December 27th, 2023 | 07:00 CET

The 2024 share rocket without e-funding - BYD, Defense Metals, Porsche and Volkswagen

With the supplementary budget 2023, the fate of the e-funding was sealed. On December 16, the purchase premium hammer came down in an "ad hoc announcement" from Berlin: The funding of up to EUR 4,500 for the purchase of a new e-vehicle has expired with immediate effect. This was announced by the Federal Office for Economic Affairs and Export Control (BAFA). The deadline for applying for the funding ended on December 17, 2023, meaning that e-mobility is now a thing of the past. Only the reduced tax rate under the company car scheme and the general exemption from vehicle tax remain. Consumer advocates are complaining about the unequal treatment of different mobility concepts that have prevailed for years, and the Federal Constitutional Court will likely have to deal with this issue in due course. Time for investors to rethink - where are the opportunities in the investment year 2024?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

BYD CO. LTD H YC 1 | CNE100000296 , DEFENSE METALS CORP. | CA2446331035 , PORSCHE AG | DE000PAG9113 , VOLKSWAGEN AG VZO O.N. | DE0007664039

Table of contents:

"[...] Nickel, therefore, benefits twice: firstly from its growing importance within batteries and secondly from the generally growing demand for such storage. [...]" Terry Lynch, CEO, Power Nickel

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BYD - Things are running smoothly even without funding

The recent news of funding cuts from Berlin is a blow to government supporters. Those who have not already received the registration certificate for their new electric car will be left empty-handed by the state. That is because the electric car had to be registered before applying for the subsidy. There is a great deal of anger, and the abrupt end to subsidies decreed by Federal Economics Minister Robert Habeck has been heavily criticized. Looking at the bigger picture, it is a wake-up call for the German automotive industry to tackle the margin gap with Chinese manufacturers with the utmost seriousness and finally bring an affordable electric car to the market. BYD has already successfully presented its 2024 models at the IAA Mobility in Munich, making a strong impact on marketing. Dealers are now being connected, and sales contracts are being signed.

