January 4th, 2023 | 07:23 CET

Rheinmetall, Globex Mining, Brenntag - Just before the breakout

The themes of the past year are likely to continue to dominate the markets in 2023. Despite excellent prospects, shares from the renewable energy and electromobility sectors corrected strongly and are currently trading at attractive long-term levels. Due to strong demand from this sector and the strengthening of the defense sector since the Ukraine conflict, commodity producers benefit in turn. In particular, companies from the Western world are likely to move closer into focus here.

time to read: 4 minutes

|

Author:

Stefan Feulner

ISIN:

RHEINMETALL AG | DE0007030009 , GLOBEX MINING ENTPRS INC. | CA3799005093 , BRENNTAG AG NA O.N. | DE000A1DAHH0

Table of contents:

"[...] Both the geology and the infrastructure around the project make for a very attractive cost structure. We expect to be able to produce at 50% of the current gold price. [...]" Bill Guy, Chairman, Theta Gold Mines Limited

Author

Stefan Feulner

The native Franconian has more than 20 years of stock exchange experience and a broadly diversified network.

He is passionate about analyzing a wide variety of business models and investigating new trends.

Tag cloud

Shares cloud

Rheinmetall - Breakout without armaments

The fact that Rheinmetall is perceived by the public primarily as an armaments company is hardly surprising given its close cooperation with the German armed forces. But there is much more behind the MDAX-listed group. For example, the Düsseldorf-based company is regarded as a renowned development partner and direct supplier to the global automotive industry, as well as a leading international systems house for security technology.

The integrated technology group was able to finalize a framework agreement with the Norwegian Defence Material Agency/NDMA for the modernization of the multi-sensor platform MSP500 system. The total value of the order is in the low double-digit million euro range.

In the electromobility market of the future, Rheinmetall received a major order worth over a quarter of a billion euros from a German premium manufacturer in the automotive sector. Here, the Düsseldorf-based company will equip the new 900-volt generation of electrically powered vehicles with a new type of contactor. In total, Rheinmetall will supply a mid-double-digit million euro number of contactors for the automaker's new vehicle platform starting in 2025.

Even in fiscal 2022, which has just ended, the largest single order ever received by Rheinmetall's non-military sector outside the traditional automotive business was booked with a volume of EUR 770 million. Here, a refrigerant compressor model with DC electronics was ordered, for which a long-term supply contract had been concluded, the Düsseldorf-based company announced. The compressor type is similar in design to those used in motor vehicles.

