October 12th, 2023 | 07:00 CEST

Strong Buy with 70% discount! TUI, Blackrock Silver, Plug Power - Secure the 2024 winners for your portfolio now!

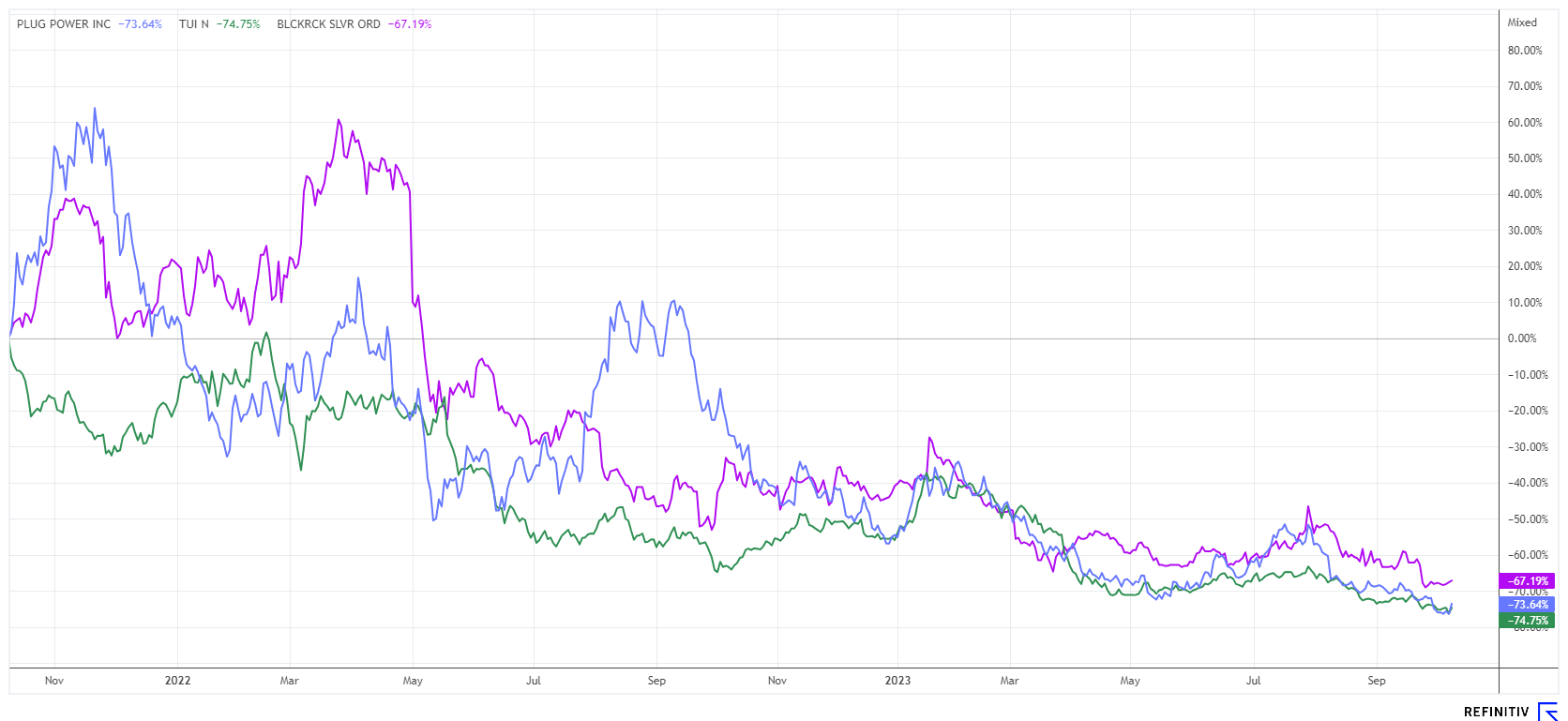

The stock markets have been in a stagnant state since March. Interest rates are rising, inflation remains high, and we have also seen better times on the economic front. When everything seems gloomy, and the cannons are thundering far away, it is buying time for lagging or unjustly beaten-up stocks. Plug Power, TUI, and Blackrock Silver shares have seen over 70% correction in just two years. It is partly fundamentally justified, partly because of one of the worst industry trends in decades. Those looking for the other side of the coin should take a closer look because this is likely where the next 100 percenters lie dormant.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

TUI AG NA O.N. | DE000TUAG505 , Blackrock Silver | CA09261Q1072 , PLUG POWER INC. DL-_01 | US72919P2020

Table of contents:

"[...] The processes in Namibia are predictable and the country itself is very safe. [...]" Heye Daun, President and CEO, Osino Resources Corp.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Blackrock Silver - New Resource Estimate Convinces

In an environment of war and uncertainty, gold and silver were able to record significant increases. This performance should come as no surprise because, with high inflation, debt, and military activities, investors' need for security is increasing daily.

