September 22nd, 2023 | 07:20 CEST

Recalculation! These are the bare figures: TUI, Saturn Oil + Gas, Deutsche Bank - Buy prices non-stop!

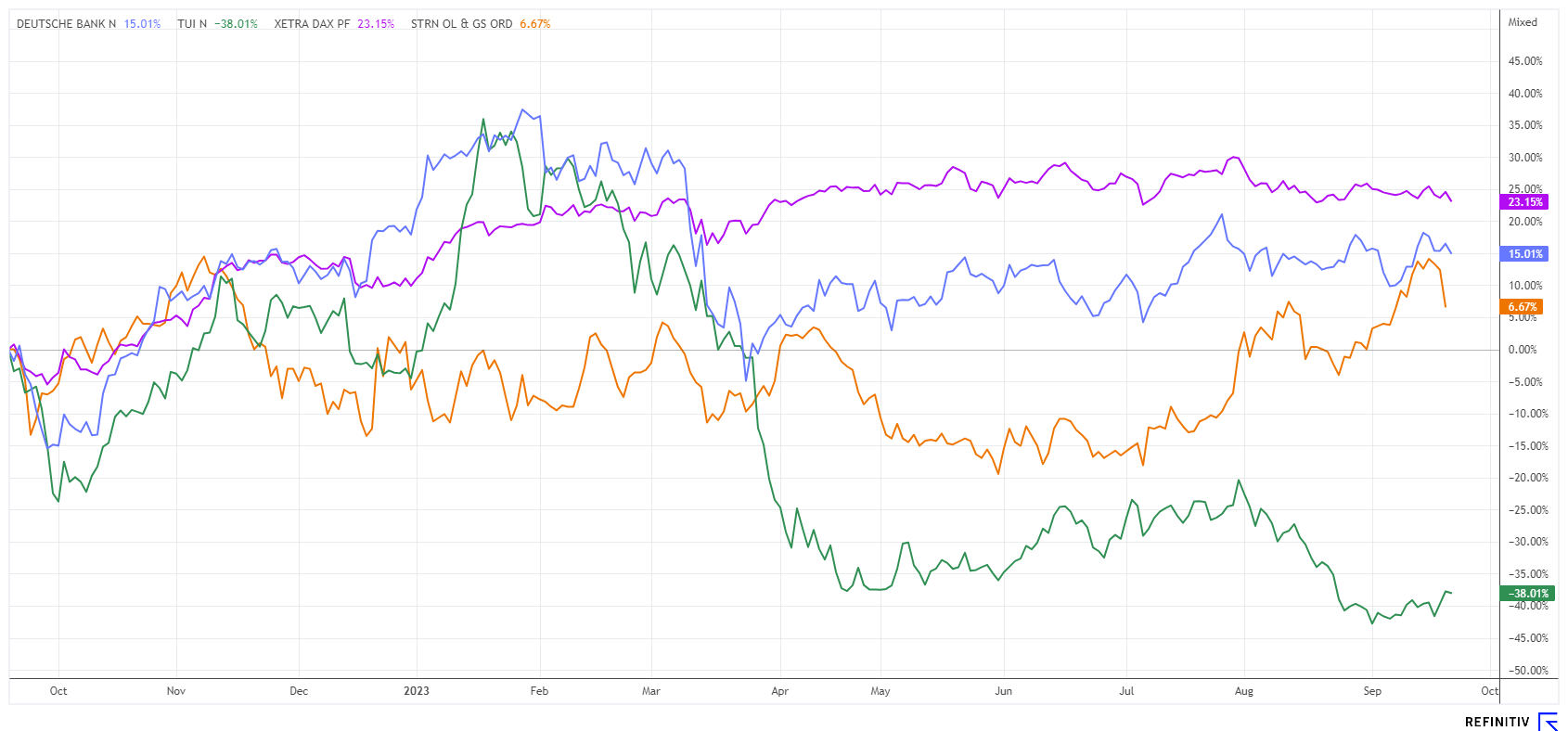

Companies do not always have good figures in their baggage. Analysts listen very carefully to the words of those in charge. Often, it is only a minor sentence that changes entire valuations. TUI is slowly approaching pre-COVID figures. Saturn Oil & Gas must backtrack slightly because of substantial forest fires in Alberta, and Deutsche Bank aims to finalize the Postbank project in 2023. All three stocks offer good buying opportunities because the long-term prospects are quite convincing.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

TUI AG NA O.N. | DE000TUAG505 , Saturn Oil + Gas Inc. | CA80412L8832 , DEUTSCHE BANK AG NA O.N. | DE0005140008

Table of contents:

"[...] The Oxbow Asset now delivers a substantial free cash flow stream to internally fund our impactful drilling and workover programs. [...]" John Jeffrey, CEO, Saturn Oil + Gas Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

TUI - Back on Track

**After a historic capital increase at the beginning of 2023, the balance sheet was somewhat relieved of debt. Now, the Hanover-based company is looking for new marketing opportunities for its package tours as booking figures are gradually recovering. In terms of revenue, the Company is already back on track to pre-crisis levels, but this is reflected across the board by significantly higher travel prices of up to 40%. Overall, TUI has sold fewer tours, but the price of individual tickets is 27% higher on average.

