October 15th, 2025 | 07:05 CEST

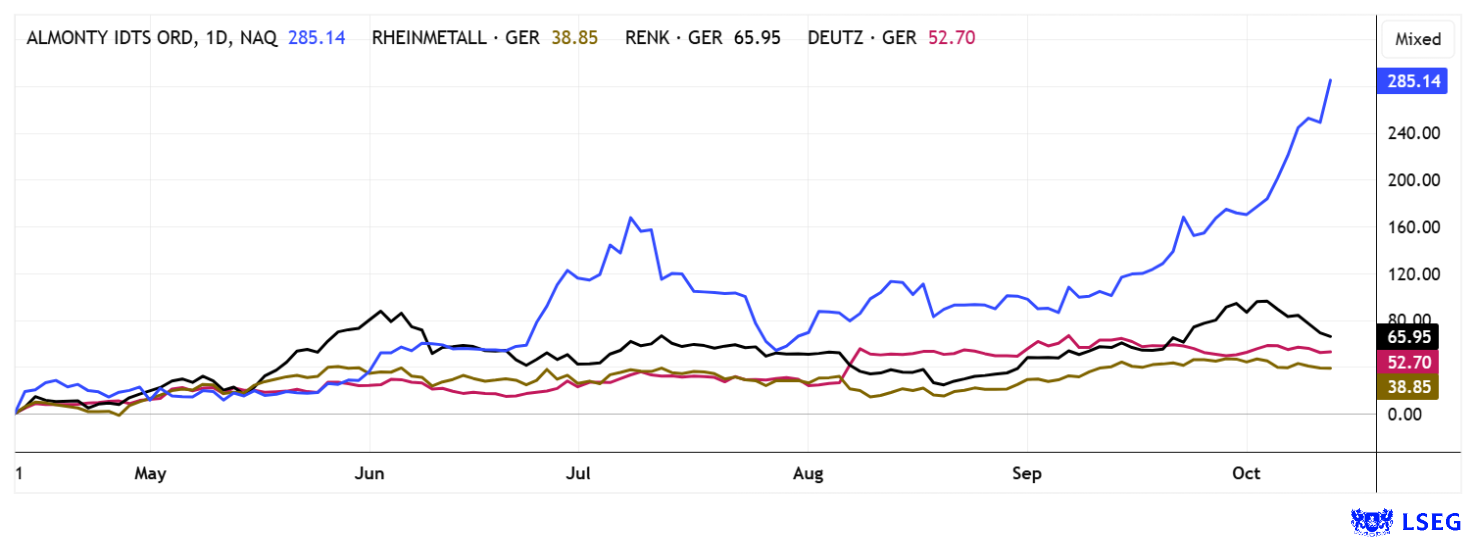

Supply chains on the NASDAQ! Critical metals sold out? What is next for Almonty - Caution advised with Rheinmetall, Deutz, and RENK

Snip-Snap! In and out of the markets! At the moment, all stock market wisdom applies, because there is nothing more unpredictable for investors than the current US president. And who would have thought that the critical metal supply chains would suddenly become a major driving force behind the NASDAQ rally? Just as Xi Jinping threw rare metals into the ring as a bargaining chip, Donald Trump blew a fuse. Punitive tariffs of up to 100% were suddenly on the table, and the markets went into a tailspin. Yet just one trading day later, everything is put into perspective, and the markets have to find their new valuation point – no easy task. Yesterday, nervousness returned, as reflected in a sharp rise in the volatility index. What should investors be keeping a close eye on now?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

ALMONTY INDUSTRIES INC. | CA0203987072 , RHEINMETALL AG | DE0007030009 , DEUTZ AG O.N. | DE0006305006 , RENK AG O.N. | DE000RENK730

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Almonty Industries – In demand and leading the way

