October 17th, 2023 | 08:10 CEST

Strategic metals, rare and in demand! Rheinmetall, Almonty Industries, JinkoSolar

We all know that the electrification of mobility and the energy transition is unstoppable. At the same time, there are numerous trouble spots in this world that make reliable access to such important metals difficult and threaten supply chains. The supply of essential raw materials has, therefore, long since become a matter for governments, while private alliances that can be terminated at any time appear too uncertain. We examine companies that are doing well in this environment and offer one or two solutions to the problem. For investors, this means promising returns!

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

RHEINMETALL AG | DE0007030009 , ALMONTY INDUSTRIES INC. | CA0203981034 , JINKOSOLAR ADR/4 DL-00002 | US47759T1007

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

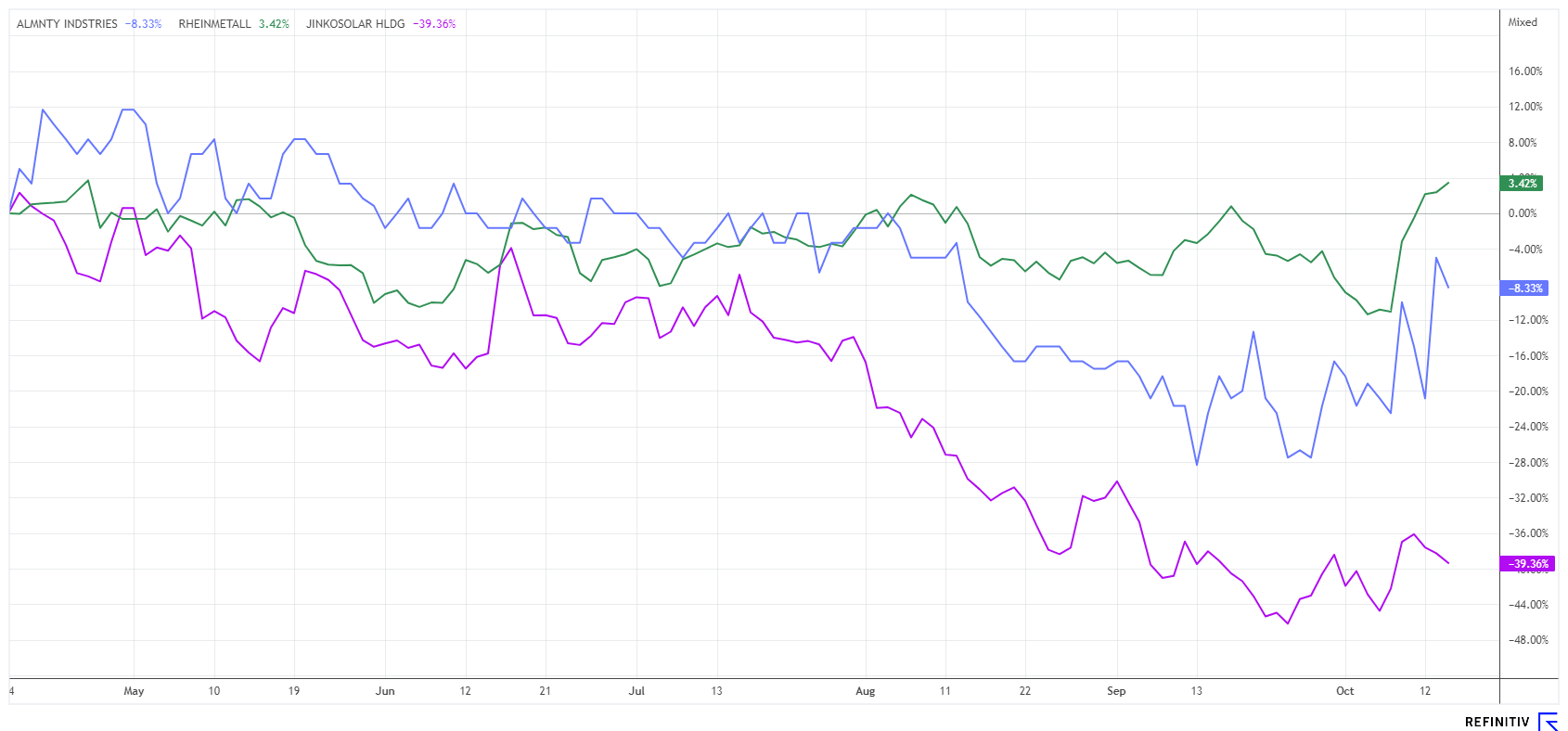

Rheinmetall - Geopolitical uncertainties impact prices

With the renewed flare-up of the Middle East conflict 10 days ago, investors very quickly recalled the strong performance of Rheinmetall & Co. at the beginning of 2022. Although the Rheinmetall share recently entered a prolonged consolidation, it has been taken back into portfolios ad hoc. Does this promise a long-term perspective in addition to quick trading gains? We look at the fundamentals.