"Without the major events such as the forest fires in Rhodes or the floods in Italy, the Company would have exceeded its expectations," said CEO Sebastian Ebel earlier this week. Despite significantly higher living costs, according to data from the travel operator Dertour, many vacationers did not skimp on their summer vacations. It is still mainly a matter of catching up on missed vacations due to COVID. "The positive booking momentum continues, and I am very optimistic for the upcoming winter and summer season," CEO Ebel stated.

TUI shares landed at a new all-time low of EUR 5.28 in September and were 7% above it again yesterday at EUR 5.68. Chart-wise, the stock should overcome the EUR 6.25 to 6.50 zone soon. While Deutsche Bank is optimistic with a "Buy" rating and EUR 9.80 price target, UBS has left its rating at "Neutral" and a price target of EUR 7.45. The 11 experts on the Refinitiv Eikon platform expect a price of EUR 8.97 in 12 to 24 months, a smooth 60% potential. Overall, TUI is a long-term turnaround speculation, and one should keep an eye on the stop at EUR 5.20.

Saturn Oil & Gas - Minor adjustments, but good prospects

The fires in Alberta have also left minor marks on the balance sheet of Canadian oil and gas producer Saturn Oil & Gas (SOIL). In the recently published operating update, average expectations were lowered somewhat due to the fires. At the same time, management reports very successful further developments in the latest Spearfish wells in the Oxbow area. After the short production dip, the expected production rates are being raised again. New forward contracts could also be concluded at significantly higher spot prices. Production expectations for 2023 now average 24,100 BOE (units calculated in barrels of oil); before the fire, 27,170 BOE were expected.

Broken down to the income statement, Saturn is expected to generate approximately CAD 430 million in adjusted EBITDA in 2023 (down from a previously estimated CAD 523 million). Free cash flow is estimated to be down to CAD 145 million from CAD 232 million, and capital expenditures will be approximately CAD 130 million. A suspension of repayments for September and December has been agreed upon with creditors in order to be able to finance the drilling program from their own funds. Net debt will be phased out at approximately CAD 455 million at year-end.

"Our light oil drilling program in the Spearfish formation has achieved capital efficiencies that are among the best we have seen across our asset base and has exceeded our internal expectations, confirming the extensive multi-zone development opportunities that our Oxbow asset offers," said Justin Kaufmann, Saturn's Chief Development Officer. In June 2023, Saturn launched the Company's first development program targeting light oil from the prolific Spearfish formation, comprising six horizontal wells in the Manor area of southeast Saskatchewan. Three of the wells were drilled as double horizontal laterals and were among the best producers in the group. Technically proving once again the ability to increase potential recovery without incurring significant drilling costs.

Saturn Oil & Gas is bringing its average production curve for the following months back up significantly with the currently announced measures and is improving its capital allocation for the year 2024. Although the overall debt is going down at a slightly slower pace, the relative operating yield on each barrel of oil produced is improving. Echelon analysts reacted promptly to the new plan numbers and now expect a 1.4 times enterprise value (EV) relative to discounted free cash flows for 2024 onwards due to the small shift into the future. As such, SOIL shares are still trading well below the peer group valuation factor of 1.9, and the rating remains "Buy" with a price expectation of CAD 5.65. From yesterday's level at about CAD 2.77, it is a good doubling opportunity. **After 2025, the value should be significantly higher because then the debts would be completely paid off.

Deutsche Bank - The largest IT project in the bank's history slows down Postbank customers

Deutsche Bank CEO Sewing has to apologize extensively for the IT mess with the Postbank integration. However, it will take some time until all problems are solved. After Postbank customers have been unable to access their accounts for months, the Frankfurt-based bank is working hard to find a solution following a reprimand from the financial supervisory authority BaFin. It is promised that nearly everything will return to normal by the end of October, but until then, patience is required at ATMs, for point-of-sale payments and online transfers. "Overall, to reduce all the backlogs, we need not only the third quarter but also the fourth quarter," said the Group CEO. Some 500 additional IT specialists are now dealing with the problems.

Complaints from Postbank customers have been mounting in recent months, mainly in connection with a never-ending IT changeover. This involved merging data from 12 million Postbank customers and 7 million Deutsche Bank customers in Germany onto a common platform since Easter 2022. According to its information, the Federal Financial Supervisory Authority (BaFin) is examining whether there are any deficiencies relevant to supervision. It would be possible for BaFin to order a special audit or appoint a special representative, as BaFin President Mark Branson described the conditions as "unacceptable."

From Sewing's point of view, the banks in Europe should not rest on their recent business successes driven by the turnaround in interest rates. Although there are now billions in surpluses again, structurally, German banks, in particular, are lagging behind their international competitors. As a board member of the banking association, he does not exclude his own institution.

The experts on the Refinitiv platform see a 12-month average price target of EUR 12.55 for DBK shares, still 25% above the current quotation. With a market capitalization of around EUR 20 billion, Germany's largest commercial bank is valued at only 4.6 times the profit expected in 2024. Buy when the cannons are firing - currently at just under EUR 10.

Corrections in the figures often lead to surprising price turns. At Saturn Oil & Gas, the current slightly weaker prices following the devastating wildfires in Alberta could represent the last entry opportunity. At TUI and Deutsche Bank, too, the train has probably already left the station.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.