August 20th, 2025 | 07:05 CEST

Rethinking energy! Siemens Energy, First Hydrogen, VW, and BYD for the winning portfolio

For a long time, it seemed that nuclear energy was disappearing from the global energy mix, but now there are clear signs of a change of course. The US, in particular, is pushing for a restart. The government has adopted an ambitious plan to quadruple nuclear power capacity. The focus is on small modular reactors (SMRs) - compact reactors that can be used in decentralized locations, are considered efficient and safe, and can also be built more quickly than conventional large-scale power plants. In addition to their role in domestic energy supply, SMRs are considered an important export product for allied countries looking to reduce their dependence on fossil fuels. At the same time, they offer the possibility of being flexibly combined with renewable energy sources, such as supplementing solar and wind farms to ensure base load capability. E-mobility also depends on a secure power supply. Which companies are attracting the most investor interest?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

First Hydrogen Corp. | CA32057N1042 , SIEMENS ENERGY AG NA O.N. | DE000ENER6Y0 , VOLKSWAGEN AG VZO O.N. | DE0007664039 , BYD CO. LTD H YC 1 | CNE100000296

Table of contents:

"[...] We know exactly what we are doing and are implementing what we consider to be a proven technology in an industrially applicable and scalable way. [...]" Uwe Ahrens, Director, Altech Advanced Materials AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Siemens Energy – Demand for nuclear power is rising

The development of new energy concepts is gaining momentum. Siemens Energy is pursuing a clear SMR strategy and is working exclusively with Rolls-Royce to supply steam turbines and other non-nuclear components for new-generation modular nuclear power plants. These SMRs, with a capacity of up to 470 megawatts, are expected to supply up to 1.1 million households with clean energy. The prefabricated and quickly installable reactors offer a flexible and cost-efficient alternative to traditional nuclear power plants. Siemens Energy sees SMRs as a key element of the global energy transition, especially in view of the growing demand for CO2-neutral energy worldwide.

The focus is on international markets, as Germany has phased out nuclear power, while countries such as the UK are reviving nuclear energy under new governments. Siemens brings its many years of experience in power plant components to the SMR segment and aims to shorten construction times and reduce costs through modular design. Despite unresolved regulatory issues and challenges in waste disposal, the Munich-based company is positioning itself as a leading supplier in the field of small power plant turbines. It intends to further expand its market position over the next five years. SMR technology is ideal for decentralized power supply and complements renewable energies. Siemens Energy is thus becoming a key player in the global energy transition with strong growth prospects. Of 26 analysts on the LSEG platform, 22 expect an average price target of EUR 96.75. However, caution is advised, as the share has already reached this target several times in 2025 and the 2026 P/E ratio is high at 32.

First Hydrogen – A lot is going on behind the scenes

First Hydrogen is also setting new standards for the clean energy future with its innovative "Hydrogen-as-a-Service" strategy. With the establishment of its subsidiary First Nuclear Corp., the Canadian company has entered the nuclear energy market and is focusing on the development of small modular reactors (SMRs). In collaboration with the University of Alberta, the SMR design is being tailored specifically to optimize green hydrogen production, particularly for use in remote areas and industrial facilities with limited grid access. SMRs offer numerous advantages over traditional nuclear reactors: They are compact, scalable, safer, and associated with lower investment costs.

The integration of advanced SMR technology will enable the on-site production of low-emission hydrogen, which will serve as a sustainable energy source for industry and filling stations. European countries are showing great interest in using SMRs to decarbonize and rebuild their energy systems. Canada is ideally suited for this thanks to its strong nuclear energy expertise and the necessary infrastructure. High-tech companies are also waiting in the wings, as the growing demand for computing power from artificial intelligence and data centers is putting additional pressure on energy suppliers. Goldman Sachs predicts that the AI-driven energy demand of data centers alone will increase by 160% by 2030, massively increasing the need for CO2-neutral energy production. First Hydrogen aims to play a decisive role in the global energy transition through its SMR technology and is evaluating potentially suitable sites in Canada and Europe.

