April 8th, 2024 | 07:00 CEST

Sell AI now and buy turnaround stocks: Nel ASA, Royal Helium, Linde and Plug Power

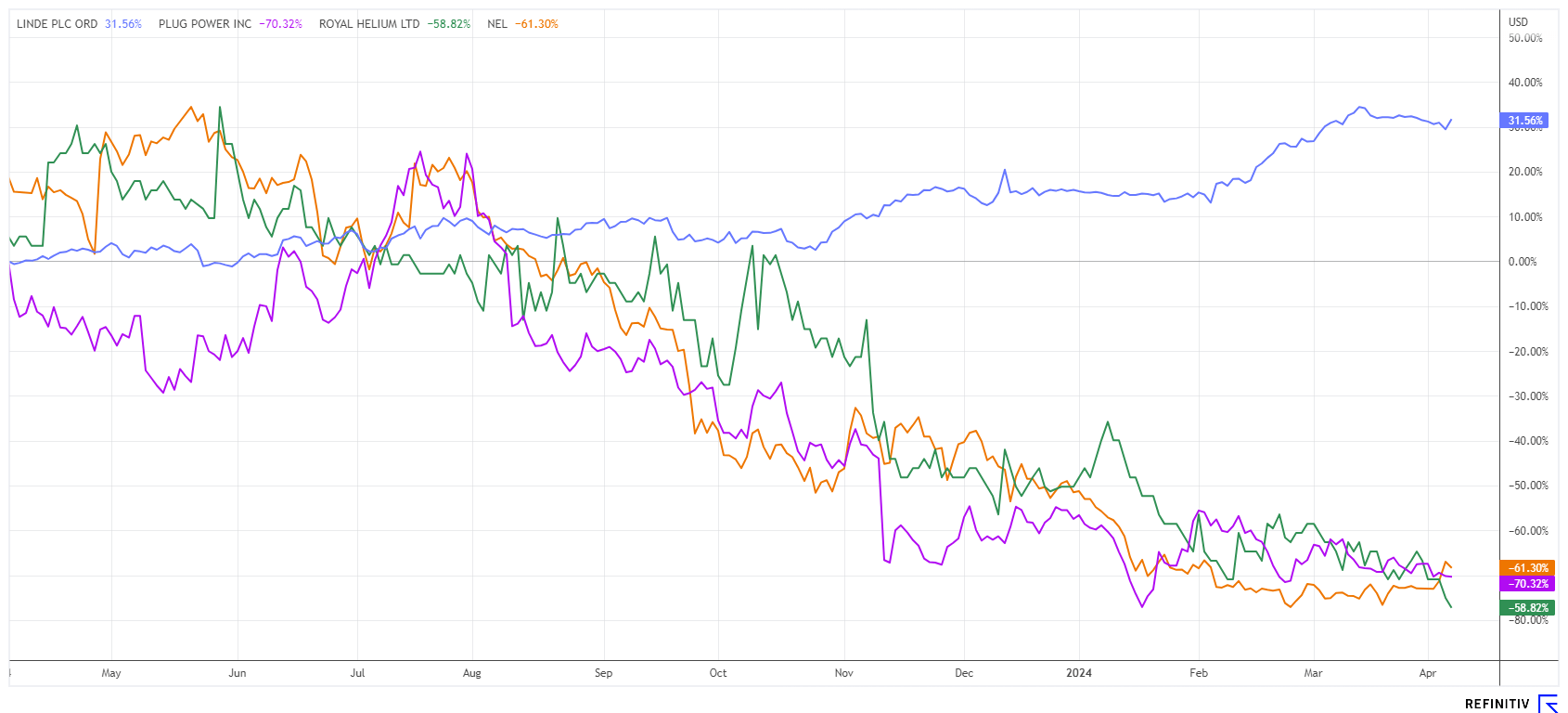

The stock market gives and takes away. When it comes to artificial intelligence and high-tech, investors have been able to make gains of up to 600% in recent months. Stocks such as Nvidia and Super Micro Computer are on the hit list of all fund managers worldwide. However, the first quarter is over, and there is no immediate reason to continue buying overpriced AI stocks. Last Thursday saw the first shot across the bow, with the NASDAQ 100 index plummeting by over 2% within three hours. Technically, the upward momentum is already waning, leading to increased profit-taking. If many investors do it simultaneously, it will result in a hefty correction. Do not wait too long; we present some interesting reallocation ideas.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

NEL ASA NK-_20 | NO0010081235 , ROYAL HELIUM LTD. | CA78029U2056 , LINDE PLC EO 0_001 | IE00BZ12WP82 , PLUG POWER INC. DL-_01 | US72919P2020

