February 26th, 2025 | 14:30 CET

Revolution in combustion engines: dynaCERT on the way to becoming a unicorn

The stock market thrives on innovations and disruptive technologies. Companies that solve pressing problems and make their solutions scalable have the potential to deliver significant returns to their investors. dynaCERT (WKN: A1KBAV | ISIN: CA26780A1084 | Ticker Symbol: DMJ) is currently in this position. With a successful equity financing of CAD 5 million, a decisive endorsement of the HydraGEN technology by VERRA – making dynaCERT one of the first companies in the world to receive this prestigious environmental certification for internal combustion engines – as well as an increasingly strengthened management team, the Company may be on the verge of a significant share price increase. Will a possible HydraGEN obligation for trucks by the new German government transform the entire industry? Read more in the report.

time to read: 5 minutes

|

Author:

Mario Hose

ISIN:

DYNACERT INC. | CA26780A1084

Table of contents:

"[...] Having Investors like Robert Friedland and Rob McEwen come in with CVMR and Terra Capital really was terrific. [...]" Terry Lynch, CEO, Power Nickel Inc.

Author

Mario Hose

Born and raised in Hannover, Lower Saxony follows social and economic developments around the globe. As a passionate entrepreneur and columnist he explains and compares the most diverse business models as well as markets for interested stock traders.

Tag cloud

Shares cloud

Cash injection for growth

The mobility transformation is proving to be more costly, complex, and expensive than initially anticipated, leading to significant delays. In particular, rising CO₂ taxes are putting increasing pressure on the logistics industry. In addition, the days when many believed that the energy transition would be simple, inexpensive, and consumer-friendly are over. "Today we know that none of this is true," industry expert Javier Blas said in an interview with the FAZ newspaper at the weekend.

dynaCERT (WKN: A1KBAV | ISIN: CA26780A1084 | Ticker Symbol: DMJ) offers a viable solution to reduce emissions and lower costs with its immediately available retrofit solution. To further accelerate growth, the Company successfully closed a CAD 5 million financing last week. These funds will be used to support the expansion of the Company and the scaling of the technology. This provides investors with an attractive entry point into a market with enormous potential. dynaCERT's market capitalization is currently still below CAD 80 million – but the question is: for how much longer?

Tailwind from Blackrock

"I am convinced that the next 1,000 unicorns, companies with a market valuation of over a billion dollars, will not be search engines or media companies, but companies that develop green hydrogen, green agriculture, green steel, and green cement," said Larry Fink, CEO of Blackrock, at the Middle East Green Initiative Summit in Riyadh, Saudi Arabia, last Monday. dynaCERT, with its bridge technology for environmental protection, also has the chance to become a unicorn.