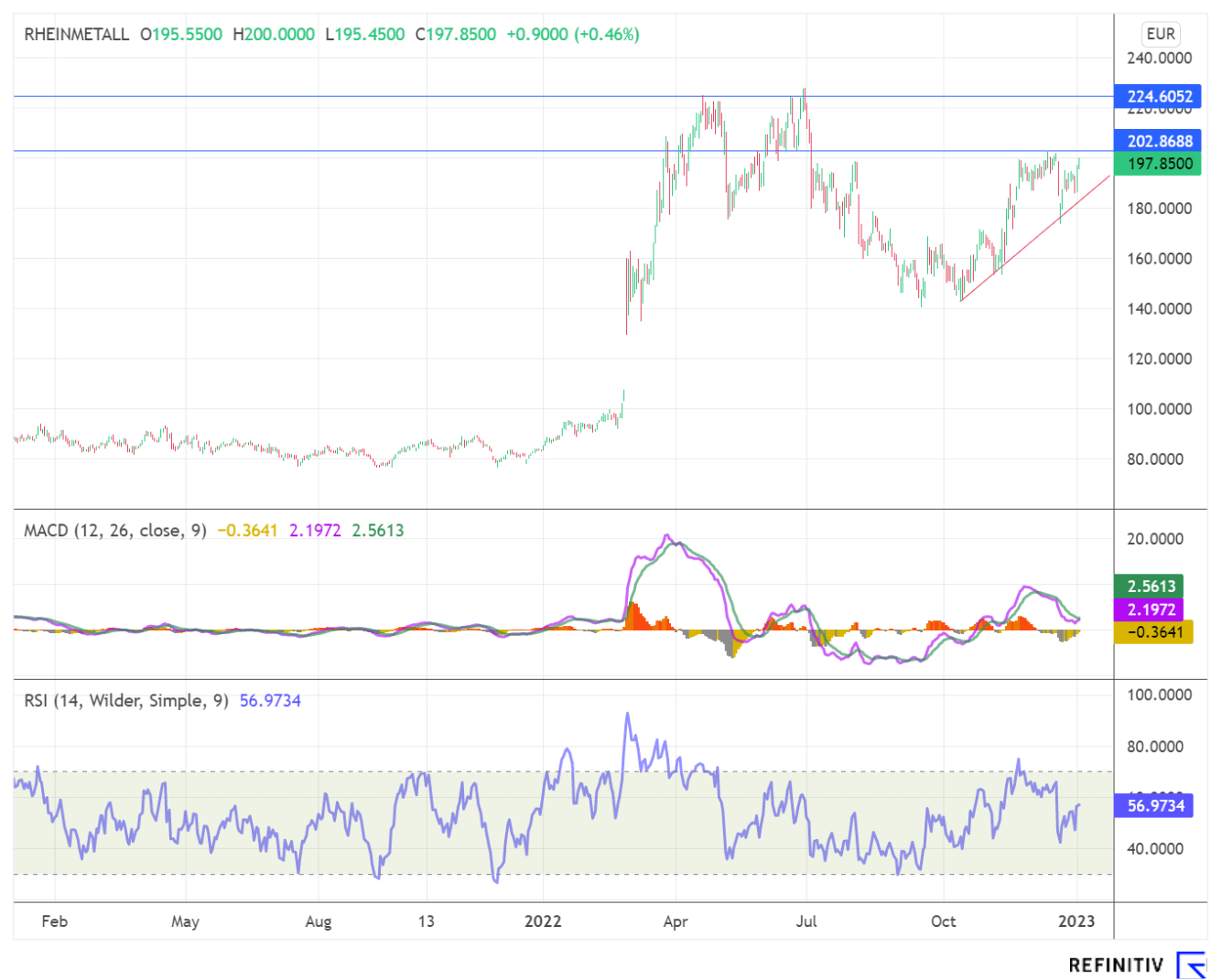

The consistently strong news flow led the share close to its breakout line at EUR 202.70. Should this be sustainably overcome, a renewed run-up to the highs of 2022 at EUR 227.90 is likely.

Globex Mining - Crisis-proof and future-proof

Electromobility and armaments. These two economic sectors have one thing in common; they require raw materials that are already classified as critical. The demand for critical metals such as copper, lithium and rare earth metals is likely to increase further due to the rearmament of the NATO states and their allies and the increased need to achieve climate targets. In addition, as in the case of rare earth metals, the required materials are dominated mainly by China and Russia. The West thus needs domestic deposits to minimize dependence in the future. The uniquely positioned company Globex Mining is likely to move more and more into the spotlight in the near future. The Canadians own 217 projects in the US, North America and Germany. Almost all commodities are represented within the portfolio, ranging from the precious metals gold, silver, platinum and palladium to the industrial metals copper, zinc, iron and nickel to rare earths and energy metals such as lithium, uranium and cobalt.

The debt-free company's market capitalization is just CAD 37.87 million, despite its large number of high-grade projects. In addition, the Canadians own about EUR 7.7 million in cash and over CAD 10 million in resilient investments, such as shares equivalent to about CAD 5.5 million in Yamana Gold. In addition, there is a consistent news flow from the optioning of properties for cash or shares. As a result, the Company receives recurring royalties, while the exploration risk is assumed by the partner.

The news flow of the past weeks impressively demonstrates the advantages of the business model. For example, the Company received an option payment of CAD 100,000 and 1,428,571 shares from partner company Orford Mining for the Joutel project. In addition, the licensee has reported gold discoveries of up to 24.4 g/t during exploration work on the Eagle Gold Mine property. Also, high-grade discoveries were made at the Kukamas project with up to 47.2 g/t gold, 62 g/t silver and 10.96% copper. In addition, Emperor Metals received funding to conduct exploration work on the Duquesne West Ottoman property. Globex Mining holds a half interest in this project.

Brenntag - Cancellation causes share price fireworks

Less is sometimes more. At least the stock market acknowledged after the cancellation of the takeover of the US rival Univar Solutions with a whopping price increase of over 7%. According to a press release, the Company had "decided not to continue these talks" after heavy criticism from shareholders, above all PrimeStone Capital.

There was also praise for the retreat from analysts. US investment bank JPMorgan, for example, reiterated its "overweight" rating. Swiss bank UBS also left its rating for Brenntag at "buy" with a price target of EUR 72.50 in light of the aborted takeover. The Hamburg-based analyst firm AlsterResearch also reiterated its buy recommendation and a price target of EUR 100.00.

Following the share price increase, the chart situation has also improved. A sustained break of the downward trend at EUR 63.40, which has been in place since September 2021, would clear the way to near the EUR 70 mark in the short term.

With a consistently good news flow, the Rheinmetall share could again test its highs from the year 2022. For Brenntag, analysts are optimistic after the renunciation of the takeover of a competitor. Globex Mining is broadly diversified and should benefit disproportionately in the next upward cycle of commodities.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.