December 22nd, 2022 | 15:35 CET

Saturn Oil + Gas, BP, First Hydrogen - Potential recognized

The high volatility on the stock markets is likely to continue in the coming year, as the economic and geopolitical situation is too uncertain. This, in turn, offers enormous opportunities to acquire promising stocks at discounted levels that have received little attention from the public. With the ongoing correction in the oil sector, which major analyst firms believe is likely to regain strength in the US in the coming year, there are attractive companies, particularly from the second tier, that should significantly outperform the broader market in the expected upturn.

time to read: 4 minutes

|

Author:

Stefan Feulner

ISIN:

Saturn Oil + Gas Inc. | CA80412L8832 , BP PLC DL-_25 | GB0007980591 , First Hydrogen Corp. | CA32057N1042

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

Stefan Feulner

The native Franconian has more than 20 years of stock exchange experience and a broadly diversified network.

He is passionate about analyzing a wide variety of business models and investigating new trends.

Tag cloud

Shares cloud

Saturn Oil & Gas - Analyst ignites share price fireworks

One of these undiscovered gems is the Canadian oil producer Saturn Oil & Gas. Within less than two years, this Company was able to expand its production by a factor of 50 to around 12,000 barrels of oil equivalent per day thanks to two transformative acquisitions. This was already evident in the figures for the third quarter. Here, average production has already reached 10,965 oil equivalent per day, an increase of 57% compared to 6,970 BOE/d in the third quarter of 2021. Operating income also increased correspondingly by 179% to CAD 50.3 million on an adjusted basis. On a fully diluted share basis, net income was CAD 2.87 in the quarter, up from CAD 2.30 after 9 months. In contrast, the share price is hovering around CAD 2.88.

Of course, this undervaluation compared to the peer group was noticed by several analyst firms. First Berlin Equity Research started the initial coverage and set Saturn Oil & Gas to "buy" with a target price of CAD 7.00. In addition, an initial study by Echelon Partners, which included the oil producer with a "buy" rating and a price target of CAD 6.00, provided for a real price fireworks in the amount of 25%. Analyst Tom Hems sees the title as "a differentiated growth strategy and a compelling valuation for investors." The expert commented in a report on The Globe and Mail website:

"We expect Saturn's execution of growth initiatives and successful drilling results to attract a broader investor base and command a valuation closer to the peer group average. However, even in a no valuation adjustment scenario, we still see tremendous upside potential of 100% given the strong FCF and growth profile we forecast through 2024. Saturn leads the oil-weighted peer group with a DAFCF [debt-adjusted free cash flow] yield of about 50% in 2023, more than double the peer group average of 19%. SOIL is also trading well below our estimated PDP NAV on Strip, which we believe is a compelling buy signal."

