December 29th, 2023 | 07:15 CET

The big turnaround 2024: Hydrogen with Nel, Plug Power, ThyssenKrupp Nucera and dynaCERT

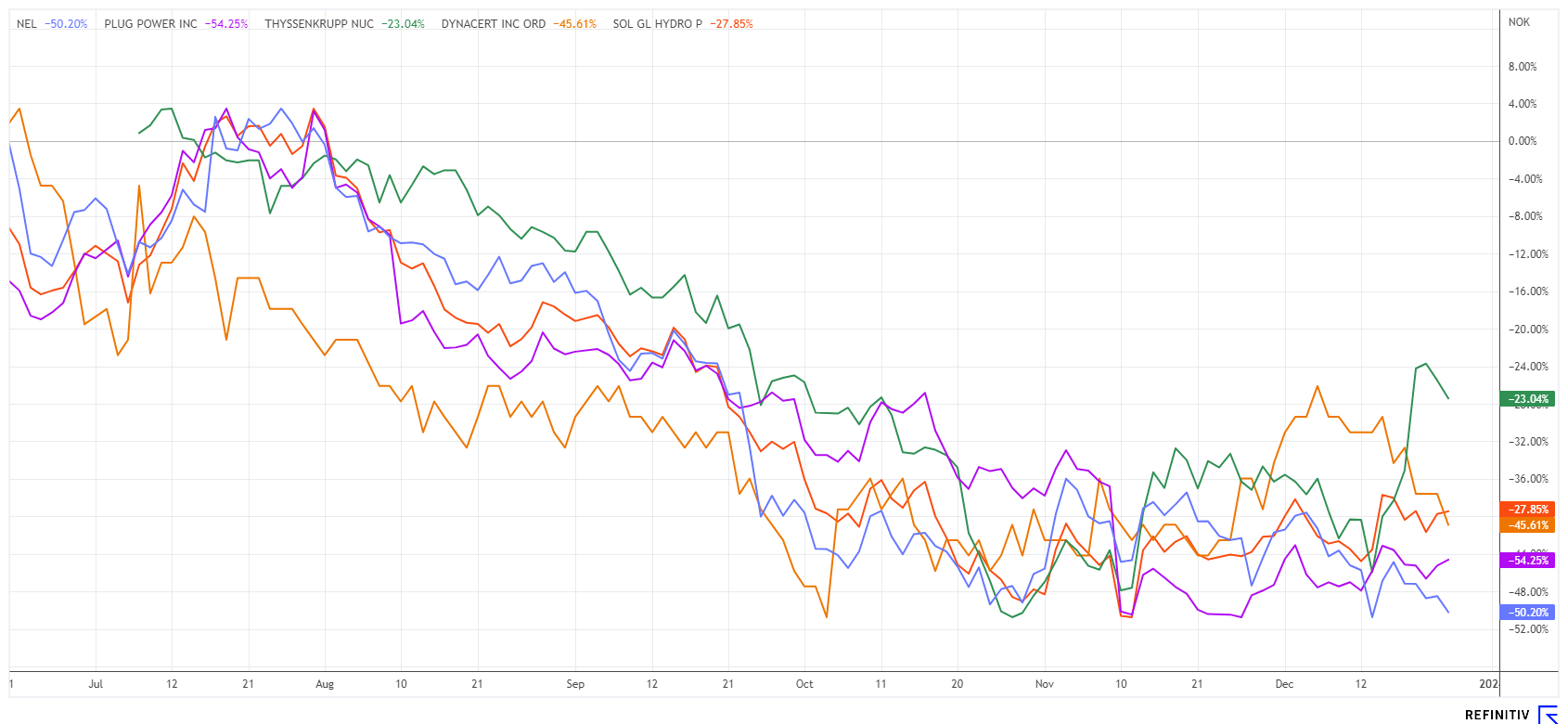

While the DAX 40 and NASDAQ indices are climbing to new all-time highs, hydrogen stocks are sinking further and further into the ground. But there is hope! With the exception of the OPEC states, around 200 countries have spoken out in favor of phasing out fossil fuels at the COP28 Climate Conference in Dubai. This should give the signatory governments a good opportunity to restart their state subsidy programs in favour of alternative energies in the coming year. Now is the time to re-examine the battered sector. Nel ASA and Plug Power have recently reported declining order volumes, while dynaCERT and Nucera are performing well operationally. We are looking at a sector that has the potential to gain several hundred percent in 2024.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

NEL ASA NK-_20 | NO0010081235 , PLUG POWER INC. DL-_01 | US72919P2020 , THYSSENKRUPP NUCERA AG & CO KGAA | DE000NCA0001 , DYNACERT INC. | CA26780A1084

Table of contents:

"[...] We can convert buses and trucks to be completely climate neutral. In doing so, we take a modular and incremental approach. That means we can work with all current vehicle types and respond to new technology and innovation [...]" Dirk Graszt, CEO, Clean Logistics SE

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

ThyssenKrupp Nucera - The share is bouncing back

The sharp downward trend since the IPO now seems to be over for ThyssenKrupp Nucera, as the figures for the past financial year brought some good news. Thanks to a complete turnaround in Q4, the Group at least achieved an operating profit and thus exceeded its own forecasts. A loss is still expected for the year as a whole, but this is mainly due to necessary investments for expansion.