For Rheinmetall, analysts expect sales to increase from EUR 7.7 billion to EUR 11.8 billion in the years 2023 to 2026, compared to EUR 6.4 billion in 2022. Thus, within 5 fiscal years, revenues will roughly double. On the surplus side, the momentum is somewhat higher still. Here, earnings per share will rise from EUR 10.62 to around EUR 24.50 - an increase of a massive 130%. This assumes, of course, that management is able to handle the high operating growth, both in terms of personnel and finance. The Rheinmetall share has already made the leap into the DAX 40 index with a threefold price increase but has been treading water since March 2023. The 16 analysts on the Refinitiv Eikon platform unanimously advise an entry into Rheinmetall and expect an average price target of EUR 300 for the next 12 months. Inclined investors might consider the 10% potential gain at prices around EUR 271 or wait for further developments. Conversely, if geopolitical uncertainties were to dissipate, it could be a rapid trigger for profit-taking.

Almonty Industries - Strategic metals take center stage

A major supplier to Rheinmetall in the international context could also be Almonty Industries. The Canadian company owns four tungsten properties and plans to bring its flagship Sangdong mine in South Korea back into production in the next 6 months. From this site, they will be able to supply 5% of the total world consumption of the ultra-hard metal, which accounts for approximately 70% of the world's deposits outside of China.

The hardening and alloying metal wolfram, or "tungsten" in English, with its extreme heat resistance, is essential for manufacturing high-tech applications in the field of energy systems, IT and armor. In recent studies, tungsten oxide is also said to have good properties for future battery technologies. However, the application range of the metal is complex and unique. Some applications require only a small amount but cannot be used without the rare metal. One major consumer is the US, which has built up a strategic stockpile in recent years, and this reserve is now largely depleted.

CEO Lewis Black is well aware of the strategic importance of their properties. In addition to the development of the Sangdong mine, the reactivation of the Spanish mines is also an option for major customers. In the short term, this could be an interesting option. Among the shareholders of Almonty Industries are the CEO, the Austrian Plansee Group, and the German Deutsche Rohstoff AG. The free float is just under 50%. Things could get exciting if new major investors show interest and want to jump on board in the final phase of the Sangdong reactivation. This could potentially drive the stock price significantly higher. The recent increase in trading volumes suggests that some investors may already be positioning themselves. Analyst firms Sphene Capital and First Berlin expect CAD 1.59 and CAD 1.70, respectively, over the next 12 months. From the current level at CAD 0.56, it is a compelling story with tripling fantasy.

Lewis Black on YouTube discussing Almonty Industries' strategic position at the 8th International Investment Forum: Watch now!

JinkoSolar - Strong correction, and now the turnaround?

Another buyer of strategic metals is JinkoSolar. The Chinese high-tech stock has gone somewhat out of fashion in recent months due to the continuously deteriorating margin situation in the solar industry caused by a substantial increase in manufacturing costs. However, price adjustments to reflect the current times have taken place, making the world leader in solar panels attractive again at a significantly lower level.

The entire company is now valued at only USD 1.6 billion. At the beginning of 2022, JinkoSolar still listed its subsidiary Jiangxi Jinko on the Singapore stock exchange, raising around USD 1 billion. Large portions of this should still be available as cash - 5 of 7 analysts on the Refinitiv Eikon platform rate JinkoSolar as a buy. The average target price is USD 51.40, approximately 70% above the current trading price. After a more than 45% price correction from its high, the title now appears attractively priced. The next figures for the third quarter are expected on October 26. **If the timid buybacks of the last few days are to be believed, a positive surprise could be lurking this time.

**Taking the climate transition seriously also requires considering where the large quantities of strategic metals will come from. The known mines are currently running at full capacity, with Russia and China continuing to be the largest suppliers. However, the energy transition depends on stable jurisdictions and deposits in politically friendly areas. A rethink by Western governments is therefore needed as quickly as possible. Almonty Industries can already deliver what Rheinmetall and JinkoSolar still urgently need.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.