March 23rd, 2023 | 07:54 CET

RWE, Myriad Uranium, Cameco - The best environment ever

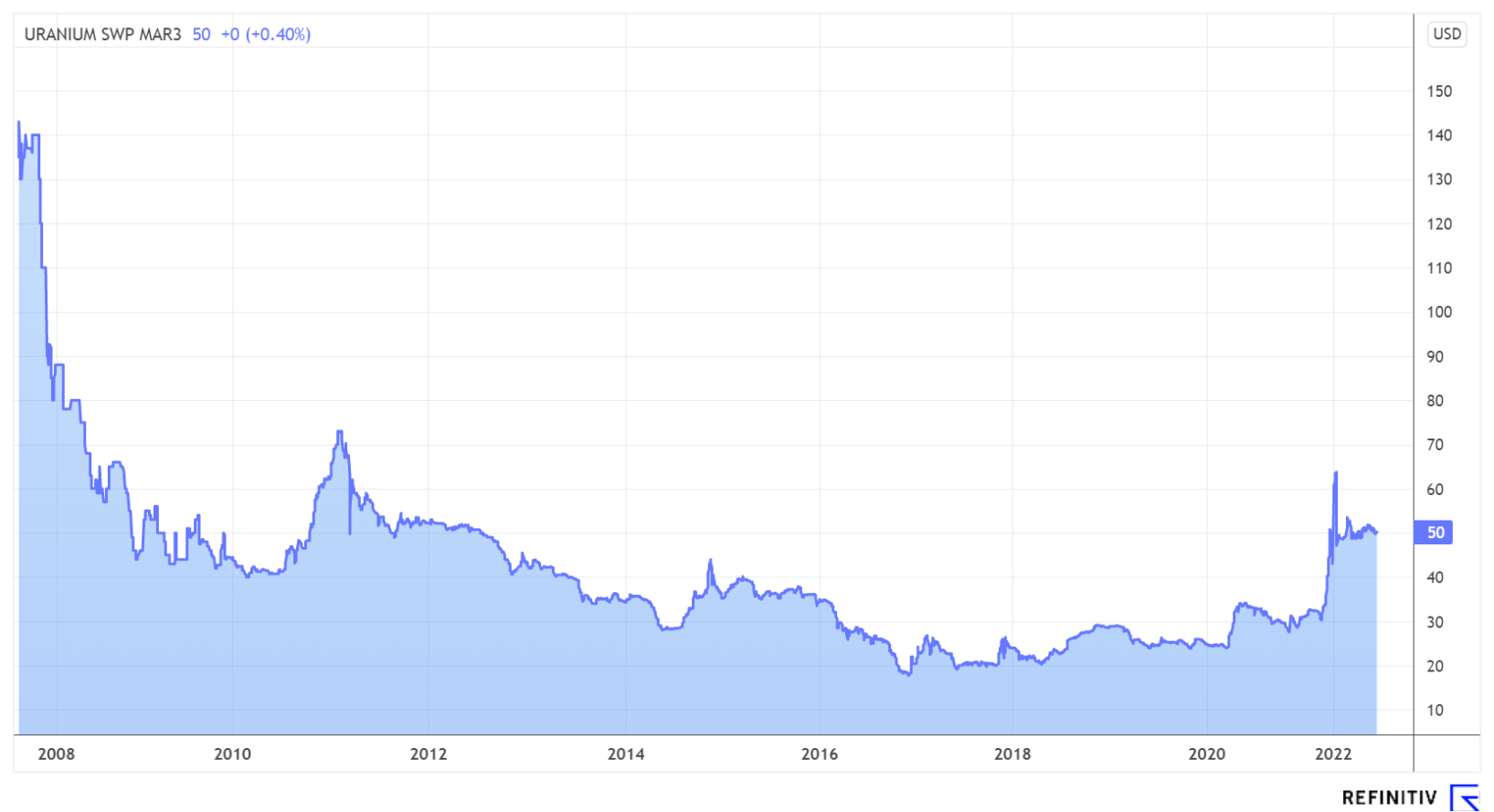

The geopolitical events of 2022 have heightened concerns about the security of supply and, combined with the ongoing focus on climate change, have created transformative tailwinds for the nuclear power industry. While Germany's last three nuclear reactors face shutdown, major industrialized nations are relying on zero-carbon nuclear power. As a result, the uranium price should be poised for a brilliant comeback after a bear market that has lasted for years.

time to read: 3 minutes

|

Author:

Stefan Feulner

ISIN:

RWE AG INH O.N. | DE0007037129 , MYRIAD URANIUM CORP | CA62857Y1097 , CAMECO CORP. | CA13321L1085

Table of contents:

Author

Stefan Feulner

The native Franconian has more than 20 years of stock exchange experience and a broadly diversified network.

