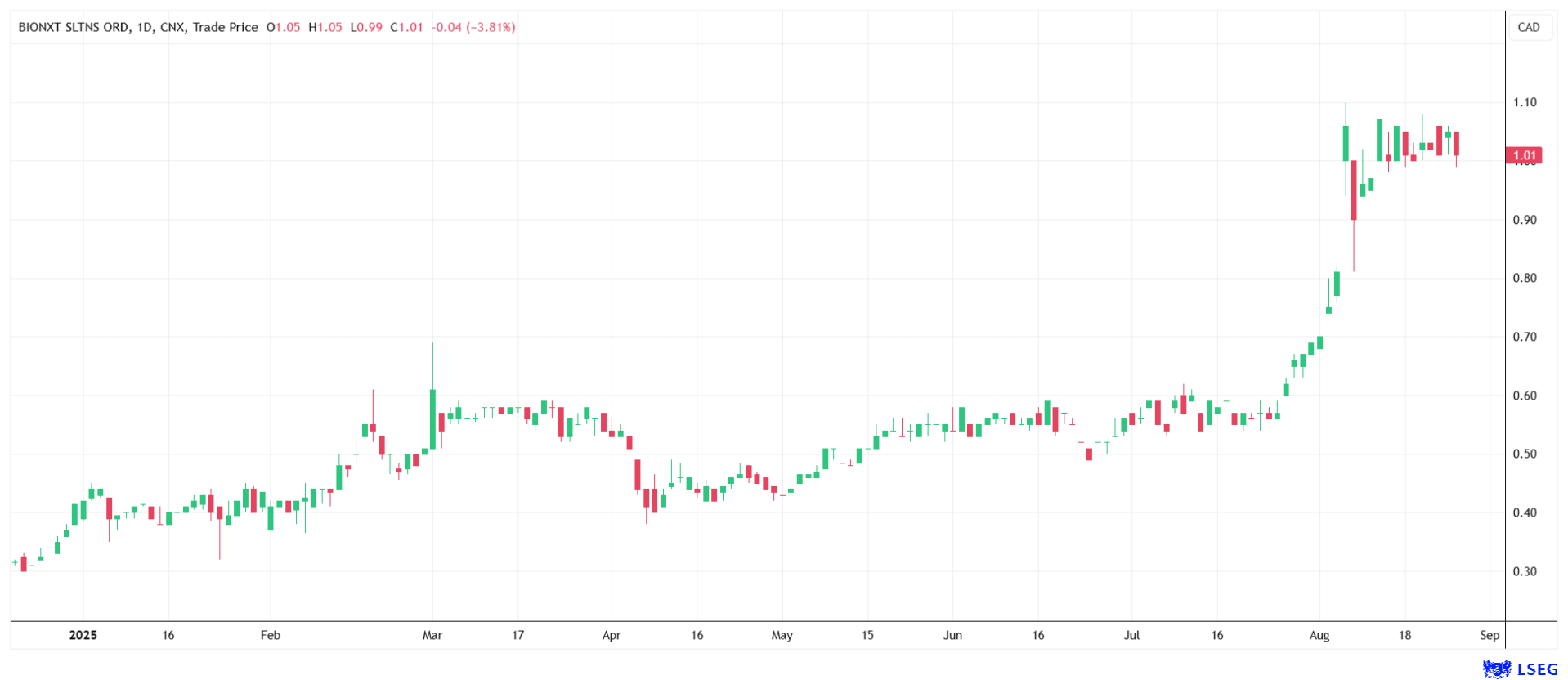

This is one of the reasons why Black Research has recommended the stock as a "Buy" with a price target of EUR 2.20. The stock is currently trading at EUR 0.654, leaving significant upside potential.

BioNxt Solutions is pursuing a clever approach: instead of taking the high risk of developing new active ingredients, the Company is optimizing their administration. The sublingual cladribine formulation for MS is a promising first endurance test in a billion-dollar market. If bioequivalence can be demonstrated, the niche "dosage form" could prove to be highly profitable. Investors have the opportunity to benefit from a pragmatic de-risking approach and a versatile technology platform before the big breakthrough becomes visible on the market.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.