November 23rd, 2023 | 07:20 CET

Saturn Oil + Gas, Rheinmetall, Bayer - Energy, Defense, Healthcare: Where short-term returns await

In Germany, the federal government put its spending on hold, a day after the Federal Constitutional Court ruled that the reallocation of EUR 60 billion of unused debt from the pandemic era to the Energy and Climate Fund was unlawful. Europe's largest economy is shrinking due to rising energy prices and trade tensions. At the same time, North America, with stable oil companies such as Saturn Oil & Gas, presents an attractive investment opportunity for investors. Rheinmetall is experiencing a target price high of EUR 370 and flirting with long-term prospects in the US. At the same time, Bayer grapples with legal challenges and the failure of the blood thinner 'asundexian'. We look at where an investment may be worthwhile now.

time to read: 7 minutes

|

Author:

Juliane Zielonka

ISIN:

Saturn Oil + Gas Inc. | CA80412L8832 , RHEINMETALL AG | DE0007030009 , BAYER AG NA O.N. | DE000BAY0017

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

Juliane Zielonka

Born in Bielefeld, she studied German, English and psychology. The emergence of the Internet in the early '90s led her from university to training in graphic design and marketing communications. After years of agency work in corporate branding, she switched to publishing and learned her editorial craft at Hubert Burda Media.

Tag cloud

Shares cloud

A jolt is going through Germany. A jolt of fear, not of movement. A day after the German Federal Constitutional Court ruled that it was wrong to shift 60 billion euros of unused money for the pandemic in 2021 into the Energy and Climate Fund (under the administration of Economics Minister Robert Habeck (Greens), the German government, led by Finance Minister Lindner (FDP), has decided to freeze public spending for the rest of the year.

Europe's largest economy, Germany, is shrinking due to rising energy prices and trade tensions that are challenging its export-oriented business model. "German industry views the current political situation with great concern," says the President of the Federation of German Industries (BDI), Siegfried Russwurm, to the news channel N-TV. The numerous unanswered questions resulting from the decision of the Federal Constitutional Court "are extremely unsettling for entrepreneurs in an already difficult economic and global situation."

Commodity Boom: Saturn Oil & Gas experiences intensified development activities in the last quarter

So, where to invest? It is here where North America comes into play. As long as the energy transition continues to cause more unrest than profits, investor icons such as Warren Buffett are fleeing to solid oil companies. The US and Canada are exemplary economies that have understood the need for solid oil and gas transitional periods for local companies. According to the US Department of Energy, oil and gas serve:

-

Affordable and accessible domestic oil and gas energy supplies inject hundreds of billions of dollars into American industry, supporting new job creation, infrastructure development, and economic opportunity in communities across the country.

-

Favorable energy prices, made possible by our comprehensive oil and gas supply, foster private investments in the US and contribute to additional economic growth.

Saturn Oil & Gas Inc. is a growing Canadian energy company focused on delivering positive returns to shareholders through the responsible development of high-quality, light oil-focused assets. Saturn has built an attractive portfolio of commercially viable, low-decline assets in central Alberta, southeast Saskatchewan and west-central Saskatchewan, offering an extensive list of long-term economic drilling opportunities in multiple zones.

Saturn has increased its development activities in the last quarter due to rising oil prices. The Company invested over CAD 26 million in drilling and completions in the third quarter of 2023, exceeding the CAD 23 million spent in the first half of the year. In this quarter, Saturn initiated its first drilling program in Alberta to develop Cardium light oil in central Alberta and Montney light oil in northern Alberta. Saturn was active and developed all four main operating areas in Alberta and Saskatchewan during the quarter, with a total of 18 (net 15.3) new wells drilled. The Company continued to reduce debt and repaid CAD 50.7 million in the quarter. Those interested in delving deeper into this investment case will have the opportunity to ask Vice President Kevin Smith questions in person during his live investment presentation at the 9th International Investment Forum on December 5 at 6 pm CET (12 pm ET, 1 am HKT). You can register for free here.

Analyst forecast: Rheinmetall benefits from bullish market environment - price target rises to record level

Following Rheinmetall's "very positive capital markets day", the US bank JP Morgan has raised its price target from EUR 340 to EUR 370 and maintained its rating at "Overweight". Analyst David Perry increased his forecasts for earnings up to 2027 by up to 15% and expressed optimism about the future prospects. The expected cash inflows of the defense and automotive supplier were also adjusted and revised upwards. With a new price target of EUR 370, JP Morgan has now set the market's highest forecast price target for Rheinmetall.