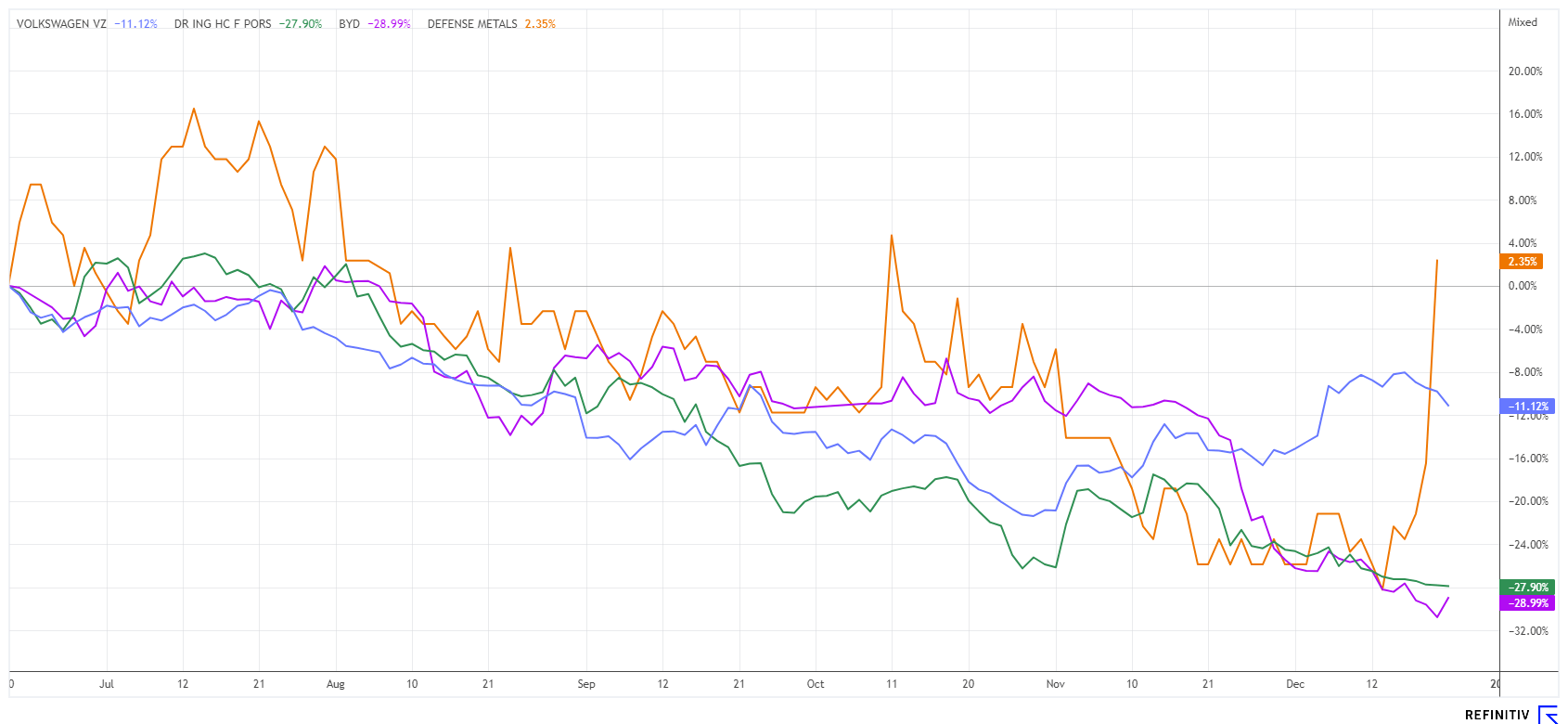

According to Chinese media reports, BYD intends to offer the entry-level Seagull model with two engine variants and several battery options. Prices on the Chinese market range from EUR 10,400 to EUR 13,300, depending on the equipment. For comparison, VW currently charges EUR 30,000 for its entry-level electric model, e-Up! The successor, the ID.2, is due to be launched in 2025 and aims to cost less than EUR 25,000. Whether VW will be able to do without the environmental bonus remains questionable. BYD shares are suffering from the current weakness in sales despite rising market shares, but with the SUV model Song L, they can present a 500 HP electric vehicle that is now also making Tesla tremble. After a 6-month loss of 22%, it might be worth considering the stock for your watchlist.

Defense Metals - What is behind the rocket-like rise?

What a fabulous rally in the Canadian rare earth stock Defense Metals. For months, investors have been ignoring the announcements made by Western governments to secure the supply of critical metals. Defense has been busy building up its production at the Wicheeda project in recent months, but the stock markets have only given this a passing mention. Representatives of the EU governments and the European Parliament agreed on the text of a corresponding regulation in the fall. It is intended in particular to promote the refining, processing and recycling of critical raw materials in Europe to reduce dependence on countries such as China. The battery raw materials copper, nickel, graphite, lithium and cobalt and the spectrum of rare earths are currently considered particularly critical.

Meanwhile, progress continues for the Canadian explorer. In early December, the Company completed the previously announced Phase II open pit geotechnical drilling program with diamond core and sonic infrastructure drilling. According to the latest resource estimate, the Company has a total of 6.4 million tons of measured mineral resources with an average total rare earth oxide (TREO) content of 2.86%. Indicated and Inferred Mineral Resources of 27.8 million tons averaging 1.84% TREO and 11.1 million tons averaging 1.02% TREO are also reported. The feasibility study for open pit mining is underway and is expected to be completed in 2024.

Craig Taylor, CEO of Defense Metals, commented on the progress: "We are pleased to have completed the Phase II geotechnical programs and are encouraged that open pit drilling has intersected significant thicknesses of REE mineralized carbonatite within the western pit wall that we were previously unaware of."

Defense Metals shares were among the most sought-after stocks on the German Tradegate platform at the end of last week. A historic volume of over 15 million shares was traded on all stock exchanges combined in one day, representing 6% of the 255.8 million shares outstanding. As a result, the Company's market value has doubled to around CAD 65 million from a standing start. It goes to show how quickly things can change when undervaluations come to light. As the topic of "strategic metals" has been the subject of political debate for months, it should come as no surprise if the party continues unabated next year.

Volkswagen and Porsche - The EU wields the baton

Volkswagen subsidiary Porsche will withdraw the Macan SUV with a petrol engine from the EU market early because the changeover to new approval regulations is too costly. A spokesperson confirmed last week that the vehicle's platform will no longer be adapted to the EU's future rules. As a result, the model will no longer be eligible for registration from the beginning of July 2024, as only vehicles that have already mapped, documented and certified all the necessary processes to increase cyber security during the development phase will be allowed to be registered in the EU. Porsche stated that since the requirements were not known at the introduction of the combustion engine model, they could not be considered during development. Production for markets outside the EU is not affected, meaning that Porsche will continue to build a model in Leipzig that can no longer be sold in the EU in its current form. The plan now is to convert the Macan to an electric drive as quickly as possible, as the model is in demand. The electric version is due to hit the market in mid-2024 after the launch was considerably delayed due to serious software problems within the VW Group.

The VW Group still has massive problems in the e-division, but time is pressing because, starting January 1, 2024, only fully electric models will be allowed to be offered in Norway. However, the decision to phase out combustion engines early in the leading European e-car market does not come from Wolfsburg but from the Norwegian importer of the VW Group brands Volkswagen, Audi, Skoda and Cupra. This is what "public pressure" looks like!

While Porsche has fallen back to its IPO price level of EUR 80, VW is fighting its way up step by step. With a valuation of EUR 72 billion, Porsche shares are now even outperforming the parent company, which, in addition to a 2024 P/E ratio of 3.8, also offers an 8% dividend. The management has just agreed with the works council to achieve savings of around EUR 10 billion in various areas by 2026. According to plans, the return on sales could thus rise again from the current 3.4% to 6.5%. In our opinion, Porsche is still too expensive, while VW has been in the EUR 107 to 112 range for a suspiciously long time. Collect!

The automotive sector has had a challenging year in 2023. Now, in Germany, the government's purchase incentive for electric vehicles, the so-called environmental bonus, is also being discontinued. Manufacturers have reacted quickly and want to take some of the bonus on themselves, but this will put additional pressure on the already tight margins. Volkswagen shines from a valuation perspective among the car manufacturers, while BYD and Porsche are not cheap. The rare earths value of Defense Metals was ignored for a long time, but now the topic is on everyone's lips.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.