March 20th, 2023 | 08:30 CET

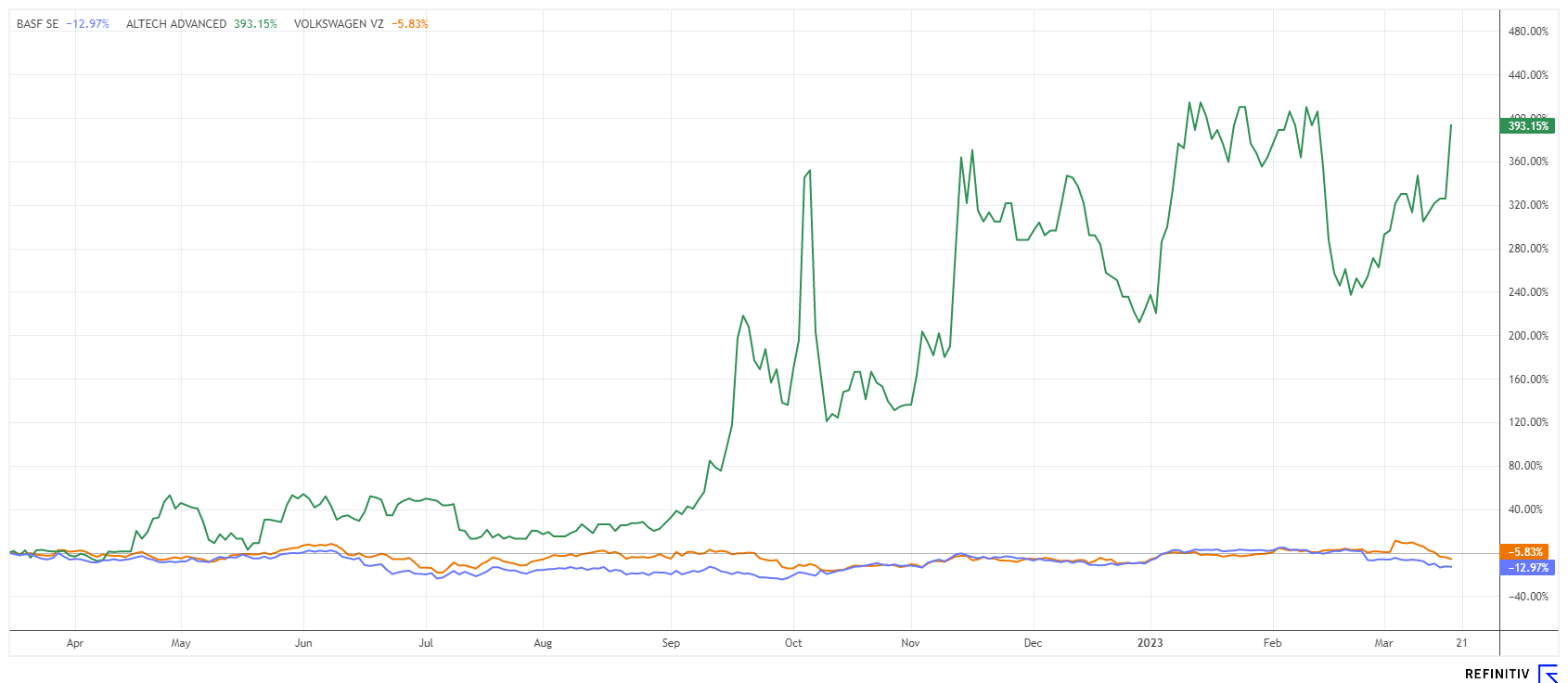

The big battery question of 2023: BASF, Altech Advanced Materials, Volkswagen - Who is the fastest?

In recent months it has become clear to investors that the global economy will have to contend with sharp price increases after the pandemic. The greatest inflationary pressure comes from scarce raw materials, especially for high-tech industrial goods. That is because the trend toward climate protection is forcing the industry to make its manufacturing processes more resource-efficient. As a result, this requires major investment in new energy plants and storage systems. Electromobility is still the smaller problem here because how will humanity secure green energy supplies around the globe? The energy hunger of the emerging nations already exceeds the new demand in the industrialized nations by a factor of six. Sophisticated ideas are needed!

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

BASF SE NA O.N. | DE000BASF111 , ALTECH ADV.MAT. NA O.N. | DE000A2LQUJ6 , VOLKSWAGEN AG ST O.N. | DE0007664005

Table of contents:

"[...] We know exactly what we are doing and are implementing what we consider to be a proven technology in an industrially applicable and scalable way. [...]" Uwe Ahrens, Director, Altech Advanced Materials AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BASF - The chemical giant is not yet convincing

The Ludwigshafen-based chemical giant knows what it is talking about when it comes to fossil fuels. No other branch of industry is as dependent on oil and gas as chemical energy. These energy sources not only serve as the basic material for thousands of products but also supply essential energy to the manufacturing processes. For instance, gas is used for high heat and local foaming and gassing purposes. Although BASF reduced its gas hunger by about 20%, there will be no getting around a certain basic requirement in 2023.

