November 2nd, 2023 | 07:30 CET

Surprise after Q3 figures: Deutsche Bank, Microsoft, Desert Gold, Siemens - Good Chart Technique and a boost from AI?

The ECB has paused its interest rate adjustments for the first time in 12 months. It is not surprising, as a declining economy is currently causing inflationary pressures to subside somewhat. Because of the numerous geopolitical conflicts, gold has surpassed the USD 2,000 mark again after a long consolidation period. And then there are the many quarterly figures. It is good for those who can keep track of them all. We look at new developments with Deutsche Bank, Microsoft's entry into the German corporate AI market, and the excellent opportunities at the explorer Desert Gold.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

DEUTSCHE BANK AG NA O.N. | DE0005140008 , MICROSOFT DL-_00000625 | US5949181045 , DESERT GOLD VENTURES | CA25039N4084

Table of contents:

"[...] We can make a big increase in value with little capital. [...]" David Mason, Managing Director, CEO, NewPeak Metals Ltd.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Deutsche Bank - Good figures, but cutbacks at Postbank

Although the DAX 40 index has been hitting the brakes for 5 months now, Deutsche Bank's share price has been able to hold up surprisingly well. Investors' reactions to the Q3 figures were quite decent, with the share price immediately moving back into forward gear after initial weakness. In the quarterly presentation, the management around CEO Christian Sewing promised better figures, a higher payout to shareholders and an end to the problems at Postbank. For months, Postbank customers have been struggling with their online banking, experiencing disappearing transactions and weeks-long data recovery processes.

Due to a slightly higher tax rate, Deutsche Bank earned EUR 1 billion in the third quarter, around 8% less than in the same period last year. Pre-tax profit, meanwhile, increased by 7% to EUR 1.72 billion. Revenues also surprised on the upside, totaling EUR 7.1 billion, an increase of 3%. In the end, it is evident that despite significant challenges in the IT sector, a healthy level has been achieved again in the core business. Germany's largest commercial bank benefited particularly from higher earnings in the retail and corporate customer areas. However, the performance in investment banking and asset management was less favorable. The bank is making gradual progress with the reduction of risk-weighted assets. In addition, the institution updated its estimates for the impact of Basel III up to 2025.

"Our results demonstrate strong and sustained business growth momentum combined with continued cost discipline," commented CEO Christian Sewing. In a public letter to employees, Sewing also addressed the chaotic conditions in Postbank's customer service. However, he expressed confidence that the problems would be under control by the end of the year. And what shareholders like to hear is that 250 branches are to be closed as the bank's level of digitalization increases. This will further reduce costs, and a higher dividend can be expected. All good news that boosted the DBK share price by 8.5%. With the recapture of the EUR 10 mark, the chart also looks promising. Collect!

Microsoft - Collaborating with Siemens on AI

After a strong performance in 2023, Microsoft is now taking the next leap. It is teaming up with German in-house supplier Siemens to drive the use of generative Artificial Intelligence (AI) for a range of industries. The first result of the collaboration is an AI-powered assistant called Siemens Industrial Copilot, designed to facilitate the interaction between humans and machines. The automotive supplier Schaeffler will be one of the first beta users to use the digital tool in development and manufacturing. Other copilots are to be developed for various industries, including infrastructure, transportation and healthcare.

According to the product description, the Siemens Industrial Copilot will enable its users to quickly generate and optimize complex programming codes for automation and eliminate errors more quickly. Similarly, simulation times in development are to be significantly reduced, as a process taking several weeks will be reduced to a few minutes using AI. Sounds revolutionary already!

Both shares saw an upward price movement at the end of October. While Siemens can be purchased at around EUR 125 with a 2024 P/E ratio of 12, Microsoft's valuation is rather advanced with a P/E ratio of 31. It will be interesting to see which stock can perform better over a 12-month horizon, the AI developer or the industrial implementer.

Desert Gold - Fuel for Gold Investors

There is a lot of spark for gold investors right now. First, there are the uncertainties arising from numerous geopolitical conflicts, which seem to be expanding more and more. In addition, despite declining inflation, inflation persists, and the continuous expansion of government debt fuels disruptions, especially in the US-dollar-dominated space. Added to this are the efforts of many BRICS countries to extend their sphere of influence to countries rich in raw materials and to distance themselves from the US dollar in the long term. These intentions are driven by the China-Russia axis, which appears to be strengthening further, especially since the invasion of Ukraine.

Those who want to consider this mix of upheavals in their investment strategy should look to Africa, where vast reserves of raw materials lie. Traditionally, the connection to Western investors is strong because they also bring important development services to the country. Canadian explorer Desert Gold Ventures is focused on the Senegal-Mali Shear Zone (SMSZ), not without reason, as drilling in 2023 in the Mogoyafara South and Kousilli West zones delivered industrially viable gold ore grades. It should be noted that gold majors Barrick, B2 Gold and Allied Gold are also in the immediate vicinity of the prospect area and are constantly looking for interesting resource extensions. Under the new name Allied Gold, the ex-Yamana management has assembled a portfolio of gold projects with estimated mineral reserves of around 10 million ounces over the past 10 years.

