September 26th, 2025 | 07:25 CEST

Shooting down Russian drones and fighter jets? NATO keeps its focus on Rheinmetall, Almonty and Hensoldt!

On the financial markets, Russian provocations involving jet and drone overflights are primarily perceived as a security risk. Such actions increase political instability and often trigger a flight to safe havens such as gold, government bonds, or the US dollar. At the same time, defense stocks and companies in the security sector tend to benefit, as investors anticipate rising defense spending in Europe and within NATO. For the broader equity market, the increased risk often translates into higher volatility and temporary price setbacks. In the long term, such threat scenarios are factored into risk premiums and valuation models, leading to more selective capital allocation in security-related sectors. Here are a few ideas.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

RHEINMETALL AG | DE0007030009 , ALMONTY INDUSTRIES INC. | CA0203987072 , HENSOLDT AG INH O.N. | DE000HAG0005

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Almonty Industries – Tungsten and molybdenum as geopolitical leverage

Critical raw materials such as tungsten have long since evolved from simple industrial materials to strategic factors that influence prices, supply chains, and geopolitical power relations. For decision-makers in defense, industry, and climate policy, secure access is now of central importance. Global supply remains tight: reserves are shrinking in the US and Europe, while demand from the defense and cleantech sectors is growing steadily. China continues to dominate around 90% of global processing, leading to bottlenecks and causing prices to rise by around 50% since 2023.

Against this backdrop, Almonty Industries' Sangdong project in South Korea plays a key role. It demonstrates how Western countries can reduce their dependence on China through targeted raw material strategies, supply chain diversification, and alliances. Almonty has now launched an extensive drilling program at its molybdenum project in Yeongwol to confirm potential reserves and lay the foundation for future production. A total of 26 drill holes covering approximately 11,700 meters will be drilled to reevaluate known mineralized structures and update resource estimates.

Molybdenum is becoming increasingly important: in addition to its use in aerospace, defense, and nuclear technology, it is increasingly being used in semiconductors and renewable energy. Accordingly, the spot price has risen by 15% since the beginning of the year to USD 25.97 per pound. In view of the critical supply situation, the South Korean government has called on private companies to develop additional sources. Almonty already has an exclusive supply agreement with SeAH M&S, which guarantees the purchase of 100% of future production. CEO Lewis Black sees Sangdong as making a significant contribution to South Korea's raw material security and providing an economic boost to the region through new jobs and population growth. At the same time, Almonty's tungsten mine in Sangdong remains the Company's core project. At full production capacity, it could supply more than 80% of global tungsten production outside China, closing a critical gap in Western supply chains.