A significant expansion of the locations is now planned for the new financial year, which will also increase the number of employees from 750 to over 1,000. According to consensus data on the Refinitiv Eikon platform, sales are expected to climb to around EUR 958 million in 2024 and could reach EUR 1.5 billion in 2026. Operating losses should only be temporary. With the current outlook, management is sticking to its medium-term target of reaching break-even in 2025. There will be no dividend for the foreseeable future, as the Group will continue to rely on self-financing.

The positive outlook has helped the share to halt the downward trend since July at around EUR 14. The subsequent recovery led to just under EUR 20. Currently, 10 out of 12 available analyses vote "Buy" or "Overweight", so the community's expectations are quite high. The average price target is expected to be EUR 24.65 in 12 months, a solid premium of 37%. Anyone who believes in the German hydrogen story should be in at the start of the year, as many of the announced programs from Berlin will likely end up in the Dortmund-based company's order book.

dynaCERT - With a promising deal pipeline into the new year

The Canadian technology company dynaCERT is also active in the hydrogen sector. With their HydraGEN™ technology, the H2 specialists from Quebec offer technical equipment that optimizes the combustion process in trucks, buses and other larger diesel engines. Hydrogen is added to the air-fuel mixture, which optimizes combustion and significantly reduces diesel consumption. Especially in times of rising eco-taxes in Europe and the abolition of subsidies in the agricultural sector in Germany, consumers and farmers must consider how they can gradually reduce fossil fuel consumption and thus positively support the energy transition. dynaCERT is one of the pioneers, as the available and patented technologies significantly reduce the energy consumption of vehicles and thus also promote the implementation of sustainable principles in fleet companies.

Together with its partner Cipher Neutron, the in-house production of green hydrogen was already sealed in 2023, with more to come in 2024. VERRA's certification of the dynaCERT product range is now in the final phase. It will enable the Company to pass on the coveted CO2 pollution rights to its customers in the future. Public operators of transportation, mining and logistics companies can thus improve their carbon footprint and generate additional income by selling the certificates. Yesterday, the Company once again provided an overview of all progress in 2023. In 2024, the Company is looking to strengthen the board and management, as there is currently a strong demand trend from all parts of the world and the launch of dynaCERT's carbon credit program is expected in early 2024.

This year's truck racing event, Dakar 2024, should also be exciting. dynaCERT's sponsorship will promote the Company's global brand awareness and, at the same time, expand dynaCERT's target group. It will promote the Company's HydraGEN™ technology to automotive associations with an existing, renowned communication platform for the European markets. The media reach of the event is over 4,200 hours of TV airtime on 70 channels in 190 countries with over 34 million hours of viewing. Exciting!

The DYA share has recently benefited from several international orders for its technologies and has almost doubled since the end of September. In a still difficult financing environment, dynaCERT is currently raising further growth capital for 2024. The share is trading at around CAD 0.16 again, valuing the Company at CAD 64 million. Those who position themselves now will benefit from the possible change in sentiment in favor of H2 stocks in the coming year and anticipate the highly probable VERRA certification. The potential in the share is considerable, but a risk-conscious investment mentality should be brought along.

Plug Power versus Nel ASA - Attempt to form a bottom

Plug Power, the American top dog in the hydrogen electrolyser business has beaten its investors to the punch. In 2021 and 2022, in particular, CEO Andy Marsh provided his followers with completely exaggerated growth expectations. During the trial, the share fell like a stone from USD 16 to just USD 7, but it got worse. When the figures achieved were far below forecasts, the stock market reacted with a sharp sell-off to the EUR 3 mark. The share is currently attempting a rebound, which has led to a gain of 35% in at least two months. The market capitalization is now only EUR 2.4 billion, which roughly corresponds to analysts' sales estimates for 2025. If expectations are not disappointed again, the share is now a Buy. After all, the price/sales ratio had already reached 25 at the end of 2020.

With a sharp downward movement, the Nel ASA share price fell by more than 50% in 2023. With a market capitalization of just under EUR 1 billion, the Company is still valued at three times sales for 2024, even at this level. In addition, the operating figures are disappointing, as the break-even point has been pushed far into the future due to extensive investments. On the other hand, the large order backlog of NOK 2.9 billion and an unchanged high cash balance of NOK 3.8 billion at the end of the third quarter are positive factors. With these resources, Nel ASA will not need to approach its shareholders in 2024 and can wait and see which public contracts end up in the order book. In terms of the chart, the Norwegians are approaching their lows from 2018/19, when the share was trading below EUR 0.50.

We are following both stocks very closely and have warned of the high valuation in recent months. As the picture has improved significantly, we are adding Plug Power and Nel ASA to our shortlist again. If the momentum turns, a quick 100% is to be expected. The losers of 2023 could be the stars of risk-conscious investor portfolios in 12 months. Position yourself during significant price increases and rising trading volume.

The hydrogen sector has caused significant losses for investors in 2023. The declines extend across all segments, as growth expectations in 2022 were set too high. Plug Power and Nel ASA are trying to bottom out, while ThyssenKrupp Nucera and Canada's dynaCERT can already report good progress in their operating business. The year 2024 will likely separate the wheat from the chaff and be extremely exciting for the H2 sector.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.