December 7th, 2023 | 08:50 CET

Snow chaos and climate madness, who is playing in the Premier League of the energy transition? Nel ASA, Power Nickel and Plug Power under the microscope

Snow chaos and new record highs. While the DAX 40 demonstrates itself as the world's best blue-chip index, the German economy is currently navigating downward. It is not the earnings outlook that is presently driving share prices but the hope of lower interest rates. Meanwhile, the endless climate debates in Dubai continue. Among realists, however, there must be fears that the local oil lobby will not let a German know-it-all put a stop to the lavish margins with fossil fuels. There will, at least, be a friendly Arab nod to the 2050 climate goals and exclusive indulgence for the high-ranking German delegation. Whether this justifies federal expenditure of more than EUR 50 million is something we will leave uncommented. More important is a look at the top titles of the upcoming energy transition - where is the next 100 percenter lurking?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

NEL ASA NK-_20 | NO0010081235 , Power Nickel Inc. | CA7393011092 , PLUG POWER INC. DL-_01 | US72919P2020

Table of contents:

"[...] The collaboration with CVMR offers two primary advantages for Power Nickel: We can cover a larger portion of the value chain in the future, and despite the extensive cooperation with all its positive outcomes, we have remained significantly independent. [...]" Terry Lynch, CEO, Power Nickel

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Nel ASA - Now also exiting the STOXX Europe 600

The Norwegian hydrogen pioneer Nel ASA is facing a dry spell. Although the Q3 figures were still in line with expectations, the 60% drop in the last 12 months has led to a reclassification of the STOXX Europe 600 due to the reduced market capitalization. We should not simply ignore this fact, as membership in a major index is essential for large stocks to be more visible to investors. Due to internal regulations, funds can only invest in certain sectors and weightings. If the shares shrink due to price losses, investment companies and pension funds are forced to eliminate positions. This could prove to be Nel ASA's downfall at the end of the year. Deutsche Börse subsidiary STOXX Limited tracks the largest European companies in the STOXX Europe 600, but as of December 18, Nel ASA will no longer be included following a recent decision. Funds, including many physically replicated ETFs, which track the index directly, must divest Nel shares and purchase shares of newly added companies in proportion.

Operationally, it is also necessary for Nel ASA to show with the figures for the coming quarters that the Company is on the way to breaking even in the medium term and is not burning even more money quarter after quarter. Analysts do not currently expect the Company to break even before 2026. It is now crucial that the share does not fall below the 3-year low of EUR 0.565 technically. The hopeful stock is still a good 10 cents away from this. Investors are currently advised to patiently observe where the share price finds its equilibrium.