From a near breakthrough to a new opportunity

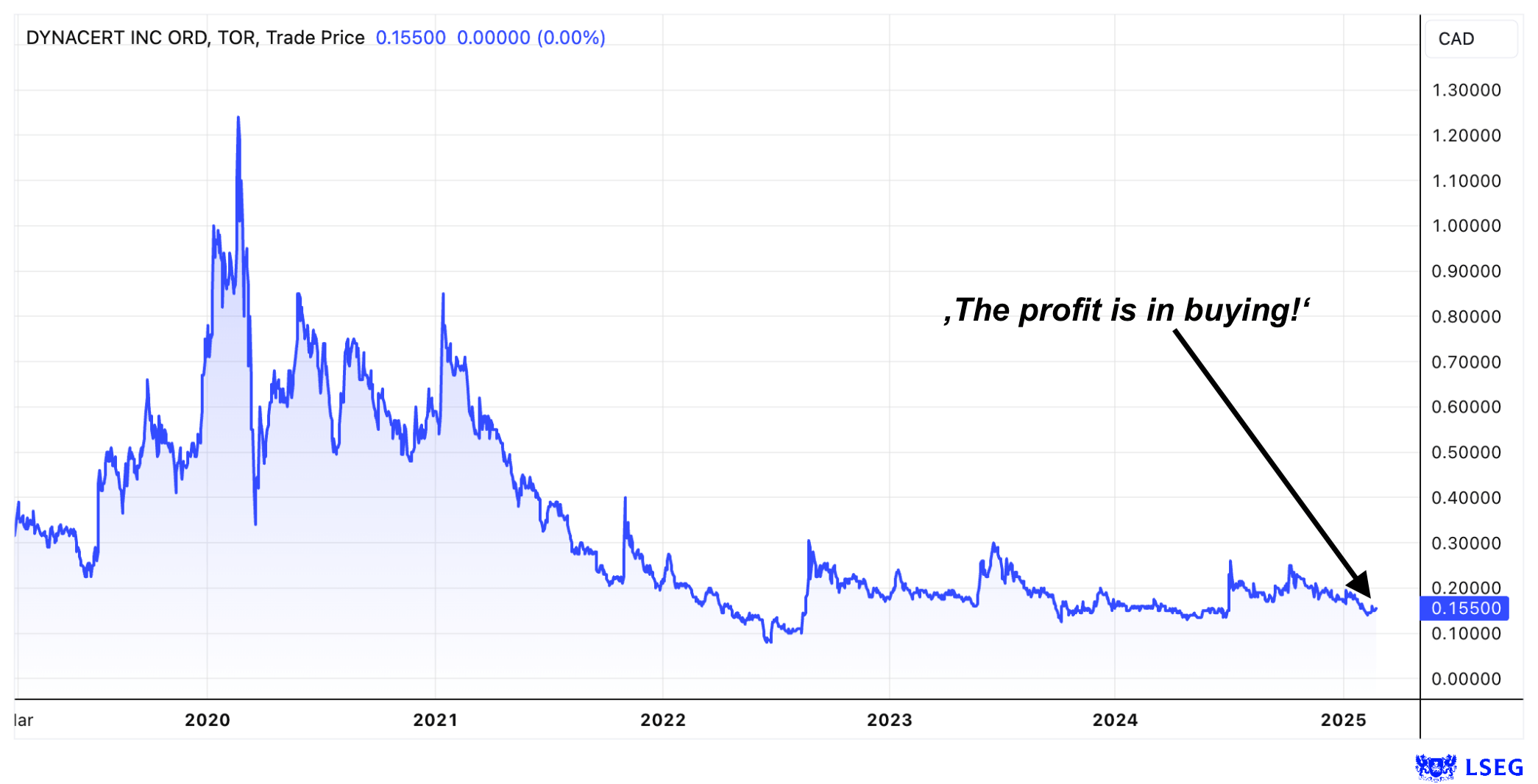

As early as 2020, dynaCERT was on the brink of a significant success. The groundbreaking HydraGEN technology for reducing emissions from internal combustion engines attracted a great deal of investor interest. Canadian investor Eric Sprott invested CAD 14 million at CAD 0.50 per share, causing the price to rise to as high as CAD 1.25. However, an unexpected setback followed: government COVID-19 measures abruptly halted business. Now, five years later, the innovation process finally seems to be bearing fruit – with potentially groundbreaking consequences. Recurring revenues from first customers are paving the way for serial production. Given the share price level at the beginning of 2020, it becomes clear how much potential the stock offers.

Added value for the environment and the economy

dynaCERT's HydraGEN technology makes it possible to drastically reduce emissions from combustion engines – without costly infrastructure measures. The principle is easy to explain: a device the size of a tower PC uses electrolysis to generate hydrogen, which is fed into the combustion process in the engine. This significantly reduces fuel consumption and emissions. The hydrogen is generated as needed from distilled water. On board, the device for long-distance trucks is a two-litre tank that lasts 80 hours of operation or over 4,000 km of driving.

A practical example impressively demonstrates the efficiency: a reference customer using HydraGEN recorded a fuel saving of 6%, a 24% reduction in AdBlue consumption, and a CO2 saving of 2,660 kg over 60,000 km.

The Company had already announced scaling effects in December 2024: After successful tests, customers ordered additional units, confirming the success and marking the entry into serial production. The increasing acceptance demonstrates that dynaCERT's technology is establishing itself in the market.

New top management strengthens the Company

With the arrival of German top manager Bernd Krüper as an investor, president, and director, the Company set the course for serial production. Krüper brings decades of experience from companies such as Daimler, Rolls-Royce, and MTU. He most recently served as CEO of the German engine manufacturer HATZ, where he led over 1,250 employees. In addition, Tanya Rowntree (formerly of the Toronto Stock Exchange, now Cboe) and James Tansey (an expert in emissions issues, including CO2 certificates) joined the board, bringing valuable expertise. The management team has also been strengthened operationally by adding further international engine and drive experts, such as Kevin Unrath, COO, and Doug Seneshen, Director, which is a clear signal of ambitious expansion plans. dynaCERT Inc. has also added Seth Baruch to the Advisory Board and engaged Carbonomics, LLC as a consultant for the implementation of VERRA emission credit projects.

VERRA Certification as a gamechanger

Another crucial factor for the future success of dynaCERT is the planned securitization of CO2 savings by dynaCERT's proprietary HydraLytica telematics solution into tradable CO2 certificates through VERRA. For over three years, the Company has been working intensively on this project, which could mean direct financial rewards for realized CO2 reductions for users of HydraGEN. This could not only accelerate the acceptance of the technology but also trigger political action. In October 2024, the Company received VERRA methodology approval and is now working on the specific implementation of projects so that CO2 certificates can be issued in the future.

Through its collaboration with Seth Baruch, dynaCERT is gaining a renowned expert in sustainability and emissions trading who has extensive experience in renewable energies, energy efficiency, and the reduction of greenhouse gas emissions. He has successfully built an emissions trading business and has been responsible for projects that save millions of tons of CO₂ annually. Experience is the key to success: Baruch has been helping companies in the US and worldwide identify and implement carbon offset projects for 14 years. These excellent conditions lay the foundation for the successful implementation of HydraGEN and HydraLytica.

The idea that governments might introduce a HydraGEN requirement for trucks is speculative but not unrealistic. After all, the device could pay for itself within a year through fuel savings. The German management of dynaCERT will make increased use of its contacts in politics and associations in this country to support the new German government with practical and self-supporting solutions for environmental issues in the transport and raw materials sector. In late summer 2024, Krüper had an initial conversation with EU Council President Ursula von der Leyen (CDU).

Conclusion: The share has enormous potential

A glance at the chart shows that the dynaCERT share (WKN: A1KBAV | ISIN: CA26780A1084 | Ticker symbol: DMJ) has been hovering around CAD 0.15 for weeks – far below the high of CAD 1.25 before the Corona measures. This represents a decline of 88%, but all signs indicate that this is only the calm before the storm – as they say, there is money to be made in every market. The VERRA implementation, rising CO2 taxes, a new German government, and many other issues could become significant value drivers for dynaCERT shares.

With strengthened market acceptance, a solid financial base and an experienced international management team, dynaCERT is poised for a potential re-rating. Anyone who wants to take advantage of the enormous potential at an early stage should keep a close eye on this stock – or better yet, add it to their portfolio now. Even after the first lockdown in 2020, GBC analysts saw a price target of EUR 1.40 or CAD 2.20 and a clear Buy recommendation. A tenfold increase in the current price? Absolutely possible! A takeover similar to the EUR 12 billion transaction for Viessmann's heat pump division could also be a potential scenario.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.