Last year, BASF was still pretty much all about gas. In the meantime, it has become clear that the greatest horror scenarios will not materialize. The price of gas on the spot market has recently fallen to a 24-month low, and the gas storage facilities in Europe are full again thanks to the mild winter and new import routes. At BASF, the outlook is somewhat more optimistic again, but the Ludwigshafen-based company is still not convincing. According to forecasts, production will fall by 5% in 2023, so the Company can only dream of a return to normality in the medium term, as it continues to be highly sensitive to the economic situation. If there is a major downturn, this could have a significant impact on BASF's balance sheets.

At EUR 44.8, shareholders will not be cheering, yet the stock has not slipped back to its lows below EUR 40 despite a gloomy outlook. However, the Group has major challenges to overcome. In China, ground has been broken for the EUR 10 billion investment. A dividend of EUR 3.40 is to be approved at the upcoming Annual General Meeting, which according to Adam Riese, currently represents a yield of 7.6%. Analysts at Refinitiv Eikon see an average 12-month price target of EUR 54.7, about 22% above the last price.

Altech Advanced Materials - This could be the breakthrough

Anyone looking for suitable technology companies in the battery sector in Germany will quickly come across Heidelberg-based Altech Advanced Materials AG. With the planned production of a new type of solid-state battery, the Company is already one step closer to the dynamic market for grid storage. Because of climate change, this segment will attract extreme attention in the coming years. If governments expand their subsidy programs a bit more, the market should boast growth rates of over 30%.

A major problem with green energies is the low base load capability and the irregular feed-in situation. The solution is therefore moving toward energy storage systems that can store electricity during low-load periods and release it later when needed. Altech is researching special coating technologies that prevent batteries from losing capacity prematurely. These new designs could also have applications for the automotive industry. The crux of the matter is: The investment cycles of the automotive industry are in 5 to 10-year windows, and currently, the conventional Li-ion technology still dominates. Very interesting is the parallel research on CERENERGY batteries together with the Fraunhofer Institute. These novel sodium-alumina solid-state batteries could revolutionize the ESG-weak performance of the entire industry by eliminating the use of lithium, graphite, copper and cobalt.

After a successful placement of a zero-coupon bond of EUR 3.5 million, the cash box is well-filled again, and subscribers also receive interesting option rights. The market capitalization has increased from EUR 8 million to almost EUR 29 million in just 12 months. Anyone who has read our reports carefully should be able to look joyfully at this portfolio value. However, the real stock market story is still in its infancy. Collect!

Volkswagen - This does not look good!

The EU no longer wants to permit the internal combustion engine as of 2035. Currently, this draft fails because of the approval of e-fuels, which the German FDP wants to be taken into account. Regardless of the outcome of this discussion, the major switch to e-mobility has probably been decided politically, even if large sections of the population do not support it. Again, an example of how European politics governs past its member countries and voters. The intentions of the green politicians will stand or fall with the tax subsidies made available because it will not be possible to sell e-mobiles on their own.

The investment decision was not easy for VW, but the Company has already decided in favor of e-mobility. The official go-ahead has now been given in Valencia for the EUR 10 billion investment in the second battery cell factory of the subsidiary PowerCo. A strategic decision has also been made to acquire a direct stake in raw material mines and sell battery cells to third-party suppliers. Construction of the battery plant will start as planned in the first quarter of 2023, the annual production capacity for manufacturing the "unit cell" is expected to be 40 GWh, but the site will not go into production until 2026. There is also optional talk that the manufacturing facility could be expanded to 60 GWh in perspective, creating up to 30,000 indirect jobs with suppliers and partners in Spain. In line with ESG, recycling and remanufacturing capacities will also be created on-site. In the supply chain for e-car production, the Valencia plant is expected to close one last important gap. So far, so good!

The VW share has recently come under heavy pressure due to contradictory statements on the margin situation in the Group and has lost a whole 17% since the beginning of March to just EUR 120. Analytically, the stock would now be spot cheap with a 2023 P/E ratio of 4.2 and a dividend yield of 6.3%. But if the big bet on e-mobility passes the consumer by, the Wolfsburg-based group will be digging itself a billion-dollar grave in the medium term. Watch out at the edge of the platform!

Gas and oil are becoming cheaper every day, so the pressure to find alternatives to fossil energy is decreasing noticeably. However, investment foresight in the matter of climate change does not lead past efficient energy storage systems. Here BASF and VW are in demand as standard stocks. Altech Advanced Materials has innovative solutions in its quiver and could thus continue its rocket rise.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.