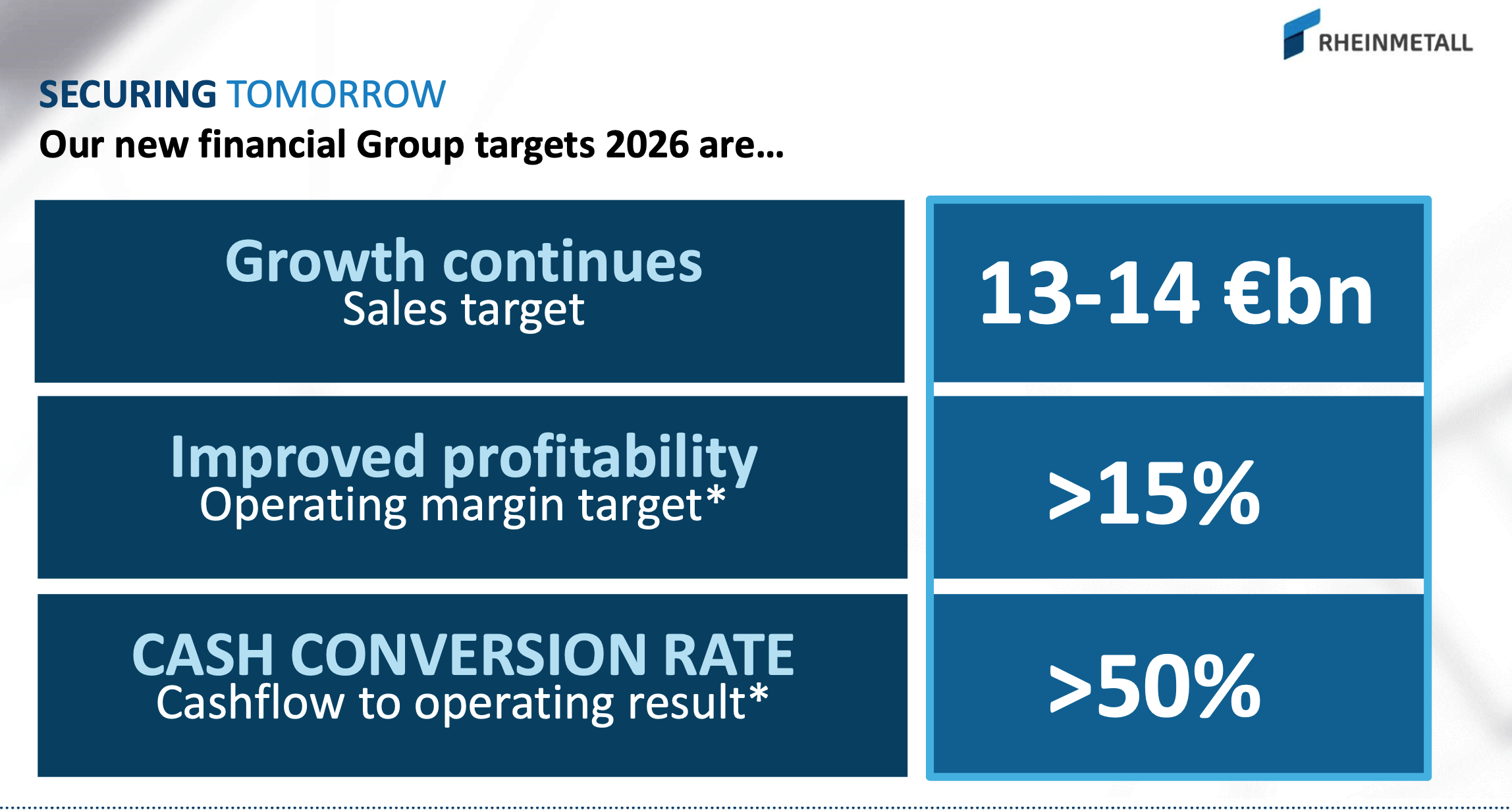

Earlier this week, Rheinmetall announced in a presentation at the Capital Market Day that they expect annual sales to almost double to EUR 13-14 billion by 2026, driven by rising defense budgets. In the same presentation, a forecast was also made for operating margins of more than 15% by that year.