Power Nickel - One of the best nickel projects is going full-throttle

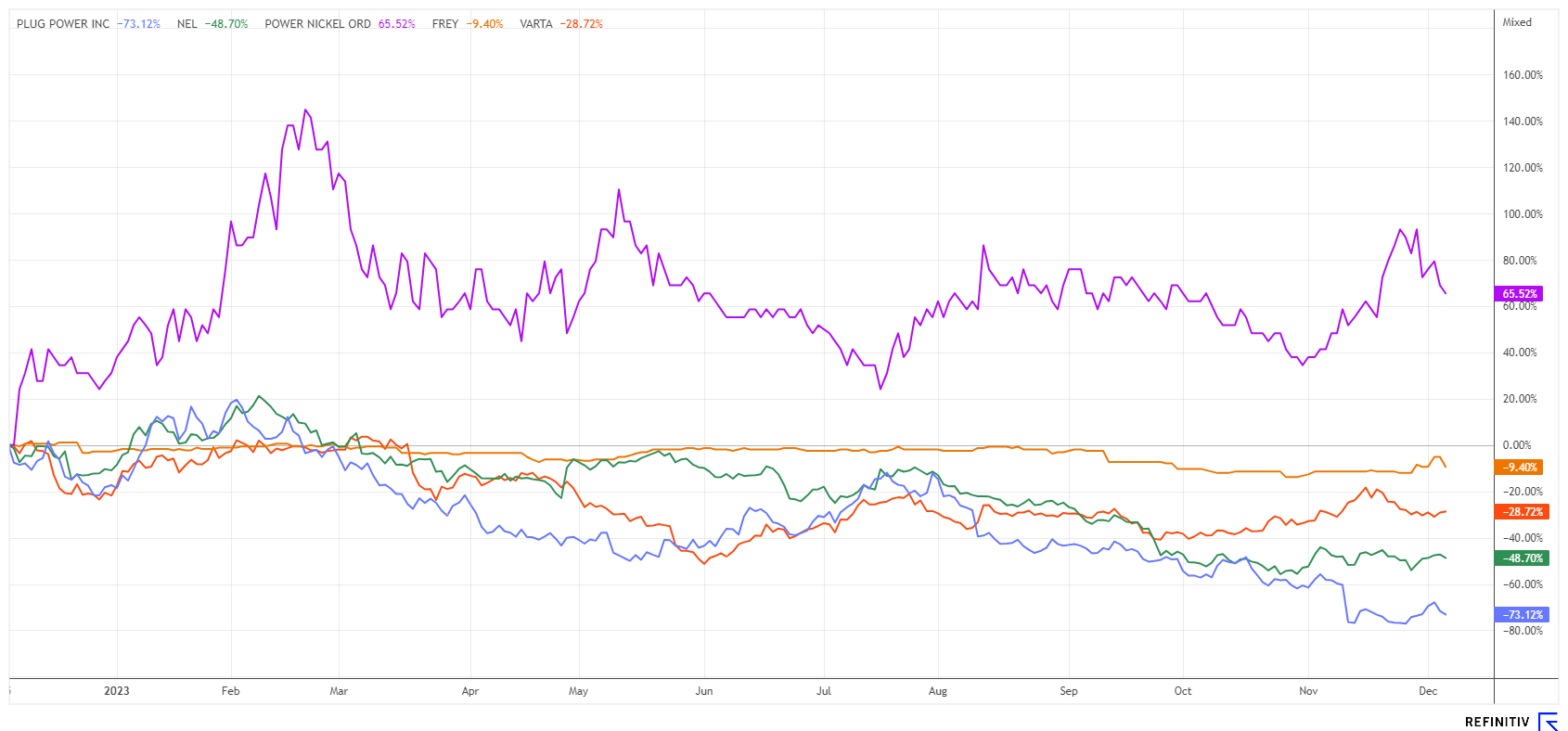

Battery stocks are currently the talk of the town, with European representatives Varta and Freyr Battery bottoming out in the last three months and now attempting a turnaround. The chances of a revival are good, as they have been among the weakest stocks of the 2023 stock market year so far. And when new highs beckon, this usually pulls the laggards upwards, too.

Melancholy is a foreign concept for the Canadian battery metal explorer Power Nickel. North America has recognized its high dependence on Asia and is now mobilizing all efforts to establish the previously one-sided supply relationships on a solid footing. The competitiveness of Western industrialized nations is at stake. However, only a few projects seem promising. Power Nickel owns claims to the high-grade nickel project NISK in Quebec. Excellent accessibility and a stable jurisdiction here make planning for stable mining production possible in the medium term.

As of October, the Company raised a further CAD 2.75 million with a highly-priced capital increase. The financing was completed with a consortium of Quebec investors secured for Power Nickel by Wealth Creation Preservation & Donation Inc. In addition, major shareholder CVMR is conducting several studies on the NISK nickel sulphide PGM project in Quebec with a view to presenting a feasibility study on the project in the second quarter of 2024. The sails are set for 2024.

Last week, Power Nickel also announced its first NI 43-101 mineral resource estimate, which shows that the Canadians have a total of 7.2 million tons of indicated and inferred mineral resources grading 1.05 to 1.35% nickel equivalent. The share is currently fluctuating between CAD 0.24 and 0.28 with high turnover, valuing the flagship property at around CAD 37 million. The current "tax-loss season" is well suited for risk-oriented investors to build up a medium-term portfolio position.

Plug Power - Joe Biden's budget is far too small

Behind the sharp sell-off of Plug Power shares in recent days is a previously secret draft from the US Treasury Department on the current funding situation for climate-friendly projects. It concerns the tax credits for the hydrogen industry planned by the Biden administration. Apparently, these are nowhere near enough to help the still-young energy sector become a profitable and competitive business. That is because, in addition to public funding, a number of private initiatives would be needed to help along the way. However, private investors do not willingly participate in projects that are loss-making for years and only generate returns in the long term.

On top of this, there was a surprising downgrade by the US investment bank Morgan Stanley, which reduced its rating from "Neutral" to "Underweight" and cut its 12-month price target from USD 3.50 to USD 3.00. After a brief rally, Plug Power's share price immediately corrected downwards again and, at USD 4.12, is only just under 12% above its three-year low of USD 3.42. The popular hydrogen stock is currently only suitable for traders who constantly monitor their entry and stop prices. Technically, the share becomes interesting only if it can rise above USD 5.80 with significant momentum. Therefore, remain cautious.

**GreenTech and battery stocks went hand in hand for a long time. At some point, it became clear that the development of industrial hydrogen would take years and consume many billions. The energy solutions sector is a little more relaxed. The protagonists, Freyr and Varta, can at least stabilize themselves; the future producer of battery metals, Power Nickel, benefits from its flagship project, NISK, in Quebec and its loyal investor base.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.