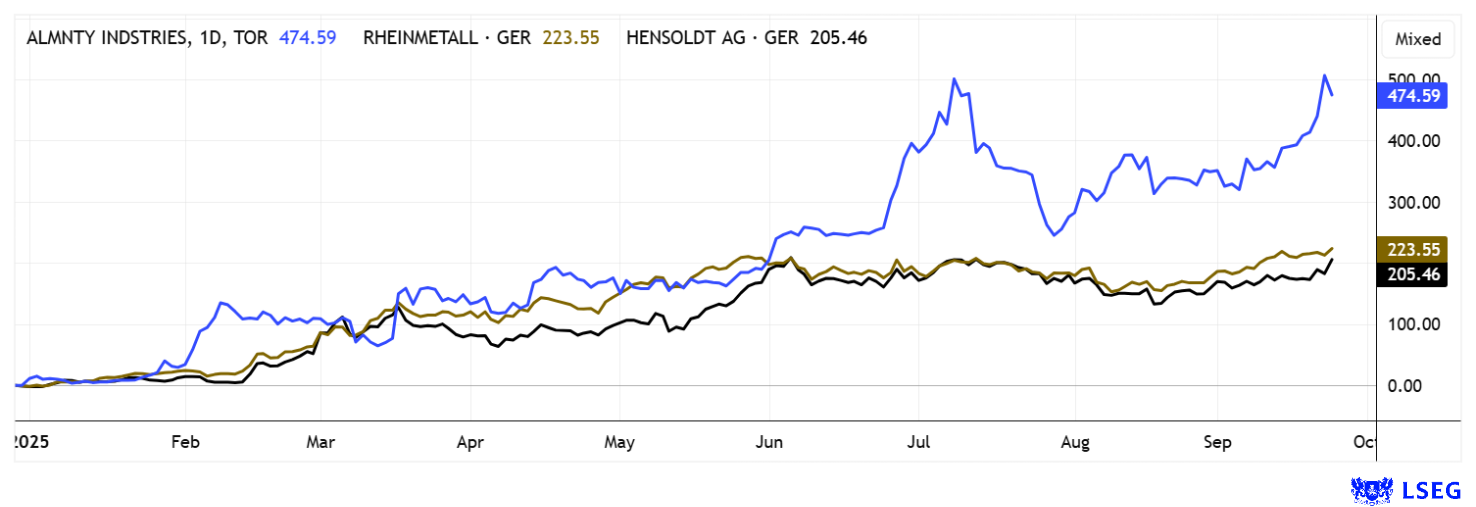

Almonty Industries combines targeted resource development with long-term supply contracts, positioning itself as an indispensable partner for Western industrial and defense strategies. After a brief consolidation, the stock is already on its way to new highs. Any hesitation in getting in will cost money!

Rheinmetall – High demand for ammunition

Rheinmetall is also a major consumer of tungsten. Yesterday, it was announced that the Düsseldorf-based defense contractor has sealed the deal to build a new ammunition factory in a NATO country. Details have not yet been disclosed, but at the end of August, a new plant was opened in Unterlüß, Lower Saxony, which is set to become the largest ammunition factory in Europe when operating at full capacity. The Company also manufactures artillery shells in Spain and plans to build similar facilities in Lithuania, Romania and Bulgaria. The DAX-listed company is responding to increased demand from the German Armed Forces, other Western armies, and the Ukrainian armed forces in light of the ongoing threat from Russia. Rheinmetall recently announced its intention to produce a total of around 1.5 million artillery shells per year from 2027 onwards.

Since the end of May, Rheinmetall's share price has been fluctuating in a pronounced sideways phase between EUR 1,480 and EUR 1,980. Although second-quarter results fell slightly short of expectations, management confirmed its positive outlook for the coming years. The market is now becoming increasingly aware that the rapid upward trend of recent months has paused for the time being and that it may take some time before a new impetus for rising prices emerges. However, those who have the necessary patience could be rewarded in the long term, given the analyst estimates, which, according to LSEG, range up to EUR 2,300 with an average 12-month target of EUR 2,125. However, it remains to be seen what developments will influence the share price in the meantime.

Hensoldt – Well-positioned for NATO's spending spree

The current situation at Hensoldt shows a company in strong growth with a record order backlog of EUR 7.07 billion, which secures capacity utilization and future growth well beyond 2035. In the first half of 2025, revenue rose by around 11% to EUR 944 million, despite minor operational challenges. The book-to-bill ratio of 1.5 signals that Hensoldt is winning significantly more orders than it is generating revenue, which is a positive sign for the future. The operating margin is around 18%, with a planned free cash flow of 50 to 60% of EBITDA. Politically, the Company is benefiting from growing defense budgets in Germany and Europe, supported by geopolitical tailwinds.

At the DSEI 2025 trade fair in London, Hensoldt presented TAROSS, a modular and scalable electro-optical sensor box for target acquisition and reconnaissance, which was specially developed for remote-controlled weapon stations, medium-caliber turrets, and unmanned vehicles. TAROSS integrates seamlessly into existing platforms and has a direct interface to Hensoldt's Ceretron, which fuses sensor data to support decision-making processes. The system represents the next generation of networked combat operations with safety benefits for soldiers through precise reconnaissance from a safe distance. Management confirmed its 2025 annual forecast with further steep revenue and profit growth, but the high valuation of the stock calls for a degree of caution.

Growing threats continue to fuel investment in defense and military technology. Rheinmetall and Hensoldt are already fully booked for the next 10 years, leading to valuations of 4 to 6 times sales. Tungsten-molybdenum producer Almonty Industries supplies valuable strategic metal components and can once again build on the upswing scenario of the first half of the year.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.