Another new high for Almonty. At the start of the week, the stock climbed to just under USD 9 on the NASDAQ - its highest level ever. The trigger this time appears to be the simmering conflict between Donald Trump and Xi Jinping. The atmosphere in the critical metals sector is growing increasingly frosty, driving up prices for producers. China sits on over 70% of the world's tungsten reserves. Although new mines are expected to open in the West in the foreseeable future, meaningful supply growth will mainly come from South Korea. That is where Almonty Industries is developing its newly established Sangdong mine, alongside its production site in Portugal. Sangdong is expected to commence operations by early 2026 at the latest and will supply the West. Significant molybdenum deposits also remain untapped, steadily gaining in value. For now, there are no signs that the tensions in the commodities markets will ease. Spot prices are currently pricing in an impending slowdown in global trade, and no one wants to bet against it. So the journey north continues.

"The trend is your friend" – to quote another stock market adage. In a recent interview, Almonty CEO Lewis Black outlined what lies ahead for Western industries should China stop supplying altogether. https://www.foxbusiness.com/video/6382702881112

Investors should refer to stocks such as Critical Metals or MP Materials in the NASDAQ valuation comparison. While CRML has already exceeded the USD 2 billion valuation mark and MP Materials is approaching the USD 20 billion mark, Almonty, with an operational mine, still sits at around USD 1.5 billion. So the upward journey is likely to continue unabated. Rumor has it that a US government stake could be in the pipeline or that one morning, an unexpected merger might make headlines. Keep accumulating, and the swimming pool of gold ducats will soon be full! Many will remember Scrooge McDuck diving right in...

Rheinmetall – Consolidation at the EUR 2,000 mark

Rheinmetall shares have also performed well over the past 12 months. This is due to the Company's pure-play positioning as a top defense stock. Starting from revenues of EUR 9.75 billion in 2024, the Company is expected to deliver annual sales growth of around 25% in the coming years - a feat achieved by few industrial players. The Düsseldorf-based company is a key contractor for a range of critical defense components, from tanks and defensive artillery, right through to the drone business. Those deterred by the currently high 2025 P/E ratio of 45 should sharpen their fundamental perspective through to 2028. This is when Rheinmetall could reach the EUR 30 billion revenue mark, accompanied by disproportionately high margin and profit growth. This forward-looking perspective is crucial given the Company's ambitious capacity expansion, needed to process its order backlog of over EUR 60 billion over the next five years. The share price is currently hovering between EUR 1,800 and EUR 2,000, consolidating at a high level. The reason: Q3 figures will be released on November 6, and CEO Armin Papperger will have to show his hand and reveal whether the rapid pace of growth in processing NATO orders can actually be maintained. Exciting!

RENK and Deutz – Life is good in the slipstream of the defense sector

A quick note on RENK and Deutz. They are often referred to as "free riders" of a booming defense industry. However, a check of the balance sheets reveals major differences. While RENK actually generates 60 to 75% of its business in the defense sector, Deutz generates less than 3%. Nevertheless, Deutz's share price nearly doubled in 2025 from EUR 4.50 to its current level of EUR 8.85. After a decline in revenue to around EUR 1.8 billion in 2024, analysts expect an increase of around 50% to approximately EUR 2.7 billion by 2027. The current market capitalization is approximately 50% of expected sales. This would not be too expensive in the medium term, but it remains to be seen whether the Cologne-based company can actually implement its strategic repositioning. Although RENK is currently in the process of significantly increasing its defense share, the underlying figures in no way justify price-to-sales ratios of over 5, let alone P/E ratios of over 40. So while RENK could depreciate by 30% from a standing start, Deutz provides a good diversification contribution for the defense share in the portfolio during periods of weakness.

The party goes on - but it feels as if the music has shifted from waltzes to hard rock. Within just 48 hours, the markets have had to switch entirely from bearish to bullish, and perhaps now back again. Not a pleasant scenario in the long run, but that is the reality of today's algo-driven high-speed stock exchanges. Diversification and staying power are required, and sometimes the courage to sell at the right moment!

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.