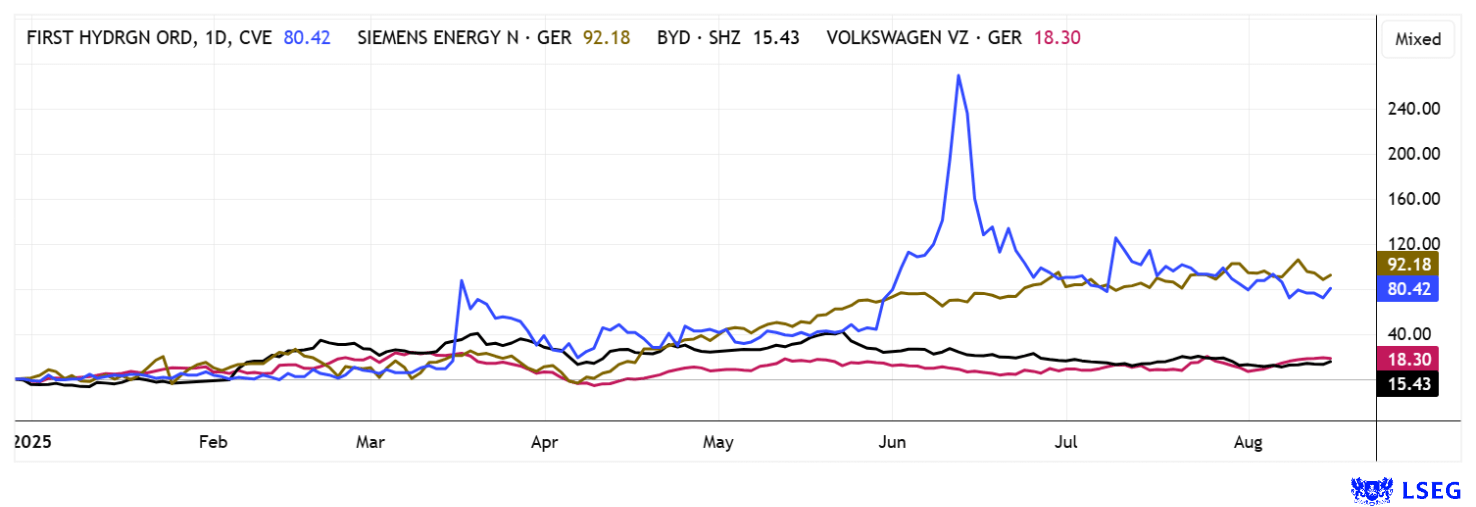

The dynamic development in the field of green hydrogen production and the increasing acceptance of SMR technology position First Hydrogen as an attractive option for sustainability-focused investors. The focus on decentralized, secure, and economical energy supply makes the Company a promising player for the years ahead. Due to its strategic expansion, the stock has regained significant attention since June, with trading volumes skyrocketing. Due to the technological ramp-up in the background, momentum has calmed down again somewhat around the stock. This is a great opportunity for investors looking to position themselves ahead of the next potential catalyst, as the medium-term prospects remain highly favorable.

BYD versus VW – China pushes the e-age forward

Vehicle manufacturers also want to help shape the electric revolution! BYD and Volkswagen have been engaged in intense competition for years, marked by recent news of price wars and margin pressure. BYD continues to benefit from strong demand in China and is steadily gaining ground in international markets. It has recently been able to increase its production capacity. BYD is pursuing an aggressive pricing policy to gain market share and consolidate its position as an innovation leader. The Company's low prices make it particularly attractive to consumers in price-sensitive segments and ensure rising sales figures. Volkswagen is responding to the growing pressure by adjusting its model range and also has to lower prices to remain competitive. The Wolfsburg-based company is thus facing enormous challenges due to rising production costs and simultaneous margin pressure resulting from strong competition in the volume segment. Technologically, the engineers also have two years of catching up to do. Not easy!

The ongoing price war between the two companies has led to a dramatic decline in margins across the entire sector. Nevertheless, Volkswagen remains an important player with its strong brand and better service infrastructure, especially in Europe, where the market is well developed. BYD, on the other hand, is focusing on expansion and technological leadership to build on its global leadership position. From 2026, deliveries will be duty-free from Hungary. From an investor perspective, both companies offer opportunities, with both stocks up 15% and 18% since the beginning of the year. Yesterday, VW regained the EUR 100 mark—a strong technical signal!

Energy stocks are once again becoming the focus of investor interest. The reason lies in the growing importance of a stable power supply, which has long since become a key issue for modern societies. Energy demand is steadily increasing, both in private households and in public infrastructure. The digital economy is particularly reinforcing this trend, as tech giants around the world require ever more computing power and energy to drive artificial intelligence and other future technologies. The market for small modular reactors (SMRs) is currently particularly dynamic, with companies such as Siemens Energy and First Hydrogen causing a stir with innovative projects.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.