Table of contents:

"[...] We expect the first three wells to be drilled, cased, completed and tested by the second week of March [...]" Andrew Davidson, CEO, Royal Helium Limited

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Linde plc - The heaviest German-rooted stock is listed in London

The heaviest German stock by far is not listed in the DAX 40 index but in London due to its designation as a PLC. The former technology pearl from Munich merged with the American Praxair in 2018, and the stock exchange listing was then moved to London. This marked the end of a traditional German company and simultaneously the birth of the world's largest provider of industrial gases, surpassing the French company Air Liquide. Under the new umbrella, Linde PLC is now the global market leader for gases such as nitrogen, oxygen, argon, helium and hydrogen, which are used in many industrial processes.

The share price has already tripled since 2018, but fundamentally, revenue has not increased significantly since 2022 - a sign that the global economy is faltering. After reaching USD 32.8 billion in revenue in 2023, an increase of only 5% to around USD 34.5 billion is expected for the current year. The EBIT margin is expected to stabilize at around 25% over the next few years, while the dividend payout will remain relatively low at 1.2%. In terms of the chart, a peak was formed in March at around USD 440. With a current 2024 P/E ratio of 30 and a sales valuation of just under 7, the share is anything but cheap, especially as orders for industrial primary products fall in the event of major recessions. At currently just under EUR 430, analysts on the Refinitiv Eikon platform have already set their sights, indicating that it is time to harvest the overripe fruits.

Royal Helium - An active start to 2024

A future supplier of industrial gases is Canadian explorer Royal Helium Ltd, an exploration, production and infrastructure company focused on developing and producing helium and associated gases. The Company controls over 4,000 sq km of prospective helium concessions in southern Saskatchewan and southeastern Alberta.

There is currently a global undersupply of helium, as known prospects are scarce and undeveloped. The gas is used in critical high-tech applications and is technically non-renewable. In the current context of de-globalization, Royal Helium, as a North American supplier, fits well into the list of strategically valuable companies that will be able to provide critical raw materials on a secure supply basis in the future. Helium is important for space travel, fibre optics and the industrial production of high-tech and medical technology. The number of suppliers worldwide is very limited, especially as hardly any free material comes onto the market due to existing supply contracts. Canada has the fifth largest helium reserves in the world and is increasingly coming under the spotlight of international technology producers.

Now, Royal Helium has signed its first offtake agreement for the sale of food and beverage grade carbon dioxide from its Steveville processing and purification facility. David Young, the Company's president, explains the strategic relevance: "This agreement represents a significant expansion of the economics of Royal's first plant and demonstrates the Company's commitment to growth and innovation. This agreement not only moves us forward in our quest to sell a diversified supply of value-added gases but is also a testament to the diverse commercial products produced at our facility, providing economic cash flow streams to our shareholders." RHC's share price has recently consolidated at CAD 0.15, valuing the Company at a low EUR 28 million. The outlook for Royal Helium is excellent in the current environment of fragile supply chains and securing North American feedstock supplies.

Nel ASA and Plug Power - The catch-up begins

For some time now, we have been evaluating the fundamental key figures of Nel ASA and Plug Power. In the years 2021 to 2023, we had to conclude that they were overpriced and hyped. However, the situation has eased in recent weeks. Due to ongoing losses in the sector, both stocks have fallen by between 80% and 95% at their peak. At the same time, the balance sheet has improved significantly, and the liquidity situation appears to have eased for the time being.

With a market capitalization of 760 million EUR, Nel ASA now only shows a price-to-sales ratio of 4.5 for 2024, while the three times higher valued Plug Power has a ratio of only 2. Operationally, both companies are expected to reach the breakeven point in 2027. The prerequisite for this assumption remains that governments worldwide stick to their decarbonization programs and continue to subsidize green hydrogen technology. Private investors tend to stay away from the sector due to ongoing losses. From a chart perspective, the situation looks much better now than at the start of the year. Nel ASA has already gained 15% from its low point, while Plug Power's multibillion-dollar capital increase is likely still weighing on the market. Those who buy cautiously now should keep their nerve and act with tight stops, as the charts are still bottoming out. We will continue to report on this.

The valuation on the stock markets is already very advanced for many high-tech stocks. Cautious investors are taking profits and re-evaluating their investments. Hydrogen stocks are still in an extended technical bottoming process. Royal Helium has made a good start to 2024 and should attract further attention through its current projects. Linde plc - The heaviest stock with German roots is listed in London.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.