However, the search continues because, beyond the USD 2,000 spot price, African producers are making real money. In Mali, the gold is near-surface, which puts the average cost per ounce in the USD 850 range when calculated on a sustainable basis. Desert Gold has identified approximately 1 million ounces in the ground to date and is valued at only CAD 11.5 million with its 279 million shares. Given the high takeover activity in the region, a drastic appreciation should be in store if a neighboring major comes knocking.

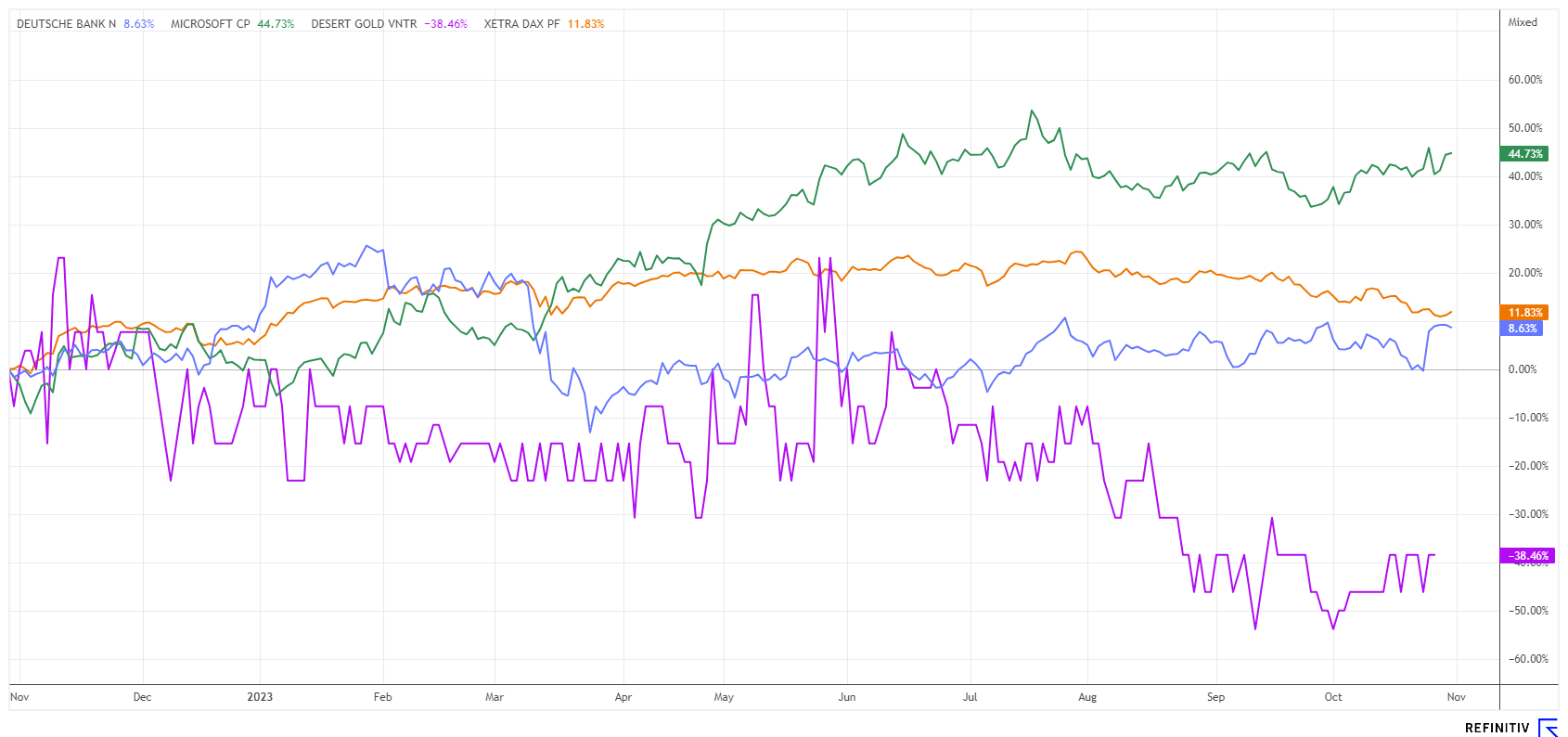

The stock market is currently moving erratically. No one is quite sure whether to hold shares or reduce their risk ratio first due to numerous uncertainties. In challenging times, valuations are often depressed and offer good entry opportunities. Among the stocks mentioned, Microsoft stands out with a pronounced AI rally. Deutsche Bank can once again clear the EUR 10 hurdle, and Siemens offers long-term stability in the portfolio. The speculative pick, Desert Gold, is significantly undervalued for the impending gold boom and could quickly attract attention through M&A activities.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.