He is passionate about analyzing a wide variety of business models and investigating new trends.

Tag cloud

Shares cloud

Cameco - Best conditions

Canada's Cameco, based in Saskatoon, Saskatchewan, is the world's largest uranium producer alongside Kazakhstan's Kazatomprom, operating several uranium mines in Saskatchewan and a uranium enrichment refinery and uranium conversion plant located in Ontario.

After a weak 2021 with a net loss of CAD 103 million, Cameco ended last year with a significant gain of CAD 89 million. CEO Tim Gitzel is extremely optimistic about the current year. He says the demand for nuclear energy provides "the best fundamentals the nuclear fuel market has ever seen." A year ago, the Russian invasion of Ukraine set in motion a geopolitical realignment of energy markets that highlighted the critical role of nuclear power in providing secure and affordable energy.

According to the Company's leader, Cameco is now back in "sustained growth mode" and has successfully capitalized on the improving environment with a record number of contract wins. Cameco is now beginning to return to its tier-one run rate to meet increasing commitments under its contract portfolio. After five years of care and maintenance, it has restarted its McArthur River/Key Lake operation in Canada. The McArthur River mine and Key Lake mill produced 1.1 million pounds on a 100% basis in 2022, while the Cigar Lake mine reached its licensed capacity of 18 million pounds per year. The plan calls for McArthur River/Key Lake to produce 18 million pounds per year (100% basis) beginning in 2024 and Cigar Lake to continue operating at its licensed capacity of 18 million pounds per year (100% basis) in 2024.

Myriad Uranium - Promising newcomer

If the trend of rising prices continues in the long term, and the demand from Western industrialized countries, especially the US, clearly suggests this will happen, second-tier uranium producers and exploration companies should benefit significantly. Myriad Uranium, which has a market capitalization of CAD 9.24 million, is a junior exploration company with an option to earn a 100% interest in over 1,800 sq km of uranium exploration licenses in the Tim Mersoi Basin in Niger, Africa, the sixth largest uranium producer in the world. Here, the Company holds four exploration licenses located near Africa's most significant uranium deposits containing 380 million pounds of equivalent uranium oxides (eU3O8).

Myriad Uranium's property is only about 30 km away from Dasa, Africa's highest-grade development stage deposit. In addition, both share the same rock structures.

Historically, 24,000 m of drilling has been completed on the deposit, as well as at least 161 relatively shallow drill holes, airborne and ground geophysical surveys, geological mapping and seismic surveys. As a result, approximately 20% of the historical drill holes within the license area have significant mineralization. In addition, it is known that high uranium grades may lie in secondary fault structures and at depths not previously explored.

Drilling programs for the current year are now being coordinated with local operating partner Loxcroft Resources, which is also the Company's largest shareholder, using a source of historical information. CEO Thomas Lamb recently spoke to our colleague Julien Desrosiers at the world's largest mining trade show, PDAC.

RWE - Significant dividend increase

RWE reports a significant increase in the dividend to EUR 1 as a minimum and a solid outlook for 2023. The majority of analysts remain positive about the energy group. The Swiss bank UBS left its rating for RWE at "buy" with a price target of EUR 46 after figures for 2022. The targets for the current year are significantly above market expectations. The expert spoke of a solid short-term outlook and an appealing medium-term strategy. The experts at Deutsche Bank Research also continue to see the share as a buy candidate with a price target of EUR 50.

Fiscal 2022 brought an outstanding result for RWE. Adjusted operating earnings before interest, taxes, depreciation and amortization rose 72% to EUR 6.31 billion. The increase in the core business was even more significant, amounting to 101% to EUR 5.56 billion. Net income was also impressive, increasing by 107% to EUR 3.232 billion. These increases were due to the increased capacity expansion for electricity from wind and solar energy, which rose by 22% compared with the previous year.

For the current fiscal year, the Essen-based company was somewhat more cautious and expects EBITDA of EUR 5.8 billion to EUR 6.4 billion and EUR 4.8 billion to EUR 5.4 billion in its core business, respectively, and EUR 2.2 billion to EUR 2.7 billion in adjusted net income.

Uranium is on the verge of a long-term turnaround due to rising demand. Cameco CEO Tim Gitzel and many experts share this view. Second-tier uranium companies, such as the exploration company Myriad Uranium are benefiting from this. RWE convinced analysts with its figures for the past year and its outlook.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.