The Canadian explorer Blackrock Silver (BRC) published very good news yesterday and caught market participants completely off guard. The sentiment in the junior mining sector has been quite negative for months, making these results all the more unexpected. Blackrock Silver was able to provide an updated mineral resource estimate (MRE) totaling 570,000 ounces of gold and 47.74 million ounces (MOZ) of silver, or 100.04 MOZ silver equivalent (AgEq), which is a 135% increase over the initial estimate for Tonopah West that was included in the April 28, 2022, technical report. When considering only grades above 200 grams/ton (AgEq) in the calculation, the average grade of the inferred mineral resource is 508.5 g/t AgEq, a 14% increase from the initial MRE. The updated overall report now includes an estimated 6.12 million tonnes of mineralized rock, an increase of 106% from the initial estimate in 2022. When the mine eventually comes on stream, the life of mine will also be extended accordingly.

In addition to the gold and silver deposits, Blackrock recently revealed lithium mineralization, making the stock attractive not only to precious metals fans but also has the allure of another strategic metals property in a secure jurisdiction, which is an important criterion for the North American high-tech and automotive industries. Blackrock Silver shares jumped from CAD 0.25 to CAD 0.30 yesterday on heavy trading volumes, pushing the market capitalization to CAD 57.5 million. The current news is likely to continue driving momentum in the medium term.

Plug Power - This could be it

Over the past 12 months, shares of the American hydrogen technology giant Plug Power have experienced a significant sell-off, with the stock price dropping by 64%. Compared to the highs from 2020, this represents a cumulative loss of 90%. On the one hand, the disappointing operating figures were to blame, and on the other, misleading statements by CEO Andy Marsh on expected sales. He was recently confronted with several class action lawsuits because of this.

Yesterday, the widely acclaimed "Plug Symposium 2023" took place. And as luck would have it, CEO Andy Marsh reported on two significant orders totaling 830 MW of electrolyser capacity. That is certainly significant news. The orders come from former joint venture partner Fortescue Future Industries for a hydrogen project in Queensland and Arcadia eFuels for a hydrogen project in Denmark. Arcadia eFuels' Vordingborg site will take advantage of Denmark's abundant wind power and use Plug's electrolyser technology to produce about 120 tons of green hydrogen daily. The green hydrogen will then be combined with biogenic CO2 to produce syngas. The plant is forecast to be commercially operational towards the end of 2026.

Is this the long-awaited liberation blow for the Plug Power share? In purely analytical terms, the stock is now valued at 1.5 times the estimated 2024 sales, and there is hope of being in the black from the end of 2025. Sales of USD 5.4 billion are expected as early as 2027. In the long term, the share thus offers doubling potential at the current level. Buy limited in several steps up to USD 7.50 because the volatility in the share is high.

TUI - Fabulous sell-off, but rising booking figures

TUI's stock, the third of the trio, has also lost over 70% in the last 12 months. However, the travel group was able to fully repay the federal government's contributions to the Corona pandemic with a huge capital increase in the middle of the year. Thanks to price increases and travel catch-up effects, sales were also up 27% at the end of the first nine months. At the moment, however, renewed revisions to German economic figures are pressing into focus, suggesting a further budget squeeze among households.

Nevertheless, the analyst firm AlsterResearch is bullish and sees more than 200% upside potential for the TUI share from the current level. In a study presented yesterday, the buy recommendation is confirmed with a 12-month price target of EUR 16. The analysts say that warlike conflicts in the Middle East can be absorbed well via flexibility in bookings. With a view to the winter season, they have reservations about Egypt, but there will be alternatives here as well. TUI, on the other hand, can convince with its improved financial situation. For the coming years, earnings per share could increase from EUR 0.69 to EUR 1.16. This calculation is not far from the consensus on the Refinitiv Eikon platform of EUR 0.72 to EUR 1.18. A total of 6 analyst firms recommend buying with a median target price of EUR 8.76, still a good 70% above the last price estimate. Accumulate the value between EUR 4.80 and EUR 5.20. TUI could deliver more than 100% performance into 2025.

After months of sell-off, many stocks have reached interesting levels. Plug Power is the market leader for hydrogen technology in North America. TUI can boast good booking figures, and Blackrock Silver is back from the summer break with a doubling of its resources. All three stocks should be allocated with a focus on the next 24 months. There is certainly a 100-percenter among them.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.