For the current year, Rheinmetall estimates that sales figures will be between EUR 7.4 billion and EUR 7.6 billion. These optimistic forecasts reflect the Company's continued growth and its confidence in the market's future development. Incidentally, these defense machines are not powered by electric motors but by conventional combustion engines.

The US is also on Rheinmetall's list of potential future home countries by the end of this decade. Rheinmetall's Common Tactical Trucks (CTT) are currently undergoing the XM30 test, which has entered the final test phase. The XM30 is a combat vehicle specifically designed for the US Army. The Company is recording an annual growth rate in sales (Sales CAGR) of around 55%. The test phase of the next-generation howitzer with the L52 gun was also successful. These developments mark important milestones and underline Rheinmetall's positive outlook in the field of tactical vehicles and artillery systems.

In addition to defense and energy, anyone looking at pharmaceuticals, agriculture and consumer health cannot ignore Bayer AG. The Company has suffered two severe setbacks in recent days. On the one hand, a lawsuit worth billions is weighing on the agricultural division. Problem child 'RoundUp™' is once again making headlines in the US. On November 19, 2023, a jury in Missouri ruled that Bayer must pay USD 1.56 billion to four plaintiffs. The verdict could force the Leverkusen-based company to rethink its legal strategy. The jury found Bayer's Monsanto division liable for negligence, design defect and omission because the plaintiffs were not adequately warned of the dangers of 'RoundUp™'. The enumerated injuries included cancer for the first time.

There has been controversy surrounding the herbicide since the WHO's Cancer Research Agency's assessment in 2015, which classified glyphosate as probably carcinogenic to humans. However, other international agencies, including the US Environmental Protection Agency (EPA) and EU agencies, do not consider glyphosate carcinogenic. In addition, the use of glyphosate in Europe has been extended by 10 years despite controversial discussions. You can find more in-depth research on Bayer AG here.

In the pharmaceutical division, a promising molecule failed in the late-stage study of all things. Great expectations were placed on 'asundexian', Bayer's blood thinner for patients with atrial fibrillation and an increased risk of stroke. The drug was expected to generate annual sales of more than EUR 4.5 billion and was specifically designed to compensate for the future loss of revenue from 'Xarelto'. The European patent protection for 'Xarelto' expires in 2026.

The Head of the Pharmaceuticals Division, Stefan Oelrich, said in a digital conference that his team found a "significant difference" in the efficacy of the experimental anticoagulant 'asundexian' compared to Eliquis from Bristol-Myers Squibb and Pfizer when testing the stopped trial. Nevertheless, plans remain to launch the product in 2026, albeit for a smaller patient group, Oelrich added.

CEO Bill Anderson added while on an analyst call on Tuesday, "Anything that effects future cash flows negatively just makes it a little tighter". "The impact of these recent events does not change our strategic options. It might just mean that some of those conditions are a little tighter." So the only remaining option may be to sell the low-risk Consumer Health division to a competitor to increase the cash position.

Investments in stable oil companies such as Saturn Oil & Gas in North America could be an attractive option given the uncertain economic situation in Germany. Saturn Oil & Gas, a growing Canadian energy company, stands out with a strategic focus on high-quality, light oil-oriented assets. The Company has successfully invested in drilling and completions, particularly in Alberta and Saskatchewan. VP Kevin Smith will be available to investors for Q&A during a live investment presentation on December 5, 2023. Click here for free registration. Armaments manufacturer Rheinmetall is literally going through the roof because of the many conflict zones worldwide and expects sales to double by 2026. The Group plans to relocate to the US by the end of the decade. Bayer AG, on the other hand, is facing challenges due to a billion-dollar lawsuit in the US and the setback in the late-stage study into the lack of efficacy of 'asundexian', an anticoagulant. The Head of the Pharmaceuticals Division, Oehlrich, nevertheless emphasizes the continuation of plans for 'asundexian', albeit for a smaller patient group. CEO Bill Anderson is discussing strategic options, including a possible sale of the Consumer Health division to increase cash reserves. The Group's net debt currently makes the share a risky investment candidate. Further details can be found in the report from November 21, 2023.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.