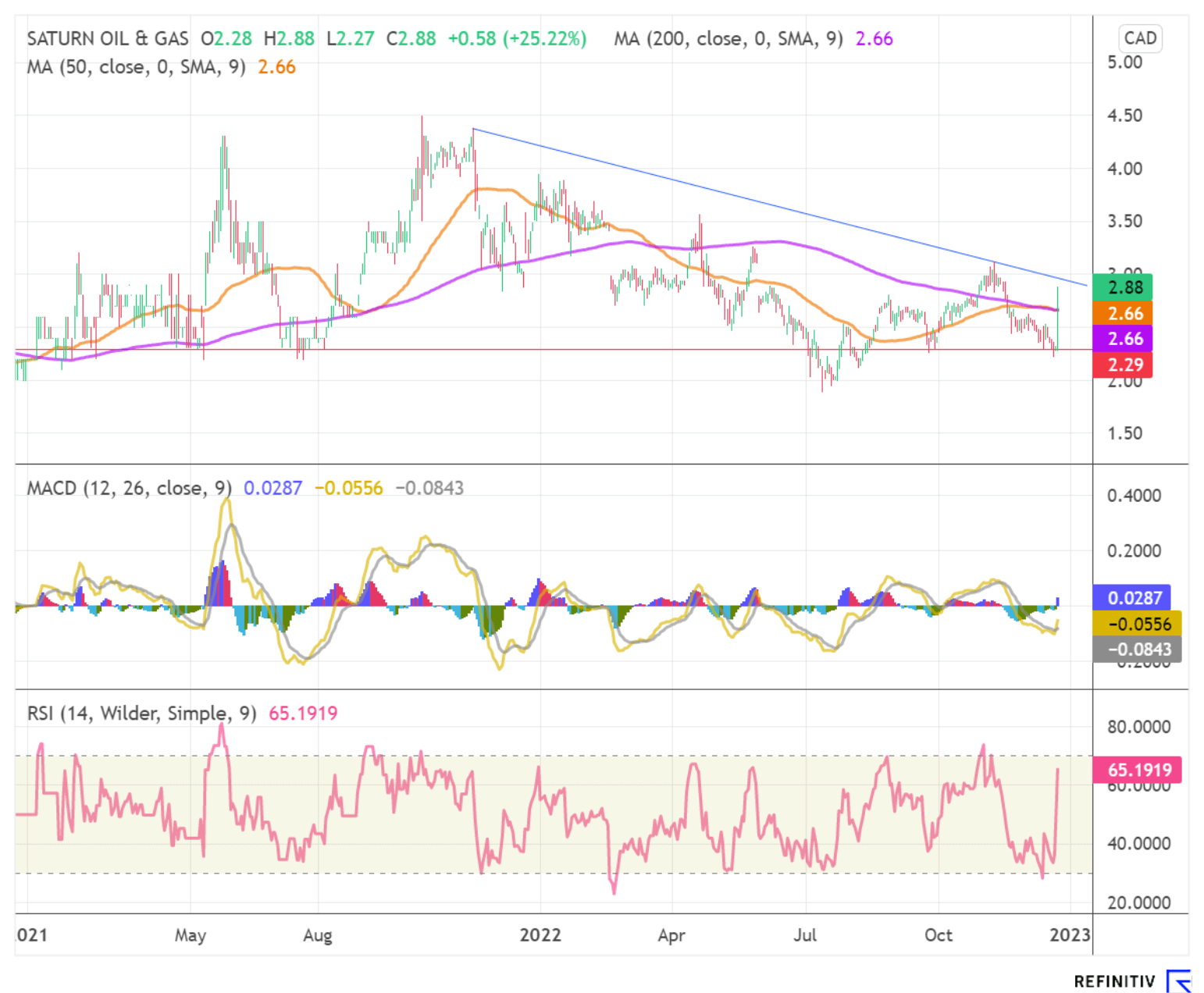

The price jump allowed the Canadian share to easily break the 200-day line at CAD 2.66. The next important hurdle to overcome would be the downward trend at CAD 2.88 formed since the end of 2021. Should this be sustainably broken, the next resistance area would only be around CAD 3.50. This should be supported by the indicators. The trend follower MACD shows positive divergences and recently generated a buy signal.

BP - Analysts positive

In contrast to the speedboat Saturn Oil & Gas, the British energy company looks like a heavy tanker. Nevertheless, analyst consensus remains positive. Canadian bank RBC continues to see BP as an outperformer but cut its price target from GBP 600 to GBP 550. Although the oil and gas industry has been buoyed by positive earnings revisions over the past two years, it still holds upside potential, analyst Biraj Borkhataria wrote. He said it is becoming increasingly apparent that the energy transition will not be linear or even orderly, and the sector is well positioned to benefit as the cost of capital normalizes.

In contrast, US-based analyst firm Jefferies raised its price target for the UK stock to GBP 500 from GBP 490, with the investment rating left at "hold." For the coming year, analyst Giacomo Romeo expects higher oil prices but lower gas prices than before.

Currently, the stock is trading at GBP 482.65. If it breaks above the high for the year at GBP 503.30, the way should be clear to the all-time high at GBP 603.60.

First Hydrogen - Series production in sight

While oil stocks were bullish last year, mainly due to the outbreak of the Ukraine conflict, the hydrogen sector was stuck in a deep correction. Global market leaders such as Plug Power, down 57%, and McPhy Energies, down 41%, lost more than half of their market value. In contrast, the stock of hydrogen newcomer First Hydrogen was a beacon, with an annual performance of over 185%. As can be read in a detailed update, the Canadians are well on their way to conquering the mass market with zero-emission, long-range hydrogen-powered vehicles in the UK, EU and North America.

The unveiling of the new next-generation vehicle is expected to bring the next milestone. For Steve Gill, CEO of Automotive at First Hydrogen Limited, it is clear that "our next generation light commercial vehicles provide a holistic solution for commercial fleet operators who want to be environmentally friendly and cost-effective. We are excited about our new designs and look forward to showcasing them soon."

Alongside the existing partners AVL Powertrain and Ballard Power, this is to be achieved with the EDAG Group as a design partner. EDAG is the world's largest independent engineering service provider for the international mobility industry and brings support in the areas of vehicle technology, electrics/electronics and production solutions.

The high degree of fluctuation on the stock markets always provides attractive entry opportunities to profit disproportionately from the next upward wave. Several analyst houses agree on Saturn Oil & Gas' undervaluation. First Hydrogen is planning vehicles for series production with a new partner, and BP continues to shine with relative strength.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.